Japan Defense Logistics Market Size, Share, By Logistics Function (Transportation, Technical Support & Maintenance, Inventory & Warehouse Management, Supply Chain & Distribution), By Commodity (Armament & Ammunition, Medical Supplies, Fuel & Energy Supplies, Spare Parts & Equipment, Others), By Mode of Transport (Roadways, Waterways, Airways, Railways), By End Use (Army, Navy, Air Force), Japan Defense Logistics Market Insights, Industry Trends, Forecasts to 2035

Industry: Aerospace & DefenseJapan Defense Logistics Market Insights Forecasts to 2035

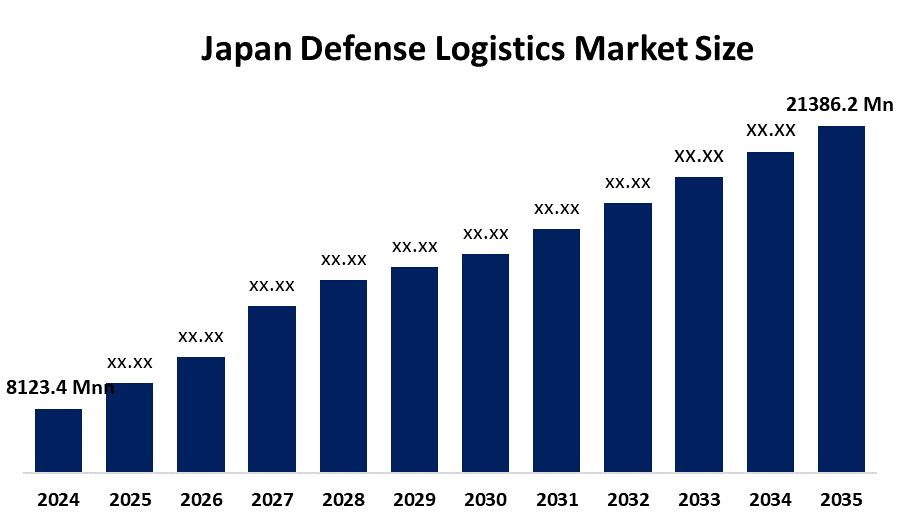

- Japan Defense Logistics Market Size 2035: USD 21386.2 Million

- Japan Defense Logistics Market CAGR 2024: 9.2%

- Japan Defense Logistics Market Segments: Logistic Functions, Commodity, Mode of Transport, and End Use

Get more details on this report -

The Japan defense logistics market includes all activities which involve planning and coordinating and transporting and storing and maintaining and distributing military resources and personnel that support national defense operations. The main functions of the army navy and air force include troop movement and ammunition and weapon storage and medical supply distribution and fuel supply and spare parts distribution and operational maintenance functions. The market serves as a vital component which enables military units to maintain their combat capabilities while conducting defense missions and protecting regional security throughout the entire country. The Japanese defense logistics system has grown in strategic importance because of increasing geopolitical conflicts and the need for military forces which can respond quickly to different situations. The market expansion occurs because defense budgets increase and the Japan self- defense forces modernize and the military forces focus on combined operational training.

The technological advancements include artificial intelligence-based inventory management systems and automatic warehouse operations and systems that provide real-time asset monitoring and systems that predict maintenance needs and unmanned delivery systems and digital twin systems that manage supply chain operations and blockchain technology-based traceability solutions. The government supports multiple initiatives which include the establishment of the JJOC in 2025 and the SHIELD unmanned defense programs and the supply chain resilience programs led by METI and the support programs for small and medium enterprises and the revisions to export regulations and the expansion of Overseas Security Assistance and the defense innovation programs managed by ATLA. The future development of cross-domain logistics systems and public-private cooperation and defense supply chains that serve international markets and advanced logistics support systems for joint multinational operations will create new business opportunities.

Japan Defense Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8123.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.2% |

| 2035 Value Projection: | USD 21386.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Logistics Function (TransportaBy Commodity (Armament & Ammunition,tion, |

| Companies covered:: | Mitsubishi Heavy Industries, Ltd., Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, IHI Corporation, NEC Corporation, Toshiba Corporation, Nippon Express Holdings, Inc., Yamato Holdings Co., Ltd., Kintetsu World Express, Inc., Logisteed, Ltd., SG Holdings Co., Ltd., K Line Logistics, Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Defense Logistics Market:

The Japan defense logistics market is driven by increasing defense expenditure, modernization of the Japan Self-Defense Forces, and rising demand for rapid deployment and sustained operational readiness. The need for joint military operations and growing regional security threats has prompted defense organizations to boost their investments in transportation systems and inventory management solutions and unified logistics control technologies.

The market faces restraints because it requires high capital investments and it has complicated regulatory compliance standards and operational difficulties which come from using modern digital logistics systems with existing defense systems. The organization faces restrictions because it needs specific equipment and it has a shortage of trained workers and it experiences prolonged delays during the acquisition process.

The implementation of AI-based logistics planning and automated warehouse systems and unmanned transportation systems and predictive maintenance platforms and blockchain-based tracing solutions allows organizations to discover major market opportunities. The expansion of public-private partnerships and the growth of multinational defense initiatives and the establishment of defense supply chains for international markets will drive substantial future growth opportunities.

Market Segmentation

The Japan defense logistics market share is classified into logistic functions, commodity, mode of transport, and end use.

By Logistics Function:

The Japan defense logistics market is divided by logistics function into transportation, technical support & maintenance, inventory & warehouse management, and supply chain & distribution. Among these, the transportation segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Operational mobility needs, troop and equipment movements, use of multimodal transport infrastructure, increasing defense readiness programs, logistics requirements across the island, and growing defense spending contribute to increased spending and sustained dominance of the transport service within the Japanese defense logistics structure.

By Commodity:

The Japan defense logistics market is divided by commodity into armament & ammunition, medical supplies, fuel & energy supplies, spare parts & equipment, and others. Among these, the armament & ammunition segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Military modernization, increased ammunition stockpile requirements, security concerns in the region, increased training, replacement life cycles, and stringent safety, handling, and storage requirements contribute substantially to increased logistics demand for armament and ammunition commodities.

By Mode of Transport:

The Japan defense logistics market is divided by mode of transport into roadways, waterways, airways, and railways. Among these, the airways segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Rapid deployment needs, readiness for emergency response, geography of an island nation, time-critical military operations, increased airlift investments, and strategic air mobility for personnel, equipment, and humanitarian missions drive sustained dominance of air transport logistics.

By End Use:

The Japan defense logistics market is divided by end use into army, navy, and air force. Among these, the army segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Increased force size, extensive ground operations, continuous training, increased equipment diversity, regular maintenance cycles, and increased reliance on steady supply chains for mobility, weapons, fuel, and provisions support the army’s dominant logistics demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan defense logistics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Defense Logistics Market:

- Mitsubishi Heavy Industries, Ltd.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- IHI Corporation

- NEC Corporation

- Toshiba Corporation

- Nippon Express Holdings, Inc.

- Yamato Holdings Co., Ltd.

- Kintetsu World Express, Inc.

- Logisteed, Ltd.

- SG Holdings Co., Ltd.

- K Line Logistics, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan defense logistics market based on the below-mentioned segments:

Japan Defense Logistics Market, By Logistics Functio

- Transportation

- Technical Support & Maintenance

- Inventory & Warehouse Management

- Supply Chain & Distribution

Japan Defense Logistics Market, By Commodity

- Armament & Ammunition

- Medical Supplies

- Fuel & Energy Supplies

- Spare Parts & Equipment

- Others

Japan Defense Logistics Market, By Mode of Transport

- Roadways

- Waterways

- Airways

- Railways

Japan Defense Logistics Market, By End Use

- Army

- Navy

- Air Force

Frequently Asked Questions (FAQ)

-

Q: What is the Japan defense logistics market size?A: Japan defense logistics market is expected to grow from USD 8123.4 million in 2024 to USD 21386.2 million by 2035, growing at a CAGR of 9.2% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rising defense expenditure, modernization of the Japan Self-Defense Forces, increasing emphasis on rapid deployment and joint operations, growing regional security challenges, and adoption of advanced logistics technologies including automation, AI-based planning, and real-time tracking systems

-

Q: What factors restrain the Japan defense logistics market?A: Constraints include high capital investment requirements, complex regulatory and compliance standards, cybersecurity risks, integration challenges with legacy defense infrastructure, shortages of skilled logistics personnel, and lengthy procurement and acquisition cycles.

-

Q: How is the market segmented?A: The market is segmented by logistics function, commodity, mode of transport, and end use.

-

Q: Who are the key players in the Japan defense logistics market?A: Key companies include Mitsubishi Heavy Industries, Ltd., Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, IHI Corporation, NEC Corporation, Toshiba Corporation, Nippon Express Holdings, Inc., Yamato Holdings Co., Ltd., Kintetsu World Express, Inc., Logisteed, Ltd., SG Holdings Co., Ltd., K Line Logistics, Ltd., and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?