Japan Glaucoma Drugs Market Size, Share, By Indication (Open Angle Glaucoma, Angle Closure Glaucoma, and Others), By Drug Class (Prostaglandin Analogues, Beta Blockers, Alpha Agonist, Carbonic Anhydrase Inhibitors, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), Japan Glaucoma Drugs Market Industry Trend, Forecasts to 2035.

Industry: HealthcareJapan Glaucoma Drugs Market Insights Forecasts to 2035

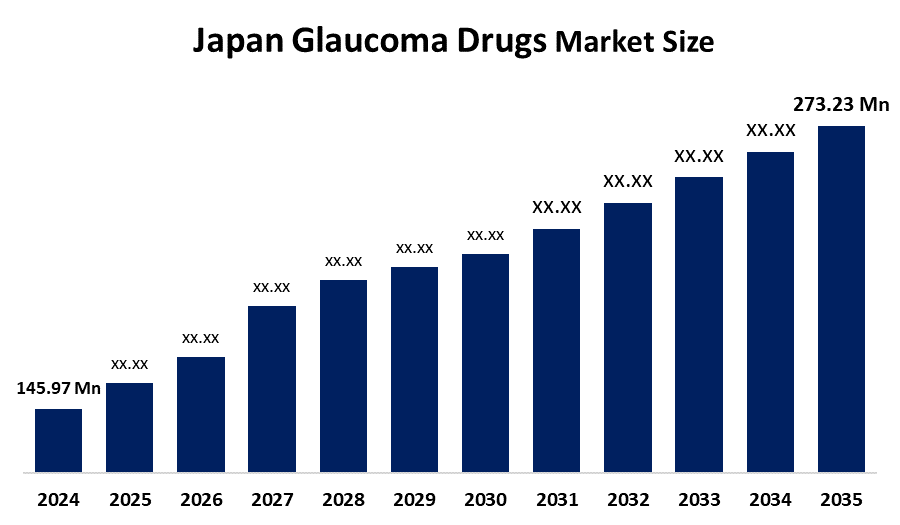

- Japan Glaucoma Drugs Market Size 2024: USD 145.97 Million

- Japan Glaucoma Drugs Market Size 2035: USD 273.23 Million

- Japan Glaucoma Drugs Market CAGR 2024: 7.16%

- Japan Glaucoma Drugs Market Segments: Indication, Drug Class, and Distribution Channel.

Get more details on this report -

The Japan Glaucoma Drugs Market Size includes medicines used to manage glaucoma, a chronic eye disease that damages the optic nerve and can cause blindness. These drugs help lower intraocular pressure to slow vision loss. The market covers prescription eye drops and combination therapies and is supported by Japan’s advanced healthcare system and aging population. Furthermore, Japan glaucoma drug market is growing due to an ageing population, rising glaucoma prevalence, increasing awareness of eye health, and early disease diagnosis. Strong healthcare infrastructure, universal insurance coverage, improved access to ophthalmologists, and advancements in drug formulations such as combination therapies and once-daily dosing further enhance treatment adoption and support sustained market growth.

Japan’s government supports the glaucoma drugs market through its universal health insurance system, which covers diagnosis and long-term treatment costs. Regulatory bodies enforce strict safety and efficacy standards for ophthalmic drugs while encouraging innovation. National clinical guidelines promote early detection, standardised treatment practices, and continuous patient management to reduce vision loss across the population.

Japan's glaucoma drug market trends include rising adoption of combination eye drops, preference for once-daily dosing, and development of preservative-free formulations. Increasing use of digital eye screening tools and artificial intelligence for early detection also supports drug demand. Pharmaceutical companies are focusing on patient-friendly therapies to improve adherence and long-term disease management outcomes.

Market Dynamics of the Japan Glaucoma Drugs Market:

The Japan Glaucoma Drugs Market Size is driven by a rapidly ageing population, increasing prevalence of glaucoma, and rising awareness of vision health. Strong healthcare infrastructure, universal insurance coverage, early diagnosis through routine eye examinations, advancements in ophthalmic drug development, and growing availability of combination and long-acting therapies continue to boost treatment adoption and overall market growth.

The Japan Glaucoma Drugs Market is restrained by high treatment costs for advanced therapies and strict regulatory approval processes. Long-term medication use can cause side effects, reducing patient compliance. Generic drug competition limits pricing power, while delayed diagnosis in early disease stages can reduce timely treatment initiation, affecting overall drug adoption in some patient groups.

The Japan Glaucoma Drugs Market Size offers opportunities in developing innovative therapies such as sustained-release formulations and preservative-free eye drops. Growing demand for combination drugs, personalised treatment approaches, and improved drug delivery systems creates expansion potential. Increasing adoption of tele-ophthalmology and home-based eye care services also presents opportunities to improve diagnosis, adherence, and market penetration.

Japan Glaucoma Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 145.97 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 7.16 % |

| 2035 Value Projection: | USD 273.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Indication, , By Drug Class |

| Companies covered:: | AbbVie GK Novartis Pharma K.K. Eli Lilly Japan K.K. Kowa Company Ltd. Chugai Pharmaceutical Co., Ltd. Santen Pharmaceutical Co., Ltd. CLEA Japan, Inc. Senju Pharmaceutical Co., Ltd. Kubota Pharmaceutical Holdings Co., Ltd. Shionogi Pharmaceutical Co., Ltd. Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan glaucoma drugs market share is classified into indication, drug class, and distribution channel.

By Indication:

The Japan Glaucoma Drugs Market Size is divided by indication into open-angle glaucoma, angle closure glaucoma, and others. Among these, the open-angle segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The open-angle segment dominates because it is the most common form of the disease, especially among the aging population. It progresses slowly and requires long-term medical management, increasing demand for prescription medications. In contrast, angle-closure glaucoma is less prevalent and often treated surgically, resulting in lower pharmaceutical consumption and market share.

By Drug Class:

The Japan Glaucoma Drugs Market Size is divided by drug class into prostaglandin analogues, beta blockers, alpha agonists, and carbonic anhydrase inhibitors. Among these, the prostaglandin analogues segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The prostaglandin analogues segment dominates because of their high efficacy in lowering intraocular pressure, once-daily dosing for better patient adherence, and a favourable safety profile. Preferred as first-line therapy over beta-blockers, alpha agonists, and carbonic anhydrase inhibitors, they see wider adoption and drive the largest market share.

By Distribution Channel:

The Japan Glaucoma Drugs Market Size is divided by distribution channel into hospital pharmacy, retail pharmacy, and online pharmacy. Among these, the retail pharmacy segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The retail pharmacy segment dominates because it is widely accessible, convenient for prescription refills, and provides pharmacist support, making it easier for patients to obtain long-term glaucoma medications compared with hospital or online pharmacy channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan glaucoma drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Glaucoma Drugs Market:

- AbbVie GK

- Novartis Pharma K.K.

- Eli Lilly Japan K.K.

- Kowa Company Ltd.

- Chugai Pharmaceutical Co., Ltd.

- Santen Pharmaceutical Co., Ltd.

- CLEA Japan, Inc.

- Senju Pharmaceutical Co., Ltd.

- Kubota Pharmaceutical Holdings Co., Ltd.

- Shionogi Pharmaceutical Co., Ltd.

- Others

Recent Developments in Japan Glaucoma Drugs Market:

- In October 2025, Santen Pharmaceutical officially launched SETANEO Ophthalmic Solution 0.002% (generic name: sepetaprost) in Japan for the treatment of glaucoma and ocular hypertension.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan glaucoma drugs market based on the below-mentioned segments:

Japan Glaucoma Drugs Market, By Indication.

- Open Angle Glaucoma

- Angle Closure Glaucoma

- Others

Japan Glaucoma Drugs Market, By Drug Class

- Prostaglandin Analogues

- Beta Blockers

- Alpha Agonist

- Carbonic Anhydrase Inhibitors

- Others

Japan Glaucoma Drugs Market, by Distribution Channel.

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Frequently Asked Questions (FAQ)

-

What is the Japan glaucoma drugs market size?Japan glaucoma drug market is expected to grow from USD 145.97 million in 2024 to USD 273.23 million by 2035, growing at a CAGR of 7.16 % during the forecast period 2025-2035.

-

What are the key growth drivers of the Japan glaucoma drugs market?Japan glaucoma drugs market is driven by the Aging population, rising glaucoma prevalence, early diagnosis, increasing awareness, advanced drug formulations, combination therapies, strong healthcare infrastructure, and insurance coverage drive growth.

-

What factors restrain the Japan glaucoma drugs market?The Japan glaucoma drugs market is restrained by High treatment costs, side effects, strict regulations, delayed diagnosis, patient non-compliance, limited awareness, and competition from generics

-

How is the Japan glaucoma drugs market segmented by drug class?The Japan glaucoma drugs market is segmented into Prostaglandin Analogues, Beta Blockers, Alpha Agonists, and Carbonic Anhydrase Inhibitors

-

Who are the key players in the Japan glaucoma drugs market?Key companies include AbbVie GK, Novartis Pharma K.K., Eli Lilly Japan K.K., Kowa Company Ltd., Chugai Pharmaceutical Co., Ltd., Santen Pharmaceutical Co., Ltd., CLEA Japan, Inc., Senju Pharmaceutical Co., Ltd., Kubota Pharmaceutical Holdings Co., Ltd., Shionogi Pharmaceutical Co., Ltd., and other

Need help to buy this report?