Japan Botanical Supplements Market Size, Share, and COVID-19 Impact Analysis, By Source (Herbs, Leaves, Spices, Flowers, and Others), By Form (Powder, Liquid, Tablets, Capsules, Gummies, and Others), By Distribution Channel (Offline and Online), and Japan Botanical Supplements Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Botanical Supplements Market Size Insights Forecasts to 2035

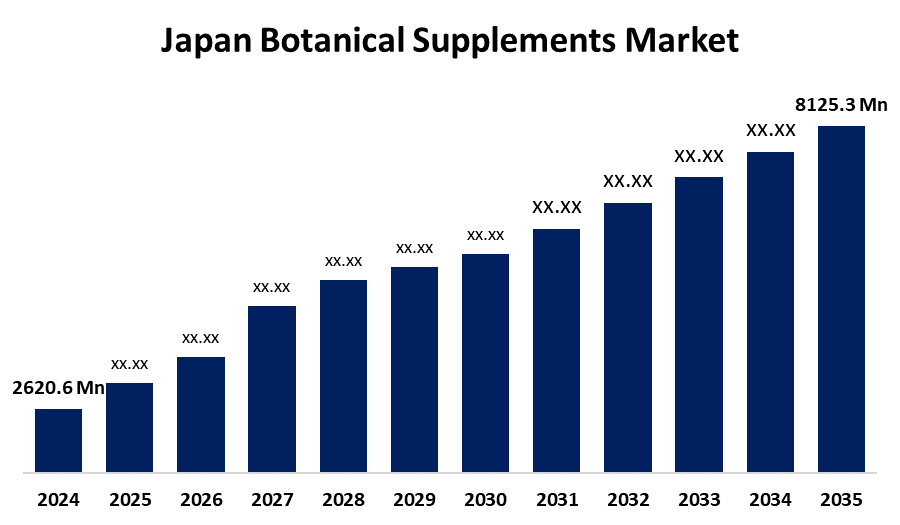

- The Japan Botanical Supplements Market Size Was Estimated at USD 2620.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.83% from 2025 to 2035

- The Japan Botanical Supplements Market Size is Expected to Reach USD 8125.3 Million by 2035

Get more details on this report -

According to a Rsearch Report Published by Spherical Insights & Consulting, The Japan Botanical Supplements Market Size is anticipated to Reach USD 8125.3 Million by 2035, Growing at a CAGR of 10.83% from 2025 to 2035. The botanical supplements market in Japan is driven by the growing customer preference for natural and plant-based products, growing health consciousness, and knowledge about preventative healthcare. Demand is also being influenced by the aging population and the emphasis on healthy aging.

Market Overview

Botanical supplements contain nutritious substances obtained from the parts of the plant, such as leaves, roots, seeds, flowers, or extracts, and goodness, to increase, prevent disease, or promote health. They are often used for nutrition, immunity, digestion, and stress management in addition to traditional medicine and overall methods. They come as capsules, powder, tea, or tincture. Traditional systems such as Ayurveda, traditional Chinese medicine (TCM), and indigenous herbal remedies, vegetation supplements are also known as herbal supplements, which represent one of the oldest and most popular types of health services. In modern times, they are classified as dietary supplements that include active substances obtained from plants and are used to improve general health, treat minor diseases, or reduce the possibility of developing diseases. Additionally, there is a more common diet and its conformity to lifestyle trends. Vegetable components are highly preferred due to an increase in consumer demand for vegetarian, clean-label preferences, and natural, chemical-free products. Customers who care about the environment and are looking for sustainable, environmentally friendly solutions for their personal health regimens will be attracted to the origin of their plant. Accessibility and consumer uptake are further improved by the wide range of forms, such as botanical supplements, including capsules, pills, powder, tea, and functional beverages.

Report Coverage

This research report categorizes the market for the Japan botanical supplements market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan botanical supplements market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan botanical supplements market.

Japan Botanical Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2620.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.83% |

| 2035 Value Projection: | USD 8125.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 184 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Source, By Form and COVID-19 Impact Analysis |

| Companies covered:: | Otsuka Pharmaceutical Co., Ltd., DHC Corporation, Suntory Wellness, FANCL Corporation, Yakult Honsha Co., Ltd., Meiji Holdings Co., Ltd., Ajinomoto Co., Inc., Kracie Holdings, Ld., Morinaga Milk Industry Co., Ltd., Nihon Shokuhin Kako Co., Ltd., Shiseido (Inner Beauty Line), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The botanical supplements market is driven by growing requirements for natural, clean-label products, strong cultural acceptance of traditional complex treatment, and an elderly population that is looking for preventive healthcare. With the help of strong retail and e-commerce distribution networks, increasing disposable income, an increase in knowledge of immunological health, and the progress from innovation in convenient formats such as pots and powder.

Restraining Factors

The botanical supplements market is mostly constrained by a lack of clinical verification due to high production costs, strict rules, and some vegetation. In addition, broad, long-term adoptions lead to obstruction of drugs and built-in neutraceuticals, as well as public mistrust of overstated health claims.

The Japan botanical supplements market share is classified into source, form, and distribution channel.

- The leaves segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan botanical supplements market is segmented by source into herbs, leaves, spices, flowers, and others. Among these, the leaves segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This dominance is due to a wide range of bioactive chemicals, including antioxidants and chlorophyll, which are often used in health and wellness products. Leaves are commonly used to improve skin health, increase immunity, and regulate weight. Demand has also increased as a result of new product introductions that address obesity issues and growing studies on herbal plants.

- The tablet segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan botanical supplements market is segmented by form into powder, liquid, tablets, capsules, gummies, and others. Among these, the tablet segment dominated in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its accessibility, ease of use, and accurate dosage. Busy consumers looking for hassle-free supplementing will find tablets intriguing because they are simple to use and store. Their appeal is further increased by their long shelf life and capacity to combine several botanical elements in a single dosage. Furthermore, improved bioavailability and efficacy are guaranteed by developments in tablet formulation processes.

- The offline segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan botanical supplements market is segmented by distribution channel into offline and online. Among these, the offline segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to its capacity to provide customers with a hands-on shopping experience, enabling them to physically examine botanical supplements and confirm their legitimacy. Supermarkets, pharmacies, and retail establishments also offer instant purchases and tailored advice, which promote dependability and confidence.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan botanical supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Otsuka Pharmaceutical Co., Ltd.

- DHC Corporation

- Suntory Wellness

- FANCL Corporation

- Yakult Honsha Co., Ltd.

- Meiji Holdings Co., Ltd.

- Ajinomoto Co., Inc.

- Kracie Holdings, Ld.

- Morinaga Milk Industry Co., Ltd.

- Nihon Shokuhin Kako Co., Ltd.

- Shiseido (Inner Beauty Line)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Botanical supplements market based on the below-mentioned segments:

Japan Botanical Supplements Market, By Source

- Herbs

- Leaves

- Spices

- Flowers

- Others

Japan Botanical Supplements Market, By End-Use

- Powder

- Liquid

- Tablets

- Capsules

- Gummies

- Others

Japan Botanical Supplements Market, By Distribution Channel

- Offline

- Online

Frequently Asked Questions (FAQ)

-

Q: What was the market size of Japan botanical supplements in 2024?A: The Japan botanical supplements market was valued at USD 2,620.6 million in 2024.

-

Q: What is the expected Japan botanical supplements market size by 2035?A: The market is projected to reach USD 8,125.3 million by 2035.

-

Q: What is the forecasted CAGR from 2025 to 2035?A: The market is expected to grow at a CAGR of 10.83% during 2025–2035.

-

Q: What are the key drivers of the Japan botanical supplements market?A: Growth is driven by increasing preference for natural and clean-label products, aging population, health consciousness, preventive healthcare, strong retail and e-commerce networks, disposable income, and innovation in convenient formats like tablets and powders.

-

Q: What are the main restraints in the Japan botanical supplements market?A: Challenges include high production costs, lack of sufficient clinical validation, strict regulations, and consumer mistrust of exaggerated health claims.

-

Q: Which source segment dominated the Japan botanical supplements market in 2024?A: The leaves segment dominated due to bioactive compounds like antioxidants and chlorophyll, commonly used for immunity, skin health, and weight management.

-

Q: Which form segment held the largest Japan botanical supplements market share in 2024?A: The tablet segment led the market due to its convenience, accurate dosage, long shelf life, and ability to combine multiple botanicals.

Need help to buy this report?