Japan Continuous Glucose Monitoring Devices Market Size, Share, By Component (Transmitters, Sensors and Receivers), By Application (Gestational Diabetes, Type-2 Diabetes & Type-1 Diabetes), By End User (Hospitals and Homecare), Japan Continuous Glucose Monitoring Devices Market Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Continuous Glucose Monitoring Devices Market Insights Forecasts to 2035

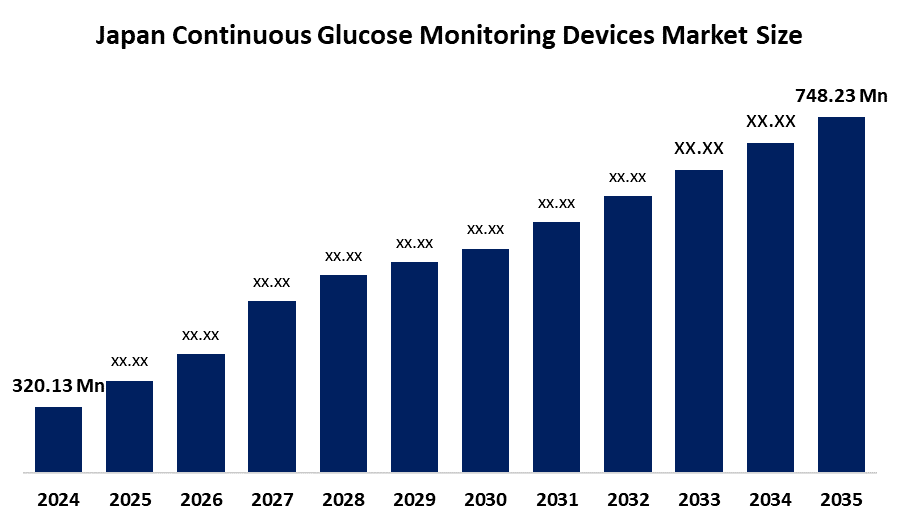

- Japan Continuous Glucose Monitoring Devices Market Size 2024: USD 320.13 Million

- Japan Continuous Glucose Monitoring Devices Market Size 2035: USD 748.23 Million

- Japan Continuous Glucose Monitoring Devices Market CAGR 2024: 8.02%

- Japan Continuous Glucose Monitoring Devices Market Segments: Components, Application and End Use.

Get more details on this report -

The Japan Continuous Glucose Monitoring Devices Market Size consists of wearable medical instruments that continuously measure blood glucose levels throughout the day and night without frequent finger-prick tests. These systems, including sensors, transmitters, and monitoring software, help patients and clinicians track glucose trends in real time to improve diabetes management, prevent complications, and support personalised care plans. Market growth reflects rising diabetes prevalence and healthcare innovation. Furthermore, Japan's continuous glucose monitoring devices market growth by Japan’s rapidly ageing population and increasing incidence of both Type 1 and Type 2 diabetes, which raises the demand for continuous glucose monitoring for better glycemic control. Advancements in wearable sensor accuracy, connectivity with digital health platforms, and integration with telemedicine and data analytics are expanding CGM adoption in clinical and home settings, making diabetes management more proactive and personalised.

The Japan government supports Japan Continuous Glucose Monitoring Devices Market Size through national health insurance coverage for eligible diabetes patients. Reimbursement policies reduce patient costs, making devices more affordable. Regulatory authorities maintain strict safety and quality standards to ensure reliable products. Government healthcare programs also promote digital health technologies and better chronic disease management, encouraging hospitals and clinics to adopt advanced glucose monitoring systems.

Japan's Continuous Glucose Monitoring Devices Market Size trends include smaller and more comfortable wearable sensors, smartphone connectivity, and cloud-based data sharing. Integration with mobile health apps allows users to track glucose trends easily. Remote patient monitoring and telemedicine services are becoming more common. There is also growing interest in personalised treatment plans supported by data analytics and smart healthcare technologies.

Japan Continuous Glucose Monitoring Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 320.13 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.02 % |

| 2035 Value Projection: | USD 748.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Component , By Application |

| Companies covered:: | Abbott Laboratories, Dexcom, Inc., Medtronic plc., Senseonics Holdings, Inc., Ascensia Diabetes Care, GlySens Incorporated, Terumo Corporation, Nipro Corporation, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Continuous Glucose Monitoring Devices Market:

The Japan Continuous Glucose Monitoring Devices Market Size is driving factors such as the increasing prevalence of diabetes, the growing elderly population, and higher healthcare spending in Japan. Patients prefer convenient and less painful monitoring methods compared to traditional testing. Improved lifestyle awareness and demand for better disease control also encourage adoption. Support from healthcare providers and recommendations from doctors further drive the continuous glucose monitoring devices market forward.

The Japan Continuous Glucose Monitoring Devices Market Size faces restraints such as high device and sensor costs, especially for patients without full insurance coverage. Some elderly patients may find wearable technology difficult to use. Limited awareness in rural areas and strict regulatory approval processes can slow product launches. Accuracy concerns and skin irritation issues may also reduce user confidence and adoption rates.

Japan Continuous Glucose Monitoring Devices Market Size opportunities include expanding use beyond severe diabetes patients to prediabetic and health-conscious individuals. The development of affordable and minimally invasive devices can attract more users. Partnerships between medical companies and digital health firms may create innovative monitoring solutions. Growing interest in preventive healthcare and home-based monitoring presents strong long-term business potential.

Market Segmentation

The Japan Continuous Glucose Monitoring devices market share is classified into components, applications, and end users.

By Component:

The Japan Continuous Glucose Monitoring Devices Market Size is divided by component into transmitters, sensors and receivers. Among these, the sensors segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The sensors segment dominates due to hey are disposable and must be replaced frequently, usually every one to two weeks. This creates continuous demand and higher recurring revenue. In contrast, transmitters and receivers are reusable and replaced less often, generating lower overall sales value.

By Application:

The Japan Continuous Glucose Monitoring Devices Market Size is divided by application into gestational diabetes, type-2 diabetes & type-1 diabetes. Among these, the type-1 diabetes segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Type 1 diabetes dominates because patients require lifelong insulin therapy and constant blood glucose monitoring. They face higher risks of sudden glucose fluctuations, making continuous tracking essential. In contrast, many Type-2 and gestational diabetes patients rely on periodic testing, resulting in lower continuous device usage rates.

By End Use:

The Japan Continuous Glucose Monitoring Devices Market Size is divided by end use into hospitals and homecare. Among these, the home care segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The homecare dominates because patients prefer convenient, real-time glucose monitoring at home. Wearable CGM devices with smartphone connectivity and remote data sharing enable self-management, reducing hospital visits and supporting continuous care, which increases adoption in the homecare setting.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Continuous Glucose Monitoring Devices Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Continuous Glucose Monitoring Devices Market:

- Abbott Laboratories

- Dexcom, Inc.

- Medtronic plc.

- Senseonics Holdings, Inc.

- Ascensia Diabetes Care

- GlySens Incorporated

- Terumo Corporation

- Nipro Corporation

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Continuous Glucose Monitoring Devices Market Size based on the below-mentioned segments:

Japan Continuous Glucose Monitoring Devices Market, By Component.

- Transmitters

- Sensors & Receivers

Japan Continuous Glucose Monitoring Devices Market, By Application

- Gestational Diabetes

- Type-2 Diabetes

- Type-1 Diabetes

Japan Continuous Glucose Monitoring Devices Market, by End Use.

- Hospitals

- Homecare

Frequently Asked Questions (FAQ)

-

Q 1: What is the Japan continuous glucose monitoring devices market size?Japan continuous glucose monitoring devices market is expected to grow from USD 320.13 million in 2024 to USD 748.23 million by 2035, growing at a CAGR of 8.02 % during the forecast period 2025-2035.

-

Q 2: What are the key growth drivers of the Japan continuous glucose monitoring devices market?The Japan continuous glucose monitoring devices market includes rising diabetes, ageing population, advanced wearable sensors, smartphone connectivity, insurance coverage, and home-monitoring convenience drive Japan’s CGM device market growth.

-

Q 3: What factors restrain the Japan continuous glucose monitoring devices market?The japan continuous glucose monitoring devices market is restrained by High device costs, limited insurance for some patients, complex technology for elderly users, regulatory hurdles, skin irritation, and occasional accuracy concerns restrain Japan’s CGM devices market growth.

-

Q 4: How is the Japan continuous glucose monitoring devices market segmented by application?The Japan continuous glucose monitoring devices market is segmented into gestational diabetes, type-2 diabetes and type-1 diabetes

-

Q 5: Who are the key players in the Japan continuous glucose monitoring devices market?Key players in the Japan continuous glucose monitoring devices market include Abbott Laboratories, Dexcom, Inc., Medtronic plc, Senseonics Holdings, Inc., Ascensia Diabetes Care, GlySens Incorporated, Terumo Corporation, Nipro Corporation, and other.

Need help to buy this report?