Japan ESG Investing Market Size, Share, By Type (ESG Integration, Impact Investing, Sustainable Funds, Green Bonds, Others), By Investor Types (Institutional Investors, Retail Investors, Corporate Investors), By Application (Environmental, Social, Governance, Integrated ESG), Japan ESG Investing Market Insights, Industry Trends, Forecasts to 2035.

Industry: Banking & FinancialJapan ESG Investing Market Insights Forecasts to 2035

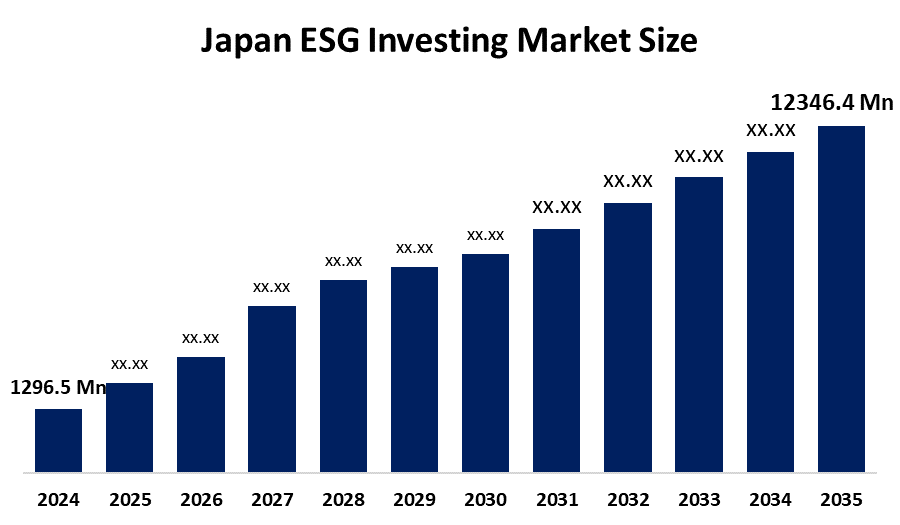

- Japan ESG Investing Market Size 2024: USD 1296.5 Mn

- Japan ESG Investing Market Size 2035: USD 12346.4 Mn

- Japan ESG Investing Market CAGR 2024: 22.74%

- Japan ESG Investing Market Segments: Type, Investor Types, and Application

Get more details on this report -

Environmental, Social, and Governance ESG investing incorporates investment techniques that involve principles of protecting the environment, upholding social responsibility, and upholding ESG corporate governance guidelines. ESG investing in Japan involves various investment tools, from investment portfolios, public investment products, treasury, sustainable investment ventures, etc., that are focused on guarding against risks while creating long-term shareholder value. The growth of ESG investing in Japan comes as a result of greater investor understanding, regulatory pressures, and responsible capital allocation.

In this regard, innovation has an important function to perform by way of AI driven ESG scoring models, big data analytics platforms, sustainable reporting solutions delivered by way of automation technology, blockchain-powered traceability solutions, and digital solutions for climate risk assessment provided by way of asset management institutions and financial service providers at large. Additionally, government initiatives emphasizing the urgency for sustainable finance practices, corporate governance laws, stewardship codes, and climate risk related disclosures by financial institutions remain key avenues that can further accelerate ESG ratings integration within the broader Japanese financial landscape going forward.

Market Dynamics of the Japan ESG Investing Market:

The Japan ESG investing market is influenced by factors such as increased awareness of environmental, social, and governance risks, increased demand for sustainable investment options, and increasing participation of institutional investors. Regulatory push towards transparency, climate related information disclosure, and corporate governance reform remains unabated in terms of ESG.

Japan's market for ESG investing faces constraints related to the consistency of the quality of ESG related information. In addition to this factor, asset management product costs are higher compared to other regions. There exists a lack of skill in the field of ESG for small players, with sustainability metrics generating certain challenges with the interpretation of the same for decision-making.

The outlook for the future of the ESG investing market in Japan exists as a promising trend. Further dimensions can be added to the market with the development of new market opportunities coming from green finance, transition bonds, impact investing, and the increasing focus of modern technology on ESG analytics. The improved market maturity with AI powered ESG scoring and data platforms will be beneficial in the long term.

Japan ESG Investing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1296.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 22.74% |

| 2035 Value Projection: | USD 12346.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Investor Types |

| Companies covered:: | Asset Management One Co., Ltd,Daiwa Asset Management Co., Ltd,Mitsubishi UFJ Asset Management Co., Ltd.,Sumitomo Mitsui Trust Asset Management Co., Ltd,Nikko Asset Management Co., Ltd.BlackRock Japan Co., Ltd And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan ESG investing market share is classified into type, investor types, and application.

By Type:

The Japan ESG investing market is divided by type into ESG integration, impact investing, sustainable funds, green bonds, and others. Among these, ESG integration dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is driven by regulatory alignment, adoption of institutional mandates, standardization of ESG frameworks, increased availability of data, and ease of integrating ESG metrics into traditional portfolio risk management and investment decision making processes.

By Investor Types:

The Japan ESG investing market is divided by investor types into institutional investors, retail investors, and corporate investors. Among these, institutional investors dominated the share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period. Strong stewardship codes, fiduciary responsibility, long-term risk mitigation objectives, regulatory disclosure requirements, and increasing focus on sustainable asset allocation are some of the things that continue to drive the pace of ESG investment adoption by institutions.

By Application:

The Japan ESG investing market is divided by application into environmental, social, governance, and integrated ESG. Among these, the integrated ESG segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Investors increasingly favor integrated ESG approaches for comprehensive risk-adjusted return capture, enhanced transparency, holistic addressing of sustainability objectives, and long-term strengthening of portfolio resilience across diversified asset classes.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan ESG investing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan ESG Investing Market:

- Asset Management One Co., Ltd.

- Daiwa Asset Management Co., Ltd.

- Mitsubishi UFJ Asset Management Co., Ltd.

- Sumitomo Mitsui Trust Asset Management Co., Ltd.

- Nikko Asset Management Co., Ltd.

- Nissay Asset Management Co., Ltd.

- Meiji Yasuda Asset Management Co., Ltd.

- Resona Asset Management Co., Ltd.

- Nomura Asset Management Co., Ltd.

- BlackRock Japan Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan ESG investing market based on the below-mentioned segments:

Japan ESG Investing Market, By Type

- ESG Integration

- Impact Investing

- Sustainable Funds

- Green Bonds

- Others

Japan ESG Investing Market, By Investor Types

- Institutional Investors

- Retail Investors

- Corporate Investors

Japan ESG Investing Market, By Application

- Environmental

- Social

- Governance

- Integrated ESG

Frequently Asked Questions (FAQ)

-

Q: What is the Japan ESG investing market size?A: The Japan ESG investing market is expected to grow from USD 1,296.5 million in 2024 to USD 12,346.4 million by 2035, registering a CAGR of 22.74% during the forecast period 2025–2035.

-

Q: What factors restrain the Japan ESG investing market growth?A: Key restraints include inconsistent ESG data quality, higher asset management costs, limited ESG expertise among smaller market participants, challenges in interpreting sustainability metrics, and the absence of fully standardized ESG evaluation methodologies across investment products.

-

Q: How is the Japan ESG investing market segmented by type?A: The market is segmented into ESG integration, impact investing, sustainable funds, green bonds, and others.

-

Q: Which segment dominated the Japan ESG investing market in 2024?A: The integrated ESG application segment dominated the market in 2024 due to its comprehensive risk-return assessment approach, stronger transparency, and alignment with long-term portfolio resilience and sustainability objectives.

-

Q: Who are the key players in the Japan ESG investing market?A: Key companies include Asset Management One Co., Ltd., Daiwa Asset Management Co., Ltd., Mitsubishi UFJ Asset Management Co., Ltd., Sumitomo Mitsui Trust Asset Management Co., Ltd., Nikko Asset Management Co., Ltd., Nissay Asset Management Co., Ltd., Meiji Yasuda Asset Management Co., Ltd., Resona Asset Management Co., Ltd., Nomura Asset Management Co., Ltd., BlackRock Japan Co., Ltd., and Others.

-

Q: What recent developments are shaping the Japan ESG investing market?A: Recent developments include the dominance of SGX FTSE Blossom Japan Index futures in ESG derivatives trading and the issuance of a certified climate resilience bond by the Tokyo Metropolitan Government, strengthening sustainable finance and ESG-linked investment adoption

-

Q: Who are the target audiences for the Japan ESG investing market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?