Japan Caramel Chocolate Market Size, Share, By Function (Colors, Toppings, Flavours, Fillings, and Others), By Form (Solid, Semi-Solid, and Liquid), By Application (Bakery, Dessert, Confectionery, Beverage, Dairy & Frozen Desserts, Snacks, and Others), Japan Caramel Chocolate Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Caramel Chocolate Market Size Insights Forecasts To 2035

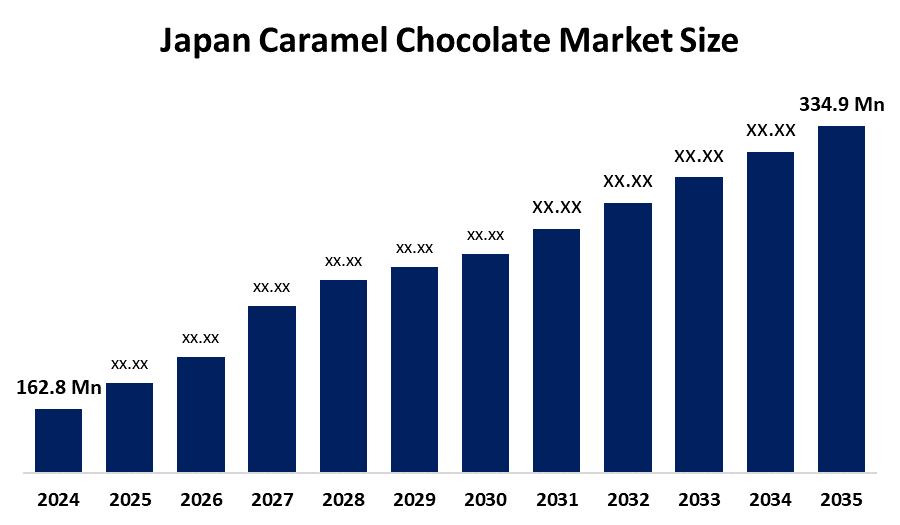

- Japan Caramel Chocolate Market Size 2024: USD 162.8 Mn

- Japan Caramel Chocolate Market Size 2035: USD 334.9 Mn

- Japan Caramel Chocolate Market Size CAGR 2024: 6.78%

- Japan Caramel Chocolate Market Size Segments: Function, Form, And Application.

Get more details on this report -

The Japanese Caramel Chocolate Market Size Includes All Aspects Related To Producing, Distributing, And Consuming Caramel-Flavoured Chocolate, Including Fillings And Artisanal Chocolates. There is also an increase in demand for healthy chocolates, low sugar chocolate, and the emergence of a "self-gifting" trend - chocolates as a treat for oneself. Manufacturers are exploring new flavour profiles and adopting sustainable sourcing practices to satisfy consumers' growing need for ethical and traceable food products.

The japanese government has set an ambitious target that by 2030, total food exports will reach 5 trillion yen,and provides support to food manufacturers through means of providing tools needed to conduct market research and establish a recognised brand identity to assist with exportation. Both of these collaborative efforts will ensure that there is a stable and secure link in the supply chain and will assist in bolstering the global competitiveness of Japanese caramel chocolate manufacturers.

Recent technological advancements within the industry have been concentrated on precision manufacturing and advanced sensing capabilities for quality assurance. The integration of technology used in traditional milk caramel production with some modern confectionery technologies has resulted in "soft candy technology," which allows for consistent texture and stable flavours. In addition to this innovation, adding Contact and Noncontact Level Sensor devices has changed the way liquid chocolate and caramel are monitored during production by providing real-time monitoring of the stream of liquid in the storage tanks.

Japan Caramel Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 162.8 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.78% |

| 2023 Value Projection: | USD 334.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Function, By Application |

| Companies covered:: | Meiji Holdings Co., Ltd., Morinaga & Co., Ltd., Lotte Co., Ltd., Ezaki Glico Co., Ltd., Fujiya Co., Ltd., Royce’ Chocolate (Sapporo), Mary Chocolate Co., Ltd., Bourbon Corporation, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Caramel Chocolate Market:

The Japanese caramel chocolate market size is driven by demand for premium and artisanal confectionery,which is on the rise due to an influx of disposable income, the growth of urban lifestyles among consumers, and consumers’ willingness to spend money on luxury items. innovation in flavour profiles, which includes product offerings like sea salt caramel and matcha, as well as products containing new ingredients, will all help appeal to a wider range of customers. The development of online shopping platforms, along with the continuing improvement of modern retail infrastructure, will help ensure easy access to product offerings within Japan's metropolitan areas.

The caramel chocolate market size in japan restrained by the cocoa price volatility, this population has also been impacted by the rising cost of raw materials. Additionally, declining interest in gift-giving traditions is also having an impact on future sales momentum, coupled with intense competition within the retail space.

Many consumers in japan are becoming increasingly health-conscious, and the functional chocolate segment of the caramel market size will continue to grow rapidly in the coming years. This trend is being fuelled by product offerings that contain less sugar, organic ingredients, or chocolate that is high in antioxidants. Government-led export initiatives and support for local brands will provide a pathway for brands to increasingly participate in the global market for premium products from Japan.

Market Segmentation

The Japan caramel chocolate market share is classified into function, form, and application.

By Function:

The japanese caramel chocolate market size is divided by function into colors, toppings, flavours, fillings, and others. among these, the flavours segment held the largest market share held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The flavours segment dominated due to strong consumer preference for innovative taste profiles and premium confectionery experiences in Japan. Growing demand for seasonal, limited-edition, and fusion flavours continues to drive sustained market growth.

By Form:

The japanese caramel chocolate market size is divided by form into solid, semi-solid, and liquid.Among these, the solid segment held a significant market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its longer shelf life, convenient packaging, and strong consumer preference for traditional chocolate bars and confectionery products. Additionally, widespread availability across retail channels and frequent product innovations are driving its sustained growth during the forecast period.

By Application:

The japanese caramel chocolate market size is divided by application into bakery, dessert, confectionery, beverage, dairy & frozen desserts, snacks, and others. Among these, the dairy & frozen desserts segment is anticipated to grow at the fastest CAGR during the forecast period. The dairy & frozen desserts segment is growing rapidly due to rising consumer preference for premium, indulgent flavors and innovative caramel-infused products. Increased demand for artisanal ice creams, flavored yogurts, and convenience desserts further accelerates segment growth in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the japan caramel chocolate market size,along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Caramel Chocolate Market:

- Meiji Holdings Co., Ltd.

- Morinaga & Co., Ltd.

- Lotte Co., Ltd.

- Ezaki Glico Co., Ltd.

- Fujiya Co., Ltd.

- Royce' Chocolate (Sapporo)

- Mary Chocolate Co., Ltd.

- Bourbon Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan caramel chocolate market based on the below-mentioned segments:

Japan Caramel Chocolate Market, By Function

- Colors

- Toppings

- Flavours

- Fillings

- Others

Japan Caramel Chocolate Market, By Form

- Solid

- Semi-Solid

- Liquid

Japan Caramel Chocolate Market, By Application

- Bakery

- Dessert

- Confectionery

- Beverage

- Dairy & Frozen Desserts

- Snacks

- Others

Frequently Asked Questions (FAQ)

-

What is the market size of the Japanese caramel chocolate market in 2024 and 2035?The market was valued at USD 162.8 million in 2024 and is projected to reach USD 334.9 million by 2035.

-

What is the expected growth rate of the Japanese caramel chocolate market?The market is expected to grow at a CAGR of 6.78% during the forecast period 2025–2035.

-

Which function segment dominates the Japan caramel chocolate market?The flavours segment dominated the market in 2024 due to strong consumer demand for innovative, premium, and seasonal taste profiles.

-

Which form segment holds the largest market share?The solid form segment held a significant market share in 2024, supported by longer shelf life, easy packaging, and high consumer preference for traditional chocolate products.

-

Which application segment is expected to grow the fastest?The dairy & frozen desserts segment is anticipated to grow at the fastest CAGR due to rising demand for premium ice creams, flavored yogurts, and caramel-infused frozen treats.

-

What are the key growth drivers of the Japan caramel chocolate market?Key drivers include increasing demand for premium and artisanal chocolates, flavor innovation, growth of e-commerce, and rising disposable incomes.

-

Who are the key players in the Japan caramel chocolate market?Major players include Meiji Holdings Co., Ltd., Morinaga & Co., Ltd., Lotte Co., Ltd., Ezaki Glico Co., Ltd., Fujiya Co., Ltd., and Royce’s Chocolate.

Need help to buy this report?