Japan Extractables and Leachables Testing Services Market Size, Share, By Product (Container Closure Systems, Drug Delivery Systems, Single-use Systems, and Others), By Application (Parenteral Drug Products, Orally Inhaled and Nasal Drug Products (OINDP), Ophthalmic Products, and Others), Japan Extractables and Leachables Testing Services Market Insights, Industry Trends, Forecasts to 2035

Industry: HealthcareJapan Extractable and Leachable Testing Services Market Insights Forecasts to 2035

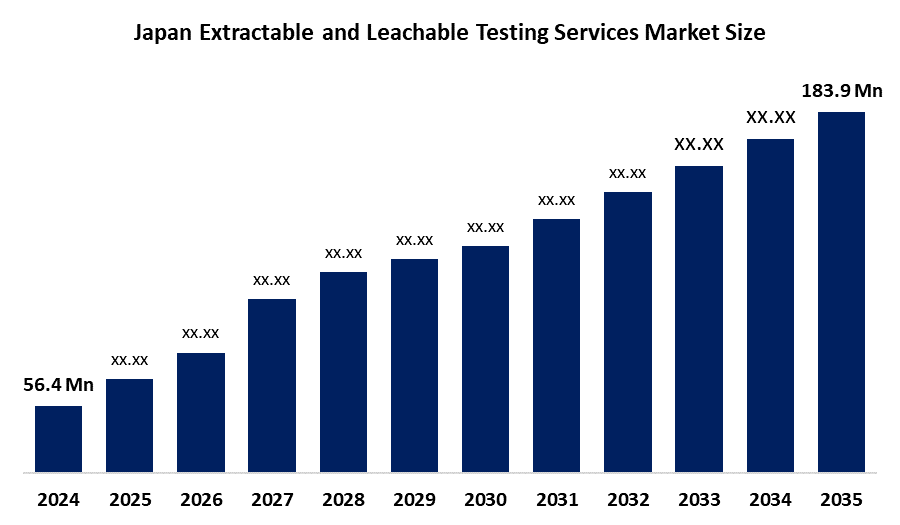

- Japan Extractable and Leachable Testing Services Market Size 2024: USD 56.4 Million

- Japan Extractable and Leachable Testing Services Market Size 2035: USD 183.9 Million

- Japan Extractable and Leachable Testing Services Market CAGR 2024: 11.34%

- Japan Extractable and Leachable Testing Services Market Segments: Product and Application

Get more details on this report -

Extractables and leachables testing services encompass investigations and quantification of chemical compounds with possible extraction and migration potential from container closure systems, drug delivery platforms, and raw materials utilized during the pharmaceutical manufacturing process. The service is critical and essential for enhancing pharmaceutical safety, integrity, and compliance during drug product testing and commercialization. Extractables and leachables testing is well recognized and adopted within pharmaceutical quality and risk management processes within Japan. The E&L testing service is utilized within parenteral drug forms, orally inhalation and nasal drugs, and complex pharmaceutical delivery platforms such as prefilled and disposable injection components and drug formulations. The need is fostered by the increasing trend of utilizing advanced drug and pharmaceutical platforms and safety of patient exposure.

Technological advancements include high-resolution mass spectrometry, automated sample preparation, and improved toxicological risk assessment methodologies. Future opportunities include increased biologics pipelines, more outsourcing to specialized analytical labs, and increasing pharmaceutical packaging and delivery system complexities, which cement the continued importance of E&L test services in the Japanese pharmaceutical industry's quality spectrum.

Japan Extractable and Leachable Testing Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 56.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 11.34% |

| 2035 Value Projection: | USD 183.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product ,By Application |

| Companies covered:: | SGS Japan, Eurofins Japan, Charles River Laboratories Japan, Inc., Mitsubishi Chemical Medience Corporation, Intertek Japan, SRL, Inc., WuXi AppTec, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Extractable and Leachable Testing Services Market:

The market for extractables and leachables testing services in Japan is fueled by stringent regulations for pharmaceutical packaging, drug delivery systems, and one-time used products, which often lie in the high-risk segment for drugs. An increase in the number of drugs, including biologics, injectables, inhalers, and ophthalmic, necessitates testing services, which is a pre-requisite for all drugs.

The market is also restrained by increasing testing costs for analysis, intricate testing and study design prerequisites, and considerable business development and validation periods. There is also a lack of expert analytical skills and modern technology, and this is increasing operational complexity for testing service providers and pharmaceutical firms.

The market offers great potential for expansion on the back of the rising outsourcing of analytical testing, larger, scale implementation of single, use systems, and more focus on material characterization at the R&D stage. Breakthroughs in highly sensitive analytical methods as well as the introduction of risk, based testing strategies will most probably help to maintain a steady requirement for extractables and leachables testing services in Japan.

Market Segmentation

The Japan Extractable and Leachable Testing Services Market share is classified into product and application.

By Product:

The Japan Extractable and Leachable Testing Services Market Size is divided by product into container closure systems, drug delivery systems, single-use systems, and others. Among these, the container closure systems segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Essential regulatory compliances and prolonged contact with drugs, along with the requirement for vials, stoppers, syringes, and bottles to undergo a wider range of testing, account for the segment's dominance and its higher level of expenditure on testing compared to other product categories.

By Application:

The Japan Extractable and Leachable Testing Services Market Size is divided by application into parenteral drug products, orally inhaled and nasal drug products (OINDP), ophthalmic products, and others. Among these, the parenteral drug products segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. High patient safety risks, strict regulatory scrutiny, and the need for comprehensive contamination control in injectable formulations drive increased demand for extractables and leachables testing compared to other application areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Extractable and Leachable Testing Services Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Extractable and Leachable Testing Services Market:

- SGS Japan

- Eurofins Japan

- Charles River Laboratories Japan, Inc.

- Mitsubishi Chemical Medience Corporation

- Intertek Japan

- SRL, Inc.

- WuXi AppTec

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Extractable and Leachable Testing Services Market Size based on the below-mentioned segments:

Japan Extractables and Leachables Testing Services Market, By Product

- Container Closure Systems

- Drug Delivery Systems

- Single-use Systems

- Others

Japan Extractables and Leachables Testing Services Market, By Application

- Parenteral Drug Products

- Orally Inhaled and Nasal Drug Products (OINDP)

- Ophthalmic Products

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan extractable and leachable testing services market size?The Japan extractable and leachable testing services market is expected to grow from USD 56.4 million in 2024 to USD 183.9 million by 2035, registering a CAGR of 11.34% during the forecast period 2025-2035.

-

What are the key growth drivers of the Japan extractable and leachable testing services market?Market growth is driven by increasing pharmaceutical and biotechnology R&D activities, rising development of biologics and injectable drugs, stringent regulatory requirements for drug packaging and delivery systems, and growing outsourcing of analytical testing to specialized service providers.

-

What factors restrain the Japan extractable and leachable testing services market?Key restraints include high testing and compliance costs, complex study design requirements, long validation and approval timelines, limited availability of skilled analytical professionals, and operational challenges associated with advanced testing methodologies.

-

Which product segment dominated the market in 2024?The container closure systems segment dominated the market in 2024 due to stringent regulatory requirements and prolonged contact of materials with drug formulations, necessitating extensive extractables and leachables testing.

-

Which application segment held the largest share in 2024?Parenteral drug products held the largest share in 2024, driven by high patient safety risks, strict regulatory scrutiny, and the need for comprehensive contamination control in injectable formulations.

-

Who are the key players in the Japan extractable and leachable testing services market?Key players include SGS Japan, Eurofins Japan, Charles River Laboratories Japan, Inc., Mitsubishi Chemical Medience Corporation, Intertek Japan, SRL, Inc., WuXi AppTec, and others.

-

What are the target audiences for the Japan extractable and leachable testing services market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?