Japan Consumer Credit Market Size, Share, By Credit Type (Revolving Credits and Non-Revolving Credits), By Payment Method (Direct Deposit, Debit Card, and Others), By Issuers (Banks, NBFCs, and Others), Japan Consumer Credit Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialJapan Consumer Credit Market Insights Forecasts to 2035

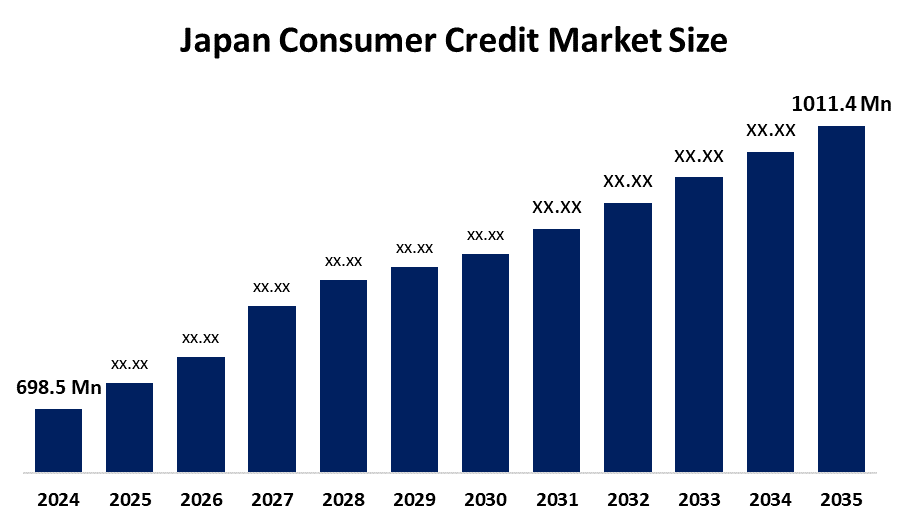

- Japan Consumer Credit Market Size 2024: USD 698.5 Mn

- Japan Consumer Credit Market Size 2035: USD 1011.4 Mn

- Japan Consumer Credit Market CAGR 2024: 3.42%

- Japan Consumer Credit Market Segments: Credit Type, Payment Method, and Issuers.

Get more details on this report -

Japanese consumers can access a wide range of financial services, such as credit cards, consumer loans, and installment payments for the purpose of purchasing personal consumer goods and services through the consumer credit market. The market is characterized by strong infrastructure and has seen growth in the use of digital payments and cashless technologies as Japan has transitioned away from its historical reliance on cash for everyday transactions. The development of credit card usage for daily purchases like groceries and food, as well as the growth in the adoption of BNPL services among the younger age group, are both emerging trends.

Japan's consumer credit industry benefits from the government's initiatives to advance a "Cashless Society". As part of the cashless vision, the Government's plans to increase the Cashless Payment Ratio beyond 40% create a government backing for this Industry. In addition to these government-supported initiatives, there are also several private sector initiatives, such as super apps and cross-service points, like Rakuten's Cross Service Points, that provide rewards, incentives, and enable deep customer engagement to promote credit usage.

Artificial Intelligence (AI) and big data integration for faster and more accurate credit scoring are the main drivers of technological developments in the Japanese consumer credit sector. AI-powered solutions are being used to automate risk management, enhance real-time fraud detection, and tailor financial product offerings based on user behavior. Additionally, the emergence of QR-code-based mobile wallets and digital banking platforms has simplified the application and payment procedures, increasing credit availability for a larger group of people.

Market Dynamics of the Japan Consumer Credit Market:

The Japan Consumer Credit Market Size is primarily driven by the government's aggressive push toward a cashless society and the rising demand for flexible financing options like BNPL among younger consumers who prefer mobile-native solutions. Additionally, advancements in AI-driven credit scoring and the expansion of digital banking platforms are making credit more accessible.

The Japanese consumer credit market is restrained by the increasingly aging population, since elderly consumers tend to shun revolving debt and favor cash. In addition, higher delinquency risks may also result from increased interest rates and the possibility of household debt overextension.

The market offers substantial prospects for the growth of embedded finance and the incorporation of blockchain technology to improve transaction security. Additionally, there is a developing market for tailored investment-linked credit products and high-value specialty credit cards aimed at affluent urban populations.

Japan Consumer Credit Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 698.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 3.42% |

| 2035 Value Projection: | USD 1011.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Credit Type, By Payment Method |

| Companies covered:: | JCB Co., Ltd. Mitsubishi UFJ NICOS Co., Ltd. Sumitomo Mitsui Card Company (SMCC) Rakuten Card Co., Ltd. AEON Credit Service Co., Ltd. ACOM Co., Ltd. (MUFG Group) AIFUL Corporation JACCS Co., Ltd. Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan consumer credit market share is classified into credit type, payment method, and issuers.

By Credit Type:

The Japan Consumer Credit Market Size is divided by credit type into revolving credits and non-revolving credits. Among these, the revolving credits segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to an increase in the need for easy financing solutions and the digital transformation of financial services. However, due to the financial industry's growing adoption of technology, such as online lending platforms and digital loan processing, the same segment is anticipated to develop at the fastest rate throughout the projected period.

By Payment method:

The Japan Consumer Credit Market Size is divided by payment method into direct deposit, debit card, and others. Among these, the direct deposit segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the high use for salary payments, recurring bill settlements, and loans, offering high convenience, security, and strong adoption among Japanese consumers and financial institutions.

By Issuers:

The Japan Consumer Credit Market Size is divided by issuers into banks, NBFCs, and others. Among these, the banks segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their extensive branch networks, strong customer trust, low-cost funding, and wide range of credit products supported by strict regulatory oversight.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan consumer credit market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Consumer Credit Market:

- JCB Co., Ltd.

- Mitsubishi UFJ NICOS Co., Ltd.

- Sumitomo Mitsui Card Company (SMCC)

- Rakuten Card Co., Ltd.

- AEON Credit Service Co., Ltd.

- ACOM Co., Ltd. (MUFG Group)

- AIFUL Corporation

- JACCS Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan consumer credit market based on the below-mentioned segments:

Japan Consumer Credit Market, By Credit Type

- Revolving Credits

- Non-Revolving Credits

Japan Consumer Credit Market, By Payment Method

- Direct Deposit

- Debit Card

- Others

Japan Consumer Credit Market, By Issuers

- Banks

- NBFCs

- Others

Frequently Asked Questions (FAQ)

-

What is the market size and growth forecast for Japan consumer credit?The market was valued at USD 698.5 million in 2024 and is projected to reach USD 1011.4 million by 2035, growing at a CAGR of 3.42% during 2025–2035.

-

What are the key drivers of the Japan consumer credit market?Major drivers include the government’s push toward a cashless society, rising adoption of digital payments, increasing popularity of BNPL among younger consumers, and AI-driven credit scoring technologies.

-

Which credit type segment dominated the market in 2024?Revolving credit dominated in 2024 due to its flexibility, ease of use, and strong adoption through credit cards and digital lending platforms.

-

Which payment method held the largest market share?Direct deposit held the largest share in 2024, driven by its widespread use for salary payments, loan repayments, and recurring bill settlements

-

Which issuer segment leads the Japan consumer credit market?Banks held the largest market share in 2024 due to their extensive branch networks, strong customer trust, low-cost funding, and broad range of regulated credit products.

-

Who are the key players in the Japan consumer credit Market?Key companies include JCB, Mitsubishi UFJ NICOS, Sumitomo Mitsui Card, Rakuten Card, AEON Credit Service, ACOM, AIFUL, and JACCS

Need help to buy this report?