Japan Frozen Food Market Size, Share, By Product (Fruits & Vegetables, Potatoes, Ready Meals, Meat, Fish/Seafood, Frozen Desserts, Bakery Products, and Others), By Freezing Technology (Individual Freezing Technology Quick Freezing (IQF), Blast Freezing, and Belt Freezing), By Distribution Channel (Food Service, Retail, Hypermarkets & Supermarkets, Convenience Stores, Online, and Others), Japan Frozen Food Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Frozen Food Market Insights Forecasts to 2035

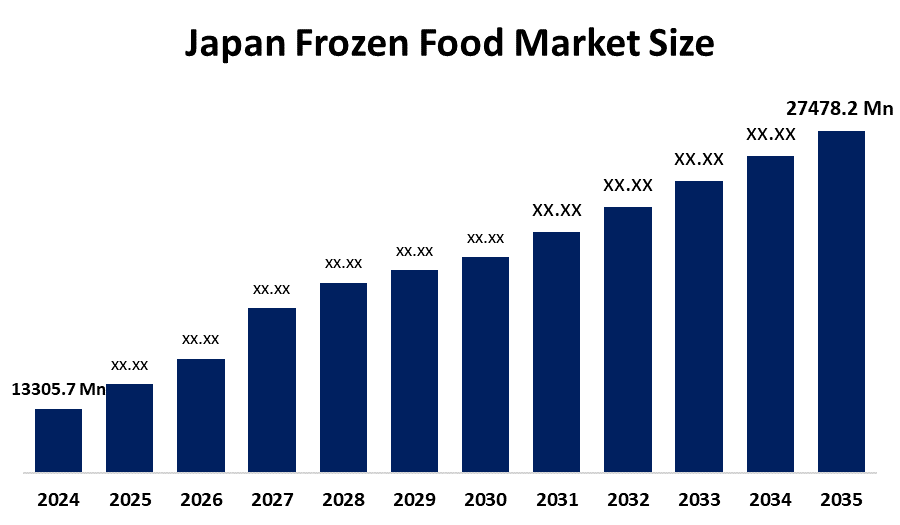

- Japan Frozen Food Market Size 2024: USD 13305.7 Mn

- Japan Frozen Food Market Size 2035: USD 27478.2 Mn

- Japan Frozen Food Market CAGR 2024: 6.81%

- Japan Frozen Food Market Segments: Product, Freezing Technology, and Distribution Channel.

Get more details on this report -

Japan’s Frozen Food sector is an area of great sophistication that involves the manufacture, distribution, and on-selling of frozen food products by means of quick-frozen methods, ensuring the retention of product quality and nutrient levels. Consumers are accustomed to an extremely high level of taste and safety, and as such, there has been an influx of frozen prepared meal products, along with a variety of other types of frozen foodstuffs such as vegetables, seafood, etc., reflecting current trends. Healthy and organic frozen foods are becoming ever more popular, and there is a growing demand for Smart Cooking methods to reduce the time needed for meal preparation, particularly amongst dual-income and single-dwelling households. In addition, there continues to be an increased interest in restaurant-quality frozen Japanese foods, such as udo, gloze, and bento boxes, reflecting the increase in "gourmet" meal preparation at home.

Japanese government legislation includes new, more stringent guidelines concerning food labeling and positive list systems for the use of packaging materials to improve consumer safety and reduce food waste. Leading private sector companies such as Ajinomoto Group and TableMark are leveraging the public and private sector synergies to develop innovative plant-based frozen foods and environmentally friendly packaging solutions, and their products help to support the national targets for carbon footprint reduction. In addition, the development of cold chain infrastructure is being enhanced through the collaboration of both public and private sector businesses to address the "2024 Logistics Problem" by improving transportation efficiencies and expanding capacity for automated warehouse operations.

In Japan's frozen food sector, utilizing advanced freezing technologies, including integration of the Internet of Things (IoT) and automated temperature monitoring systems, provides real-time tracking of temperature throughout the supply chain and is thereby especially important for ensuring that sensitive products are preserved throughout shipping. Additionally, the innovations being applied with regard to microwaveable packaging and vacuum sealing are fueling the continued growth and expansion of this segment of the marketplace by allowing consumers to heat food conveniently without sacrificing the freshness associated with home cooking.

Market Dynamics of the Japan Frozen Food Market:

The Frozen Food Market Size in Japan is mainly driven by the growth of the number of dual-income households and single-person housing situations, where individuals are seeking convenient, quick-to-prepare meals. Additionally, increased urbanization of the world and the continued growth of the elderly population will increase the need for ready-to-eat frozen meals that are easy to prepare and provide the proper portion sizes and nutritional requirements for each individual. Advances in technology, specifically high-speed freezing methods, have resulted in a much-improved quality of the finished product, allowing the frozen products to be a high-quality, tasty alternative to fresh food for health-conscious consumers in Japan.

The Japan Frozen Food Market Size is restrained by its high operating costs for manufacturers in this market and presents a significant challenge for industry participants. Another challenge to the industry is the stringent requirements for compliance with the Food Safety Law and the new packaging material regulations, which add further complexity to the production of frozen, ready-to-eat meals.

There is currently a very large and growing opportunity for manufacturers of frozen, ready-to-eat meals to utilize the emergence of e-commerce and home delivery platforms to market their product directly to consumers. In addition, there is an extremely large opportunity for the development of premium, healthy, and environmentally friendly frozen products that appeal to the growing number of consumers seeking sustainable and functional food products.

Japan Frozen Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13305.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 6.81% |

| 2035 Value Projection: | USD 27478.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Freezing Technology |

| Companies covered:: | Ajinomoto Frozen Foods Co., Inc. TableMark Co., Ltd. Nichirei Foods Inc. Nippon Suisan Kaisha, Ltd. Maruha Nichiro Corporation Toyo Suisan Kaisha, Ltd. Day Break Co., Ltd. AEON Co., Ltd. Akihito, Limited Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan frozen food market share is classified into product, freezing technology, and distribution channel.

By Product:

The Japanese Frozen Food Market Size is divided by product into fruits & vegetables, potatoes, ready meals, meat, fish/seafood, frozen desserts, bakery products, and others. Among these, the Frozen desserts segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Consumers are increasingly looking for convenient, tasty sweets in a variety of unique flavors. Health-conscious consumers are increasingly interested in low-fat, dairy-free, and low-sugar choices.

By Freezing Technology:

The Japanese Frozen Food Market Size is divided by freezing technology into individual quick freezing (IQF), blast freezing, and belt freezing. Among these, the blast freezing segment held the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This growth is associated with the ability to freeze vast amounts of food quickly, preserving texture, flavor, and nutritional content while reducing ice crystal formation and cellular damage. Furthermore, this technology dramatically minimizes the risk of bacterial growth, increases shelf life, and ensures food safety, making it suitable for meats, seafood, produce, and prepared meals.

By Distribution Channel:

The Japanese Frozen Food Market Size is divided by distribution channel into food service, retail, hypermarkets & supermarkets, convenience stores, online, and others. Among these, the food service segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to quick-service restaurants, motels, and catering enterprises that may easily satisfy high client demand while maintaining consistent quality and flavor.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Frozen Food Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Frozen Food Market:

- Ajinomoto Frozen Foods Co., Inc.

- TableMark Co., Ltd.

- Nichirei Foods Inc.

- Nippon Suisan Kaisha, Ltd.

- Maruha Nichiro Corporation

- Toyo Suisan Kaisha, Ltd.

- Day Break Co., Ltd.

- AEON Co., Ltd.

- Akihito, Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan frozen food market based on the below-mentioned segments:

Japan Frozen Food Market, By Product

- Fruits & Vegetables

- Potatoes

- Ready Meals

- Meat

- Fish/Seafood

- Frozen Desserts

- Bakery Products

- Others

Japan Frozen Food Market, By Freezing Technology

- Individual Quick Freezing (IQF)

- Blast Freezing

- Belt Freezing

Japan Frozen Food Market, By Distribution Channel

- Food Service

- Retail

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

Frequently Asked Questions (FAQ)

-

What is the projected market size of the Japan frozen food market by 2035?The Japan frozen food market is expected to grow from USD 13,305.7 million in 2024 to USD 27,478.2 million by 2035

-

What is the expected CAGR of the Japan frozen food market during the forecast period?The market is projected to grow at a CAGR of 6.81% during the forecast period from 2025 to 2035.

-

Which product segment dominated the Japan frozen food market in 2024?The frozen desserts segment dominated the market in 2024 due to rising demand for convenient, indulgent, and health-oriented frozen sweet products

-

Which freezing technology held the largest market share in 2024?Blast freezing held the largest market share in 2024 as it efficiently preserves food quality, texture, flavor, and nutritional value while ensuring food safety

-

Which distribution channel led the Japan frozen food market in 2024?The food service distribution channel led the market in 2024, driven by strong demand from quick-service restaurants, hotels, and catering services.

-

Who are the key players in the Japan frozen food market?Key players include Ajinomoto Frozen Foods Co., Inc., Nichirei Foods Inc., TableMark Co., Ltd., Maruha Nichiro Corporation, and Nippon Suisan Kaisha, Ltd.

Need help to buy this report?