Japan Edible Oil and Fats Market Size, Share, By Product (Oils and Fats), By Packaging Type (Bottles, Pouches, Cans, and Jars), and By Distribution Channel (Offline, Online), Japan Edible Oil and Fats Market Insights, Industry Trend, Forecasts to 2035.

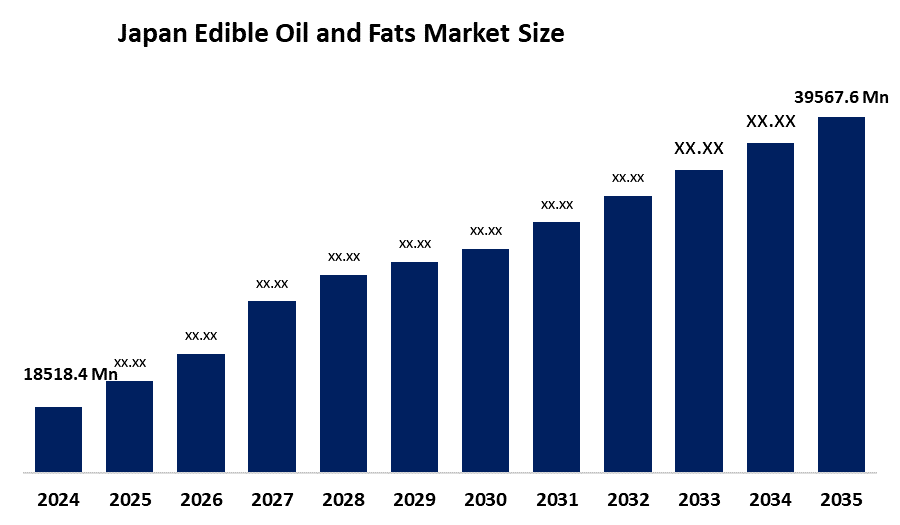

Industry: Food & Beverages- Japan Edible Oil and Fats Market Size 2024: USD 18518.4 Mn

- Japan Edible Oil and Fats Market Size 2035: USD 39567.6 Mn

- Japan Edible Oil and Fats Market CAGR: 7.15%

- Japan Edible Oil and Fats Market Segments: Product, Packaging Type, and Distribution Channel

Get more details on this report -

The market for edible oils and fats in Japan is an established one that is slowly but surely growing. One of the main drivers of this growth is the change in consumer preferences towards healthier oils like olive, rice bran, canola, and speciality oils. The market demand is supported by both household consumption and the foodservice industry that includes ready-to-eat meals and fried foods. Retail channels such as supermarkets, convenience stores, and the growing influence of e-commerce are making accessibility easier and are thus contributing to growth. The trend towards healthiness and the consumers' desire for quality and functional benefits are still affecting consumption patterns.

The Japanese administration, via the Ministry of Agriculture, Forestry, and Fisheries (MAFF), executes its policies aiming at supply stabilization in the first place, then to provide aid to the domestic production, and finally guaranteeing food safety. Among the measures, MAFF controls the quality based on certain standards, does the labeling and import management, all these being ways to keep the market clean, aside from the public health instructions, which are in fact pushing for the use of better oils.

The areas where it is possible to make higher margins are in premiumization, functional and organic oils, sustainable sourcing, and local specialty oils. Moreover, e-commerce expansion, along with supply chains that are traceable, also makes it possible for the brands to reach, in an effective manner, the niche market of health-conscious consumers.

Market Dynamics of the Japan Edible Oil and Fats Market:

The soaring health consciousness and the alteration of consumers’ diets are the main factors that prop up the Japanese edible oil and fats market. People are more concerned about their cardiovascular health and being overweight, thus the oils that are less saturated, i.e., olive oil, rice bran oil, canola oil, and the ones rich in unsaturated fats, are getting more acceptance among consumers. The strong presence of the food processing and foodservice industries, including ready-to-eat meals and fried food segments, continues to maintain the steady demand for edible oils and fats due to the latter's support of the former. The aging population of Japan is one of the factors that pushes the demand for functional and premium oils, which provide extra nutritional advantages.

The market encounters some constraints that slow down the growth. The Japanese market is totally reliant on oilseed imports, particularly soybeans, sunflower oil, and palm oil, which renders the whole sector exposed to global price swings, currency changes, and supply chain disturbances. Further, the industry's growth is mainly through replacement, as the market is full of stable per capita consumption. In addition, the enforcement of safety regulations and maintaining high-quality standards are some of the factors that inflate manufacturers' costs.

The market is full of substantial chances. The increasing use of oils that are organic, non-GMO, and sustainably sourced is not only allowing products to be differentiated but also making it possible to charge higher prices. The rising e-commerce and specialty retail channels are allowing brands to connect with such consumers in a better way. In addition, the introduction of new functional oils and local specialty oils has opened up a wide range of opportunities for companies in this industry to grow their businesses in the long run.

Japan Edible Oil and Fats Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18518.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.15% |

| 2035 Value Projection: | USD 39567.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Nisshin Oilio Group Ltd, J-OIL MILLS, Inc., Fuji Oil Co., Ltd., Yamanaka Cooking Oil Co., Ltd., Toyo Olive Co., Ltd. & Regional Producers, Agri Olive Shodoshima, Cargill, Incorporated, Archer-Daniels-Midland Company (ADM), Bunge Limited, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan Edible Oil and Fats Market share is classified into product, packaging type, and distribution channel.

By Product Type:

The Japanese edible oil and fats market is categorised by product type into oils and fats. Among these, the oil segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is driven by the widespread use of olive, sesame, rapeseed (canola), and soybean oils in home, restaurant, and food processing settings. The widespread use of oils in everyday Japanese cuisine, rising demand for plant-based and functional oils, and growing health consciousness all contribute to the strong preference for oils.

By Packaging Type:

The Japan edible oil and fats market is divided by packaging type into bottles, pouches, cans, and jars. Among these, the bottle segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. Strong consumer preference for both home and foodservice applications, as well as their ease of handling, reusability, and convenience. In addition to improving product visibility, bottles are frequently used for both high-end and regular cooking oils.

By Distribution Channel:

The Japanese edible oil and fats market is classified by distribution channel into offline and online. Among these, the offline segment held the majority market share in 2024 and is predicted to grow at a remarkable rate in the future. For regular edible oil purchases, consumers rely on supermarkets, hypermarkets, convenience stores, and specialty food stores. This dominance is sustained by well-established retail networks, instant product availability, and customer confidence in physical stores.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan edible oil and fats market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Edible Oil and Fats Market:

- Nisshin Oilio Group Ltd

- J-OIL MILLS, Inc.

- Fuji Oil Co., Ltd.

- Yamanaka Cooking Oil Co., Ltd.

- Toyo Olive Co., Ltd. & Regional Producers

- Agri Olive Shodoshima

- Cargill, Incorporated

- Archer-Daniels-Midland Company (ADM)

- Bunge Limited

- Others

Recent Developments in Japan Edible Oil and Fats Market:

- In April 2025, Fuji Oil Co., Ltd. completed the acquisition of PROVENCE HUILES S.A.S, a French edible oil manufacturer specializing in high-oleic sunflower oil and other plant-based oils.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan oil and fats market based on the following segments:

Japan Edible Oil and Fats Market, By Product

- Oils

- Fats

Japan Edible Oil and Fats Market, By Packaging Type

- Bottles

- Pouches

- Cans

- Jars

Japan Edible Oil and Fats Market, By Distribution Channel

- Offline

- Online

Frequently Asked Questions (FAQ)

-

1.What is the base year and historical data period for this market report?The base year is 2024, and the historical data covers 2020–2023.

-

2.What is the expected market size and growth of the Japan edible oil and fats market?The market is expected to grow from USD 18,518.4 million in 2024 to USD 39,567.6 million by 2035, registering a CAGR of 7.15% during 2025–2035.

-

3.How is the market segmented by product type?The market is categorized into oils and fats, with the oils segment dominating due to high usage of olive, sesame, rapeseed, and soybean oils in homes, restaurants, and food processing.

-

4.What are the key packaging types in the market?Packaging types include bottles, pouches, cans, and jars. Bottles hold the largest market share due to convenience, reusability, and visibility for both high-end and regular cooking oils.

-

5.How is the market segmented by distribution channel?The market is divided into offline (supermarkets, hypermarkets, convenience stores) and online channels. Offline channels currently dominate due to established retail networks and customer trust.

Need help to buy this report?