Japan Blood Testing Market Size, Share, By Test Type (Glucose, Lipid Panel, Prostate-Specific Antigen, Blood Urea Nitrogen, Thyroid-Stimulating Hormone, Infectious-Disease Serology, Vitamin D, and High-Sensitivity C-Reactive Protein), By Product (Instruments and Consumables), By Technology (Clinical Chemistry, Molecular Diagnostics, Immunoassay, and Others), By End User (Diagnostic Laboratories, Hospitals, and Others), Japan Blood Testing Market Insights, Industry Trends, Forecasts to 2035.

Industry: HealthcareJapan Blood Testing Market Insights Forecasts to 2035

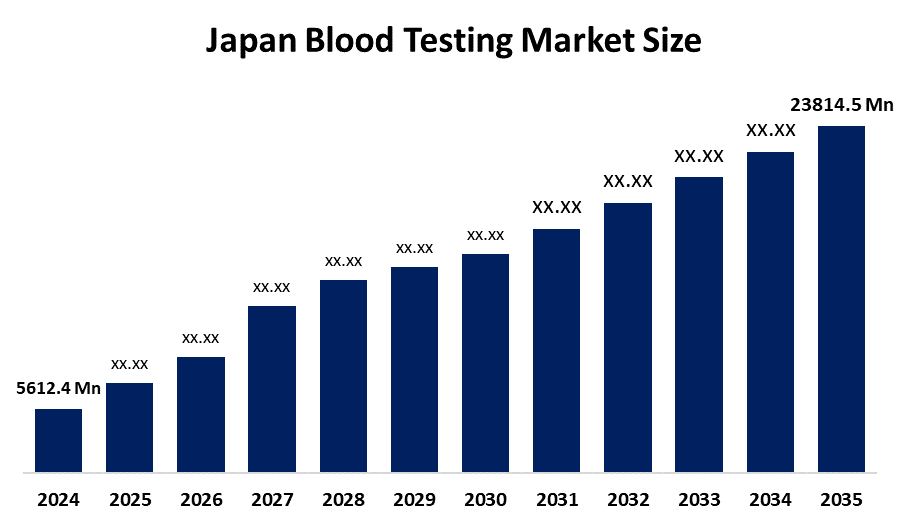

- Japan Blood Testing Market Size 2024: USD 5612.4 Mn

- Japan Blood Testing Market Size 2035: USD 23814.5 Mn

- Japan Blood Testing Market CAGR 2024: 14.04%

- Japan Blood Testing Market Segments: Test Type, Product, Technology, and End User

Get more details on this report -

The Japan Blood Testing Market Size refers to the laboratory and point-of-care-based diagnostic tests performed on blood samples to aid in the detection, monitoring, and preventive aspects of healthcare. These tests are generally performed for fasting glucose and HbA1c, lipid profiles, liver and renal function, hormonal studies, infectious disease screenings, as well as oncology, related tests. Due to its clinical significance, cost, effectiveness, and usefulness in population screening, blood testing is a very important component of the Japanese healthcare system. The practice is further aided by the mandatory annual health check-up, employer-driven screening initiatives, and patient compliance with preventive testing. Demand in the market is mainly fuelled by the rapidly aging population of Japan, cases of diabetes, cardiovascular disease, and chronic kidney disease, as well as the early diagnosis focus.

Technological development is mainly focused on automatic clinical chemistry analysers, advanced immunoassays, molecular diagnostics, and laboratory management systems. Government support is mainly offered through Japan’s universal healthcare system, the Ministry of Health, Labour and Welfare, and the PMDA. Initiatives such as Medical DX Riesa Vision 2030 promote the digitalization of the healthcare system, which will create future opportunities in AI-driven diagnostics, decentralized testing, and preventive screening programs.

Market Dynamics of the Japan Blood Testing Market:

The Japan Blood Testing Market Size is mainly driven by the aging population of Japan, the growing number of patients with chronic diseases like diabetes, cardiovascular diseases, and kidney ailments, and the high level of participation in health check-ups. The culture of mandatory annual medical check-ups and the rising awareness of early diagnosis have been contributing factors.

The market is moderated by the price pressure associated with the national health insurance reimbursement system in Japan, high capital expenses for sophisticated diagnostic equipment, and strict regulatory standards set by the PMDA. Smaller labs are challenged by the need to upgrade to automated and molecular platforms.

Opportunities for the future are arising from the growth of preventive healthcare programs, the adoption of automated and AI-assisted diagnostic solutions, and the use of immunoassays and molecular diagnostics for early disease detection. Current healthcare digitalization projects and the need for faster and highly accurate diagnostic results are anticipated to improve the efficiency of laboratories and provide long-term growth opportunities in the Japanese diagnostic market.

Market Segmentation

The Japan blood testing market share is classified into test type, product, technology, and end user.

By Test Type:

The Japan Blood Testing Market Size is divided by test type into glucose, lipid panel, prostate-specific antigen, blood urea nitrogen, thyroid-stimulating hormone, infectious-disease serology, vitamin D, and high-sensitivity C-reactive protein. Among these, glucose testing dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Frequent testing, diabetes cases, acceptance of screening tests, demand in hospitals and labs, preventive health programs, aging, coverage, point-of-care tests, integration with continuous monitoring, suggestions from health authorities, and awareness among doctors lead to the dominance of glucose tests in Japan.

By Product:

The Japan Blood Testing Market Size is divided by product into instruments and consumables. Among these, consumables dominated the share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period. Frequent usage of reagents, single-use test kits, increasing volumes in diagnosis, growing preventive testing, tracking patients with chronic diseases, reliance on hospital labs, compatibility with automation, pricing standardization, minimal reusability, standardization in government regulations, and constant replenishment needs make consumables the most prosperous selling category.

By Technology:

The Japan Blood Testing Market Size is divided by technology into clinical chemistry, molecular diagnostics, immunoassay, and others. Among these, clinical chemistry dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Applicability to a broad test base, economical costs, high compatibility with automated systems, shorter turnaround times, standardized processes, well-established infrastructure, widespread adaptation in hospitals, high sample throughput, compatibility with systems in a lab, and applicability to screening tests are dominating factors in making technology in the domain of clinical chemistry a nationwide success in Japan.

By End User:

The Japan Blood Testing Market Size is divided by end user into diagnostic laboratories, hospitals, and others. Among these, diagnostic laboratories dominated the share in 2024 and are anticipated to grow at a remarkable CAGR during the forecast period. Centralized testing systems, the volume of samples, the level of automation, cost savings, qualified staff availability, outsourcing from hospitals, shorter turnaround times, quality controls, scalability, compliance with regulatory requirements, and investment in high-throughput analysers make the dominance of the diagnostic labs across the Japan market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Blood Testing Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Blood Testing Market:

- Sysmex Corporation

- SRL, Inc. (H.U. Group Holdings)

- BML, Inc.

- Fujirebio Holdings, Inc.

- Abbott Japan LLC

- Roche Diagnostics K.K.

- Siemens Healthineers K.K.

- Beckman Coulter K.K.

- ARKRAY, Inc.

- Nipro Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Inssights has segmented the Japan Blood Testing Market based on the below-mentioned segments:

Japan Blood Testing Market, By Test Type

- Glucose

- Lipid Panel

- Prostate-Specific Antigen

- Blood Urea Nitrogen

- Thyroid-Stimulating Hormone

- Infectious-Disease Serology

- Vitamin D

- High-Sensitivity C-Reactive Protein

Japan Blood Testing Market, By Product

- Instruments

- Consumables

Japan Blood Testing Market, By Technology

- Clinical Chemistry

- Molecular Diagnostics

- Immunoassay

- Others

Japan Blood Testing Market, By End User

- Diagnostic Laboratories

- Hospitals

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan blood testing market size?The Japan blood testing market is expected to grow from USD 5,612.4 million in 2024 to USD 23,814.5 million by registering 2035, a CAGR of 14.04% during the forecast period 2025–2035.

-

What are the key growth drivers of the Japan blood testing market?Market growth is driven by Japan’s aging population, rising prevalence of diabetes, cardiovascular and renal diseases, mandatory annual health checkups, increased preventive screening adoption, technological advancements in diagnostics, automation in laboratories, and strong support from Japan’s universal healthcare system

-

What factors restrain the Japan blood testing market?Key restraints include price controls under the national health insurance reimbursement system, high capital investment for advanced diagnostic instruments, strict PMDA regulatory requirements, and financial pressure on smaller laboratories to upgrade to automated and molecular platforms.

-

How is the Japan blood testing market segmented?The market is segmented by test type, product, technology, and end user.

-

What are the major test types covered in the Japan blood testing market?Major test types include glucose, lipid panel, prostate-specific antigen, blood urea nitrogen, thyroid-stimulating hormone, infectious-disease serology, vitamin D, and high-sensitivity C-reactive protein tests

-

Who are the key players in the Japan blood testing market?Key companies include Sysmex Corporation, SRL, Inc. (H.U. Group Holdings), BML, Inc., Fujirebio Holdings, Abbott Japan LLC, Roche Diagnostics K.K., Siemens Healthineers K.K., Beckman Coulter K.K., ARKRAY, Inc., and Nipro Corporation

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?