Japan Cold Chain Market Size, Share, By Type (Storage, Transportation, Equipment, and Others), By Application (Food & Beverages, Pharmaceuticals, and Others), Japan Cold Chain Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationJapan Cold Chain Market Insights Forecasts to 2035

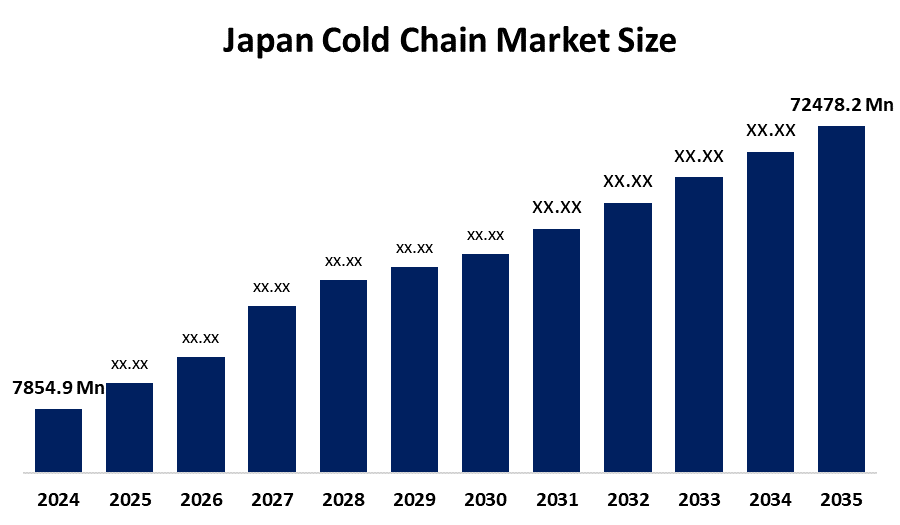

- Japan Cold Chain Market Size 2024: USD 7854.9 Mn

- Japan Cold Chain Market Size 2035: USD 72478.2 Mn

- Japan Cold Chain Market CAGR 2024: 22.39%

- Japan Cold Chain Market Segments: Type and Application

Get more details on this report -

The Japanese cold chain market is a specialized industry of managing temperature-sensitive goods in strict conditions, focusing on keeping product quality, safety, and efficacy intact. Most notably, a large portion of the Japanese cold chain market relies heavily upon precision logistics due to the large number of convenience stores in Japan and the increasing trend towards purchasing premium, high-purity ingredients. Current trends include greater integration of IoT-based temperature monitoring and automation solutions to reduce waste, as well as the transition towards using more energy-efficient systems as a way of reducing both environmental impacts and operational expenses.

In response to growing concerns, the Ministry of Health, Labour and Welfare (Japan) established PIC/S-GDP-compliant guidelines for pharmaceutical supply chains, which outline strict standards for quality control and traceability. Public-private partnerships are focused on modernizing the distribution of food in Japan and reducing waste by implementing a stronger cold chain infrastructure.

The increased use of technology, including the application of blockchain technology for an immutable record of transactions, has been transformed by technological advances. Similarly, the use of artificial intelligence (AI)-based predictive analytics is providing supply chains with a more sophisticated means of optimizing their potential. Sensors equipped with IoT technology provide real-time notifications of temperature or humidity excursions and enable immediate corrective action during transit. In addition, the construction and expansion of multi-temperature facilities and automated inventory systems have increased the reliability of the last-mile delivery of pharmaceuticals and goods from online stores, which have grown significantly in the last few years

Japan Cold Chain Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7854.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 22.39% |

| 2035 Value Projection: | USD 72478.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Segments covered: | By Type,By Application |

| Companies covered:: | Nichirei Logistics Group Inc. Nippon Express Yamato Holdings Co., Ltd. Sagawa Express Co., Ltd. Mitsubishi Logistics Corporation Kintetsu World Express, Inc. Itochu Logistics Corp. Yokorei Co., Ltd. and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Cold Chain Market:

The Japanese cold chain market has been driven mainly by the increased demand for temperature-sensitive pharmaceuticals, such as vaccines and biologics, which have been attributed primarily to the aging population and the increase in chronic illnesses. In addition to pharmaceutical demand, the rapid growth of e-commerce and online grocery delivery services has created the need for enhanced last-mile delivery solutions for both fresh and frozen products. There are also regulatory pressures from various government agencies concerning food safety that have further driven the need for strong, reliable cold chain solutions to ensure that food does not spoil or become contaminated.

The Japanese cold chain market is restrained by its high operational costs associated with cold chain management, as well as the large upfront investment in advanced technologies that will allow for efficient and effective cold chain management. Additionally, much of the cold chain infrastructure currently in place is old, and the country has a critical shortage of skilled labor, drivers, and other logistical resources required to adequately implement the cold chain logistics needed to support cold storage facilities across the country.

On the other hand, there are opportunities that have been created by the development and application of AI-enabled predictive analytics that will allow for better operational decisions and carbon footprint reductions. There is also growing interest from companies in outsourcing their cold chain logistics to specialized cold chain logistics companies, which could provide further growth opportunities and improve operational efficiencies within the cold chain logistics industry.

Market Segmentation

The Japan cold chain market share is classified into type and application.

By Type:

The Japanese cold chain market is divided by type into storage, transportation, equipment, and others. Among these, the storage segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Consumers' changing dietary and lifestyle habits are boosting demand for frozen foods, which is likely to increase demand for storage solutions.

By Application:

The Japanese cold chain market is divided by application into food & beverages, pharmaceuticals, and others. Among these, the food & beverages segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Technological advancements in seafood storage, packaging, and processing are expected to accelerate the expansion of this industry. However, processed food is expected to rise greatly in the coming years due to continuous advances in packaging materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan cold chain market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Cold Chain Market:

- Nichirei Logistics Group Inc.

- Nippon Express

- Yamato Holdings Co., Ltd.

- Sagawa Express Co., Ltd.

- Mitsubishi Logistics Corporation

- Kintetsu World Express, Inc.

- Itochu Logistics Corp.

- Yokorei Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035.Spherical Insights has segmented the Japan cold chain market based on the below-mentioned segments:

Japan Cold Chain Market, By Type

- Storage

- Transportation

- Equipment

- Others

Japan Cold Chain Market, By Application

- 2Food & Beverages

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the projected market size of the Japan cold chain market by 2035?A: The market is expected to grow from USD 7,854.9 million in 2024 to USD 72,478.2 million by 2035.

-

Q: What is the expected CAGR of the Japan cold chain market during the forecast period?A: The Japan cold chain market is projected to grow at a CAGR of 22.39% during the forecast period from 2025 to 2035.

-

Q: Which type of segment dominated the Japan cold chain market in 2024?A: The storage segment dominated the market in 2024 due to rising demand for frozen foods and increasing need for advanced temperature-controlled warehousing.

-

Q: Which application segment held the largest market share in 2024?A: The food & beverages segment held the largest market share in 2024, driven by strong demand for seafood, processed foods, and convenience food products.

-

Q: What are the key growth drivers of the Japan cold chain market?A: Major growth drivers include rising demand for temperature-sensitive pharmaceuticals, growth of e- commerce grocery delivery, strict food safety regulations, and adoption of IoT-enabled cold chain technologies.

-

Q: Who are the key players operating in the Japan cold chain market?A: Key players include Nichirei Logistics Group Inc., Nippon Express, Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Mitsubishi Logistics Corporation, and Kintetsu World Express, Inc.

Need help to buy this report?