Japan Bisphenol S Market Size, Share, By Product Type (Liquid Form And Powder Form), By Sales Channel (Direct Sales And Indirect Sales), And Japan Bisphenol S Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Bisphenol S Market Size Insights Forecasts to 2035

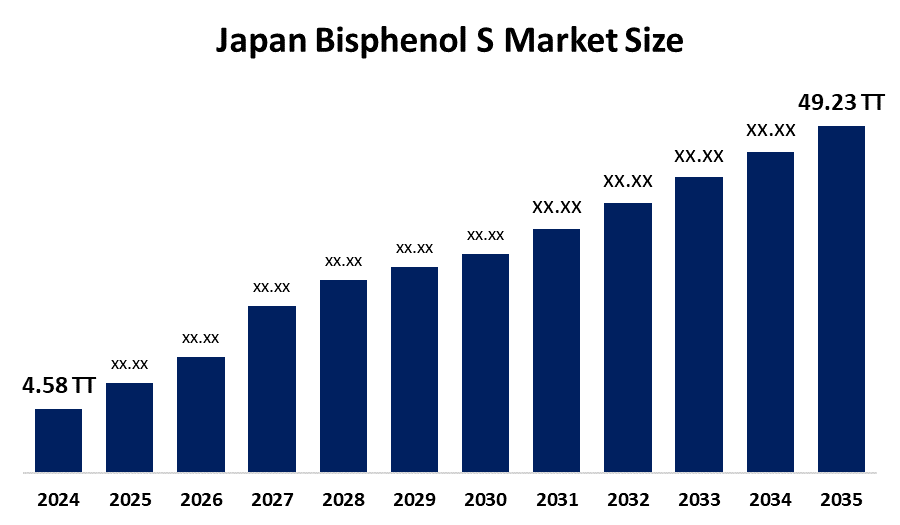

- Japan Bisphenol S Market Size 2024: 4.58 Thousand Tonnes

- Japan Bisphenol S Market Size 2035: 49.23 Thousand Tonnes

- Japan Bisphenol S Market CAGR 2024: 24.1%

- Japan Bisphenol S Market Segments: Product Type and Sales Channel

Get more details on this report -

The Japan Bisphenol S (BPS) Market Size covers the entire economy from manufacturing to usage of bisphenol s. BPS has similar applications to those of bisphenol a (BPA), it is widely used in making products such as plastics and epoxy resins. They structurally different from BPA and increasingly being used in applications that previously required the use of BPA, especially when there is a need for high-temperature resistance or less toxicity. In Japan, the BPS market includes both local manufacturers and end-use industries including automotive and consumer electronics.

The bisphenol s in Japan are backed by government support, including the Chemical Substances Control Law (CSCL), which governs the pre-market review, hazard evaluation, and regulation of chemical substances manufactured or imported into the country. Japan’s broader chemical regulatory reporting requirements: under CSCL, manufacturers and importers are obligated to report and evaluate any chemicals produced or imported above specific volume thresholds annually. These regulatory reporting frameworks help quantify chemical flows and enforce safety standards, which indirectly support shifts toward safer alternatives in markets like bisphenol s.

As technology advances, Japanese bisphenol s providers are now using innovations in the BPS-based material area to improve both their performance and sustainability. Some of the most recent innovations in this area are the creation of high-performance epoxy resins made from BPS where the resins have superior thermal and chemical resistance and used for electronics, auto parts and protective coatings. Developments of this nature can also be directly tied to research regarding catalyst systems as well as polymerization methods which help to improve the efficiency and provide lower energy production of BPS derived materials and facilitate their use in high value applications, thus exhibiting a larger industrial movement that focuses on optimizing performance while hitting environmental targets.

Market Dynamics of the Japan Bisphenol S Market:

The Japan bisphenol s market is driven by the strong government regulations on chemical safety, shift toward regulated and comparatively safer alternatives like BPS, expansion of thermal paper usage in retail and logistics, increasing application of epoxy resins in construction and industrial coatings, Japan’s focus on sustainable manufacturing and export-oriented chemical production, and ongoing R&D investments by domestic chemical companies propel the market growth.

The Japan bisphenol s market is restrained by the ongoing scientific and regulatory scrutiny of bisphenol analogues, complex regulations or public caution affecting BPS uptake, need for cost-effective production, and competition from alternative materials or technologies continues to challenge market expansion.

The future of Japan bisphenol s market is bright and promising, with versatile opportunities emerging from the increasing demand for more advanced, sustainable polymers especially in fast-growing industries such as electric cars, renewable energy sources, or next-generation consumer electronics advancements within BPS derivatives creating safer, more sustainable chemical processes and developing collaborations among businesses and government on research to create sustainable chemical processes to differentiate themselves and gain global market share are expected to offer opportunities for competition as well.

Market Segmentation

The Japan Bisphenol S Market share is classified into product type and sales channel.

By Product Type:

The Japan bisphenol s market is divided by product type into liquid form and powder form. Among these, the liquid form segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Superior handling characteristics, versatility in production processes, high demand from end use industries, and benefit for more uniform application and faster mixing all contribute to the liquid form segment's largest share and higher spending on bisphenol s when compared to other product type.

By Sales Channel:

The Japan bisphenol s market is divided by sales channel into direct sales and indirect sales. Among these, the direct segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct segment dominates because it provides superior cost control, ensures supply chain stability for crucial downstream applications, and enables direct relationships between manufacturers and large-scale industrial buyers.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan bisphenol s market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Bisphenol S Market:

- Konishi Chemical Ind. Co., Ltd.

- Honshu Chemical Industry Co., Ltd.

- Nisso Metallochemical Co., Ltd.

- Nippon Kayaku Co., Ltd.

- Solvay S.A.

- BASF Japan Ltd.

- Evonik Industries AG

- Arkema S.A.

- Others

Recent Developments in Japan Bisphenol S Market:

In October 2024, Japanese producer Idemitsu announced the complete cessation of Bisphenol A production at its 81,000 t/yr Chiba facility, citing oversupply and intense competition creating opportunities for alternative, specialized materials like BPS in specific, high-performance applications.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan bisphenol s market based on the below-mentioned segments:

Japan Bisphenol S Market, By Product Type

- Liquid Form

- Powder Form

Japan Bisphenol S Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the Japan bisphenol s market size?A: Japan bisphenol s market is expected to grow from 4.58 thousand tonnes in 2024 to 49.23 thousand tonnes by 2035, growing at a CAGR of 24.1% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong government regulations on chemical safety, shift toward regulated and comparatively safer alternatives like BPS, expansion of thermal paper usage in retail and logistics, increasing application of epoxy resins in construction and industrial coatings, Japan’s focus on sustainable manufacturing and export-oriented chemical production, and ongoing R&D investments by domestic chemical companies propel the market growth.

-

Q: What factors restrain the Japan bisphenol s market?A: Constraints include the ongoing scientific and regulatory scrutiny of bisphenol analogues, complex regulations or public caution affecting BPS uptake, need for cost-effective production, and competition from alternative materials or technologies continues to challenge market expansion.

-

Q: How is the market segmented by product type?A: The market is segmented into liquid form and powder form.

-

Q: Who are the key players in the Japan bisphenol s market?A: Key companies include Konishi Chemical Ind. Co., Ltd., Honshu Chemical Industry Co., Ltd., Nisso Metallochemical Co., Ltd., Nippon Kayaku Co., Ltd., Solvay S.A., BASF Japan Ltd., Evonik Industries AG, Arkema S.A., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?