Japan Fan-Out Packaging Market Size, Share, And COVID-19 Impact Analysis, By Fan-Out Type (Fine Pitch Fan-Out And Wide Fan-Out), By Substrate Material (Organic Resin, Polyimide, Silicon Interposer, And Rigid Organic Laminate), By Device Architecture (Stacked Die, 2.5 Chip Integration, And 3D Chip Integration), By Carrier Type (200 mm, 300 mm, And Panel), And Japan Fan-Out Packaging Market Insights, Industry Trend, Forecast To 2035

Industry: Semiconductors & ElectronicsJapan Fan-Out Packaging Market Insights Forecasts to 2035

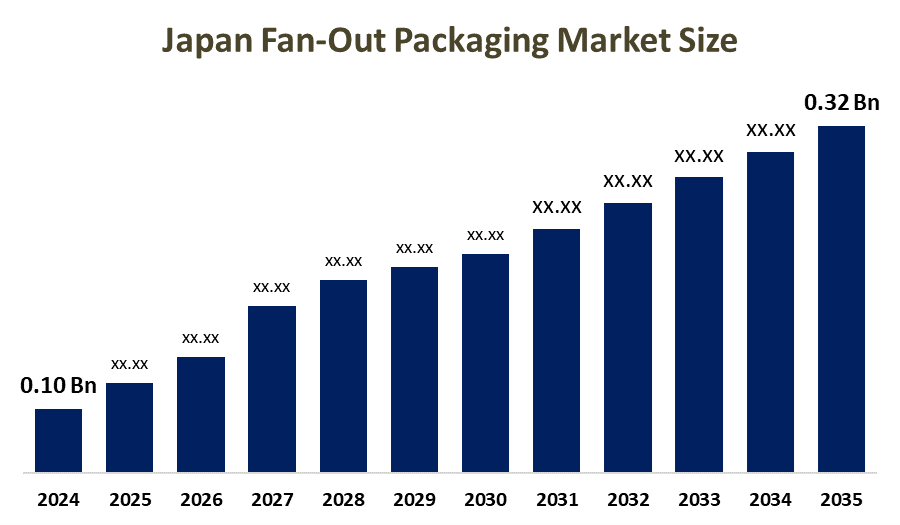

- Japan Fan-Out Packaging Market Size Was Estimated at USD 0.10 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 11.26% from 2025 to 2035.

- Japan Fan-Out Packaging Market Size is Expected to Reach USD 0.32 Billion by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Fan-Out Packaging Market Size is Anticipated to reach USD 0.32 Billion by 2035, growing at a CAGR of 11.26% from 2025 to 2035. The Japan Fan-Out Packaging Market Size is driven by a booming demand for smaller, powerful electronics in 5G, AI, automotive, and data centres, automotive electronics growth, miniaturization trends, and government support for semiconductor industry including fan-out packaging.

Market Overview

Fan-out packaging is the electrical connections emanate from the semiconductor chip and expand outward in order to create a larger packaging design that does not have a substrate. The electrical connections within this type of package are created by embedding the die in a molding material, and including embedded redistribution Layer to provide additional I/O connections. The Japan Fan-Out Packaging Market Size consists of the market that utilizes fan-out advanced semiconductor packaging technology, within Japan. This market growth is driven by growing demand for compact, high-performance electronics, such as smart phones, artificial intelligence (AI), and automotive technology. Many companies in Japan, such as Sony and TSMC, are currently heavily investing in research and development of this technology.

The Japan Fan-Out Packaging Market Size is also driven by the increasing need for smaller size and higher performance electronics, along with rapid adoption of 5G that require compact components. Japan has a rich technology base and high levels of spending by consumers on technology, along with trends of advanced data centre computing AI and IoT, all demanding new and more advanced energy-efficient integration beyond conventional limits. The support from the Japanese government is extensive for the Fan-out packaging market through large-scale National Semiconductor initiatives. The Japanese Advanced Semiconductor Packaging Initiative (JASPI) is a comprehensive program consisting of grants, Tax-Aid and R&D support for advanced materials to strengthen domestic production capabilities, attract foreign direct investment, and a comprehensive policy focus on Innovation and Import substitution in Japan fan-out packaging market.

Report Coverage

This research report categorizes the market for the Japan fan-out packaging market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan fan-out packaging market Size Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan fan-out packaging market.

Japan Fan-Out Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.26% |

| 2035 Value Projection: | USD 0.32 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Fan-Out Type, By Substrate Material, By Device Architecture, By Carrier Type |

| Companies covered:: | Shin-Etsu Chemical, JSR Corporation, Sumitomo Bakelite Co., Ltd, Ajinomoto Fine-Techno Co., Inc., Toray Industries, Hitachi Chemicals Co., Ltd, Mitsui Chemicals, Sony Group Corp, Toshiba Corporation, Panasonic Holdings Corp, Mitsubishi Electric, Fujitsu Limited, Amkor Technology, Taiwan Semiconductor Mfg. and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan fan-out packaging market is driven by an aging population, urbanization, the increasing need for smaller and more powerful consumer electronics, rapid advancement in technology such as 5G, AI, automotive and data centres, rapid growth of the automotive electronics sector, trend toward miniaturization, and strong technological foundation with government support.

Restraining Factors

The high cost of production, complex manufacturing processes, substantial investments in research and development, and potential supply chain issues, technical issues, and stringent sustainability regulations restrain the Japan fan-out packaging market Size in Japan.

Market Segmentation

The Japan fan-out packaging market Size share is classified into fan-out type, substrate material, device architecture, and carrier type.

- The fine pitch fan-out segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Japan fan-out packaging market Size is segmented by fan-out type into fine pitch fan-out, and wide fan-out. Among these, the fine pitch fan-out segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by strong demand for miniaturization, cost effective for mass production, improving yield rates, and offers scalability, high performance computing applications that need a greater number of connections to function effectively, and advanced integration.

- The organic resin segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan fan-out packaging market Size is segmented by substrate material into organic resin, polyamide, silicon interposer, and rigid organic laminate. Among these, the organic resin segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to their cost-effectiveness, widespread use in consumer electronics, ongoing innovations in higher density organic material, growth in AI and consumer demand for advanced electronics.

- The 2.5 Chip Integration segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan fan-out packaging market Size is segmented by device architecture into stacked die, 2.5 chip integration, and 3D chip integration. Among these, the 2.5 chip integration segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its high performance computing, AI, and 5G infrastructure demanding high bandwidth & integration for advanced packaging, heterogeneous integration overcoming single-chip limitations, strong demand in market companies heavily investing in and delivering 2.5 solutions.

- The 300 mm segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan fan-out packaging market Size is segmented by carrier type into 200 mm, 300 mm, and panel. Among these, the 300 mm segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is due to its widespread adoption by Japanese companies, made substantial investments, superior efficiency and economics of scale in high volume manufacturing, and established infrastructure that ensures high quality, reliability, and widespread compatibility with existing production lines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Japan fan-out packaging market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shin-Etsu Chemical

- JSR Corporation

- Sumitomo Bakelite Co., Ltd

- Ajinomoto Fine-Techno Co., Inc.

- Toray Industries

- Hitachi Chemicals Co., Ltd

- Mitsui Chemicals

- Sony Group Corp

- Toshiba Corporation

- Panasonic Holdings Corp

- Mitsubishi Electric

- Fujitsu Limited

- Amkor Technology

- Taiwan Semiconductor Mfg. Co

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In October 2024, DELO, a company active in the FOWLP market, introduced an innovative method involving UV-curable molding materials. Their feasibility study indicated this approach significantly reduces warpage and die shift in fan-out wafer-level packaging processes compared to traditional heat-curing materials, enhancing manufacturing efficiency.

• In November 2023, The Japanese chip materials manufacturer Resonac announced plans to establish a research and development facility for cutting-edge semiconductor materials and packaging in Silicon Valley. This initiative aims to support advancements in advanced packaging, including fan-out technologies, by focusing on essential materials and components.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2025 to 2035. Spherical Insights has segmented The Japan fan-out packaging market Size based on the below-mentioned segments:

Japan Fan-Out Packaging Market, By Fan-Out Type

- Fine Pitch Fan-Out

- Wide Fan-Out

Japan Fan-Out Packaging Market, By Substrate Material

- Organic Resin

- Polyimide

- Silicon Interposer

- Rigid Organic Laminate

Japan Fan-Out Packaging Market, By Device Architecture

- Stacked Die

- 2.5 Chip Integration

- 3D Chip Integration

Japan Fan-Out Packaging Market, By Carrier Type

- 200 mm

- 300 mm

- Panel

Frequently Asked Questions (FAQ)

-

Q. What is the projected market size & growth rate of the Japan fan-out packaging market?A. Japan fan-out packaging market was valued at USD 0.10 Billion in 2024 and is projected to reach USD 0.32 Billion by 2035, growing at a CAGR of 11.26% from 2025 to 2035.

-

Q. What are the key driving factors for the growth of the Japan fan-out packaging market?A. Japan fan-out packaging market is driven by an aging population, urbanization, the increasing need for smaller and more powerful consumer electronics, rapid advancement in technology such as 5G, AI, automotive and data centres, rapid growth of the automotive electronics sector, trend toward miniaturization, and strong technological foundation with government support.

-

Q. What are the top players operating in the Japan fan-out packaging market?A. Shin-Etsu Chemical, JSR Corporation, Sumitomo Bakelite Co., Ltd, Ajinomoto Fine-Techno Co., Inc., Toray Industries, Hitachi Chemicals Co., Ltd, Mitsui Chemicals, Sony Group Corp, Toshiba Corporation, Panasonic Holdings Corp, Mitsubishi Electric, Fujitsu Limited, Amkor Technology, Taiwan Semiconductor Mfg. Co, and Others.

-

Q. What segments are covered in the Japan fan-out packaging market report?A. Japan fan-out packaging market is segmented based on Fan-Out Type, Substrate Material, Device Architecture, and Carrier Type.

Need help to buy this report?