Japan Ethylene Vinyl Acetate Market Size, Share, By Product Grade (Very Low Density EVA, Low Density EVA, Medium Density EVA, And High Density EVA), By Application (Films, Solar Cell Encapsulation, Foams, Hot Melt Adhesives, Extruded Sheets & Molded Items, And Wire & Cable Insulation), And Japan Ethylene Vinyl Acetate Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsJapan Ethylene Vinyl Acetate Market Insights Forecasts to 2035

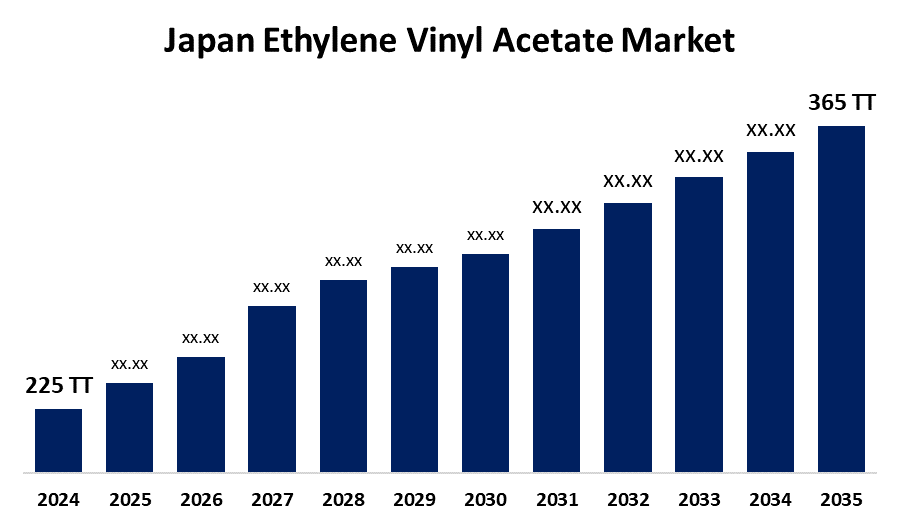

- Japan Ethylene Vinyl Acetate Market 2024: 225 Thousand Tonnes

- Japan Ethylene Vinyl Acetate Market Size 2035: 365 Thousand Tonnes

- Japan Ethylene Vinyl Acetate Market CAGR 2024: 4.5%

- Japan Ethylene Vinyl Acetate Market Segments: Product Grade and Application

Get more details on this report -

Japan Ethylene Vinyl Acetate (EVA) Market Size refers to all activities related to the production of EVA copolymers, which are made from copolymerizing ethylene with vinyl acetate. These flexible polymers are characterized by their toughness, clarity and excellent impact resistance. EVA is widely used in a variety of applications, including flexible packaging films, midsoles and foamed products for footwear, solar photovoltaic encapsulation, hot melt adhesives, wire and cable jacketing, and many different types of consumer and industrial products. The Japan EVA market is supported by a diverse manufacturing base and demand across multiple sectors including electronics, automotive, construction and renewable energy.

The ethylene vinyl acetate in Japan are backed by government support, including the national Green Growth Strategy Through Achieving Carbon Neutrality in 2050, which aims to transition Japan’s industrial economy toward more sustainable and advanced materials and manufacturing. Japan’s goal to reduce greenhouse gas emissions by 46% by 2030 (from 2013 levels), a target that is shaping policy and industrial investment priorities including in polymer materials that enable renewable energy and energy-efficient applications.

As technology advances, Japanese ethylene vinyl acetate providers are now focused on specialized, high-quality EVA grades that meet strict demands of a variety of industries, including the solar industry where improved ultraviolet resistance and mechanical strength are very important, and creating new resins for medical device packaging and specialty adhesives for electronics assembly. Additionally, new products have been developed using recyclable or bio-based feedstock to support Japanese manufacturers’ goals of being environmentally-friendly and developing product lines based around lifecycle principles by helping Japan’s manufacturers to meet more rigorous global quality and sustainability standards imposed on products exported out of Japan.

Market Dynamics of the Japan Ethylene Vinyl Acetate Market:

The Japan Ethylene Vinyl Acetate Market Size is driven by the robust demand in packaging, rapid growth in e-commerce, expanding use in solar PV encapsulation, increasing renewable energy deployment, continued consumption in footwear and foam applications, growth in electronics and automotive sectors, increasing EVA’s adaptability and reliability make it a preferred polymer, and Japan’s strong industrial base and emphasis on high-quality materials further propel the market growth.

The Japan Ethylene Vinyl Acetate Market Size is restrained by the competition from alternative polymers and material systems, need for improved environmental profiles, stringent environmental regulations and sustainability expectations, and challenging traditional EVA producers for rapid innovation.

The future of Canadian Ethylene Vinyl Acetate Market Size is bright and promising, with versatile opportunities emerging from the rapid growth of renewable energy adoption, particularly solar PV, has created increasing demand for EVA as an encapsulant in the production of solar modules, while increased focus on environmental sustainability creates opportunities for the development of high value biologically-based and recyclable EVA formulations. Additionally, with the emergence of new industries based on advanced technologies, the need for EVA enhance the performance of custom materials within the country and globally.

Japan Ethylene Vinyl Acetate (EVA) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 225 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.5% |

| 2035 Value Projection: | 365 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Mitsui Chemicals, Inc. Sumitomo Chemical Co., Ltd. Tosoh Corporation DuPont-Mitsui Polychemicals Co., Ltd. Asahi Kasei Corporation Toray Industries, Inc. Sekisui Chemical Co., Ltd. Inabata & Co., Ltd. Dow Chemical Japan ExxonMobil Chemical Company LyondellBasell Industries Celanese Corporation Hanwha Solutions Formosa Plastics Corporation Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan Ethylene Vinyl Acetate Market share is classified into product grade and application.

By Product Grade:

The Japan Ethylene Vinyl Acetate Market Size is divided by product grade into very low density EVA, low density EVA, medium density EVA, and high density EVA. Among these, the low density EVA segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High demand for EVA films in packaging and solar encapsulation, require low-temperature sealing properties, superior flexibility, and lower melting points all contribute to the low density EVA segment’s largest share and higher spending on ethylene vinyl acetate segment when compared to other product grade.

By Application:

The Japan Ethylene Vinyl Acetate Market Size is divided by application into films, solar cell encapsulation, foams, hot melt adhesives, extruded sheets & molded items, and wire & cable insulation. Among these, the films segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The films segment dominates because of high demand for solar energy, offers superior and durable material properties, continued technological advancements in photovoltaic technologies, and strong well established manufacturing base for EVA in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Ethylene Vinyl Acetate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Ethylene Vinyl Acetate Market:

- Mitsui Chemicals, Inc.

- Sumitomo Chemical Co., Ltd.

- Tosoh Corporation

- DuPont-Mitsui Polychemicals Co., Ltd.

- Asahi Kasei Corporation

- Toray Industries, Inc.

- Sekisui Chemical Co., Ltd.

- Inabata & Co., Ltd.

- Dow Chemical Japan

- ExxonMobil Chemical Company

- LyondellBasell Industries

- Celanese Corporation

- Hanwha Solutions

- Formosa Plastics Corporation

- Others

Recent Developments in Japan Ethylene Vinyl Acetate Market:

In September 2024, Dow-Mitsui Polychemicals commenced marketing of biomass-based EVA and low density polyethylene under the EVAFLEX and MIRASON brands. Produced at their Chiba Plant using the mass balance method, these products obtained ISCC PLUS certification to reduce greenhouse gas emissions while maintaining properties of conventional EVA.

In May 2024, Sumitomo Chemical collaborated with Lummus Technology to license Sumitomo’s high pressure production process for EVA and LDPE, aiming for more sustainable production technology.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan ethylene vinyl acetate market based on the below-mentioned segments:

Japan Ethylene Vinyl Acetate Market, By Product Grade

- Very Low Density EVA

- Low Density EVA

- Medium Density EVA

- High Density EVA

Japan Ethylene Vinyl Acetate Market, By Application

- Films

- Solar Cell Encapsulation

- Foams

- Hot Melt Adhesives

- Extruded Sheets & Molded Items

- Wire & Cable Insulation

Frequently Asked Questions (FAQ)

-

What is the Japan ethylene vinyl acetate market size?Japan ethylene vinyl acetate market is expected to grow from 225 thousand tonnes in 2024 to 365 thousand tonnes by 2035, growing at a CAGR of 4.5% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by the robust demand in packaging, rapid growth in e-commerce, expanding use in solar PV encapsulation, increasing renewable energy deployment, continued consumption in footwear and foam applications, growth in electronics and automotive sectors, increasing EVA’s adaptability and reliability make it a preferred polymer, and Japan’s strong industrial base and emphasis on high-quality materials further propel the market growth

-

What factors restrain the Japan ethylene vinyl acetate market?Constraints include the competition from alternative polymers and material systems, need for improved environmental profiles, stringent environmental regulations and sustainability expectations, and challenging traditional EVA producers for rapid innovation

-

How is the market segmented by product grade?The market is segmented into very low density EVA, low density EVA, medium density EVA, and high density EVA

-

Who are the key players in the Japan ethylene vinyl acetate market?Key companies include Mitsui Chemicals, Inc., Sumitomo Chemical Co., Ltd., Tosoh Corporation, DuPont-Mitsui Polychemicals Co., Ltd., Asahi Kasei Corporation, Toray Industries, Inc., Sekisui Chemical Co., Ltd., Inabata & Co., Ltd., Dow Chemical Japan, ExxonMobil Chemical Company, LyondellBasell Industries, Celanese Corporation, Hanwha Solutions, Formosa Plastics Corporation, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?