Japan Gelatin Market Size, Share, and COVID-19 Impact Analysis, By Source (Porcine, Bovine, poultry, marine, and Others), By End Use (Food & Beverages, Healthcare & Pharmaceuticals, Cosmetics, and Others), and Japan Gelatin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Gelatin Market Insights Forecasts to 2035

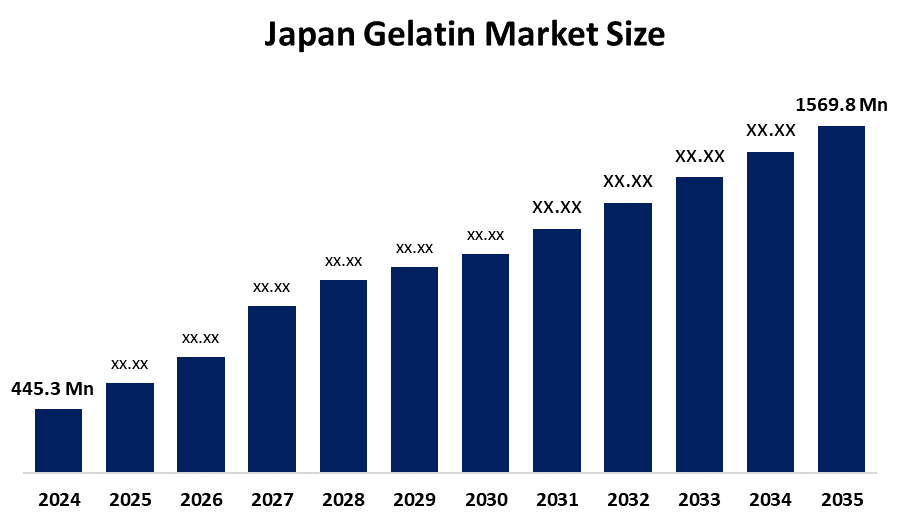

- The Japan Gelatin Market Size Was Estimated at USD 445.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.14 % from 2025 to 2035

- The Japan Gelatin Market Size is Expected to Reach USD 1569.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan gelatin market size is anticipated to reach USD 1569.8 million by 2035, growing at a CAGR of 12.14 % from 2025 to 2035. The gelatin market in Japan is driven by the growing food and beverages sector, specifically in the areas of confections, dairy products, and desserts, as a result of shifting consumer tastes and rising demand for processed food.

Market Overview

The Term Gelatin Market Size refers to the manufacturing, processing, and distribution of gelatin, a naturally occurring protein that is obtained from the partial hydrolysis of collagen found in fish, pigs, and cows. In many different sectors, gelatin is a flexible gelling, thickening, stabilizing, and binding agent. Food and drink (desserts, candies, dairy products), medicine (capsules, bandages for wounds), cosmetics (anti-aging and skin care products), and photography are some of the main uses. The gelatin market in Japan is driven by strong demand from food, confectionery, and pharmaceutical applications, including gummy candies, yogurts, capsule coatings, and health supplements. As consumers are now leaning towards functional and protein-based ingredients, growing trends of gelatin and collagen manufacture for functional applications, and growing trends of fish-based gelatin and halal-certified gelatin alternatives are helping to fulfill those needs in the Japanese market. Moreover, improvements in gelatin manufacturing methods, such as eco-friendly sourcing and the creation of halal and kosher-approved items, have created new market prospects. In general, the gelatin market in Japan is flourishing because of these related factors, establishing it as a profitable sector with encouraging future potential.

Report Coverage

This research report categorizes the market for the Japan gelatin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan gelatin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan gelatin market.

Japan Gelatin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 445.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 12.14 % |

| 2035 Value Projection: | USD 1569.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Source, By End Use |

| Companies covered:: | Nitta Gelatin Inc., Asahi Gelatine Industrial Co., Ltd., Nippi Inc., Jellice Co., Ltd., Konishi Co., Ltd., Toyo-Morton, Ltd., Alteco Inc., Daiso Industries Co., Ltd., And Others, Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The gelatin market in Japan is driven by the increasing utilization of gelatin in food products, beverages, and pharmaceuticals due to its gelling and stabilizing properties. The increase in demand for collagen-based dietary supplements, functional food products, and products high in protein builds upon this growth. Additionally, Japan's strong research and development ecosystem and supportive regulatory environment for food and food contact provide excellent conditions for improving high-grade gelatin, helping to strengthen the value of gelatin in Japan's health, nutrition, and functional ingredients sectors.

Restraining Factors

The gelatin market in Japan is mostly constrained by cultural and religious stigma on porcine material, competition from plant-based substitutes, and raw material price volatility. There is also limited growth and market penetration across various industries and consumer segments due to growing concerns about environmental context, stringent regulatory obligations, and educational constraints about non-food applications of gelatin.

Market Segmentation

The Japan gelatin market share is classified into source and end use.

- The porcine segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gelatin market is segmented by source into porcine, bovine, poultry, marine, and others. Among these, the porcine segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Gelatin sourced from porcine has outstanding gelling power, clarity, and texture, making it common in foods, confectionery, and pharmaceuticals. Japan also has a well-established supply chain for pork by-products to ensure raw materials access and stable production.

- The food & beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan gelatin market is segmented by end use into food & beverages, healthcare & pharmaceuticals, cosmetics, and others. Among these, the food & beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is widely employed for gelling, stabilizing, and texturizing in confectionery, dairy desserts, beverages, and processed foods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan gelatin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nitta Gelatin Inc.

- Asahi Gelatine Industrial Co., Ltd.

- Nippi Inc.

- Jellice Co., Ltd.

- Konishi Co., Ltd.

- Toyo-Morton, Ltd.

- Alteco Inc.

- Daiso Industries Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2024, Nitta announced a new product line of collagen peptide, DI-PEPTIDE, designed to provide additional collagen supplementation. The product highlights hydroxyproline, an amino acid that is a key component of collagen function. This is meant to augment Nitta's presence in the functional gelatin and health supplement space in Japan.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan gelatin market based on the below-mentioned segments:

Japan Gelatin Market, By Source

- Porcine

- Bovine

- poultry

- marine

- Others

Japan Gelatin Market, By End Use

- Food & Beverages

- Healthcare & Pharmaceuticals

- Cosmetics

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan gelatin market size?Japan gelatin market size is expected to grow from USD 445.3 million in 2024 to USD 1569.8 million by 2035, growing at a CAGR of 12.14 % during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the increasing utilization of gelatin in food products, beverages, and pharmaceuticals due to its gelling and stabilizing properties.

-

What factors restrain the Japan gelatin market?Constraints include by cultural and religious stigma on porcine material, competition from plant-based substitutes, and raw material price volatility.

-

How is the market segmented by source type?The market is segmented into porcine, bovine, poultry, marine, and others.

-

Who are the key players in the Japan gelatin market?Key companies include Nitta Gelatin Inc., Asahi Gelatine Industrial Co., Ltd., Nippi Inc., Jellice Co., Ltd., Konishi Co., Ltd., Toyo-Morton, Ltd., Alteco Inc., and Daiso Industries Co., Ltd, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?