Japan Gene Amplification Technologies Market Size, Share, By Product (Instruments, Kits & Reagents, and Services), and By End User (Pharmaceutical & Biotechnology Companies, Academic & Research Industries, and Others) Japan Gene Amplification Technologies Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Gene Amplification Technologies Market Insights Forecasts to 2035

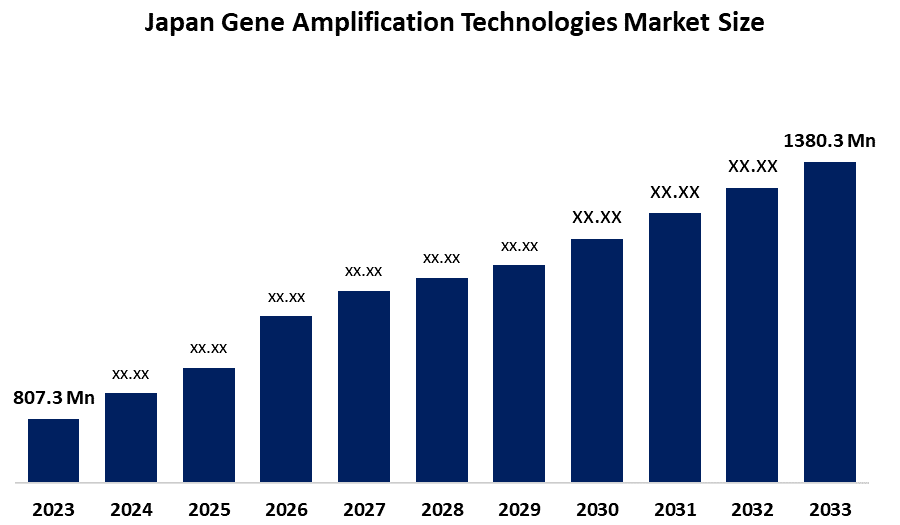

- Japan Gene Amplification Technologies Market Size 2024: USD 807.3 Mn

- Japan Gene Amplification Technologies Market Size 2035: USD 1380.3 Mn

- Japan Gene Amplification Technologies Market CAGR: 5%

- Japan Gene Amplification Technologies Market Segments: Product & End user

Get more details on this report -

The market for gene amplification technologies in Japan is growing steadily due to the high demand in research applications, oncology, clinical diagnostics, and infectious disease testing. The market is expected to expand at a moderate pace, with PCR-based amplification continuing to be the leading segment, and isothermal amplification techniques like LAMP exhibiting quick adoption because of their speed and ease of use. The widespread use of cutting-edge nucleic acid amplification platforms and reagents is supported by Japan's advanced healthcare infrastructure and high R&D investment. To address the needs of hospitals, diagnostic labs, and research institutions, both domestic and international players are innovating.

The gene amplification market is indirectly boosted by Japan's government's active support of biotechnology and genomic medicine. Precision medicine and cancer genomic medicine are prioritized in national health strategies. For instance, the creation of core genomic medicine hospitals and the Cancer Genomic Medicine Promotion Consortium facilitates the integration of genomic profiling, which is backed by national insurance coverage for thorough genomic testing.

Technological advances are propelling the growth of the market. Improvements in real-time PCR, digital PCR, and isothermal amplification technologies have increased sensitivity, speed, and multiplexing analysis, thus improving the accuracy of results obtained. The technology of combining automation, artificial intelligence-assisted analysis, and micro-scale technology is enabling efficient gene amplification. These technological advancements, together with the strategic emphasis on personalized medicine and genomic medicine in Japan, offer a rapidly changing environment for the development of the market.

Market Dynamics of the Japan Gene Amplification Technologies Market:

The growing need for molecular diagnostics to facilitate the early and precise detection of cancer and infectious diseases is a major market driver. To identify low-abundance genetic markers and enable precision diagnostics and personalized medicine, gene amplification technologies like qPCR and digital PCR are essential. Furthermore, ongoing technological developments in amplification platforms—such as increased sensitivity, speed, and multiplexing capabilities—are broadening the range of applications beyond conventional clinical settings into domains like pathogen surveillance, oncology, and prenatal screening. Adoption and innovation within Japan's thriving healthcare and life sciences ecosystem are further stimulated by government initiatives supporting biotechnology and genomics research.

The market is constrained by several factors, despite favorable demand dynamics. Wider adoption is hindered by the high cost of sophisticated gene amplification equipment, supplies, and maintenance, particularly in smaller laboratories or decentralized environments. Public acceptance of new products can be hampered by complicated regulatory requirements and ethical issues with genetic data privacy and testing. Routine deployment without trained personnel is further complicated by the technical complexity and contamination risks inherent in amplification workflows.

The integration of AI and machine learning presents significant opportunities to improve the analysis of amplification data, lower error rates, and streamline workflows. New markets are created by the development of portable amplification systems and point-of-care diagnostics, especially for quick testing for infectious diseases. Additionally, there are opportunities for diversification and innovation through growing non-clinical applications (such as food safety and environmental monitoring) and industry-academia partnerships.

Japan Gene Amplification Technologies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 807.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5% |

| 2035 Value Projection: | USD 1380.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By End User |

| Companies covered:: | Thermo Fisher Scientific Inc,Roche Diagnostics,QIAGEN N.V Inc,Roche Diagnostics,QIAGEN N.V,Bio-Rad Laboratories, Inc,Illumina, Inc,Merck KGaA (Sigma-Aldrich),New England Biolabs (NEB) And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

Japan Gene Amplification Technologies Market share is classified into product and end user.

By Product:

The Japan gene amplification technologies market is divided by product into Instruments, Kits & Reagents, and Services. Among these, the kits & reagents segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is primarily attributed to the recurring demand for reagents and consumables in routine diagnostic testing, research applications, and clinical workflows. Unlike instruments, which represent one-time capital investments, kits and reagents are required continuously for PCR, qPCR, digital PCR, and isothermal amplification procedures, ensuring sustained revenue generation.

By End User:

The Japan gene amplification technologies market is categorized by end user into pharmaceutical & biotechnology companies, academic & research industries, and others. Among these, the pharmaceutical & biotechnology segment accounts for the largest market share in 2024 and is expected to grow at a remarkable rate during the forecast period. The aforementioned dominance is mainly attributable to the wide-ranging applications of gene amplification technologies across various fields, including drug discovery, biomarker identification, companion diagnostics, and quality control.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan gene amplification technologies market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Gene Amplification Technologies Market:

- Thermo Fisher Scientific Inc.

- Roche Diagnostics

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc

- Merck KGaA (Sigma-Aldrich)

- New England Biolabs (NEB)

- Other

Recent Developments in Japan Gene Amplification Technologies Market:

- In October 2025, Thermo Fisher Scientific unveiled a fresh assortment of qPCR reagent products, which were aimed at improving the sensitivity and specificity of diagnostic and research uses, thus strengthening the company's competitive standing in Japan's molecular diagnostics market.

- In September 2025, Bio-Rad Laboratories extended its distribution coverage in Japan by forming partnership agreements with local companies, thereby enhancing the service and support networks for its digital PCR and single-cell amplification technologies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan gene amplification technologies market based on the following segments:

Japan Gene Amplification Technologies Market, By Product

- Instruments, Kits & Reagents

- Services

Japan Gene Amplification Technologies Market, By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Industries

- Others

Frequently Asked Questions (FAQ)

-

What is the base year and forecast period for the Japan Gene Amplification Technologies Market?The base year for the Japan gene amplification technologies market is 2024, with historical data spanning 2020–2023. The market forecast period runs from 2025 to 2035.

-

What is the current and projected market size of Japan’s gene amplification technologies market?The market was valued at USD 807.3 million in 2024 and is expected to reach USD 1,380.3 million by 2035, growing at a CAGR of 5% during the forecast period.

-

Which product segment dominated the market in 2024?The kits & reagents segment dominated the market share in 2024. This dominance is attributed to the recurring demand for consumables required in routine diagnostic testing, research activities, and clinical workflows, ensuring sustained revenue compared to one-time instrument purchases.

-

Which end-user segment holds the largest market share in Japan?The pharmaceutical & biotechnology companies segment accounted for the largest market share in 2024.

Need help to buy this report?