Japan Flash Memory Market Size, Share, By Memory Type (3D NAND, 2D NAND, NOR Flash, and More), By Density (Up To 256 Mb, 512 Mb-2 Gb, and More), By Interface/Form Factor (eMMC, UFS, SATA SSD, and More), By End-User Application (Data Centre and Enterprise Servers, Mobile and Tablets, Automotive, Industrial and IoT Devices, and More), Japan Flash Memory Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsJapan Flash Memory Market Size Insights Forecasts to 2035

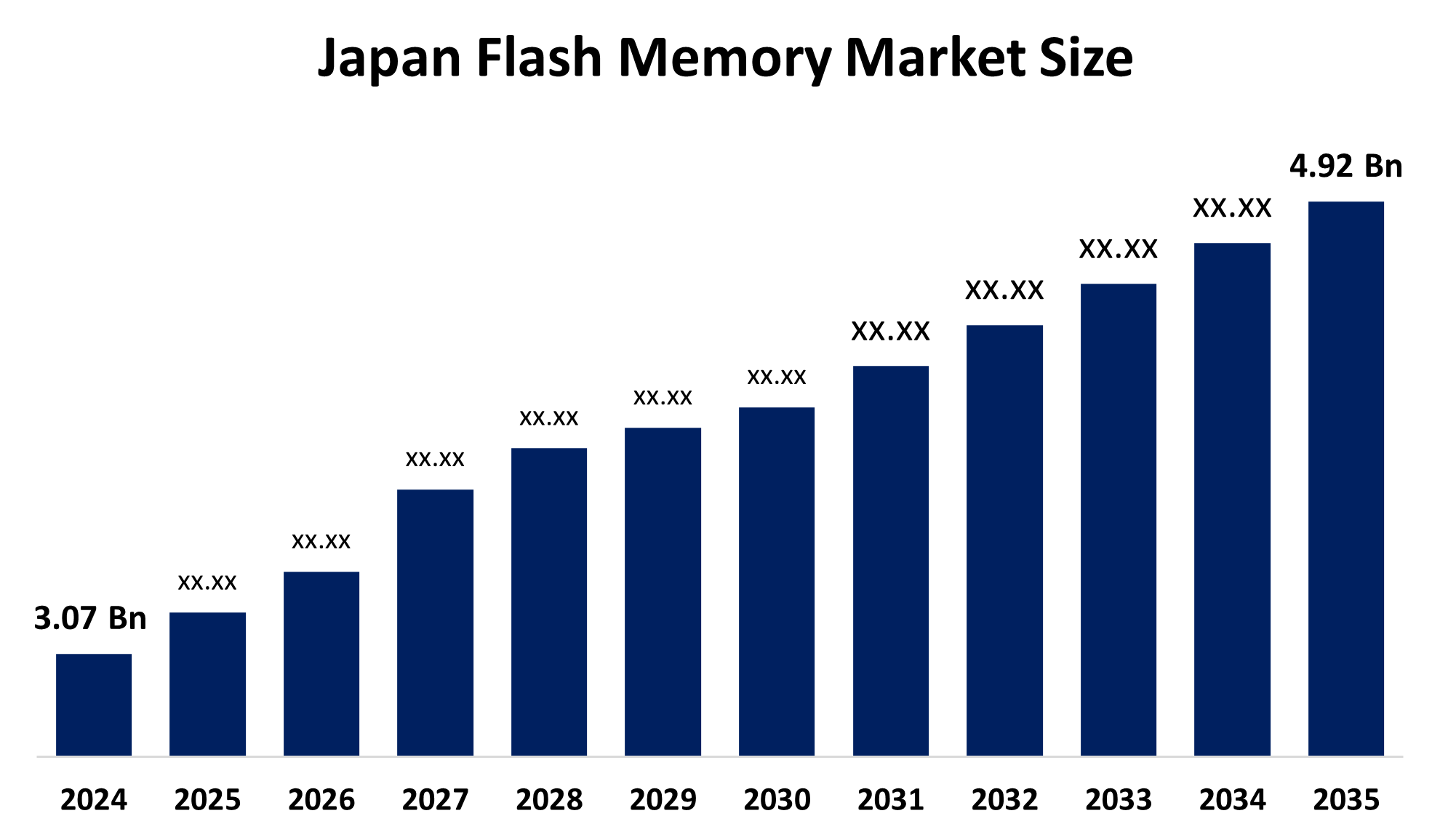

- Japan Flash Memory Market Size 2024: USD 3.07 Bn

- Japan Flash Memory Market Size 2035: USD 4.92 Bn

- Japan Flash Memory Market CAGR 2025-2035: 4.38%

- Japan Flash Memory Market Segments: Memory Type, Density, Interface/Form Factor, End-User Application

Get more details on this report -

Flash memory is a non, volatile semiconductor technology that can store data without power. It is a technology that is widely used in Japan for mobile devices, data centers, automotive systems, industrial controllers, and IoT devices. Reliable storage is provided by general, purpose ICs such as 3D NAND, 2D NAND, and NOR flash, while application, specific ICs enhance performance for automotive, consumer electronics, and industrial applications. The demand is fuelled by the growth of smartphones, enterprise servers, connected vehicles, and industrial automation, which are in need of fast, compact, and durable memory solutions.

The Japanese flash memory industry is supported by robust local manufacturing and government assistance. Verified trade data indicate considerable exports of memory ICs, which is an indication of global demand, while imports are complementing domestic production for advanced manufacturing. The government is promoting chip production through subsidies and technology support programs that are facilitating capacity expansion and lessening dependence on imports. Performance and reliability are being improved by technological advancements such as high, layer 3D NAND, automotive, grade flash, and next, generation memory modules. The Japanese flash memory market will continue to grow due to the rising demand for advanced automotive storage, hyperscale data centers, IoT expansion, and edge computing applications, which in turn will enhance its global competitiveness.

Market Dynamics of the Japan Flash Memory Market:

The Japan Flash Memory Market Size is fueled by the increasing demand for these products in the technology, automotive, electronics, and data center industries. Innovations such as 3D NAND, high, performance automotive, grade flash, and ultra, dense storage solutions are contributing to market expansion. The market growth is further sustained by corporate investments in R&D, collaborations with global tech companies, and adoption of the next, generation memory interfaces such as UFS and CXL modules. Incentives and grants aimed at facilitating semiconductor manufacturing and technology upgrading in the country are instrumental in the creation of a local supply chain that is more sustainable and robust.

The domestic market is restrained by high production costs, complicated fabrication processes, and reliance on imported raw materials. Rapid technology obsolescence, strict quality standards for automotive and industrial applications, and supply chain disruptions are some of the challenges that manufacturers and end, users have to deal with.

The flash memory market in Japan remains viable and has a lot of potentials in the near future particularly in edge computing, IoT devices, automotive storage, and industrial applications. The combination of continuous energy, efficient memory, post, quantum secure storage, large, scale memory modules, government incentives, and corporate partnerships will drive production capacity and market growth over the next ten years

Japan Flash Memory Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.07 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.38% |

| 2035 Value Projection: | USD 4.92 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Memory Type, By Density |

| Companies covered:: | Kioxia Holdings Corporation, Renesas Electronics Corporation, Sony Semiconductor Solutions Corporation, Panasonic Holdings Corporation, Toshiba Electronic Devices and Storage Corporation, Infineon Technologies AG, Micron Technology, Inc., Western Digital Corporation, Samsung Electronics Co., Ltd., SK Hynix Inc., and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Japan Flash Memory Market share is classified into memory type, density, interface/form factor, and end-user application.

By Memory Type:

The Japan Flash Memory Market Size is divided by memory type into 3D NAND, 2D NAND, NOR Flash, and more. Among these, the 3D NAND segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Its dominance is mainly attributed to higher storage density, better endurance, lower cost per bit, and growing usage in mobile devices, data centers, and enterprise storage applications.

By Density:

The Japan Flash Memory Market Size is divided by density into up to 256 Mb, 512 Mb–2 Gb, and more. Among these, the 512 Mb-2 Gb segment dominated the share in 2024 and is expected to grow at a notable CAGR over the forecast period. This segment is ahead because of its perfect balance of performance, cost, and power consumption, which makes it a viable source of power for consumer electronics, automotive systems, and industrial devices.

By Interface/Form Factor:

The Japan Flash Memory Market Size is divided by interface/form factor into eMMC, UFS, SATA SSD, and more. Among these, the UFS segment dominated the share in 2024 and is anticipated to grow significantly during the forecast period. Their expansion is mainly driven by quicker data transfer rates, low latency, and more extensive adoption in high, end smartphones, tablets, and automotive applications.

By End-User Application:

The Japan Flash Memory Market Size is divided by end-user application into data center and enterprise servers, mobile and tablets, automotive, industrial and IoT devices, and more. Among these, the mobile and tablets segment dominated the share in 2024 and is projected to grow at a remarkable CAGR. Expansion is backed by increased smartphone penetration, demand for high, capacity storage, and growing consumption of multimedia and applications in the consumer electronics sector in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Flash Memory Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Flash Memory Market:

- Kioxia Holdings Corporation

- Renesas Electronics Corporation

- Sony Semiconductor Solutions Corporation

- Panasonic Holdings Corporation

- Toshiba Electronic Devices and Storage Corporation

- Infineon Technologies AG

- Micron Technology, Inc.

- Western Digital Corporation

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

Recent Developments in Japan flash memory market:

- In June 2025, Kioxia Corporation announced the confirmation of volume output for a 2 Tb QLC die that allows single, package 1 TB UFS parts. Kioxia also revealed a roadmap exceeding 300 layers by 2027 and established collaboration with Toyota, Honda and Subaru to develop next, generation sesor, fusion storage in Japan.

- In March 2025, Micron Technology, Inc. started mass production of 1, generation DRAM and NAND at its Hiroshima fab, delivering high, bandwidth memory and automotibe, grade flash to Toyota, Denso and Sony for in, vehicle computing and imaging systems in Japan.

- In February 2025, Western Digital and Kioxia have jointly initiated a program to develop CXL 3.0 memory modules. These memory modules will integrate 218, layer BiCS Flash with controller logic. The main aim of the project is to supply these memory modules to Japaness hyperscale's NTT Data, Fujitsu, and NEC, thus enabling them to advance high, performance computing and the next generation of data center storage in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Flash Memory Market Size based on the below-mentioned segments:

Japan Flash Memory Market,

By Memory Type

- 3D NAND

- 2D NAND

- NOR Flash

- Others

Japan Flash Memory Market, By Density

- Up to 256 Mb

- 512 Mb - 2 Gb

- More than 2 Gb

Japan Flash Memory Market, By Interface/Form Factor

- eMMC

- UFS

- SATA SSD

- Others

Japan Flash Memory Market, By End-User Application

- Data Centre and Enterprise Servers

- Mobile and Tablets

- Automotive

- Industrial and IoT Devices

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan Flash Memory Market size?A: Japan Flash Memory Market is expected to grow from USD 3.07 billion in 2024 to USD 4.92 billion by 2035, growing at a CAGR of 4.38% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the Japan flash memory market?A: Market growth is driven by rising demand for memory in smartphones, data centers, automotive systems, industrial automation, and IoT devices. Innovations such as 3D NAND, automotive-grade flash, and next-generation memory modules further boost market expansion. Government incentives and domestic manufacturing support also accelerate growth.

-

Q: What factors restrain the Japan flash memory market?A: Constraints include high production costs, complex fabrication processes, reliance on imported raw materials, rapid technology obsolescence, strict quality standards, and occasional supply chain disruptions.

-

Q: How is the Japan Flash Memory Market segmented by memory type?A: The market is segmented into 3D NAND, 2D NAND, NOR Flash, and Others.

-

Q: How is the market segmented by density?A: The market is divided into Up to 256 Mb, 512 Mb-2 Gb, and More than 2 Gb.

-

Q: How is the market segmented by interface/form factor?A: The market is divided into eMMC, UFS, SATA SSD, and Others.

-

Q: How is the market segmented by end-user application?A: The market is segmented into Data Centre and Enterprise Servers, Mobile and Tablets, Automotive, Industrial and IoT Devices, and Others.

-

Q: Who are the key players in the Japan flash memory market?A: Key companies include Kioxia Holdings Corporation, Renesas Electronics Corporation, Sony Semiconductor Solutions Corporation, Panasonic Holdings Corporation, Toshiba Electronic Devices and Storage Corporation, Infineon Technologies AG, Micron Technology, Inc., Western Digital Corporation, Samsung Electronics Co., Ltd., and SK Hynix Inc.

Need help to buy this report?