Japan Canned Tuna Market Size, Share, By Product (Yellowfin, Skipjack, Others), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online), Japan Canned Tuna Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Canned Tuna Market Insights Forecasts to 2035

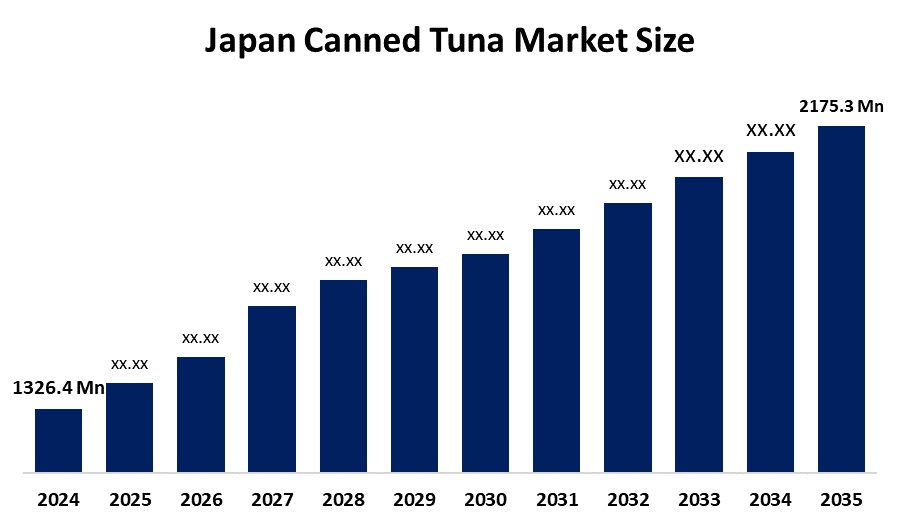

- Japan Canned Tuna Market Size 2024: USD 1326.4 Mn

- Japan Canned Tuna Market Size 2035: USD 2175.3 Mn

- Japan Canned Tuna Market CAGR 2024: 4.6%

- Japan Canned Tuna Market Segments: Product and Distribution Channel

Get more details on this report -

The Japan Canned Tuna Market Size includes preserved tuna products that are ready to eat and available in various forms, primarily canned yellowfin and skipjack tuna. These products are widely used in home meals such as salads, rice bowls, sandwiches, and on-the-go foods. The foodservice industry and meal preparation companies rely on canned tuna due to its consistent quality, long shelf life, and ease of use. Japan’s strong seafood-based food culture continues to drive demand for protein-rich, convenient food options. In 2023, Japan imported approximately 70,253.6 tonnes of prepared and preserved skipjack and bonito tuna products, valued at around USD 419.7 million, with Thailand, Indonesia, and the Philippines as the primary exporting countries. During the same year, Japan exported preserved tuna products totaling approximately 552.7 tonnes, with an estimated value of USD 7.33 million, mainly to Saudi Arabia and the United States.

The shelf life of products increases through retort processing and vacuum sealing and advanced sterilization technology innovations while their original flavour and nutritional content remain intact. These enhancements lead to reduced product waste while they improve product dependability. Government initiatives which aim to expand seafood export markets and improve seafood traceability systems will help boost industry competitiveness. The market will maintain its importance through 2035 because premium health-focused canned tuna products and sustainable eco-certified sourcing and online grocery expansion and convenience store distribution present new market opportunities.

Japan Canned Tuna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1326.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.6% |

| 2035 Value Projection: | USD 2175.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product ,By Distribution Channel |

| Companies covered:: | Maruha Nichiro Corporation, Nippon Suisan Kaisha, Kyokuyo Co., Ltd., Hagoromo Foods Corporation, Thai Union Group PCL, Mitsubishi Corporation, Dongwon Industries Co., Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Canned Tuna Market:

The Japan Canned Tuna Market Size experiences growth because people in Japan consume seafood products extensively and they choose ready-to-eat protein products and their households and foodservice establishments start using ready-to-eat meals. The demand for canned tuna products increases because urbanization and dual-income households and people who want to maintain their health push more people to choose canned tuna products. The technological advances in retort processing and vacuum sealing and sterilization methods enable manufacturers to produce canned tuna products that reach high-quality standards and maintain their freshness throughout extended shelf-life periods.

The market experiences limitations because raw material prices at different times of the year and seasonal material shortages and rules about sustainable fishing methods and traceability need to be followed. The need to follow environmental rules together with fishing quota regulations results in higher operating expenses for businesses while restricting their capacity to produce goods. The intense competition from both domestic and global brands creates difficulties for smaller companies to keep their existing market share.

The future business potential exists in tuna products that offer both added value and health benefits together with the expansion of online shopping and convenient distribution methods and the implementation of sustainable packaging solutions. The plant-based and alternative protein market segments together with the premium ready-to-eat tuna sector are predicted to increase consumer interaction which will establish sustainable market growth until 2035.

Market Segmentation

The Japan Canned Tuna Market share is classified into product and distribution channel.

By Product:

The Japan Canned Tuna Market Size is divided by product into yellowfin, skipjack, and others. Among these, the skipjack segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment's growth originates from multiple reasons which include its widespread availability and low cost and its ability to satisfy consumer needs and its various uses in both home and food service settings and its strong demand from both Japanese retail stores and commercial businesses.

By Distribution Channel:

The Japan Canned Tuna Market Size is divided by distribution channel into hypermarkets & supermarkets, specialty stores, and online. Among these, the hypermarkets & supermarkets segment dominated the share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment expands because of its widespread retail distribution which enables customers to shop at one location while the store promotes products through organized events and customers increasingly trust hypermarkets and Japanese families begin using ready-to-eat tuna products.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Canned Tuna Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

- Top Key Companies in Japan Canned Tuna Market:

- Maruha Nichiro Corporation

- Nippon Suisan Kaisha

- Kyokuyo Co., Ltd.

- Hagoromo Foods Corporation

- Thai Union Group PCL

- Mitsubishi Corporation

- Dongwon Industries Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Canned Tuna Market Size based on the below-mentioned segments:

Japan Canned Tuna Market, By Product:

- Yellowfin

- Skipjack

- Others

Japan Canned Tuna Market, By Distribution Channel:

- Hypermarkets & Supermarkets

- Specialty Stores

- Online

Frequently Asked Questions (FAQ)

-

Q: What is the Japan canned tuna market size?A: Japan canned tuna market is expected to grow from USD 1,326.4 million in 2024 to USD 2,175.3 million by 2035, at a CAGR of 4.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by Japan’s strong seafood consumption, growing demand for convenient, protein-rich meals, urbanization, dual-income households, and health-conscious consumers. Technological advancements in retort processing, vacuum sealing, and sterilization further support product quality and shelf life.

-

Q: What factors restrain the Japan canned tuna market?A: Constraints include fluctuating tuna raw material prices, seasonal supply shortages, regulatory compliance with sustainable fishing and traceability requirements, and intense competition among domestic and international brands, which challenge smaller players’ market share.

-

Q: How is the market segmented by product?A: The market is segmented into yellowfin, skipjack, and others. The skipjack segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period due to its wide availability, affordability, and strong demand in households and foodservice.

-

Q: How is the market segmented by distribution channel?A: The market is segmented into hypermarkets & supermarkets, specialty stores, and online. hypermarkets & supermarkets dominated the share in 2024 and are expected to grow at a remarkable CAGR due to widespread retail presence, organized promotions, and growing consumer trust.

-

Q: Who are the key players in the Japan canned tuna market?A: Key companies include Maruha Nichiro Corporation, Nippon Suisan Kaisha (Nissui), Kyokuyo Co., Ltd., Hagoromo Foods Corporation, Thai Union Group PCL, Mitsubishi Corporation, Dongwon Industries Co., Ltd., and others.

Need help to buy this report?