Japan Cold Storage Market Size, Share, and COVID-19 Impact Analysis, By Type (Refrigerated Warehouse, Refrigerated Transport), By Temperature (Frozen, Chilled), and By Application (Dairy and Frozen Desserts, Fish, Meat and Seafood Products, Bakery and Confectionery Products, Fruit Vegetables, Others) and Japan Cold Storage Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Cold Storage Market Insights Forecasts to 2035

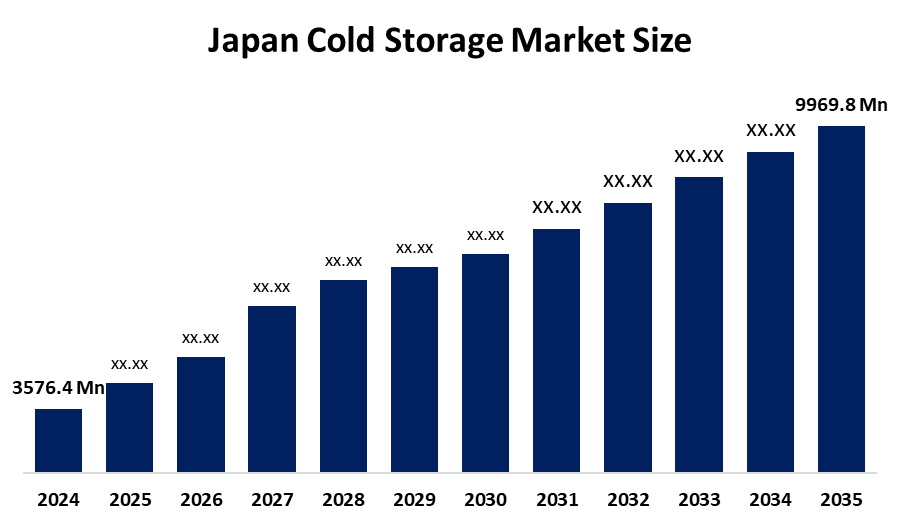

- The Japan Cold Storage Market Size Was Estimated at USD 3576.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.77 % from 2025 to 2035

- The Japan Cold Storage Market Size is Expected to Reach USD 9969.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Cold Storage Market Size is anticipated to reach USD 9969.8 Million by 2035, Growing at a CAGR of 9.77 % from 2025 to 2035. The cold storage market in Japan is driven by the growing use of cold storage technology brought on by the rise in demand for perishable commodities

Market Overview

The cold storage market involves the infrastructure, technologies, and services that enable safe, long-term storage and transportation of perishable goods under controlled temperatures. The cold storage market in Japan is important in sustaining the nations food, pharmaceutical, and logistics sectors through temperature-controlled storage for perishables. With Japan having a large demand for fresh and frozen food, and an increase in e-commerce grocery delivery options, as well as strict food safety laws, the market is growing. The government of Japan has launched initiatives regarding the cold storage market, which includes aspects of energy efficiency, sustainability, and food security. Specifically, within the Green Growth Strategy Through Achieving Carbon Neutrality by 2050, Japan is advocating for low-carbon and natural refrigerants to be used in cold storage facilities to reduce greenhouse gas emissions. Enhancements in technology are improving operational efficiency through automation, energy-efficient refrigeration, and smart monitoring systems. The increasing demand in the biotechnology and pharmaceutical sectors is creating additional demand for cold chain storage solutions. Growth of the cold storage is supported by government incentives aimed at increasing food security and supporting sustainable cold storage infrastructure. Alternative opportunities include the advancement of cold chain logistics, automation, energy-efficient systems, pharmaceutical storage, and smart monitoring technologies in response to the growing demand for e-commerce and export markets.

Report Coverage

This research report categorizes the market for the Japan cold storage market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cold storage market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cold storage market.

Japan Cold Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3576.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.77 % |

| 2035 Value Projection: | USD 9969.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type and By Temperature |

| Companies covered:: | Daifuku, Kawasaki Logistics, Yamato Holdings, Asahi Group Holdings, SHOJI, Fujikyu, Murakami, Miyoshi Kasei, Kato Sangyo, Mitsui and Co., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The cold storage market in Japan is driven by the increasing need for perishable food items, including seafood, dairy, and frozen food, along with an increase in the prominence of e-commerce and online grocery delivery businesses. There is also a need for consistent cold chain systems due to Japan's aging population and its growing preference toward the consumption of ready-to-eat meals. Coupled with the above factors, the importance of reliable cold chain systems increases with the expansion of the pharmaceuticals and biotechnology sectors, which demand advanced temperature-controlled storage of vaccines, biologics, and medical supplies. In our evolving marketplace, technological advancements, such as automation, Internet of Things-based temperature monitoring systems, and energy-efficient refrigeration systems, support operational efficiency. Additionally, government initiatives promoting sustainable cold storage and low-carbon refrigerants are also significantly impacting the growth and modernization of the marketplace.

Restraining Factors

The cold storage market in Japan is mostly constrained by the high energy and operating costs of having a temperature-controlled environment. Also, land availability for building new large-scale facilities is limited, especially in urbanized areas. Furthermore, there is a lack of talented labor in the market with both refrigeration technologies and logistics experience. Additionally, the existing labor is costly and is a barrier to entry for small and medium-sized enterprises. Furthermore, environmental regulations regarding refrigerants and carbon emissions also increase compliance costs and hurt profitability, and slow the growth of new infrastructure.

Market Segmentation

The Japan cold storage market share is classified into type, temperature, and application.

- The refrigerated warehouse segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cold storage market is segmented by type into refrigerated warehouse and refrigerated transport. Among these, the refrigerated warehouse segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Advancements in technology, such as automated storage systems, energy-efficient refrigerators, and real-time temperature monitoring, have further improved efficiency in warehouses and have an important role in supporting Japan's cold storage infrastructure.

- The frozen segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cold storage market is segmented by temperature into frozen and chilled. Among these, the frozen segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Primarily frozen segment leads because of the robust consumer demand for frozen seafood, meat, and ready-to-eat meals that need long-term storage

.

- The dairy and frozen desserts segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan cold storage market is segmented by application into dairy and frozen desserts, fish, meat and seafood products, bakery and confectionery products, fruit and vegetables, and others. Among these, the dairy and frozen desserts segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. In Japan, the dairy and frozen desserts category leads the cold storage market, reflecting high consumption levels of dairy products, such as milk, cheese, yogurt, and ice cream, by Japanese consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cold storage market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daifuku

- Kawasaki Logistics

- Yamato Holdings

- Asahi Group Holdings

- SHOJI

- Fujikyu

- Murakami

- Miyoshi Kasei

- Kato Sangyo

- Mitsui and Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2024, Mitsui Fudosan and GLP Japan announced a joint investment of ¥3.5 billion towards expanding their cold storage facilities. The expansion plan will increase the overall floor area of the company’s cold warehouses to approximately 430,000 square meters by 2028, which is 1.9 times the current area, meeting the high demand in major cities.

- In September 2024, a cutting-edge cold storage facility was developed in Nagaoka City, featuring an innovative ammonia and CO2 refrigeration system designed for energy efficiency and environmental sustainability.

- In June 2024, Asahi Group Holdings is investing ¥6 billion to build a new cask warehouse at its Tochigi plant, enhancing storage capacity for its Nikka whisky brand.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan cold storage market based on the below-mentioned segments:

Japan Cold Storage Market, By Type

- Refrigerated Warehouse

- Refrigerated Transport

Japan Cold Storage Market, By Temperature

- Frozen

- Chilled

Japan Cold Storage Market, By Application

- Dairy and Frozen Desserts

- Fish

- Meat and Seafood Products

- Bakery and Confectionery Products

- Fruit Vegetables

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Japan cold storage market size?A: Japan cold storage market size is expected to grow from USD 3576.4 million in 2024 to USD 9969.8 million by 2035, growing at a CAGR of 9.77 % during the forecast period 2025-2035

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing need for perishable food items, including seafood, dairy, and frozen food, along with an increase in the prominence of e-commerce and online grocery delivery businesses

-

Q: What factors restrain the Japan cold storage market?A: Constraints include high energy and operating costs of having a temperature-controlled environment. Also, land availability for building new large-scale facilities is limited, especially in urbanized areas

-

Q: How is the market segmented by type?A: The market is segmented into refrigerated warehouse and refrigerated transport.

-

Q: Who are the key players in the Japan cold storage market?A: Key companies include Daifuku, Kawasaki Logistics, Yamato Holdings, Asahi Group Holdings, SHOJI, Fujikyu, Murakami, Miyoshi Kasei, Kato Sangyo, and Mitsui and Co.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?