Japan Cardiac Biomarker Market Size, Share, By Biomarker Type (Troponins, Myoglobin, Brain Natriuretic Peptide, and Others), By Application (Myocardial Infarction, Congestive Heart Failure, Acute Coronary Syndrome, and Others), and Japan Cardiac Biomarker Market Insights, Industry Trend, Forecasts to 2035.

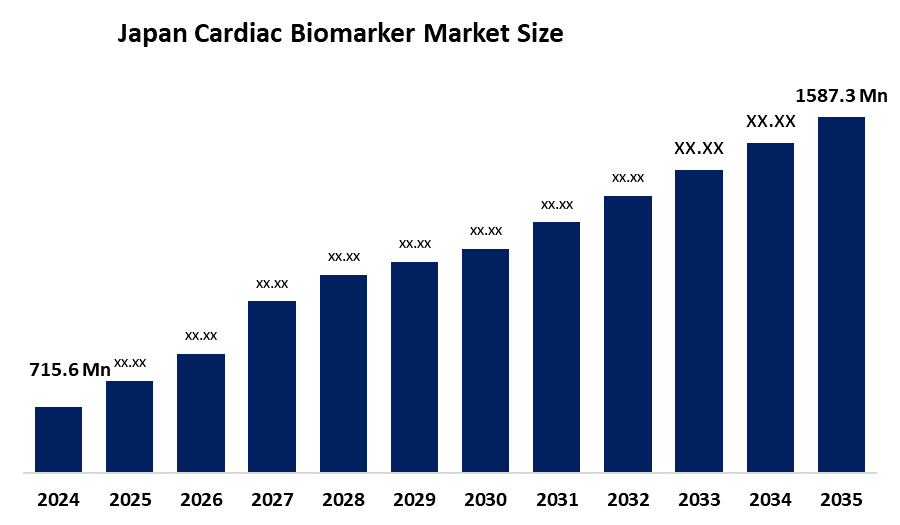

Industry: Healthcare- Japan Cardiac Biomarker Market Size 2024: USD 715.6 Mn

- Japan Cardiac Biomarker Market Size 2035: USD 1587.3 Mn

- Japan Cardiac Biomarker Market CAGR: 7.51%

- Japan Cardiac Biomarker Market Segments: Biomarker Type and Application

Get more details on this report -

Cardiac biomarkers are the proteins or molecules that disintegrate and worm their way into the blood when the heart is affected by diseases. In general, they facilitate doctors' diagnosis, as well as managing a heart disorder. The three that are most frequently referred to in the context of cardiac biomarkers are troponins, creatine kinase-MB (CK-MB), and B-type natriuretic peptide (BNP). Troponins are regarded as the most specific sensors of heart tissue injury, and their role in heart attack diagnosis is immensely important.

The Japanese government is playing a very active role in the cardiac biomarker market by means of the Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceuticals and Medical Devices Agency (PMDA), making no less than the whole marketing strategy.

The market growth is mainly driven by technological innovations like high-sensitivity troponin assays, fast point-of-care testing, and automatic immunoassay platforms that all contribute to diagnostic precision and shorten the time taken for getting the results. Moreover, the universal health insurance system in Japan covers almost all diagnostic tests through reimbursement, which ultimately leads to greater patient access.

Market Dynamics of the Japan Cardiac Biomarker Market:

Japan's heart disease biomarker market has the major driver being the soaring occurrence of cardiac ailments (CVDs) such as heart attack and heart failure caused mostly by Japan's aging population and modern habits. Greater focus on early diagnosis and preventive healthcare, which is facilitated by government initiatives and clinical guidelines, is encouraging the use of cardiac biomarker testing.

The market is experiencing numerous constraints. The high prices of cutting-edge diagnostic tools and new biomarker tests in smaller healthcare facilities may pretty much restrict their use. The rigorous steps taken for regulatory approval, along with extensive clinical validation, can make it a long journey to market for new biomarkers. In addition, different interpretations of the biomarker and worries about false positives may negatively influence the trust of clinicians in the biomarker tests.

The market is full of large-scale expansion opportunities. Continuous research on new biomarkers, such as multi-marker panels are likely to lead to better risk assessment. The combination of artificial intelligence, digital diagnostics, and data analytics can support clinical decision-making. Together, the increase in point-of-care testing, home-based diagnostics, and partnerships of diagnostic companies with health care providers will open up new opportunities for the Japan cardiac biomarker market.

Japan Cardiac Biomarker Market Segmentation

The Japan Cardiac Biomarker Market share is classified into biomarker type and applications.

By Biomarker Type:

The Japanese cardiac biomarker market is categorised by biomarker type into troponins, myoglobin, brain natriuretic peptide, and others. Among these, the troponins segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is driven by extensive clinical application in the early detection and treatment of acute myocardial infarction and other cardiac conditions, as well as its high diagnostic accuracy.

By Application:

The Japanese cardiac biomarker market is divided by application into myocardial infarction, congestive heart failure, acute coronary syndrome, and others. Among these, the myocardial infarction segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. A growing number of elderly people, the high incidence of cardiovascular diseases, and the widespread use of cardiac biomarkers for early diagnosis, risk assessment, and prompt clinical intervention.

Competitive Analysis:

The report provides an in-depth analysis of the key organisations/companies involved in the Japan cardiac biomarker market, along with a comparative evaluation based on their product offerings, business overviews, geographic presence, enterprise strategies, segment market shares, and SWOT analyses. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Cardiac Biomarker Market:

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Danaher Japan (Beckman Coulter)

- QuidelOrtho Japan

- BioMérieux

- Bio-Rad Laboratories

- Others

Recent Developments in Japan Cardiac Biomarker Market:

- In September 2025, Roche Diagnostics launched an advanced cardiac biomarker assay in Japan that reportedly incorporates AI-enhanced algorithms to improve diagnostic accuracy in cardiac event detection.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Japan Cardiac Biomarker Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 715.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.51% |

| 2035 Value Projection: | USD 1587.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Danaher Japan (Beckman Coulter), QuidelOrtho Japan, BioMérieux, Bio-Rad Laboratories, Others, and Other Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan cardiac biomarker market based on the following segments:

Japan Cardiac Biomarker Market, By Biomarker Type

- Troponins

- Myoglobin

- Brain Natriuretic Peptide

- Others

Japan Cardiac Biomarker Market, By Application

- Myocardial Infarction

- Congestive Heart Failure

- Acute Coronary Syndrome

- Others

Frequently Asked Questions (FAQ)

-

1.What is the base year and forecast period for the Japan Cardiac Biomarker Market?The base year is 2024, with historical data covering from 2020 to 2023. The forecast period extends from 2025 to 2035.

-

2.What is the current and projected market size of the Japanese Cardiac Biomarker Market?The market was valued at USD 715.6 million in 2024 and is projected to reach USD 1,587.3 million by 2035, growing at a CAGR of 7.51% during the forecast period.

-

3.What is the current and projected market size of the Japan Cardiac Biomarker Market?The market was valued at USD 715.6 million in 2024 and is projected to reach USD 1,587.3 million by 2035, growing at a CAGR of 7.51% during the forecast period.

-

4.Which biomarker type dominates the market?The troponins segment dominated the market in 2024 due to its high diagnostic accuracy and widespread use in the early detection of acute myocardial infarction and cardiac injury.

-

5.What are the major restraints affecting the market?Market growth is restrained by the high cost of advanced diagnostic instruments, stringent regulatory approval requirements, long clinical validation timelines, and concerns related to false-positive results and variability in biomarker interpretation.

-

1.What is the base year and forecast period for the Japan Cardiac Biomarker Market?The base year is 2024, with historical data covering from 2020 to 2023. The forecast period extends from 2025 to 2035.

-

2.What is the current and projected market size of the Japanese Cardiac Biomarker Market?The market was valued at USD 715.6 million in 2024 and is projected to reach USD 1,587.3 million by 2035, growing at a CAGR of 7.51% during the forecast period.

-

3.What is the current and projected market size of the Japan Cardiac Biomarker Market?The market was valued at USD 715.6 million in 2024 and is projected to reach USD 1,587.3 million by 2035, growing at a CAGR of 7.51% during the forecast period.

-

4.Which biomarker type dominates the market?The troponins segment dominated the market in 2024 due to its high diagnostic accuracy and widespread use in the early detection of acute myocardial infarction and cardiac injury.

-

5.What are the major restraints affecting the market?Market growth is restrained by the high cost of advanced diagnostic instruments, stringent regulatory approval requirements, long clinical validation timelines, and concerns related to false-positive results and variability in biomarker interpretation.

Need help to buy this report?