Japan Fiber Cement Market Size, Share, By Raw Material (Portland Cement, Silica, Cellulosic Fiber, And Others), By Construction Type (Siding, Roofing, Molding & Trim, And Others), And Japan Fiber Cement Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingJapan Fiber Cement Market Insights Forecasts to 2035

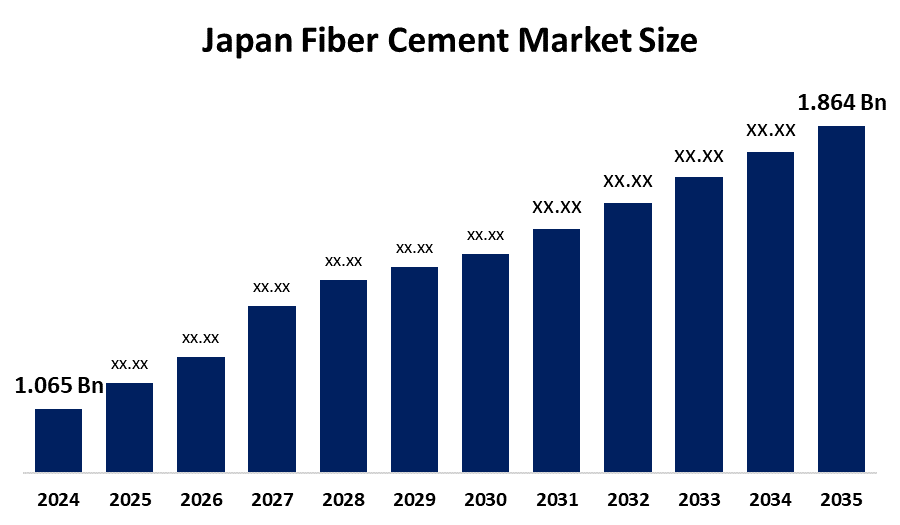

- Japan Fiber Cement Market Size 2024: USD 1.065 Billion

- Japan Fiber Cement Market Size 2035: USD 1.864 Billion

- Japan Fiber Cement Market CAGR 2024: 5.22%

- Japan Fiber Cement Market Segments: Raw Material and Construction Type

Get more details on this report -

The Japan Fiber Cement Market Encompasses Sales Or Uses Fibre Cement Products Within The Japanese Construction Trade. Fibre cement is a composite material, primarily consisting of cement, cellulose fibres and silica, which provide the properties of durability, fire-resistance, moisture tolerance and low maintenance compared to other products like vinyl or wood. Fibre cement products can be used for a variety of purposes including exterior cladding, siding, roofs, partition walls and roofing panels; thus serving both the residential and commercial construction sectors.

The fiber cement in Japan is backed by government support, including the Building Energy Efficiency Act and the Zero Energy House (ZEH) initiative. These policies, supported by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), aim to reduce greenhouse gas emissions from buildings and improve energy performance, effectively boosting the adoption of materials with favourable environmental profiles such as fiber cement.

As technology advances, Japanese fiber cement providers are now using fiber advanced formulation to make fiber cement, driven by a variety of factors including new ways to produce the product, improved performance, improving the way raw materials are combined to make fiber cement boards by using advanced technology; the use of reinforced composites that have superior weather resistant properties, higher fire ratings, and improved dimensional stability across the diverse climate conditions across Japan; and allowing for an improved competitive edge over other aesthetic and decorative options; by improving both performance and aesthetic appeal in Japan.

Japan Fiber Cement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.065 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.22% |

| 2035 Value Projection: | USD 1.864 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Raw Material, By Construction Type |

| Companies covered:: | Nichiha Corporation, Asahi Fiber Cement, Sumitomo Osaka Cement Co., Ltd., KMEW Co., Ltd., Taiheiyo Cement Corporation, Toray Industries, Inc., James Hardie Companies, Etex Group, Cembrit Holding A/S, Knauf Gips KG, Sika AG, CSR Limited, Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Fiber Cement Market:

The Japan fiber cement market is driven by the stringent building codes and safety standards, demand for reliable cladding and siding solutions, urban redevelopment in metropolitan areas, demand for durable with low-maintenance building products, growing emphasis on sustainability and green construction practices, and Japan’s aging housing stock and associated renovation projects sustain stable demand for fiber cement to meet modern performance expectations.

The Japan fiber cement markets is restrained by skilled labour shortage in construction industry, installation capacity and prolong project timelines challenges, requiring skilled workmanship, rising costs of key raw materials, and demographic trends like a declining population and reduced new housing starts in some regions.

The future of Japan fiber cement market is bright and promising, with versatile opportunities emerging from the demand for sustainable, resilient building structures is paving the way for new types of fibre cement products to be developed that meet green building standards and net-zero objectives. There is therefore a significant opportunity for these types of products to be used within developing and disaster-related building markets. Investment in the development of circular economic systems, including recycling of fibre cement components, and production technologies with minimal carbon footprints, will increase the competitiveness of fibre cement products and meet national environmental objectives, thereby creating an opportunity for both developers and policy makers to become increasingly interested in fibre cement products.

Market Segmentation

The Japan Fiber Cement Market share is classified into raw material and construction type.

By Raw Material:

The Japan fiber cement market is divided by raw material into portland cement, silica, cellulosic fiber, and others. Among these, the portland cement segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Cost effectiveness, wide availability, excellent strength, durable actions, and proven performance in demanding seismic conditions all contribute to the portland cement segment's largest share and higher spending on fiber cement when compared to other raw material.

By Construction Type:

The Japan fiber cement market is divided by construction type into siding, roofing, molding & trim, and others. Among these, the siding segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The siding segment dominates because of its excellent durability, low maintenance, resistance to extreme weather, meeting strict sustainability goals, and replicating natural textures, making it ideal for Japan’s seismic activity and humid climate.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan fiber cement market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Fiber Cement Market:

- Nichiha Corporation

- Asahi Fiber Cement

- Sumitomo Osaka Cement Co., Ltd.

- KMEW Co., Ltd.

- Taiheiyo Cement Corporation

- Toray Industries, Inc.

- James Hardie Companies

- Etex Group

- Cembrit Holding A/S

- Knauf Gips KG

- Sika AG

- CSR Limited

- Others

Recent Developments in Japan Fiber Cement Market:

In December 2025, major Japanese manufacturers are deploying AI-based formulation systems to optimize raw material usage, reducing costs by upto 10% and enhanced sustainability in high-density fiber cement production.

In October 2025, Sumitomo Osaka Cement announced the pilot testing of a process that uses waste gypsum wallboard to produce calcium carbonate from cement plant CO2 emissions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan fiber cement market based on the below-mentioned segments:

Japan Fiber Cement Market, By Raw Material

- Portland Cement

- Silica

- Cellulosic Fiber

- Others

Japan Fiber Cement Market, By Construction Type

- Siding

- Roofing

- Molding & Trim

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan fiber cement market size?A: Japan artificial turf market is expected to grow from USD 1.065 billion in 2024 to USD 1.864 billion by 2035, growing at a CAGR of 5.22% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the stringent building codes and safety standards, demand for reliable cladding and siding solutions, urban redevelopment in metropolitan areas, demand for durable with low-maintenance building products, growing emphasis on sustainability and green construction practices, and Japan’s aging housing stock and associated renovation projects sustain stable demand for fiber cement to meet modern performance expectations.

-

Q: What factors restrain the Japan fiber cement market?A: Constraints include the skilled labour shortage in construction industry, installation capacity and prolong project timelines challenges, requiring skilled workmanship, rising costs of key raw materials, and demographic trends like a declining population and reduced new housing starts in some regions.

-

Q: How is the market segmented by raw material?A: The market is segmented into portland cement, silica, cellulosic fiber, and others.

-

Q: Who are the key players in the Japan fiber cement market?A: Key companies include Nichiha Corporation, Asahi Fiber Cement, Sumitomo Osaka Cement Co., Ltd., KMEW Co., Ltd., Taiheiyo Cement Corporation, Toray Industries, Inc., James Hardie Companies, Etex Group, Cembrit Holding A/S, Knauf Gips KG, Sika AG, CSR Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?