Japan Convenience Store Market Size, Share, By Product Type (Staple Products, Impulse Products, and Emergency Products), By Store Type (Kiosks, Mini Convenience Stores, Limited Selection Convenience Stores, Traditional Convenience Stores, Expanded Convenience Stores, and Hyper Convenience Stores), By Ownership Model (Independent Stores, Franchise Stores, and Corporate-Owned Chains), Japan Convenience Store Market Insights, Industry Trends, and Forecasts to 2035

Industry: Consumer GoodsJapan Convenience Stores Market Insights Forecasts to 2035

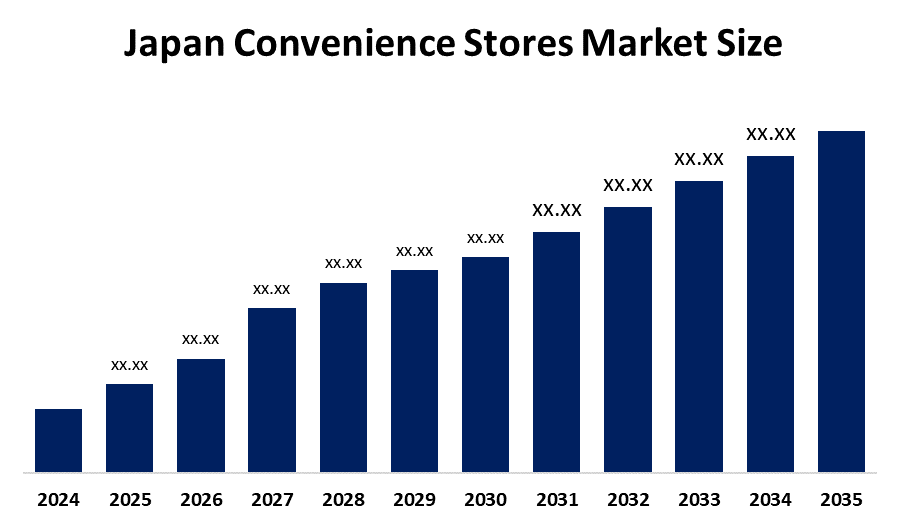

- Japan Convenience Stores Market CAGR 2024: 4.7%

- Japan Convenience Stores Market Segments: Product Type, Store Type, and Ownership Model

Get more details on this report -

The Japan Convenience store market size is essentially a network of retail outlets that provide an organized shopping experience mainly through small stores situated nearby in residential or commercial areas. These stores with extended operating hours and in most cases 24/7 availability, serve the neighbourhood customers, office workers, and people on their daily commutes passing through the area. The typical use case scenarios would be having a meal, doing a light shopping, paying utility bills, sending and receiving parcels, buying tickets, and conducting basic bank transactions. The major factors behind the market demand are the concentration of population in urban areas, the lack of time due to busy working schedules, the aging of the population, and the high level of dependence on neighbourhood retail for everyday needs.

Technological innovation plays a significant part in the industry where the use of POS analytics, AI, based demand forecasting, cashless payment systems, digital signage, and automated inventory replenishment is almost universal thus boosting overall productivity. Furthermore, government support for digitization through various programs of the promotion of retail modernization as well as policies aimed at cashless payments continues to pave the way for the retail sector's progress. The market potential is enormous going forward as the private label premiumization, health, conscious ready meals, unmanned store formats, and last, mile delivery services are only some of the initiatives that will drive the retailer and facilitate the customer's journeys. Further market relevance and competitive positioning in the future can be realized through the development of data, driven personalization and sustainable packaging solutions.

Market Dynamics of the Japan Convenience Stores Market:

The Japan Convenience Store Market Size is primarily driven by urbanization, time, crammed lifestyles, and the desire for convenient, ready, to, eat food and essential items that can be accessed 24/7. Franchise growth, efficient supply chain management, product innovations in private labels, and combining value, added services such as payment, logistics, and food services are some of the factors that further drive the market.

The market is restrained by labor shortages, increased labor costs, and rising operating costs especially related to logistics and utility expenses. In addition, the market is also burdened with stringent food safety, labelling, and operating standards, which push the costs of compliance higher, and market saturation in urban Japan, which discourages aggressive store network expansion and fuels competition among existing market players.

There are growth potentials in the areas of automation, unmanned and semi, unmanned stores, and the use of data analytics for workforce and inventory management optimization. In addition, the market is driven by the demand for health, focused food, eco, friendly packaging, and domestic product offerings. Moreover, the scaling, up of last, mile delivery partnerships, digital platforms, and smart retailing technologies is foreseen to bring about efficiency and open up new revenue gradually during the forecast period.

Japan Convenience Stores Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 4.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Store Type |

| Companies covered:: | Seven-Eleven Japan Co., Ltd. Family Mart Co., Ltd. Lawson, Inc. Mini stop Co., Ltd. Seicomart Co., Ltd. Yamazaki Baking Co., Ltd. (Daily Yamazaki) Poplar Group, Inc. Other Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan convenience stores market share is classified into product type, store type, and ownership model.

By Product Type:

The Japan Convenience Store Market size is divided by product type into staple products, impulse products, and emergency products. Among these, the impulse products segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Impulse merchandise hold the leading position in Japanese convenience stores largely because of the high number of people going in and out, the tendency of customers to buy on impulse very often, the needs for snacks and drinks being quite strong, the premiumization of the products, the limited time for shopping, the locations being extremely close to each other in urban areas, and the continuous launch of new products that bring customers back and increase the sales margins.

By Store Type:

The Japan Convenience Store Market Size is divided by store type into kiosks, mini convenience stores, limited selection convenience stores, traditional convenience stores, expanded convenience stores, and hyper convenience stores. Among these, traditional convenience stores dominated the share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period. Traditional convenience stores hold most of the share in the Japanese market as their main strengths lie in offering an extensive range of products, quick pick food, providing around, the, clock services, offering integrated services, having well, known franchise brands, being easily accessible in the neighbourhood, and having efficient supply chains which all together lead to higher sales volumes and customer loyalty when compared to smaller or niche formats.

By Ownership Model:

The Japan Convenience Store Market Size is divided by ownership model into independent stores, franchise stores, and corporate-owned chains. Among these, franchise stores dominated the share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period. Franchise stores dominate Japan’s convenience store market because they are able to offer standardized operations, they have strong brand trust, they have nationwide scale, they have advanced logistics, centralized procurement, technology adoption, and marketing support which all together enable them to expand quickly, provide consistent service quality, and achieve superior profitability when compared to independent or corporate, owned outlets.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan convenience stores market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Convenience Stores Market:

- Seven-Eleven Japan Co., Ltd.

- Family Mart Co., Ltd.

- Lawson, Inc.

- Mini stop Co., Ltd.

- Seicomart Co., Ltd.

- Yamazaki Baking Co., Ltd. (Daily Yamazaki)

- Poplar Group, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan convenience stores market based on the below-mentioned segments:

Japan Convenience Store Market, By Product Type

- Staple Products

- Impulse Products

- Emergency Products

Japan Convenience Store Market, By Store Type

- Kiosks

- Mini Convenience Stores

- Limited Selection Convenience Stores

- Traditional Convenience Stores

- Expanded Convenience Stores

- Hyper Convenience Stores

Japan Convenience Store Market, By Ownership Model

- Independent Stores

- Franchise Stores

- Corporate-Owned Chains

Frequently Asked Questions (FAQ)

-

What is the Japan convenience stores market?The Japan convenience stores market comprises organized small-format retail outlets offering daily essentials, ready-to-eat food, beverages, and value-added services such as bill payments, parcel handling, and ticketing, typically operating with extended hours or on a 24/7 basis.

-

What are the key growth drivers of the Japan convenience stores market?Market growth is driven by high urban population density, time-constrained consumer lifestyles, rising demand for ready-to-eat meals, an aging population, and sustained dependence on neighbourhood retail formats for everyday consumption needs.

-

What factors restrain the Japan convenience stores market?The market is restrained by labor shortages, rising wage and operating costs, increasing logistics and utility expenses, stringent food safety and labelling regulations, and high market saturation in urban areas, limiting large-scale store expansion

-

Who are the key players in the Japan convenience stores market?Key players operating in the Japan Convenience Stores Market include Seven-Eleven Japan Co., Ltd., FamilyMart Co., Ltd., Lawson, Inc., Ministop Co., Ltd., Seicomart Co., Ltd., Yamazaki Baking Co., Ltd. (Daily Yamazaki), Poplar Group, Inc., and other regional operators.

-

Who are the target audiences for this market report?The report is intended for market participants, investors, end-users, government and regulatory authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?