Japan Fast Fashion Market Size, Share, By Type (Casual Wear, Formal Wear, and Others), By End-User (Women and Men), By Distribution Channel (Offline Stores and Online Stores/E-commerce), Japan Fast Fashion Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Fast Fashion Market Insights Forecasts to 2035

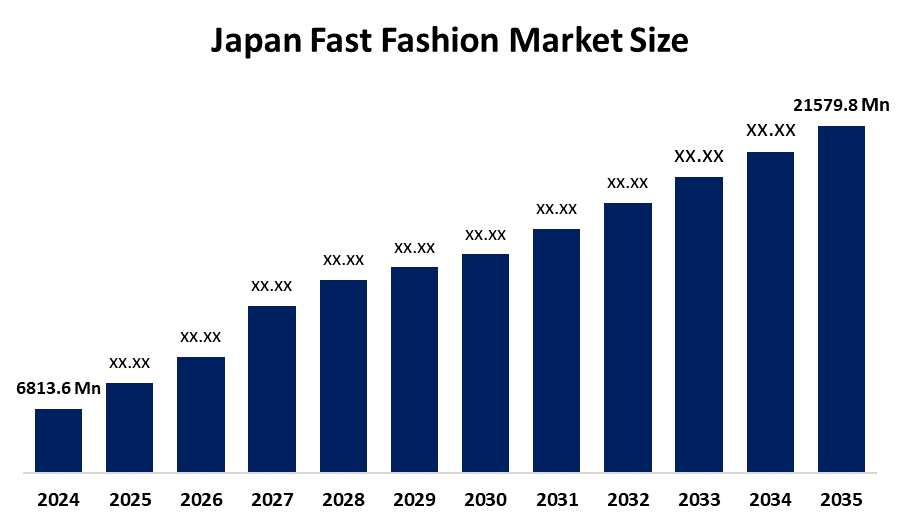

- Japan Fast Fashion Market Size 2024: USD 6813.6 Mn

- Japan Fast Fashion Market Size 2035: USD 21579.8 Mn

- Japan Fast Fashion Market CAGR 2024: 11.05%

- Japan Fast Fashion Market Segments: Type, End-User, and Distribution Channel.

Get more details on this report -

The fast fashion market in Japan refers to the retail segment offering trendy, affordable clothing produced and distributed rapidly to match changing consumer preferences, emphasizing short product cycles, efficient supply chains, and mass-market appeal across physical stores and online platforms. The fast fashion market in Japan has rapidly grown over the last few years, and some factors that are responsible for this rapid growth include the ability of companies to quickly produce low-cost, high-volume fashionable clothing items to meet constantly changing customer needs. More recently, customers in Japan are beginning to prefer lower-priced clothing that has been constructed from very functional textiles, such as heat-extracting and moisture-retaining materials, when purchasing fast fashion products.

The Japanese government has launched an initiative that aims to lower the volume of waste produced by households by 25% by 2030 via better infrastructure for the reuse and recycling of used products. A comprehensive national action plan will be completed by March 2026 to help local governments and businesses create better garment collection systems and manage the life cycles of garments. Meanwhile, many major retailers in the private sector have begun implementing principles of the circular economy, working together to develop recycling technologies and establish high levels of corporate social responsibility to meet the expectations of eco-aware consumers.

Technological advances continue to influence the fashion and textile industries, by integrating artificial intelligence into design software and using predictive analytics for better inventory management and reduced lead times, companies are able to use technology to provide customers with more efficient services. Additionally, new technologies, including virtual fitting rooms, 3D body scanning, and touch-free in-store technologies such as automatic click-and-collect lockers, are providing opportunities for technology-driven consumer experiences that bridge both online and offline shopping experiences.

Japan Fast Fashion Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6813.6 million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 11.05% |

| 2035 Value Projection: | USD 21579.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By End-User |

| Companies covered:: | Uniqlo (Fast Retailing Co., Ltd.), Shimamura Group, Honeys, Earth Music & Ecology, Ryohin Keikaku Co., Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysi |

Get more details on this report -

Market Dynamics of the Japan Fast Fashion Market:

The Japan Fast Fashion Market Size is driven by expanding reach of social media and e-commerce has played a crucial role in the growth of the fast fashion market, which has been most pronounced among millennials and generation Z. Urbanization has resulted in time-constrained customers increasingly gravitating toward trendy fast fashions, this trend will continue as urban areas become more developed and consumers become more familiar with online shopping.

The fast fashion market in japan restrained by competition to offer low-priced products, leading to aggressive price competition and diminished profit margins. Additionally, there is an increasing concern among consumers about the environmental impact of producing and disposing of textiles, which has made it difficult for brands to maintain their traditional fast fashion business practices.

As consumers seek to become more sustainable, the emergence of new technologies, including clothing rental and resale platforms, presents an opportunity for significant growth within the sustainable fashion segment. Additionally, brands can make use of advanced technology, such as AI, to provide consumers with a personalized wardrobe through on-demand production and custom-made products.

Market Segmentation

The Japan fast fashion market share is classified into type, end-user, and distribution channel.

By Type:

The Japan Fast Fashion Market Size is divided by type into casual wear, formal wear, and others. Among these, the casual wear segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Casual attire and footwear are popular throughout all age groups and generations, contributing to the casual wear segment's domination. Furthermore, growing customers' access to trend-responsive clothes at low rates is propelling the casual wear market forward.

By End-User:

The Japan Fast Fashion Market Size is divided by end-user into women and men. Among these, the women's segment held the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to women consumers having a higher level of fashion consciousness, frequent wardrobe upgrading needs, and greater product availability than men end-users. Furthermore, the growing number of female social media influencers advocating fashionable apparel suits created for female consumers is fueling the segment's expansion.

By Distribution Channel:

The Japan Fast Fashion Market Size is divided by distribution channel into offline stores and online stores/e-commerce. Among these, the offline stores segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The offline segment's leading position is due to the large physical retail presence of clothes stores and shopping malls, as well as the ease with which shoppers can purchase products at these locations. Furthermore, consistent retailers' and brands' retail expansion efforts, such as the introduction of a fresh clothes shop chain, are helping to drive segmental revenue growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Fast Fashion Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Fast Fashion Market:

- Uniqlo (Fast Retailing Co., Ltd.)

- Shimamura Group

- Honeys

- Earth Music & Ecology

- Ryohin Keikaku Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Fast Fashion Market Size based on the below-mentioned segments:

Japan Fast Fashion Market, By Type

- Casual Wear

- Formal Wear

- Others

Japan Fast Fashion Market, By End-User

- Women

- Men

Japan Fast Fashion Market, By Distribution Channel

- Offline Stores

- Online Stores/E-commerce

Frequently Asked Questions (FAQ)

-

What is the current market size of the Japan fast fashion market?The Japan fast fashion market was valued at USD 6,813.6 million in 2024 and is projected to reach USD 21,579.8 million by 2035, growing at a CAGR of 11.05% during the forecast period.

-

What factors are driving the growth of the fast fashion market in Japan?Key growth drivers include rising social media influence, expanding e-commerce adoption, urbanization, demand for affordable trendy apparel, and increasing preference for functional and innovative textiles among younger consumers.

-

Which end-user segment holds the largest share in the market?The women's segment held the largest market share in 2024, supported by higher fashion awareness, frequent wardrobe updates, broader product availability, and influence from female social media creators.

-

Which distribution channel leads the Japan fast fashion market?Offline stores accounted for the largest market share in 2024 due to strong physical retail presence, shopping mall culture, and consumers’ preference for in-store trials and immediate purchases.

-

What are the major challenges faced by the fast fashion market in Japan?Major challenges include intense price competition, declining profit margins, rising environmental concerns, and increasing consumer scrutiny over textile waste and sustainability practices.

-

Who are the key players in the Japan fast fashion market?Leading companies include Uniqlo (Fast Retailing Co., Ltd.), Shimamura Group, Honeys, Earth Music & Ecology, Ryohin Keikaku Co., Ltd., and other regional and international brands.

Need help to buy this report?