Japan Food Processing Blades Market Size, Share, By Product Type (Straight Blades, Circular Blades, Rotary Blades, and Specialty Blades), By Material (Stainless Steel, High-carbon Steel, Carbide, Ceramic, and Plastic), By Application (Meat Processing, Poultry Processing, Seafood Processing, Fruit and Vegetable Processing, Bakery and Confectionery Processing, Dairy Processing, and Pharmaceutical Processing), Japan Food Processing Blades Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Food Processing Blades Market Insights Forecasts To 2035

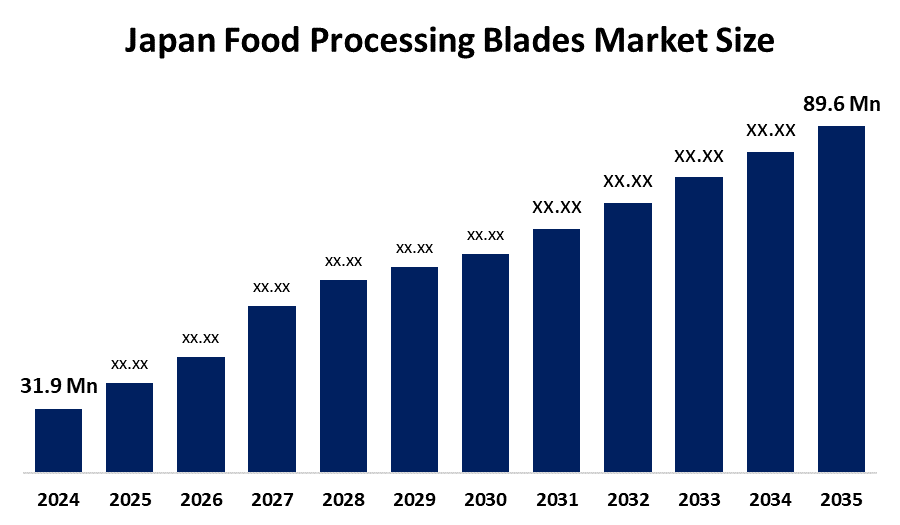

- Japan Food Processing Blades Market Size 2024: USD 31.9 Mn

- Japan Food Processing Blades Market Size 2035: USD 89.6 Mn

- Japan Food Processing Blades Market Size CAGR 2024: 9.84%

- Japan Food Processing Blades Market Size Segments: Product Type, Material, And Application.

Get more details on this report -

The Japanese Food Processing Market Size encompasses all types of industrial tools and their elements, including but not limited to straight, circular, and rotary types of blades and speciality cutting tool blades. These tools must be used in food processing equipment to perform the cutting, dicing, grinding, peeling, and portioning tasks of food production, as well as many other equipment applications. Food processing blades are required for uniformity and fast-paced production in automated manufacturing processing plants for meats, vegetables, dairy, baked goods, and pre-cooked meals.

To Address Impending Labour Shortages In The Japanese Food Processing Sector, improve safety and advanced quality, and aid in increasing productivity levels, Japanese government agencies, particularly the Ministry of Agriculture, Fisheries, and Forestry, have created sanitation management guidelines to be followed during the implementation phase of robotics and other advanced technological systems in food manufacturing processing plants. Additionally, through these guidelines, food processors can utilise automated cutting and preparation systems while continuing to comply with existing sanitation standard policies, such as risk assessments with Hazard Analysis and Critical Control Points (HACCP) and International Standards Organisation (ISO) for food safety and quality control (22000).

The Technological Advancements In Food Processing Blades Are An Ongoing Trend, And It Continues To Be Revolutionised By Improvements In The Area Of Precision Engineering, Manufacturing Methods, and the usage of new materials and existing materials with design optimisation methodology. Manufacturers continue to invest in new technologies that create more durable and more efficient cutting tools, and hygienically utilise those tools. As well, manufacturers utilise corrosion-resistant stainless steel types, ceramic composite materials, and protective coating technologies to help reduce wear and the risk of contamination as a result of utilising various cutting tools. Also, food processors can maximise their cutting performance with various new advances, such as automated cutting and preparation systems, robotic process automation, and continuous improvement using real-time monitoring technology.

Japan Food Processing Blades Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 31.9 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 9.84% |

| 2023 Value Projection: | 89.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type By Application |

| Companies covered:: | Nippon Kogyo Hamono Co., Ltd., OLFA Corporation, Chubu Machine Blades Co., Ltd., Ishida Co., Ltd., and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Food Processing Blades Market:

The Japanese Food Processing Blades Market Size is driven by demand for processed food, ready-to-eat food, and convenience foods, which will continue to grow based on changing consumer lifestyles and the growing number of older adults in our population. The increased use of automation in food processing will help to alleviate the labour shortage while increasing the demand for high-quality and durable cutting blades. In addition, the strict requirements of food safety, food hygiene, and HACCP compliance will drive the use of new types of advanced, corrosion-resistant cutting blades that deliver a consistent quality product under sanitary conditions.

The Japanese Food Processing Blades Market Size is restrained by high initial costs associated with the adoption of premium-quality cutting blades made from advanced materials, such as carbide and ceramics, which will limit the number of small- to mid-sized processors that adopt these new cutting blade technologies. In addition to high initial costs, the cost of maintaining and replacing these cutting blades on a regular basis due to the amount of time they are in operation will increase the cost of doing business.

The Future Opportunities Lie In The Development Of High-Performance Cutting Blades, Long-Life Coatings For Cutting Blades, And The Creation Of Customised Designs For Cutting Blades Based On Specific Food Processing Applications. In addition, the growth of export-oriented food processors, smart factory concepts, and robotic cutting systems will drive the need for innovative and efficient cutting blade solutions for the food processing industry.

Market Segmentation

The Japan Food Processing Blades Market Share Is Classified Into Product Type, Material, And Application.

By Product Type:

The Japan Food Processing Blades Market Size Is Divided By Product Type Into Straight Blades, Circular Blades, Rotary Blades, And Speciality Blades. among these, the curved blades are expected to grow at the fastest cagr over the forecast period. the curved blades provide improved accessibility, allowing for complex cutting operations that need precision and control. furthermore, as the food sector prioritizes quality and presentation, there is an increased demand for curved blades, notably in meat and seafood processing.

By Material:

The Japan Food Processing Blades Market Size Is Divided By Material Into Stainless Steel, High-Carbon Steel, Carbide, Ceramic, And Plastic. Among these, the stainless steel segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to superior corrosion resistance, hygiene, durability, and ability to keep sharpness, which align perfectly with demanding food safety and high-volume processing needs for various foods.

By Application:

The Japan Food Processing Blades Market Size Is Divided By Application Into Meat Processing, Poultry Processing, Seafood Processing, Fruit And Vegetable Processing, Bakery And Confectionery Processing, Dairy Processing, And Pharmaceutical Processing. among these, the meat processing segment held the largest market share in 2024 and is anticipated to grow at a significant cagr during the forecast period. this is due to its high meat consumption, strong demand for processed and ready-to-cook meat products, and broad automation of meat cutting, slicing, and portioning.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organisations/Companies Involved Within The Japan Food Processing Blades Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Food Processing Blades Market:

- Nippon Kogyo Hamono Co., Ltd.

- OLFA Corporation

- Chubu Machine Blades Co., Ltd.

- Ishida Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Food Processing Blades Market based on the below-mentioned segments:

Japan Food Processing Blades Market, By Product Type

- Straight Blades

- Circular Blades

- Rotary Blades

- Speciality Blades

Japan Food Processing Blades Market, By Material

- Stainless Steel

- High-carbon Steel

- Carbide

- Ceramic

- Plastic

Japan Food Processing Blades Market, By Application

- Meat Processing

- Poultry Processing

- Seafood Processing

- Fruit and Vegetable Processing

- Bakery and Confectionery Processing

- Dairy Processing

- Pharmaceutical Processing

Frequently Asked Questions (FAQ)

-

What is the Japan food processing blades market?It refers to the market for industrial cutting blades used in food processing operations such as slicing, chopping, dicing, and portioning across meat, poultry, seafood, bakery, dairy, fruit & vegetable, and pharmaceutical processing industries in Japan.

-

What is the current Japan food processing blades market size and growth outlook?The market was valued at USD 31.9 million in 2024 and is expected to reach USD 89.6 million by 2035, growing at a strong CAGR of 9.84% during 2025–2035.

-

What are the key product types in the Japan food processing blades market?The market includes straight blades, circular blades, rotary blades, and specialty blades, with curved/rotary blades expected to grow fastest due to precision cutting requirements.

-

Which application segment leads to the Japan food processing blades market?Meat processing dominates the market, driven by high meat consumption, strong demand for processed meat, and extensive automation in meat cutting and portioning.

-

What are the main drivers of Japan food processing blades market growth?Growth is driven by rising demand for processed and ready-to-eat foods, labor shortages boosting automation, and strict food safety and HACCP regulations.

-

Who are the key companies operating in the Japan food processing blades market?Major players include Nippon Kogyo Hamono Co., Ltd., OLFA Corporation, Chubu Machine Blades Co., Ltd., and Ishida Co., Ltd., along with other domestic manufacturers.

-

Who are the target audiences for the Japan Food Processing Blades market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?