Japan Biopsy Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Needle-Based Biopsy, Procedure Trays, Localized Wires, and Others), By Application (Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, and Others), and Japan Biopsy Devices Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareJapan Biopsy Devices Market Insights Forecasts to 2035

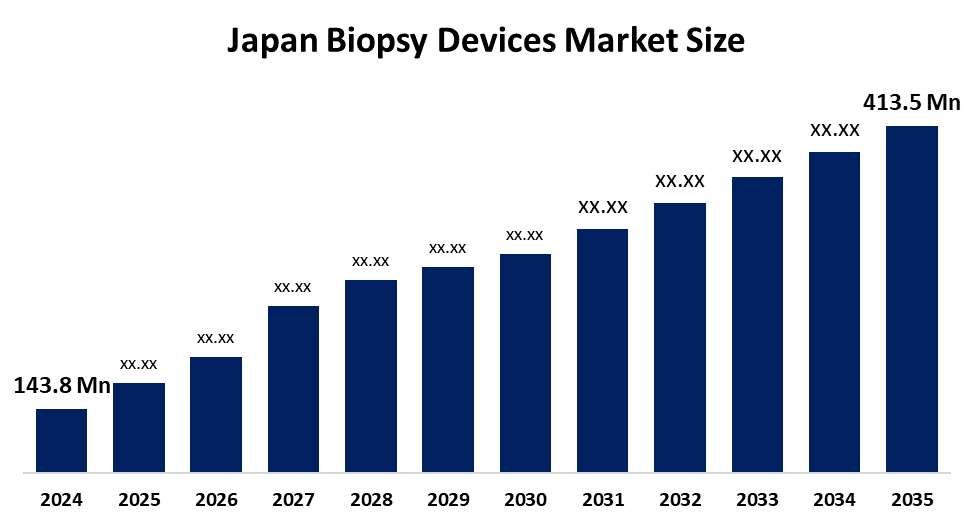

- The Japan Biopsy Devices Market Size was estimated at USD 143.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.08% from 2025 to 2035

- The Japan Biopsy Devices Market Size is Expected to Reach USD 413.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Biopsy Devices Market Size is anticipated to reach USD 413.5 million by 2035, growing at a CAGR of 10.08% from 2025 to 2035. The growing prevalence of cancer & other chronic diseases, along with the integration of AI-based biopsy systems, is driving the biopsy devices market in Japan.

Market Overview

The Japan biopsy devices market refers to the industry for specialized instruments used for extracting tissue samples for diagnostic purposes, primarily to identify diseases such as cancer. Biopsy devices are an integral part of diagnostic workup for many medical conditions, with specific attention given to choosing the most effective biopsy technique and device for procuring adequate material without complications. Various types of biopsy procedures, including needle biopsy, endoscopic biopsy, skin biopsy, bone marrow biopsy, and surgical biopsy, are used for the diagnosis of cancer, like breast cancer, blood cancer, and melanoma. Cancer genetic testing products and technology platforms, including Biopsy Devices, are being offered by high-tech companies that are offering to biopharmaceutical companies and research institutions. For instance, in March 2024, HaploX established a Japanese Subsidiary to expand Biopsy Devices and transomics analysis services.

The emergence of robotics and AI-assisted biopsy systems for targeted biopsy of lesions is providing growth opportunities in the biopsy devices market. For instance, in June 2025, Johnson & Johnson MedTech‘s Monarch robotics-assisted bronchoscopy system reaches deep into the lungs for biopsies, offering a minimally invasive alternative to transthoracic needle biopsy while maximizing diagnostic yield.

Report Coverage

This research report categorizes the market for the Japan biopsy devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan biopsy devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan biopsy devices market.

Japan Biopsy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 143.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.08% |

| 2035 Value Projection: | USD 413.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Boston Scientific Corporation, Hologic Inc., Medtronic plc, Taisho Biomed Instruments Co. Ltd., TSK Laboratory Japan, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The prevalence of cancer in Japan is estimated to increase 13.1% from 2020 to 2050, which is anticipated to drive the need for biopsy devices for diagnosis, thereby propelling the market demand. With the increasing adoption of digital pathology, the use of AI-based multimodal modeling in biopsy aids in propelling market growth. Additionally, an increasing government support for regular diagnostic awareness is contributing to driving the biopsy devices market. For instance, the Japan Cancer Society (JCS) is promoting cancer screening and raising public awareness about cancer prevention.

Restraining Factors

The stringent regulations and underdeveloped healthcare infrastructure are responsible for restraining the biopsy devices market. Further, an increasing number of product recalls is affecting the market growth.

Market Segmentation

The Japan biopsy devices market share is classified into product type and application.

- The needle based segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biopsy devices market is segmented by product type into needle-based biopsy, procedure trays, localized wires, and others. Among these, the needle based segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fine needle aspiration and core needle biopsy are commonly used procedures that use a needle biopsy. Needle biopsy is used for taking tissue or fluid samples from lymph nodes, liver, lungs, bone, as well as organs like the thyroid gland, kidney, and stomach. The surging development of advanced biopsy devices, owing to the growing demand for rapid & gentle procurement of cell samples, is propelling the market.

- The breast biopsy segment dominated the biopsy devices market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan biopsy devices market is segmented by application into breast biopsy, lung biopsy, colorectal biopsy, prostate biopsy, and others. Among these, the breast biopsy segment dominated the biopsy devices market in 2024 and is expected to grow at a significant CAGR during the forecast period. Breast biopsy involves the removal of a sample of breast tissue for testing, that are sent to a lab for tissue sample diagnosis. The procedure is used to investigate unusual findings on a mammogram, ultrasound or other breast exam. The introduction of advanced biopsy devices like Eviva Breast Biopsy system and the Brevera breast biopsy is propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan biopsy devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation

- Hologic Inc.

- Medtronic plc

- Taisho Biomed Instruments Co. Ltd.

- TSK Laboratory Japan

- Others

Recent Developments:

- In October 2025, Olympus Corporation (Olympus), a global MedTech company, announced the launch of SecureFlex, a single-use fine needle biopsy device. SecureFlex would be commercially available in Japan and Japan in Autumn 2025, with a subsequent global rollout subject to regulatory requirements such as product registration and market clearance.

- In August 2024, Hitachi High-Tech Corporation and Gencurix, Inc. entered a strategic partnership (the Partnership) in the field of cancer molecular diagnostics.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Biopsy Devices Market based on the below-mentioned segments:

Japan Biopsy Devices Market, By Product Type

- Needle-Based Biopsy

- Procedure Trays

- Localized Wires

- Others

Japan Biopsy Devices Market, By Application

- Breast Biopsy

- Lung Biopsy

- Colorectal Biopsy

- Prostate Biopsy

- Others

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Japan Biopsy Devices Market over the forecast period?The Japan Biopsy Devices Market is projected to expand at a CAGR of 10.08% during the forecast period.

-

2. What is the market size of the Japan Biopsy Devices Market?The Japan Biopsy Devices Market size is expected to grow from USD 143.8 million in 2024 to USD 413.5 million by 2035, at a CAGR of 10.08% during the forecast period 2025-2035.

-

3. Who are the top companies operating in the Japan Biopsy Devices Market?Key players in the Japan Biopsy Devices Market include Boston Scientific Corporation, Hologic Inc., Medtronic plc, Taisho Biomed Instruments Co. Ltd., and TSK Laboratory Japan.

-

4. What are the main drivers of growth in the Japan Biopsy Devices Market?The growing prevalence of cancer, regular diagnostic awareness, and digital pathology are the main drivers of growth in the Japan biopsy devices market.

-

5. What challenges are limiting the Japan Biopsy Devices Market?The underdeveloped healthcare infrastructure, product recalls, and strict regulations remain key restraints in the Japan Biopsy Devices market.

-

6. What are the latest trends in the Japan biopsy devices market?Integration of AI-based biopsy systems, with the adoption of digital pathology, is the key trend in the Japan biopsy devices market.

Need help to buy this report?