Japan Dental Services Market Size, Share, By Type (Laser Dentistry, Orthodontics, Endodontics, Cosmetic Dentistry, Oral & Maxillofacial Surgery, Periodontics, Dental Implants, Dentures, and Others), By End-Use (Hospitals and Dental Clinics), Japan Dental Services Market Insights, Industry Trends, Forecasts to 2035

Industry: HealthcareJapan Dental Services Market Insights Forecasts to 2035

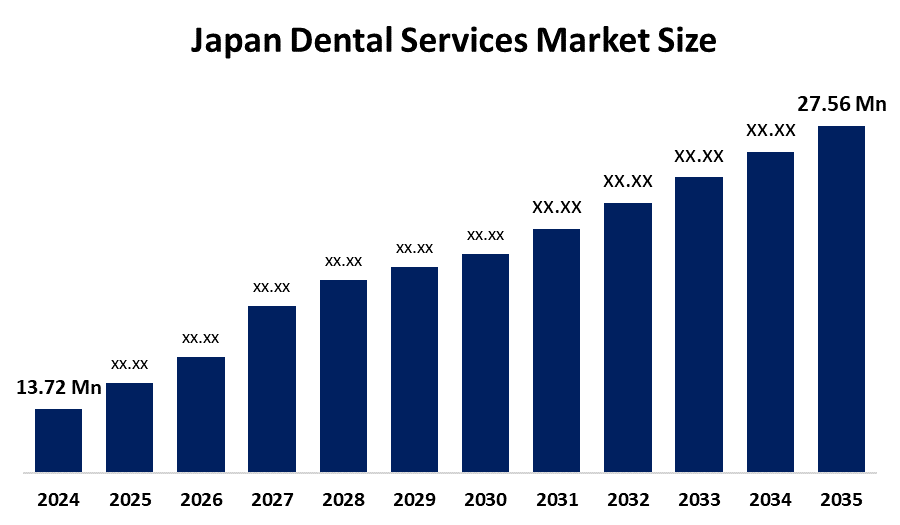

- Japan Dental Services Market Size 2024: USD 13.72 Mn

- Japan Dental Services Market Size 2035: USD 27.56 Mn

- Japan Dental Services Market CAGR 2024: 6.55%

- Japan Dental Services Market Segments: Type and End Use

Get more details on this report -

The Japan Dental Services Market Size includes professional oral health services, which cover a range of services including prevention, diagnosis, treatment, surgery, and cosmetic dentistry. Japan, being a nation with a strong preventive health practice, needs a range of dental services, which cover the frequent utilization rates, along with the burgeoning requirement for age-related oral health, disease prevention, and the need for the longevity of teeth.

Technological advancements are greatly influencing dental practice with the introduction of technologies like digital radiography, CAD/CAM dentistry, AI diagnostics, laser dentistry, and the introduction of dental clinic management software. Government support can be said to significantly influence the overall stability of the dental market with the availability of universal health coverage that entails the cost of most dental procedures, mandatory dental checkups once a year, the 8020 Campaign, and the proposed Vision 2040 aimed at coping with the super-aging population. Future outlook on the dental market reveals future opportunities in the said area, particularly in preventive dentistry, digital dentistry, gerontology, cosmetic dentistry, technology-driven dental clinic expansions.

Market Dynamics of the Japan Dental Services Market:

The Japan Dental Services Market Size is fuelled by high levels of preventive healthcare knowledge, annual compulsory dental check-ups, and extensive universal health insurance coverages. An ageing population drives the need for periodontal, dentures, implants, and other treatments. Increasing adoption of digital dentistry, AI diagnostics, and minimally invasive treatments continues to support the market services.

The market growth is restrained due to high operational costs, lack of insurance cover, workforce shortages in rural areas, regulatory complexities related to medical devices, as well as insurance system-related constraints in increasing revenue growth from premiums related to high-end dental procedures.

The opportunities available in the future can be attributed to the development of preventive and geriatric dentistry treatments, expansion of oral and maxillofacial surgery, and use of digitalization in dental clinics. There is an increased demand for personalized oral and dental treatments. Funding support from government authorities promotes the adoption of digital health and development of oral health.

Japan Dental Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.72 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 6.55% |

| 2035 Value Projection: | USD 27.56 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By End-use |

| Companies covered:: | J. Morita Manufacturing Corp. GC Corporation Takara Belmont Corporation Mani, Inc. Nakanishi Inc. The Yoshida Dental Mfg. Co., Ltd. Tokuyama Dental Corporation Shofu Inc. Nissin Dental Products Inc. Dentsply Sirona Japan K.K. KaVo Dental Systems Ivoclar Vivadent Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan dental services market share is classified into type and end use.

By Type:

The Japan Dental Services Market size is divided by type into laser dentistry, orthodontics, endodontics, cosmetic dentistry, oral & maxillofacial surgery, periodontics, dental implants, dentures, and others. Among these, the orthodontics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The drivers of growth are increasing incidence of malocclusion, growing aesthetic awareness among adults and adolescents, increased use of clear aligners, continued improvements in technology, growing availability of orthodontic clinics, and increasing willingness to invest in long-term corrective dental treatments among the Japanese population.

By End-use:

The Japan Dental Services Market Size is divided by end-use into hospitals and dental clinics. Among these, the dental clinics segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Segment growth is enhanced by the rising number of private dental clinics, an increase in access to specialty dental procedures, reduced waiting periods, low-cost outpatient procedures, and patient preference for seeking care in a localization context, along with the growing need for routine and cosmetic dentistry procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Dental Services Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Dental Services Market:

- J. Morita Manufacturing Corp.

- GC Corporation

- Takara Belmont Corporation

- Mani, Inc.

- Nakanishi Inc.

- The Yoshida Dental Mfg. Co., Ltd.

- Tokuyama Dental Corporation

- Shofu Inc.

- Nissin Dental Products Inc.

- Dentsply Sirona Japan K.K.

- KaVo Dental Systems

- Ivoclar Vivadent

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan dental services market based on the below-mentioned segments:

Japan Dental Services Market, By Type

- Laser Dentistry

- Orthodontics

- Endodontics

- Cosmetic Dentistry

- Oral & Maxillofacial Surgery

- Periodontics

- Dental Implants

- Dentures

- Others

Japan Dental Services Market, By End-use

- Hospitals

- Dental Clinics

Frequently Asked Questions (FAQ)

-

What is the Japan dental services market size?The Japan dental services market is expected to grow from USD 13.72 million in 2024 to USD 27.56 million by 2035, registering a CAGR of 6.55% during the forecast period 2025-2035.

-

What are the key growth drivers of the Japan dental services market?Market growth is driven by strong preventive oral healthcare awareness, mandatory annual dental checkups, comprehensive universal health insurance coverage for most dental procedures, an aging population, rising demand for orthodontic and cosmetic dentistry, and increasing adoption of digital and technology-enabled dental services

-

What factors restrain the Japan dental services market?Market growth is restrained by high operational and equipment costs for clinics, limited insurance coverage for premium cosmetic and implant procedures, workforce shortages in rural areas, regulatory complexity related to dental devices, and reimbursement constraints under the national insurance system

-

How is the Japan dental services market segmented?The market is segmented by type into laser dentistry, orthodontics, endodontics, cosmetic dentistry, oral & maxillofacial surgery, periodontics, dental implants, dentures, and others, and by end-use into hospitals and dental clinics

-

Which segment dominates the Japan dental services market?The orthodontics segment dominated the market share in 2024, supported by rising aesthetic awareness, increased use of clear aligners, growing incidence of malocclusion, and higher willingness to invest in long-term corrective dental treatments.

-

Who are the key players in the Japan dental services market?Key players include J. Morita Manufacturing Corp., GC Corporation, Takara Belmont Corporation, Mani, Inc., Nakanishi Inc., The Yoshida Dental Mfg. Co., Ltd., Tokuyama Dental Corporation, Shofu Inc., Nissin Dental Products Inc., Dentsply Sirona Japan K.K., KaVo Dental Systems, Ivoclar Vivadent, and others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?