Japan Cryptocurrency Market Size, Share, By Type (Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, and Other), By Component (Hardware and Software), By Process (Mining, Transaction, Staking & Smart Contract Operations), By Application (Trading, Remittance, Payment, and Other), Japan Cryptocurrency Market Insights, Industry Trends, Forecasts to 2035.

Industry: Banking & FinancialJapan Cryptocurrency Market Insights Forecasts to 2035

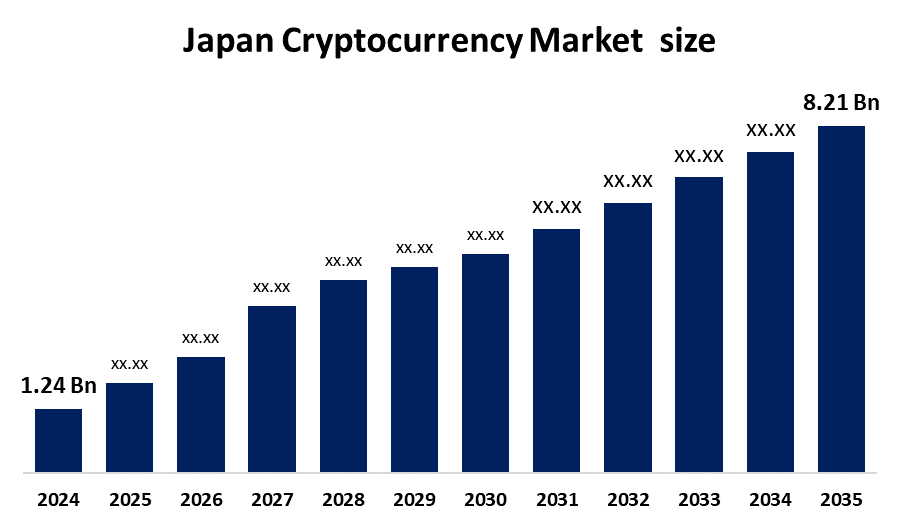

- Japan Cryptocurrency Market Size 2024: USD 1.24 Billion

- Japan Cryptocurrency Market Size 2035: USD 8.21 Billion

- Japan Cryptocurrency Market CAGR 2024: 18.75%

- Japan Cryptocurrency Market Segments: Type, Component, Process and Application

Get more details on this report -

Cryptcurrency functions as a digital currency which employs cryptographic methods to create secure decentralized transactions that operate independently from conventional banking systems. The Japan cryptocurrency market provides trading, investment, custody, and payment services which operate through its digital assets. The application extends to various areas which include retail and institutional investment portfolios and merchant and peer-to-peer payment systems and cross-border remittance services and decentralized finance platforms. The market experiences expansion because of high digital literacy rates which enable more people to access the internet and mobile devices while cryptocurrency adoption continues to grow in combination with traditional financial systems to deliver quick and dependable payment methods.

The financial services agency enforces licensing requirements and compliance standards while providing investor protections to create market security and transparency. Technological innovations which include yen-pegged stablecoins and central bank digital currency pilot programs deliver enhanced efficiency and interoperability. Providers use blockchain technology and secure wallets to enhance their transaction processing speed while maintaining data integrity. Japan will become an Asian cryptocurrency center when digital payments achieve mainstream acceptance and regulated digital asset services expand and exchange systems create partnerships with licensed financial institutions.

Japan Cryptocurrency Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.21 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 18.75% |

| 2035 Value Projection: | 8.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Component |

| Companies covered:: | Bitflyer, Coincheck, Bitbank, Binance Japan, SBI Crypto, Hashkey DX, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Cryptocurrency Market:

The Japan cryptocurrency market is driven by the growing adoption of digital payments, the increasing interest in blockchain-based financial services, and the rising demand for secure, transparent, and decentralized transactions. The market expands because government bodies create tools to support fintech development while banks and retail stores adopt blockchain technology and retail and institutional investors learn about cryptocurrency investing. The development of crypto infrastructure and wallets together with AI-powered trading platforms drives adoption in different industries.

The market is restrained by regulatory uncertainty, volatility in cryptocurrency prices, cybersecurity threats, and limited mainstream acceptance among traditional financial institutions. The combination of high operating expenses, absence of uniform standards, and difficulties in making cryptocurrencies work with current financial systems creates obstacles that hinder adoption while making it hard for investors and service providers to operate.

The Japan cryptocurrency market will develop into a strong industry through its decentralized finance (DeFi) sector and central bank digital currency (CBDC) testing and its blockchain cross-border payment systems and asset tokenization methods. The trading process will become more efficient because crypto exchanges will expand and AI-based trading analytics will develop and security measures will become more effective.

Market Segmentation

The Japan cryptocurrency market share is classified into type, component, process, and application.

By Type:

The Japan cryptocurrency market is divided by type into bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and other. Among these, the bitcoin segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The Japan cryptocurrency market operates under a dominant Bitcoin standard which results from its high liquidity and broad Japanese user base and its established market standing and reputation as a secure investment and its presence on all main trading platforms and its backing from institutional investors and its clear regulatory status.

By Component:

The Japan cryptocurrency market is divided by component into hardware and software. Among these, the software segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Software dominates because cryptocurrency exchange platforms, digital wallets, blockchain management tools, and staking applications are critical for user transactions, trading efficiency, security, and compliance with Japan’s financial regulations.

By Process:

The Japan cryptocurrency market is divided by process into mining, transaction, and staking & smart contract operations. Among these, the transaction segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The rising use of cryptocurrency for payments by both retail customers and institutional customers together with the increasing volume of high-frequency trading and the development of fintech applications and the rising need for remittances and the quick settlement capacity of Japan's blockchain system drive transaction growth.

By Application:

The Japan cryptocurrency market is divided by application into trading, remittance, payment, and others. Among these, the trading segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The Japan market experiences trading dominance because both retail and institutional investors actively participate in the market while crypto exchanges attract users who want to invest through speculative trading and government-approved platforms offer access to diverse digital assets.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan cryptocurrency market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Cryptocurrency Market:

- bitFlyer

- Coincheck

- bitbank

- Binance Japan

- SBI Crypto

- HashKey DX

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Sperical Insights has segmented the Japan cryptocurrency market based on the below-mentioned segments:

Japan Cryptocurrency Market, By Type

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Other

Japan Cryptocurrency Market, By Component

- Hardware

- Software

Japan Cryptocurrency Market, By Process

- Mining

- Transaction

- Staking & Smart Contract Operations

Japan Cryptocurrency Market, By Application

- Trading

- Remittance

- Payment

- Other

Frequently Asked Questions (FAQ)

-

Q: What is the Japan cryptocurrency market size?A: Japan cryptocurrency market is expected to grow from USD 1.24 billion in 2024 to USD 8.21 billion by 2035, growing at a CAGR of 18.75% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing adoption of digital payments, rising interest in blockchain-based financial services, and increasing demand for secure, transparent, and decentralized transactions. Government support for fintech, adoption by banks and retail stores, and AI-powered trading platforms further push market expansion.

-

Q: What factors restrain the Japan cryptocurrency market?A: Constraints include regulatory uncertainty, volatility in cryptocurrency prices, cybersecurity threats, and limited mainstream adoption by traditional financial institutions. High operational costs, lack of standardization, and integration challenges with existing financial systems slow adoption and increase barriers for investors and service providers.

-

Q: How is the Japan cryptocurrency market segmented by component?A: Japan cryptocurrency market is segmented into hardware and software.

-

Q: How is the Japan cryptocurrency market segmented by process?A: Japan cryptocurrency market is segmented into mining, transaction, and staking & smart contract operations.

Need help to buy this report?