Japan Dental Devices Market Size, Share, By Product (General and Diagnostics Equipment, Dental Consumables, and Others), By Treatment (Orthodontic, Endodontic, Periodontic, and Prosthodontic), By End User (Hospitals, Clinics, and Others), Japan Dental Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Dental Devices Market Insights Forecasts to 2035

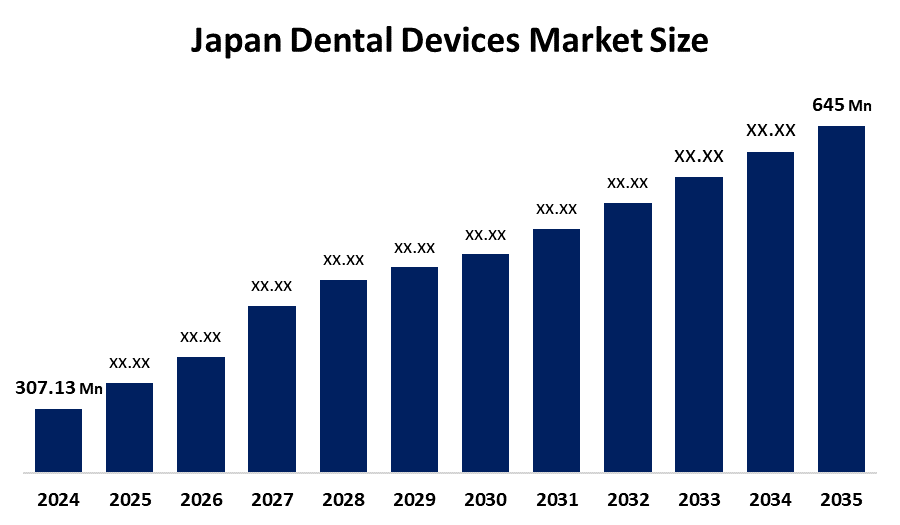

- Japan Dental Devices Market Size 2024: USD 307.13 Million

- Japan Dental Devices Market Size 2035: USD 645 Million

- Japan Dental Devices Market CAGR 2024: 6.98%

- Japan Dental Devices Market Segments: Product, Treatment, and End User.

Get more details on this report -

Japan Dental Devices Market Size describes the industry within Japan that is involved in the development, production, and use of dental devices or tools for dental purposes. It involves dental devices that diagnose, treat, prevent, and restore dental functions and services with products such as image devices, dental chairs, dental implants, dental tools and instruments, and dental consumables. The dental devices market in Japan contributes to dental practices and operations of dental clinics, hospitals, and dental labs within Japan. Furthermore, The Japan dental devices market is growing due to the increasingly ageing population, growing need for restorative and preventive dental care, awareness regarding oral care, and technological improvements such as digital dentistry and 3D imaging. In addition, the growing market of cosmetic dentistry and a highly developed infrastructure of healthcare contribute to increasing the adoption of technologically advanced dental devices.

The Japan government’s policies also contribute significantly to innovation and development in the dental devices market. The Pharmaceuticals and Medical Devices Act (PMD Act) ensures the safety and efficacy of all dental devices used in Japan. The Japanese government has also introduced innovation incentives and easy approval procedures, encouraging research and development regarding more advanced technologies. The Japanese community is involved in community health programs, deriving benefits from oral health and preventive practices, and is thereby adopting more innovative dental devices.

The trends in Japan dental devices market are propelled by strong growth due to an ageing population, increasing awareness of dental health, and demands for restorative, aesthetic, and preventive dental treatments. The trend in adopting digital dental treatment methods is increasing due to 3D imaging, intraoral scanners, CAD/CAM systems, and AI diagnostics. The demands for minimally invasive treatment methods, ergonomic designs, diagnostics, aesthetic solutions such as orthodontics, and teeth whitening kits are on the increase.

Japan Dental Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 307.13 million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.98% |

| 2035 Value Projection: | USD 645 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Treatment |

| Companies covered:: | Dentsply Sirona 3M GC Corporation Takara Belmont Corporation Mani, Inc. Dentech Corporation J. Morita Manufacturing Corp. KaVo Dental Systems Japan A-Dec, Inc. Patterson Companies, Inc. Straumann Carestream Health, Inc. and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Dental Devices Market:

The Japan Dental Devices Market Size is driven by a steadily increasing elderly population, demand for prosthetics, implants, and restorative dental care. Education on oral hygiene and preventive dentistry stimulates the demand for diagnostic and treatment equipment. The development of technologies such as digital dentistry solutions, CAD/CAM machines, intraoral scanners, and AI-powered diagnostic systems is pulling the growth trigger. The popularity of cosmetic dentistry and favourable government initiatives also accelerate the growth.

The Japan Dental Devices Market Size is restrained by certain factors, such as high pricing for digital dentistry and CAD-CAM systems, which limit their use to bigger dental practices. Likewise, rigorous regulations and approval procedures also tend to delay the launch of a wide range of products. Lack of competent dental practitioners, market saturation in big cities, and economic sensitivity, which impedes elective procedures, also limit growth within this market.

The Japan Dental Devices Market Size offers opportunities in the growing demand for digital dental care, such as CAD/CAM devices, 3D imaging, and intraoral scanners. The development of cosmetic and preventive dentistry procedures like tooth whitening and aligners also widens the scope of investment. Rising awareness about oral health care and developments in minimally invasive and friendly dental devices also open many avenues for investment and development.

Market Segmentation

The Japan Dental Devices Market share is classified into product, treatment, and end user.

By Product:

The Japan Dental Devices Market Size is divided by product into general and diagnostic equipment, dental consumables, and others. Among these, the dental consumables segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dental consumables segment dominates because these items, such as fillings, crowns, implants, and orthodontic supplies, are used in every dental procedure and require frequent replacement. High patient volume, routine dental treatments, and ongoing preventive care drive consistent demand. In contrast, general and diagnostic equipment have higher costs and longer replacement cycles, limiting their market share.

By Treatment:

The Japan Dental Devices Market Size is divided by treatment into orthodontic, endodontic, periodontic, and prosthodontic. Among these, the prosthodontic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The prosthodontic segment dominates because of the country's ageing population and high prevalence of tooth loss, driving demand for dentures, implants, crowns, and bridges. Cosmetic and restorative dentistry trends further boost this segment. While orthodontic, periodontic, and endodontic treatments grow steadily, prosthodontics generates the largest revenue and market share due to necessity and higher-cost procedures.

By End User:

The Japan Dental Devices Market Size is segmented by end user into hospitals, clinics, and others. Among these, the hospitals segment dominated the market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.The dominance of the hospitals segment is attributed to the availability of advanced infrastructure, specialized dental departments, and comprehensive treatment capabilities, enabling hospitals to perform complex procedures such as dental implants and prosthodontics. While clinics primarily focus on routine dental care, hospitals generate higher demand for dental devices and greater revenue, positioning them as the largest end-user segment in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Dental Devices Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the Japan Dental Devices Market

• Dentsply Sirona

• 3M

• GC Corporation

• Takara Belmont Corporation

• Mani, Inc.

• Dentech Corporation

• J. Morita Manufacturing Corp.

• KaVo Dental Systems Japan

• A-Dec, Inc.

• Patterson Companies, Inc.

• Straumann

• Carestream Health, Inc.

Recent Developments in Japan Dental Devices Market:

- In April 2025, A landmark clinical trial began for TRG-035, a tooth regrowth drug developed by a team at Kyoto University. This intravenous drug targets the USAG-1 protein to stimulate the growth of new natural teeth.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions advisors has segmented the Japan Dental Devices Market Size based on the below-mentioned segments:

Japan Dental Devices Market, By Products

- General and Diagnostics Equipment

- Dental Consumables

- Others

Japan Dental Devices Market, By Treatment

- Orthodontic

- Endodontic

- Periodontic

- Prosthodontic

Japan Dental Devices Market, By End User

- Hospitals

- Clinics

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan dental devices market size?Japan dental devices market is expected to grow from USD 307.13 million in 2024 to USD 645 million by 2035, growing at a CAGR of 6.98% during the forecast period 2025-2035.

-

What are Japan dental devices market?Japan dental devices include instruments, equipment, and consumables used for diagnosing, preventing, and treating dental conditions. These include dental chairs, imaging systems, handpieces, implants, orthodontic appliances, and restorative materials.

-

What factors are driving the Japan dental devices market?Key driver factors include Japan’s ageing population, rising prevalence of oral diseases, increasing demand for cosmetic dentistry, and growing adoption of advanced and digital dental technologies.

-

Which treatment segment dominates in Japan dental devices market?The prosthodontic segment dominates due to high demand for dentures, crowns, bridges, and dental implants, driven by tooth loss among elderly patients.

-

What are the major product trends in Japan dental devices market?Key trends include digital dentistry, adoption of CAD/CAM systems, 3D printing, AI-based imaging, and increased use of minimally invasive dental technologies.

Need help to buy this report?