Japan CBD Pouches Market Size, Share, By CBD Content (Up to 10 mg, 10 mg to 20 mg, and Others), By Type (Flavored and Unflavoured), By Distribution Channel (Offline and Online), Japan CBD Pouches Market Insights, Industry Trends, and Forecasts to 2035

Industry: Consumer GoodsJapan CBD Pouches Market Insights Forecasts to 2035

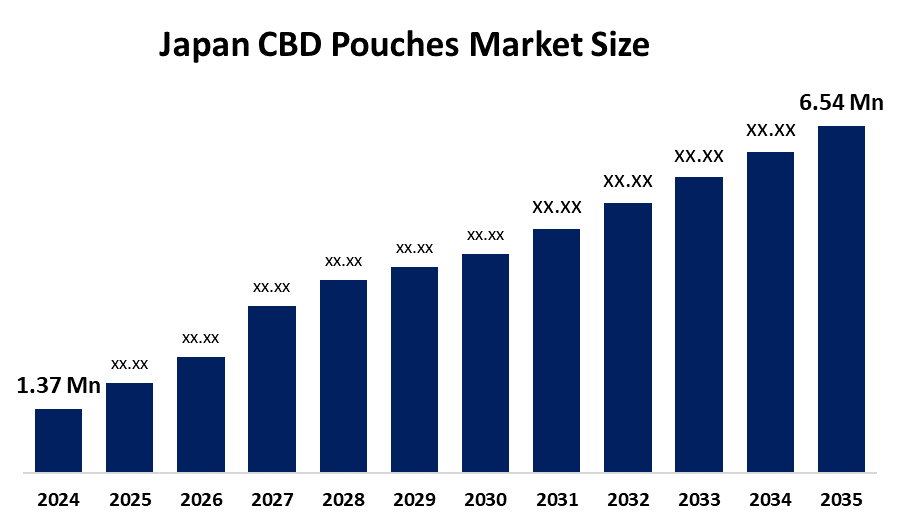

- Japan CBD Pouches Market Size 2024: USD 1.37 Million

- Japan CBD Pouches Market Size 2035: USD 6.54 Million

- Japan CBD Pouches Market CAGR 2024: 15.27%

- Japan CBD Pouches Market Segments: CBD Content, Type, and Distribution Channel

Get more details on this report -

Cannabidiol (CBD) Pouches Serve As Oral Products Which Enable Users To Consume Cannabidiol Through Absorption Via Their Mouth Tissues. The products provide users with a stealthy, portable solution which functions better than oil and tincture products and inhalation methods. Health-conscious adults in Japan use CBD pouches mainly for purposes of stress relief and relaxation and wellness support. The market demand exists because consumers want products which provide non-psychoactive effects and can be easily consumed while matching their contemporary lifestyle needs. The Cannabis Control Act controls all import and export operations in Japan while allowing commercial use of CBD products which contain no THC and originate from designated plant materials. The regulatory framework enables businesses to import CBD products and ingredients which meet standards for domestic market distribution.

Technological innovation in the market focuses on precision dosing and improved pouch materials and enhanced bioavailability and advanced purification and testing methods which enable organizations to achieve regulatory compliance. The Ministry of Health Labour and Welfare Department implement government regulations which require organizations to execute thorough quality assessments and certification processes for their products thus establishing an environment which permits stable market operations. Rising consumer awareness and online retail expansion and product premiumization and increased demand for plant-based wellness solutions create future business opportunities. The market shows strong potential for growth through innovation because consumers increasingly understand regulations and governments create more accessible standards.

Japan CBD Pouches Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.37 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.27% |

| 2035 Value Projection: | USD 6.54 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By CBD Content, By Type, By Distribution Channel |

| Companies covered:: | HealthyTOKYO, AstraSana Japan Co., Ltd., Cannadips CBD, V&YOU, Canndid, Nicopods ehf., SpectrumLeaf Limited, Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the Japan CBD Pouches Market:

The Japan CBD pouches market is driven by increasing consumer preference for smoke-free, discreet, and convenient wellness products that match their current lifestyle requirements. The market is seeing adoption among urban and working people who want simple products because of their knowledge about cannabidiol's non-psychoactive effects and the growing need for stress relief.

Japan's strict Cannabis Control Act regulatory framework prevents market expansion because it only allows specific CBD sources and requires products to contain no THC. Manufacturers and importers face operational difficulties because they must pay high compliance costs and follow complicated product approval systems while only having access to limited raw materials and needing to conduct complete laboratory tests.

The market provides strong business opportunities because of new formulation technologies and better purification techniques and because people are becoming more accepting of plant-based wellness products. The market will grow through three factors, which include compliant online distribution channel expansion and premium product positioning and partnerships with certified international suppliers.

Market Segmentation

The Japan CBD pouches market share is classified into CBD content, type, and distribution channel.

By CBD Content:

The Japan CBD pouches market is divided by CBD content into up to 10 mg, 10 mg to 20 mg, and others. Among these, the up to 10 mg segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The lower-dose CBD pouch segment dominates because consumers acceptance of the product while regulations exercise caution and users prefer controlled dosages and the product suits first-time users and the product meets Japanese cannabis-derived product standards.

By Type:

The Japan CBD pouches market is divided by type into flavored and unflavoured. Among these, the flavored segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance of flavored CBD pouches in Japan exists because these products mask the natural CBD bitterness while creating better customer experiences and customers who try them again and because manufacturers use product differentiation methods.

By Distribution Channel:

The Japan CBD pouches market is divided by distribution channel into offline and online. Among these, the offline segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The combination of consumer trust in physical retail locations and pharmacist guidance and the need for regulatory compliance and age verification and the existence of specialty wellness stores leads to increased sales through offline distribution channels in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan CBD pouches market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan CBD Pouches Market:

- HealthyTOKYO

- AstraSana Japan Co., Ltd.

- Cannadips CBD

- V&YOU

- Canndid

- Nicopods ehf.

- SpectrumLeaf Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan CBD pouches market based on the below-mentioned segments:

CBD Pouches Market, By CBD Content

- Up to 10 mg

- 10 mg to 20 mg

- Others

CBD Pouches Market, By Type

- Flavored

- Unflavoured

CBD Pouches Market, By Distribution Channel

- Offline

- Online

Frequently Asked Questions (FAQ)

-

Q: What is the Japan CBD pouches market size?A: Japan CBD pouches market is expected to grow from USD 1.37 million in 2024 to USD 6.54 million by 2035, growing at a CAGR of 15.27% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the Japan CBD pouches market?A: Market growth is driven by rising consumer preference for smoke-free and discreet wellness products, increasing awareness of non-psychoactive CBD benefits, expansion of compliant online retail channels, and growing demand for convenient, plant-based relaxation and stress-management solutions.

-

Q: What factors restrain the Japan CBD pouches market?A: Market restraints include Japan’s strict Cannabis Control Act, zero-THC compliance requirements, limited approved CBD raw material sources, high product testing and certification costs, and regulatory complexities related to import approvals and labelling compliance.

-

Q: How is the Japan CBD pouches market segmented?A: The market is segmented by CBD content into up to 10 mg, 10 mg to 20 mg, and others; by type into flavored and unflavoured; and by distribution channel into offline and online.

-

Q: Who are the key players in the Japan CBD pouches market?A: Key companies include HealthyTOKYO, AstraSana Japan Co., Ltd., Cannadips CBD, V&YOU, Canndid, Nicopods ehf., SpectrumLeaf Limited, and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?