Japan Gastrointestinal Endoscopic Devices Market Size, Share, By Type (Rigid GI Endoscopes, Flexible GI Endoscopes, and Disposable GI Endoscopes), By End Use (Hospitals and Outpatient Facilities), Japan Gastrointestinal Endoscopic Devices Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareJapan Gastrointestinal Endoscopic Devices Market Insights Forecasts to 2035

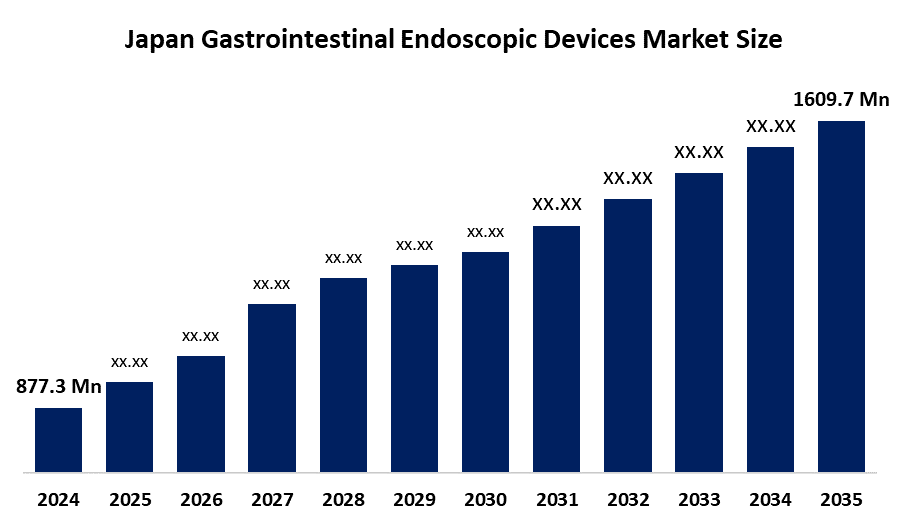

- Japan Gastrointestinal Endoscopic Devices Market Size 2024: USD 877.3 Mn

- Japan Gastrointestinal Endoscopic Devices Market Size 2035: USD 1609.7 Mn

- Japan Gastrointestinal Endoscopic Devices Market CAGR 2024: 5.67%

- Japan Gastrointestinal Endoscopic Devices Market Segments: Type and End Use.

Get more details on this report -

Japan's Gastrointestinal (GI) Endoscopy Device Market Size includes a very specific group of devices and equipment for assessing, diagnosing, and treating the digestive system. These devices provide high-quality imaging and offer slim insertion tubes with therapeutic applications so that patients can experience minimally invasive procedures. The two most important factors that define current trends are that AI is being rapidly integrated to provide real-time recognition of lesions, and there is an increasing trend toward single-use endoscopes in order to reduce risk for cross-contamination, as well as to create more efficient workflows in hospitals.

Government and private sector programs will continue to shape the future of endoscopy in Japan. Additionally, the Japanese National Health Insurance's (NHI) new reimbursement codes implemented in 2024 for AI-assisted endoscopy procedures incentivize hospitals to upgrade their equipment with more advanced CADe-enabled systems. Ongoing partnerships among the Japan Gastroenterological Endoscopy Society, universities, and manufacturers of endoscopy equipment, including Olympus and Fujifilm, serve to define clinical standards and disseminate Japanese endoscopy technology.

The Japanese technology market has dramatically moved forward due to several advances in 4K and 8K ultra-high-definition visual systems and robot-assisted endoscopy platforms. The development of intelligent imaging, which utilizes CNNs to perform optical biopsies, is another significant advancement in this area of expertise. With the introduction of new technologies such as magnetically guided capsule endoscopes and advances in Narrow Band Imaging Technology, non-invasive diagnostic procedures have improved dramatically, making the ability to detect precancerous conditions much easier and more accurate.

Market Dynamics of the Japan Gastrointestinal Endoscopic Devices Market:

The market is primarily driven by Japan's rapidly aging population, which has led to a surge in age-related gastrointestinal disorders and cancers requiring frequent diagnostic screenings. Additionally, high domestic demand for minimally invasive procedures, which offer shorter recovery times and lower infection risks, further accelerates the adoption of advanced endoscopic towers.

The Japan Gastrointestinal Endoscopic Devices Market Size is restrained by the critical shortage of certified endoscopists and specialized nursing staff, particularly in rural regions, limits the procedural capacity of many Japanese hospitals. Furthermore, high upfront capital costs for 4K/8K systems and strict NHI price controls can strain the return on investment for smaller medical facilities.

The integration of cloud-based AI for real-time diagnostic support presents significant opportunities for vendors to offer value-added software bundles that improve adenoma detection rates. Additionally, the expansion of ambulatory surgical centers (ASCs) creates a growing niche for compact, portable endoscopy systems optimized for high-throughput outpatient care.

Japan Gastrointestinal Endoscopic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 877.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 5.67% |

| 2035 Value Projection: | USD 1609.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-use |

| Companies covered:: | Olympus Corporation Fujifilm Holdings Corporation HOYA Corporation (PENTAX Medical) Asoka Electric Co., Ltd. Nidi Co., Ltd. Nihon Kohen Corporation Nagashima Medical Instruments Co., Ltd. Prolix Medical Devices, Inc. Boston Scientific Japan Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan gastrointestinal endoscopic devices market share is classified into type and end use.

By Type:

The Japan Gastrointestinal Endoscopic Devices Market Size is divided by type into rigid GI endoscopes, flexible GI endoscopes, and disposable GI endoscopes. Among these, the disposable GI endoscopes segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to their versatility in diagnostic and therapeutic applications. Disposable GI endoscopes are recognized as the fastest-growing sub-segment, driven by increasing concerns over reprocessing costs and infection control.

By End Use:

The Japan Gastrointestinal Endoscopic Devices Market Size is divided by end use into hospitals and outpatient facilities. Among these, the hospitals segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Hospitals remain the primary end-users, accounting for the highest volume of complex therapeutic surgeries. However, outpatient facilities and ambulatory surgical centers are witnessing rapid growth as healthcare reforms encourage a shift toward cost-effective, same-day endoscopic procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Gastrointestinal Endoscopic Devices Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Gastrointestinal Endoscopic Devices Market:

- Olympus Corporation

- Fujifilm Holdings Corporation

- HOYA Corporation (PENTAX Medical)

- Asoka Electric Co., Ltd.

- Nidi Co., Ltd.

- Nihon Kohen Corporation

- Nagashima Medical Instruments Co., Ltd.

- Prolix Medical Devices, Inc.

- Boston Scientific Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Gastrointestinal Endoscopic Devices Market Size based on the below-mentioned segments:

Japan Gastrointestinal Endoscopic Devices Market, By Type

- Rigid GI Endoscopes

- Flexible GI Endoscopes

- Disposable GI Endoscopes

Japan Gastrointestinal Endoscopic Devices Market, By End Use

- Hospitals

- Outpatient Facilities

Frequently Asked Questions (FAQ)

-

What is the current size and future outlook of the market?The market was valued at USD 877.3 million in 2024 and is projected to reach USD 1609.7 million by 2035, expanding at a CAGR of 5.67% during the forecast period.

-

What are the key factors driving growth in the Japan GI endoscopic devices market?Major growth drivers include Japan’s rapidly aging population, rising incidence of gastrointestinal cancers, strong demand for minimally invasive diagnostics, and increasing adoption of AI-assisted endoscopy systems

-

Which type of GI endoscopic device dominates the market?Disposable GI endoscopes dominated the market in 2024 and are expected to grow at a strong CAGR due to rising infection control concerns, reduced reprocessing costs, and improved hospital workflow efficiency

-

Which end-use segment holds the largest share in Japan?Hospitals hold the largest market share, as they handle a high volume of complex diagnostic and therapeutic endoscopic procedures, supported by advanced infrastructure and skilled medical professionals.

-

What are the major challenges faced by the market?Key challenges include a shortage of certified endoscopists and trained nursing staff, high capital investment required for advanced imaging systems, and reimbursement price controls under Japan’s National Health Insurance system

-

What opportunities exist for companies in the Japan GI endoscopic devices market?Opportunities include cloud-based AI diagnostic platforms, portable endoscopy systems for outpatient facilities, expansion of ambulatory surgical centers, and innovations such as capsule and robot-assisted endoscopy technologies

Need help to buy this report?