Japan Grain Storage Silos Market Size, Share, By Silo Type (Flat Bottom Silos, Hopper Silos, Grain Bins, and Others), By Storage Capacity (Less than 1000 tons, 1000 to 5000 tons, and Above 5000 tons), By Material (Steel, Aluminium, Wood, and Others), By End Use (Farming / Primary Producers (On-Farm), Feed Mills & Animal Feed, Grain Processing Mills, Port & Bulk Terminals, and Food & Beverage Processors), By Operation Type (Manual, Semi-Automatic, and Automatic), Japan Grain Storage Silos Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Grain Storage Silos Market Insights Forecasts to 2035

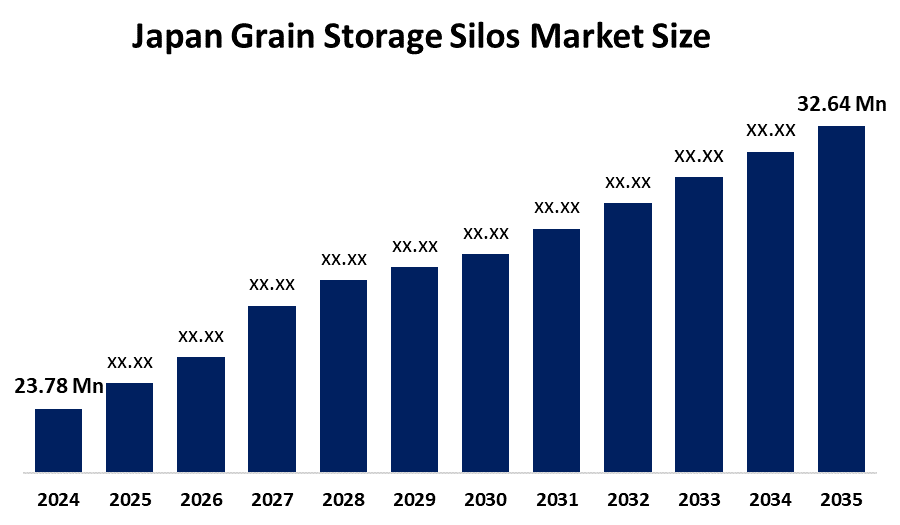

- Japan Grain Storage Silos Market Size 2024: USD 23.78 Million

- Japan Grain Storage Silos Market Size 2035: USD 32.64 Million

- Japan Grain Storage Silos Market CAGR 2024: 2.92%

- Japan Grain Storage Silos Market Segments: Silo Type, Storage Capacity, Material, End Use, and Operation Type

Get more details on this report -

Japan grain storage silos sector refers to an infrastructure system that is used to safely preserve the storage and handling of grains like rice, wheat, corn, and oilseeds in the agricultural and food processing value chain of Japan. Silos are being used by farms, grain processing plants, feed manufacturing plants, food factories, and ports to preserve the storage and handling of grains, thereby reducing the wastage of grains. There is an increased demand for silos that will help in reducing the wastage of grains. The demand is further fueled by the need to promote efficient storage and handling of grains.

Technological developments are modernizing storage operations with various advancements, such as automated monitoring systems, smart technologies to control temperatures and humidity, IoT technology used in tracking inventory, aerated storage systems, steel structures to prevent corrosion, and modular silos, which improve durability and enhance storage operations. Opportunities in this industry are seen in supply chain modernization, business developments in grain processing, demand for efficient storage facilities at centers such as ports, and reliance on automation technology to improve grain handling, offering good growth opportunities in the long term with a changing environment related to agriculture and food production in Japan.

Japan Grain Storage Silos Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.78 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 2.92% |

| 2035 Value Projection: | USD 32.64 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Silo Type ,By Storage Capacity |

| Companies covered:: | Satake Corporation, AGCO Corporation (GSI), Ag Growth International (AGI), Sukup Manufacturing Co., Sioux Steel Company, CST Industries, Symaga, Silos Cordoba, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Grain Storage Silos Market:

The key factors driving the Japan Grain Storage Silos Market Size are the growing need for efficient grain storage, reduction of post-harvest losses, modernization of agricultural infrastructure, and the growth of the commercial grain processing and animal feed sectors. There is also an increased emphasis on food security and the overall efficiency of grain movements at ports and through supply chains.

The Japan Grain Storage Silos Market Size is impacted by restraints like high installation costs, maintenance costs, structural safety issues, changing prices of materials like steel, financial constraints faced by small-scale farmers, and lack of space for storage in highly populated areas of the country.

The future of Japan Grain Storage Silos Market Size looks promising with opportunities in the areas of smart silos enabled by the Internet of Things, smart monitoring technologies, live inventory tracking, advanced aeration, increasing investments in ports, modernization in the grain chain, and modular designs that offer future-proof resistant designs.

Market Segmentation

The Japan Grain Storage Silos Market share is classified into silo type, storage capacity, material, end use, and operation type.

By Silo Type:

The Japan Grain Storage Silos Market Size is divided by silo type into flat bottom silos, hopper silos, grain bins, and others. Among these, the flat bottom silos segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Large-scale commercial demand for grain storage, increased suitability of high storage capacity, cost-effective bulk handling, long-term durability, efficient systems of aeration, and strong adoption in ports, processing facilities, as well as centralized storage infrastructure, boost the flat bottom silos market growth.

By Storage Capacity:

The Japan Grain Storage Silos Market Size is divided by storage capacity into less than 1000 tons, 1000 to 5000 tons, and above 5000 tons. Among these, the 1000 to 5000 tons segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Balanced storage flexibility, mid-scale farm and processor suitability, lower installation costs compared to mega silos, effective inventory turnover management, applicability of the system to varying regional grain volumes, as well as its easier integration into existing agricultural infrastructure, are the drivers of segment growth.

By Material:

The Japan Grain Storage Silos Market Size is divided by material into steel, aluminium, wood, and others. Among these, the steel segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High structural capacity, pest and moisture resistance, longer operational lifespan, applicability in automated systems, low maintenance requirements, capacity to survive Japan’s climatic changes, and strong demand from commercial entities are driving the market for steel silo material.

By End Use:

The Japan Grain Storage Silos Market Size is divided by end use into farming / primary producers (on-farm), feed mills & animal feed, grain processing mills, port & bulk terminals, and food & beverage processors. Among these, the grain processing mills segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The continuous raw material supply needs, necessity of consistent grain quality, domestic food processing demand, integrated storage requirement with the milling operation, higher volume capacity, and reduction of post-harvest loss are the factors influencing the growth of the grain processing mills segment.

By Operation Type:

The Japan Grain Storage Silos Market Size is divided by operation type into manual, semi-automatic, and automatic. Among these, the automatic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Rising labor shortage issues, need for live monitoring, reduced human errors, improvement in product inventory tracking, integration with smart agriculture technology, improvement in overall operation efficiency, and enhanced safety requirements for large storage spaces fuel the growth of the automatic silo operation market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Grain Storage Silos Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Grain Storage Silos Market:

- Satake Corporation

- AGCO Corporation (GSI)

- Ag Growth International (AGI)

- Sukup Manufacturing Co.

- Sioux Steel Company

- CST Industries

- Symaga

- Silos Cordoba

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Grain Storage Silos Market Size based on the below-mentioned segments:

Japan Grain Storage Silos Market, By Silo Type

- Flat Bottom Silos

- Hopper Silos

- Grain Bins

- Others

Japan Grain Storage Silos Market, By Storage Capacity

- Less than 1000 tons

- 1000 to 5000 tons

- Above 5000 tons

Japan Grain Storage Silos Market, By Material

- Steel

- Aluminium

- Wood

- Others

Japan Grain Storage Silos Market, By End Use

- Farming / Primary Producers (On-Farm)

- Feed Mills & Animal Feed

- Grain Processing Mills

- Port & Bulk Terminals

- Food & Beverage Processors

Japan Grain Storage Silos Market, By Operation Type

- Manual

- Semi-Automatic

- Automatic

Frequently Asked Questions (FAQ)

-

Q: What is the Japan grain storage silos market size?A: Japan grain storage silos market is expected to grow from USD 23.78 million in 2024 to USD 32.64 million by 2035, growing at a CAGR of 2.92% during the forecast period 2025–2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by increasing demand for efficient grain storage infrastructure, reduction of post-harvest losses, modernization of agricultural supply chains, expansion of grain processing and feed industries, rising food security concerns, and adoption of automated and smart silo technologies.

-

Q: What factors restrain the Japan grain storage silos market?A: Constraints include high installation and maintenance costs, fluctuations in steel prices, structural safety concerns, limited space availability in densely populated regions, and financial limitations faced by small-scale farmers adopting advanced storage infrastructure.

-

Q: Who are the key players in the Japan grain storage silos market?A: Key companies include Satake Corporation, AGCO Corporation (GSI), Ag Growth International (AGI), Sukup Manufacturing Co., Sioux Steel Company, CST Industries, Symaga, Silos Córdoba, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?