Japan Corporate Training Market Size, Share, and COVID-19 Impact Analysis, By Training Type (Technical Training, Soft Skills, Quality Training, Compliance, Others), By End Use Industry (Retail, Pharmaceutical and Healthcare, Financial Services, Professional Services, Public Enterprises, Information Technology, Others), and Japan Corporate Training Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Corporate Training Market Size Insights Forecasts to 2035

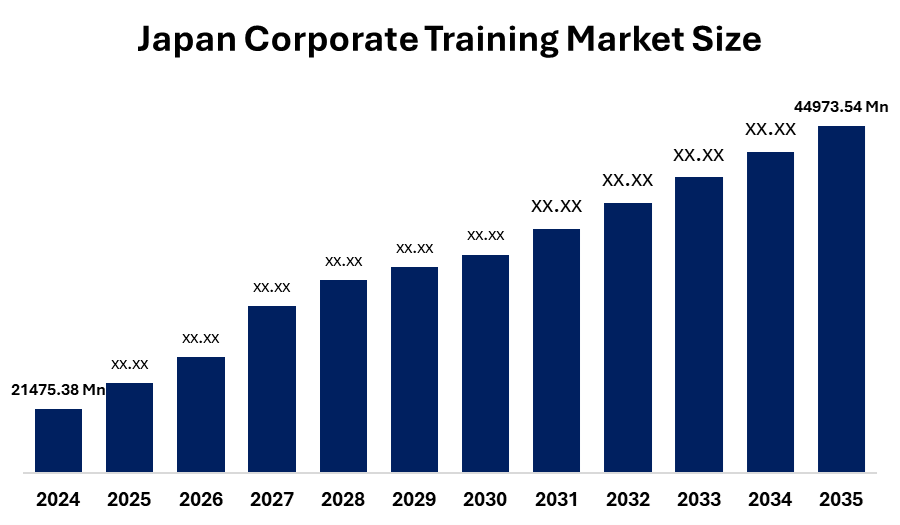

- The Japan Corporate Training Market Size Was Estimated at USD 21,475.39 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.95% from 2025 to 2035

- The Japan Corporate Training Market Size is Expected to Reach USD 44,973.54 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Corporate Training Market Size is Anticipated to reach USD 44,973.54 Million by 2035, Growing at a CAGR of 6.95% from 2025 to 2035. The market growth is driven by quick digital change-over in Japanese companies, the growing need for skilled workers, and the shift to learning frameworks that fit productivity and innovation ambitions, which have all contributed to the scenario.

Market Overview

The Japanese Corporate Training Market Size refers to structured learning programs with the aim of boosting professional skills, technical capabilities, compliance awareness, and leadership competencies of employees in organizations. Corporate training in Japan is a very important factor in filling the skill gaps that have resulted from technological advancements, an aging workforce, and global competition. The Japanese corporate training market is greatly influenced by key trends such as the soaring adoption of digital learning platforms, blended learning models, AI-enabled training analytics, and bespoke enterprise learning solutions. Organizations are laying more and more emphasis on soft skills, leadership training, and compliance, along with technical training, to make the entire workforce more efficient. The main factors driving these changes include greater automation, the necessity for continuous learning in the context of Industry 4.0, global expansion of Japanese companies, and the increasing focus on productivity and retention of employees.

The Japanese government takes an active role in the development of the workforce by means of various programs, including Society 5.0, upskilling workers in digital skills for a better world, and giving enterprises financial assistance for their workforce training that is directed towards the enhancement of innovation, digital literacy, and global competition.

Report Coverage

This research report categorizes the market for the Japan Corporate Training Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan corporate training market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan corporate training market.

Japan Corporate Training Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 21,475.39 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.95% |

| 2035 Value Projection: | 44,973.54 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Training Type, By End Use |

| Companies covered:: | Globis Corporation, Trainocate Holdings Co., Ltd, Benesse Corporation, Gakken Holdings Co., Ltd., Fujitsu Learning Media Limited, NEC Management Partner, Ltd., Hitachi Academy Co., Ltd., Recruit Management Solutions Co., Ltd., Pasona Group Inc., Japan Management Association Management Center (JMAM), and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan Corporate Training Market Size is driven by the trends in digital transformation that speed up the process, the more frequent use of technology like robots and AI, and the requirement for workers to be retrained according to changes in their job profiles are the major driving forces of this sector. Companies are actually allocating significant resources for the training of both technical and non-technical employees in order to keep up with productivity levels, to be more innovative, and to tackle the problem of labor shortage. Besides, increasing regulatory requirements and compliance standards are putting more pressure on businesses to adopt corporate training solutions.

Restraining Factors

The Japan Corporate Training Market Size is restrained by high costs of implementation, the small businesses' limited budgets for training, and the resistance of the employees to leave the traditional learning methods, which are some of the factors that affect the adoption of e-learning. On top of that, some trainers do not want to work with certain languages, and there are also trainers who want to be able to adapt their solutions to specific client needs, which both scenarios imply adding more complex and costly situations for the training providers.

Market Segmentation

The Japan corporate training market share is categorized by training type and end-use industry.

- The Technical Training segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Corporate Training Market Size is segmented by training type into technical training, soft skills, quality training, compliance, and others. Among these, the technical training segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by the increasing need for digital skills, IT infrastructure training, knowledge of cybersecurity, and competencies related to automation. Japanese companies give high importance to technical skills in order to be competitive in the world and technology driven markets.

- The Information Technology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Corporate Training Market Size is segmented by end-use industry into retail, pharmaceutical and healthcare, financial services, professional services, public enterprises, information technology, and others. Among these, the information technology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is driven by technological advancement at a fast pace, unceasing software updates, and the necessity for specialized technical knowledge to a great extent. Compliance and digital transformation are the driving forces behind financial services and healthcare sectors, which are experiencing rapid growth.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan corporate training market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Globis Corporation

- Trainocate Holdings Co., Ltd

- Benesse Corporation

- Gakken Holdings Co., Ltd.

- Fujitsu Learning Media Limited

- NEC Management Partner, Ltd.

- Hitachi Academy Co., Ltd.

- Recruit Management Solutions Co., Ltd.

- Pasona Group Inc.

- Japan Management Association Management Center (JMAM)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2025, Udemy Japan launched expanded AI-powered learning solutions to address the growing AI skills gap in the Japanese workforce, including localized training content and enterprise-focused programs to support corporate upskilling initiatives across industries.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Corporate Training Market based on the following segments:

Japan Corporate Training Market, By Training Type

- Technical Training

- Soft Skills

- Quality Training

- Compliance

- Others

Japan Corporate Training Market, By End Use Industry

- Retail

- Pharmaceutical and Healthcare

- Financial Services

- Professional Services

- Public Enterprises

- Information Technology

- Others

Frequently Asked Questions (FAQ)

-

What factors restrain the Japan Corporate Training Market?Market growth is restrained by traditional preferences for in-person training formats, budget constraints among SMEs, resistance to digital learning adoption, and cultural challenges in transitioning from legacy training methods.

-

What types of training are included in the corporate training market?The market includes various training types such as technical training, soft skills, quality training, compliance training, and others designed to meet diverse corporate learning objectives.

-

How has digital transformation influenced the market?Digital transformation has accelerated the adoption of e-learning and blended learning formats, increased demand for technology-oriented skill development, and expanded online training opportunities beyond traditional classroom sessions.

Need help to buy this report?