Japan Compostable Plastics Market Size, Share, By Product (Polylactic Acid, Starch Blends, PBAT, and PBS), By End-Use (Packaging, Agriculture, Consumer Goods, Textile, Automotive & Transportation, Building & Construction, and Others), Japan Compostable Plastics Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Compostable Plastics Market Insights Forecasts to 2035

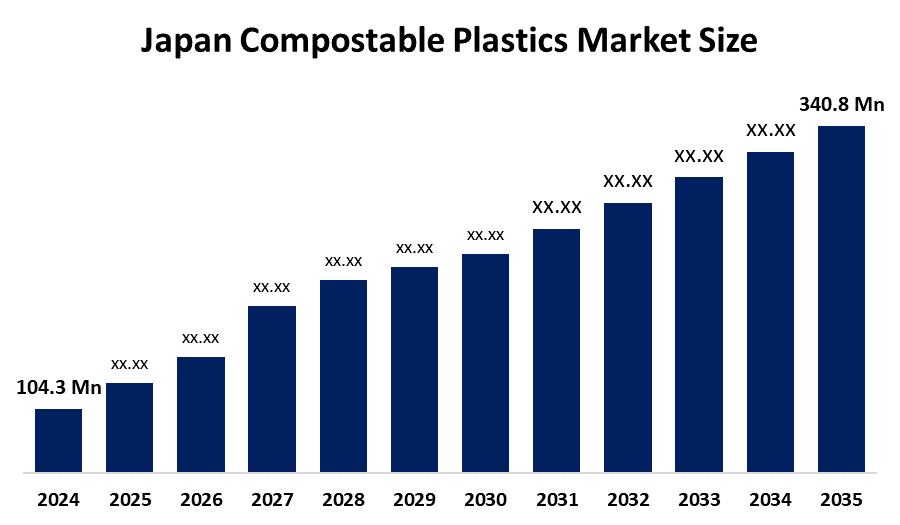

- Japan Compostable Plastics Market Size 2024: USD 104.3 Mn

- Japan Compostable Plastics Market Size 2035: USD 340.8 Mn

- Japan Compostable Plastics Market CAGR 2024: 11.36%

- Japan Compostable Plastics Market Segments: Product and End-Use.

Get more details on this report -

The Japan compostable plastics market refers to the industry centered on plastic materials that undergo biological decomposition in a composting site to yield CO2, water, inorganic compounds, and biomass at a rate consistent with other known compostable materials. The market is characterized by a strong cultural emphasis on meticulous packaging and hygiene, which historically led to high single-use plastic consumption but is now pivoting toward bio-based alternatives.

Government and private initiatives are pivotal in driving the transition toward a circular economy in Japan. The Ministry of the Environment's "Plastic Resource Circulation Strategy" aims to reduce single-use plastics by 25% by 2030 and introduces a goal of deploying 2 million tons of bio-based plastics by the same year. Private sector efforts are spearheaded by the Japan BioPlastics Association and the Japan Climate Initiative, a network of over 700 companies working toward a decarbonized society, with many members already implementing green packaging strategies in response to these mandates.

Technological advancements are revolutionizing the performance and versatility of compostable materials within the Japanese market. Innovations such as marine-degradable polymers and CO2-based plastics produced by hydrogen-oxidizing bacteria are addressing the limitations of earlier biodegradable materials that required specific high-temperature industrial composting conditions.

Japan Compostable Plastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 104.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 11.36% |

| 2035 Value Projection: | USD 340.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 165 |

| Segments covered: | By Product,By End-Use |

| Companies covered:: | Mitsubishi Chemical Group Corporation Kaneka Corporation Mitsui Chemicals, Inc. Toyo Seikan Group Holdings, Ltd. Toppan Inc. Rengo Co., Ltd. Sumitomo Chemical Co., Ltd. Asahi Kasei Corporation Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Compostable Plastics Market:

The Japan compostable plastics market is primarily driven by the "Plastic Resource Circulation Act" and stringent government mandates targeting a significant reduction in single-use plastic waste. The market is further propelled by massive corporate R&D investments into marine-degradable and bio-based polymers to satisfy both domestic environmental goals and international ESG investment standards.

The Japanese compostable plastics market is restrained by high production costs of compostable resins compared to petroleum-based alternatives, often ranging from 25% to 75% higher due to complex polymerization processes. Additionally, a limited industrial composting infrastructure across many Japanese municipalities prevents these materials from decomposing as intended in circular systems.

The ongoing expansion of e-commerce presents a major opportunity for compostable flexible packaging, such as mailing bags and protective wraps. Furthermore, the agricultural sector's shift toward biodegradable mulch films, which can be plowed back into the soil to improve moisture retention and eliminate plastic residue, offers a vast potential for market scaling.

Market Segmentation

The Japan compostable plastics market share is classified into product and end-use.

By Product:

The Japan compostable plastics market is divided by product into polylactic acid, starch blends, PBAT, and PBS. Among these, the starch blends segment held the largest market share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Starch blends are versatile and can be utilized in a variety of applications, such as packaging and agricultural films, by combining them with other biodegradable polymers to improve flexibility and durability.

By End-Use:

The Japan compostable plastics market is divided by end-use into the packaging, agriculture, consumer goods, textile, automotive & transportation, building & construction, and others. Among these, the packaging segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to the growing consumer and company demand for environmentally friendly and sustainable packaging options. Companies in a variety of industries, particularly the food, beverage, and retail sectors, are implementing biodegradable packaging to meet sustainability goals and satisfy customer preferences for greener products as awareness of environmental issues like plastic waste rises.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Compostable Plastics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Compostable Plastics Market:

- Mitsubishi Chemical Group Corporation

- Kaneka Corporation

- Mitsui Chemicals, Inc.

- Toyo Seikan Group Holdings, Ltd.

- Toppan Inc.

- Rengo Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan compostable plastics market based on the below-mentioned segments:

Japan Compostable Plastics Market, By Product

- Polylactic Acid

- Starch Blends

- PBAT

- PBS

Japan Compostable Plastics Market, By End-Use

- Packaging

- Agriculture

- Consumer Goods

- Textile

- Automotive & Transportation

- Building & Construction

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the market size and growth outlook for Japan compostable plastics?A: The market was valued at USD 104.3 million in 2024 and is expected to reach USD 340.8 million by 2035, growing at a CAGR of 11.36% during the forecast period.

-

Q: What are the key drivers of the Japan compostable plastics market?A: Key drivers include the Plastic Resource Circulation Act, government targets to reduce single-use plastics, strong corporate ESG commitments, and increased R&D investments in bio-based materials.

-

Q: Which product segment dominated the market in 2024?A: Starch blends dominated the market in 2024 due to their versatility, cost-effectiveness, and suitability for applications such as packaging and agricultural films.

-

Q: Which end-use segment holds the largest market share?A: The packaging segment held the largest share in 2024, driven by rising demand for sustainable packaging in food, beverage, retail, and e-commerce industries.

-

Q: What are the major challenges faced by the Japan compostable plastics market?A: High production costs compared to conventional plastics and limited industrial composting infrastructure across municipalities are the primary challenges.

-

Q: What opportunities exist in the Japan compostable plastics market?A: Opportunities include growth in e-commerce packaging, adoption of biodegradable agricultural mulch films, and advancements in marine-degradable and CO₂-based plastics.

-

Q: Who are the key players in the Japan compostable plastics market?A: Key players include Mitsubishi Chemical Group, Kaneka, Mitsui Chemicals, Toyo Seikan Group Holdings, Toppan, Rengo, Sumitomo Chemical, Asahi Kasei, and other industry participants.

Need help to buy this report?