Japan Commercial Insurance Market Size, Share, By Insurance Type (Liability Insurance, Commercial Property Insurance, Commercial Motor Insurance, Marine Insurance, and Others), By End-Use Industry (Manufacturing, Construction, Transportation and Logistics, Healthcare, IT and Telecom, Energy and Utilities, and Others), Japan Commercial Insurance Market Insights, Industry Trends, Forecasts to 2035

Industry: Banking & FinancialJapan Commercial Insurance Market Insights Forecasts to 2035

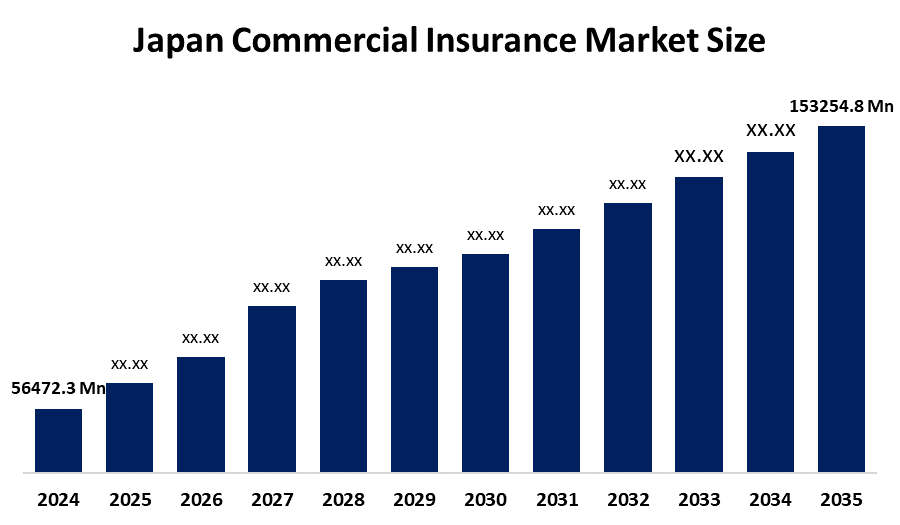

- Japan Commercial Insurance Market Size 2024: USD 56472.3 Million

- Japan Commercial Insurance Market Size 2035: USD 153254.8 Million

- Japan Commercial Insurance Market CAGR 2024: 9.5%

- Japan Commercial Insurance Market Segments: Insurance Type and End Use Industry

Get more details on this report -

The Japan Commercial Insurance Market Size offers businesses insurance solutions which protect their assets and their liability claims and their business operations and their vehicle incidents and their marine cargo transit risks. The policies safeguard manufacturing facilities and construction sites and healthcare operations and logistics centers and IT and telecom networks and energy facilities from financial losses while permitting businesses to operate their essential functions. Business adoption of the solution depends on two major factors which include increased enterprise risk awareness and mandatory insurance requirements included in contracts and rising natural disaster and supply chain disruption risks that impact Japanese companies.

The use of technology now operates both underwriting processes and claims handling procedures because AI risk analytics and telematics fleet monitoring and IoT asset tracking systems and digital policy management platforms deliver better results through their operational performance and operational transparency. Insurers create commercial insurance packages which combine property protection with liability coverage and cyber protection and business interruption insurance to satisfy changing requirements from businesses. Organizations in the future will discover new opportunities which allow them to expand their cyber risk protection capabilities and implement parametric catastrophe insurance and create climate risk modeling solutions and develop embedded insurance solutions which support Japan's digital transformation and its worldwide business ecosystem.

Japan Commercial Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 56472.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.5% |

| 2035 Value Projection: | USD 153254.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Insurance Type ,By End-Use Industry |

| Companies covered:: | Tokio Marine & Nichido Fire Insurance Co., Ltd., Sompo Japan Insurance Inc., MS&AD Insurance Group Holdings, Inc., AIG General Insurance Company Ltd., Chubb Insurance Japan Ltd., Nisshin Fire & Marine Insurance Co., Ltd., Kyoei Fire & Marine Insurance Co., Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Commercial Insurance Market:

The Japan Commercial Insurance Market Size is driven by rising natural disaster risks, growing cyber security and liability threats, mandatory insurance requirements in contracts, and increasing adoption of enterprise risk management practices which various industries implement. Commercial insurance adoption by Japanese enterprises is supported by business interruption protection needs which arise from digitalization and supply chain complexities and rising demand for insurance.

The Japan Commercial Insurance Market Size faces multiple obstacles which include expensive premiums and strong market competition and difficult regulatory requirements and low insurance knowledge among small and medium-sized enterprises and underwriting problems which arise from high disaster claim rates. Businesses that need to manage costs will find it difficult to adopt new technologies because of their operational costs and challenges in understanding upcoming cyberspace threats.

The Japan Commercial Insurance Market Size will grow because of two main factors which include the development of cyber insurance and parametric disaster solutions and climate risk assessment tools and digital platform embedded insurance solutions. Japanese insurers will find new business opportunities through the increasing use of AI-powered underwriting and predictive analytics and IoT-based risk assessment and industry-specific insurance solutions.

Market Segmentation

The Japan Commercial Insurance Market share is classified into insurance type and end use industry.

By Insurance Type:

The Japan Commercial Insurance Market Size is divided by insurance type into liability insurance, commercial property insurance, commercial motor insurance, marine insurance, and others. Among these, the commercial property insurance segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. A high concentration of insured physical assets, higher catastrophe-related losses in Japan, tough lender insurance requirements, rising property values, and a need for business interruption coverage are propelling the uptake of commercial property insurance policies.

By End-Use Industry:

The Japan Commercial Insurance Market Size is divided by end-use industry into manufacturing, construction, transportation and logistics, healthcare, IT and telecom, energy and utilities, and others. Among these, the manufacturing segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Large-scale manufacturing facilities, high concentration of costly machinery, tough workplace safety obligations, export-oriented supply chain risks, reliance on continuous business operations, growing automation-related risks, and contractual coverage mandates are pushing the penetration of commercial insurance in Japan’s manufacturing sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Commercial Insurance Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Commercial Insurance Market:

- Tokio Marine & Nichido Fire Insurance Co., Ltd.

- Sompo Japan Insurance Inc.

- MS&AD Insurance Group Holdings, Inc.

- AIG General Insurance Company Ltd.

- Chubb Insurance Japan Ltd.

- Nisshin Fire & Marine Insurance Co., Ltd.

- Kyoei Fire & Marine Insurance Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Commercial Insurance Market Size based on the below-mentioned segments:

Japan Commercial Insurance Market, By Insurance Type

- Liability Insurance

- Commercial Property Insurance

- Commercial Motor Insurance

- Marine Insurance

- Others

Japan Commercial Insurance Market, By End-Use Industry

- Manufacturing

- Construction

- Transportation and Logistics

- Healthcare

- IT and Telecom

- Energy and Utilities

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan commercial insurance market size?A: Japan commercial insurance market is expected to grow from USD 56472.3 million in 2024 to USD 153254.8 million by 2035, growing at a CAGR of 9.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rising natural disaster risks, increasing cyber and liability threats, strict contractual insurance requirements, growing enterprise risk management adoption, expanding digitalization across industries, and increasing demand for business interruption and asset protection coverage among Japanese enterprises.

-

Q: What factors restrain the Japan commercial insurance market?A: Constraints include high premium costs, intense pricing competition, complex regulatory compliance requirements, limited insurance awareness among small and medium enterprises, underwriting volatility due to disaster claims, and challenges in assessing emerging cyber risks which may slow broader market adoption.

-

Q: How is the market segmented?A: The market is segmented by insurance type into liability insurance, commercial property insurance, commercial motor insurance, marine insurance, and others; and by end-use industry into manufacturing, construction, transportation and logistics, healthcare, IT and telecom, energy and utilities, and others.

-

Q: Who are the key players in the Japan commercial insurance market?A: Key companies include Tokio Marine & Nichido Fire Insurance Co., Ltd., Sompo Japan Insurance Inc., MS&AD Insurance Group Holdings, Inc., AIG General Insurance Company Ltd., Chubb Insurance Japan Ltd., Nisshin Fire & Marine Insurance Co., Ltd., Kyoei Fire & Marine Insurance Co., Ltd., and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?