Japan Food Enzymes Market Size, Share, By Type (Carbohydrates, Proteases, Lipases, and Others), By Application (Bakery, Confectionery, Dairy and Frozen Desserts, Meat, Poultry and Seafood Products, Beverages, and Others), Japan Food Enzymes Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Food Enzymes Market Size Insights Forecasts to 2035

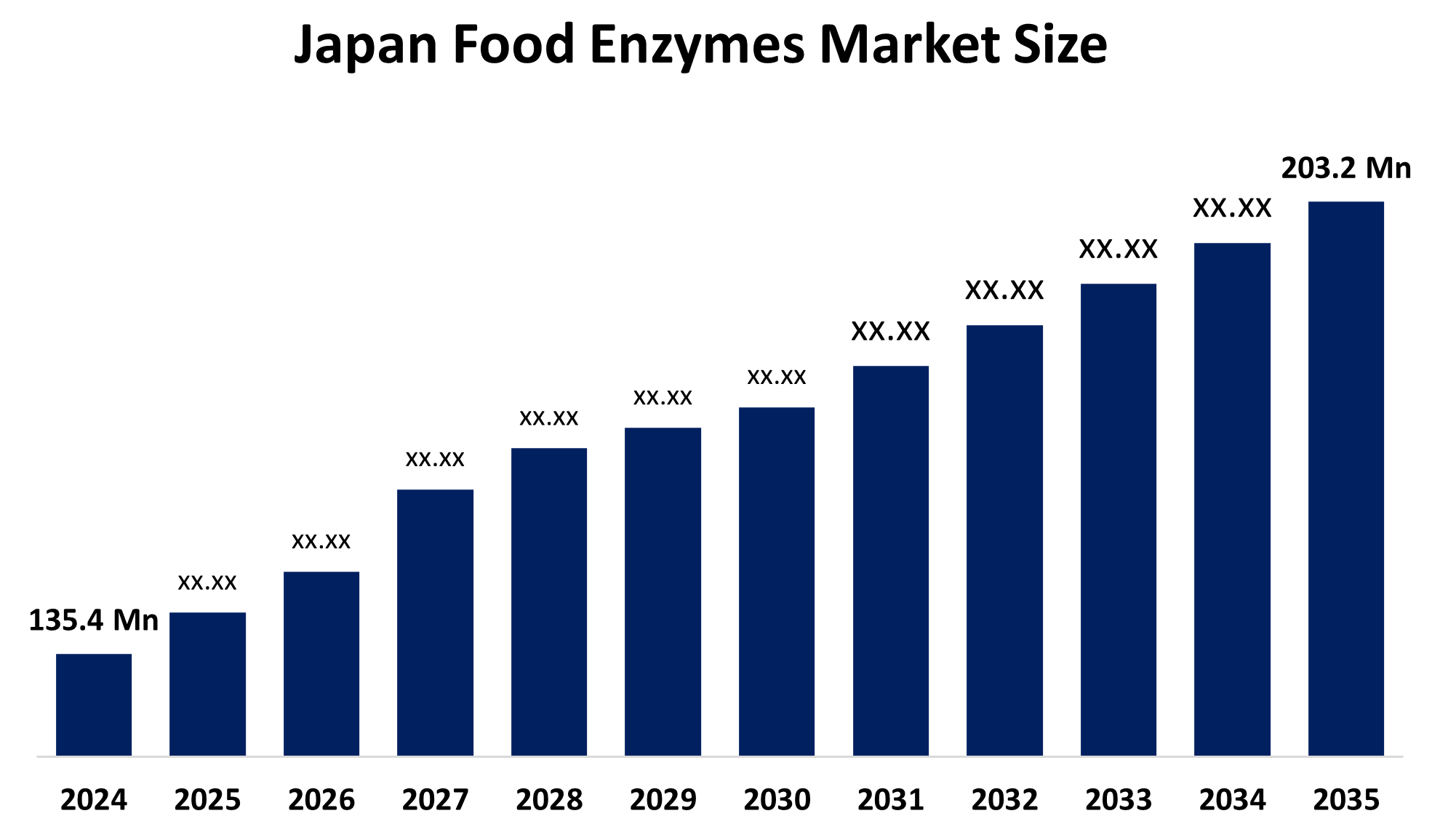

- Japan Food Enzymes Market Size 2024: USD 135.4 Million

- Japan Food Enzymes Market Size 2035: USD 203.2 Million

- Japan Food Enzymes Market Size CAGR 2025–2035: 3.76%

- Japan Food Enzymes Market Size Segments: Type and Application

Get more details on this report -

The Japan Food Enzymes Market Size is made up of catalysts that are naturally obtained and are used to make the processing of food more efficient and at the same time, it's the one with the highest demand for processed and functional foods, raising health awareness, clean label trends, and the use of advanced technologies in enzyme engineering that make it possible for food to be manufactured in a very ecologically correct manner and with high standards of quality, consistency, and productivity. Food enzymes are one of the main factors that influence the quality of the product, and they are the proteins that are responsible for the acceleration of the biochemical reactions in food processing. The use of food enzymes has thus expanded to cover baking, dairy, beverages, meat processing, and confectionery industries in Japan, enhancing dough handling, fermentation, flavor development, and preservation.

The food safety authorities of Japan lay down strict regulations on the usage of enzymes under the Food Sanitation Act, thereby safeguarding the consumers and, at the same time, allowing the innovation to progress. Moreover, the government supported research and development programs and partnerships between food producers and biotechnological firms set the stage for the creation of new enzyme applications that not only meet the criteria of sustainability but also the objectives of food security.

The market for food enzymes in Japan is getting a makeover due to tech advancements, which include enzyme optimization, microbial fermentation technologies, and precision biotechnology. The use of thermostable enzymes, targeted enzyme blends, and genetically optimized strains not only results in great efficiency but also in less waste and energy savings. Such innovations help the industry in scaling up while still complying with Japan's rigorous quality and environmental norms.

Market Dynamics of the Japan Food Enzymes Market Size

The JJapan Food Enzymes Market Size is driven by increasing demand for the increasing consumption of processed and convenience foods, health consciousness, and the preference for clean-label and natural ingredients. By means of their versatility, enzymes are able to increase processing efficiency, lower costs, and guarantee consistency in product quality, which makes them very appealing to manufacturers in the food industry. Further, the developing use of enzymes in the bakery, dairy, and beverage industries, along with the progress in the formulation of enzymes continue to contribute to the growth of this market.

The market is restrained by high development and production costs of specialized enzymes, rigorous regulatory approval processes, and limited consumer awareness of enzyme functionality still constitute the major obstacles to the market growth of enzymes. Furthermore, small-scale food producers' price sensitivity and reliance on imported raw materials may possibly restrict market enlargement.

The Japan Food Enzymes Market Size in the future is going to be very favorable because of the increasing need for functional foods, plant-based products, and eco-friendly food processing methods. The demand for personalized nutrition, lactose-free dairy, gluten-free bakery, and low-sugar beverages is likely to give rise to new growth areas. Market potential will be much more because of the ongoing innovation in enzyme engineering activities.

Japan Food Enzymes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 135.4 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.76% |

| 2035 Value Projection: | USD 203.2 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Amano Enzyme Inc., Nagase & Co., Ltd., Ajinomoto Co., Inc., Mitsubishi Chemical Group, Kao Corporation, Meiji Holdings Co., Ltd., Kikkoman Corporation, Kyowa Hakko Bio Co., Ltd., UBE Corporation, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Japan Food Enzymes Market Size, share is classified into type and application.

By Type

The Japan Food Enzymes Market Size is segmented by type into carbohydrates, proteases, lipases, and others. Among these, the carbohydrates segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Carbohydrates are nothing short of pivotal in food processing generally and specifically in bakery, beverages, and dairy sectors, where they are mainly used for textural improvements, sweetness, and fermentation efficiency. The market for this segment is supported mainly by its large-scale application in bakery, beverage, and dairy processing, where carbohydrates have significant involvement in starch hydrolysis, sugar conversion, and fermentation optimization, and so on. These enzymes make it easier to handle the dough, improve the sweetness profile, enable a more efficient yield, and ensure the quality of the product remains consistent.

By Application

The Japan Food Enzymes Market Size is segmented by application into bakery, confectionery, dairy and frozen desserts, meat, poultry and seafood products, beverages, and others. Among these, the bakery segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The segment leading position mainly results from the high per capita consumption of bread, pastries, and other baked goods in Japan and the growing preference for premium, healthier, and longer-lasting bakery products. The food enzymes are extensively used to improve dough's properties such as elasticity, volume, crumb softness, and freshness, and at the same time, lessen the use of chemical additives.

Competitive Analysis

The report offers an appropriate analysis of the key organizations/companies involved within the Japan Food Enzymes Market Size, along with a comparative evaluation primarily based on their product offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on recent news and developments, including product innovations, capacity expansions, partnerships, mergers & acquisitions, and strategic collaborations, enabling a comprehensive evaluation of market competition.

Top Key Companies in Japan Food Enzymes Market Size

- Amano Enzyme Inc.

- Nagase & Co., Ltd.

- Ajinomoto Co., Inc.

- Mitsubishi Chemical Group

- Kao Corporation

- Meiji Holdings Co., Ltd.

- Kikkoman Corporation

- Kyowa Hakko Bio Co., Ltd.

- UBE Corporation

- Others

Recent Developments in Japan Food Enzymes Market

- In April 2024, Amano Enzyme Inc. expanded its food enzyme R&D capabilities in Japan to develop advanced enzyme solutions for bakery and dairy applications, focusing on clean-label and sustainability requirements.

- In September 2024, Ajinomoto Co., Inc. enhanced its enzyme-based food ingredient portfolio to support functional food production and improved nutritional profiles in processed foods.

- In January 2025, Nagase & Co., Ltd. strengthened strategic partnerships with biotechnology firms to advance enzyme innovation for beverage and plant-based food applications in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Food Enzymes Market Size based on the following segments:

Japan Food Enzymes Market, By Type

- Carbohydrates

- Proteases

- Lipases

- Others

Japan Food Enzymes Market, By Application

- Bakery

- Confectionery

- Dairy and Frozen Desserts

- Meat, Poultry, and Seafood Products

- Beverages

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan Food Enzymes Market size?A: Japan Food Enzymes Market is expected to grow from USD 135.4 million in 2024 to USD 203.2 million by 2035, growing at a CAGR of 3.76% during the forecast period 2025 to 2035.

-

Q: What are the key growth drivers of the market?A: Growth is driven by increasing demand for processed and functional foods, clean-label trends, technological advancements in enzyme engineering, and rising health consciousness among Japanese consumers.

-

Q: What factors restrain the Japan food enzymes market?A: Restraining factors include high R&D costs, strict regulatory approvals, limited consumer awareness, and price sensitivity among small food manufacturers.

-

Q: How is the market segmented?A: The market is segmented by type (carbohydrates, proteases, lipases, others) and application (bakery, confectionery, dairy and frozen desserts, meat, poultry and seafood products, beverages, others).

-

Q: Who are the key players in the Japan Food Enzymes Market?A: Key companies include Amano Enzyme Inc., Ajinomoto Co., Inc., Nagase & Co., Ltd., Mitsubishi Chemical Group, Kyowa Hakko Bio Co., Ltd., and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?