Japan Biomarkers Market Size, Share, by Product (Consumables, Services and Software), Type (Efficacy Biomarkers, Safety Biomarkers and Validation Biomarkers), End User (Pharmaceutical and Biotechnology Companies, Diagnostic and Research Laboratories, Hospitals and Speciality Clinics, and Others), Japan Biomarkers Market Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Biomarkers Market Insights Forecasts to 2035

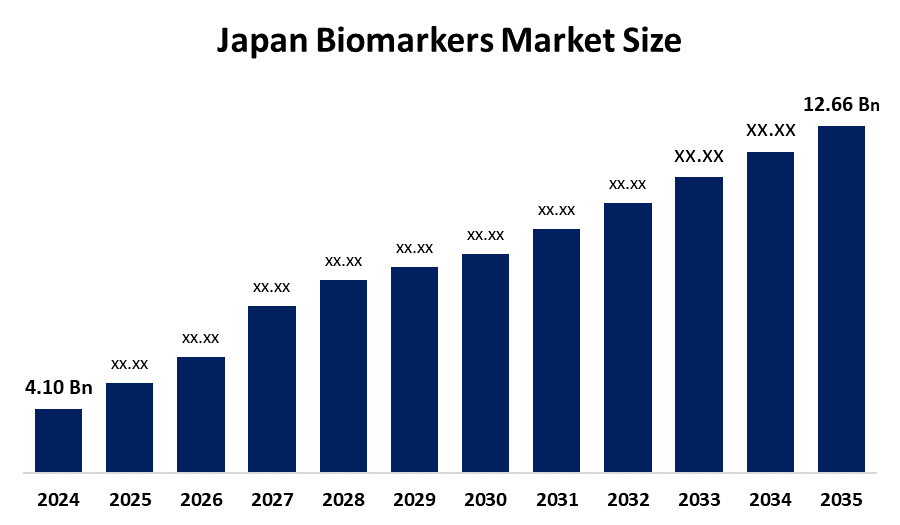

- Japan Biomarkers Market Size 2024: USD 4.10 Billion

- Japan Biomarkers Market Size 2035: USD 12.66 Billion

- Japan Biomarkers Market CAGR 2024: 10.79%

- Japan Biomarkers Market Segments: Product, Type, and End Use.

Get more details on this report -

The Japan Biomarkers Market Size measures the biological indicators within the human body for the purpose of disease detection and prediction, diagnosis, monitoring disease states, and predicting response to treatment. Biomarkers can aid in the early detection of disease, as well as provide improved treatment through personalised medicine, drug development, and the conduct of clinical research. As a result, improved healthcare outcomes and increased precision in the delivery of treatment can be accomplished in Japan’s sophisticated clinical diagnostics and healthcare systems through the use of biomarkers. Furthermore, Japan biomarkers market is growth factors for the Japanese biomarkers market stem from the growing number of people diagnosed with chronic diseases and age-related illnesses. Increased availability of analytical technologies, along with increased awareness by healthcare providers and patients, along with government investment in early disease detection and precision therapy, are all expected to increase demand for biomarkers to be used in the diagnosis of disease, and the development of new medicines.

Japan’s government policy continues to foster innovation in healthcare and supports biomarker research through providing funding, support and a favourable regulatory environment. The PMDA is able to facilitate the review and approval process for new novel diagnostic products that will assist in the detection and treatment of disease; additionally, public-private collaborations are able to accelerate the development of clinical trials and projects in precision medicine. Japan’s government policies also have a strong emphasis on preventive care, the growing needs of Japan’s aged population, and advances in emerging technologies; therefore, these supportive policies help to facilitate the adoption and development of Japan's biomarkers.

Japan Biomarkers Market Size include increasing use of liquid biopsy and non-invasive diagnostic methods for identifying diseases at their earliest stages, particularly cancers; increasing use of multiple omics and digital biomarkers, which are a combination of genomic data, proteomic data, and wearable sensors; expanding artificial intelligence (AI) and bioinformatics for discovering and analyzing biomarkers; as well as increasing interest and use of personalized medicine and companion diagnostics designed specifically for a patient profile.

Japan Biomarkers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.10 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.79 % |

| 2035 Value Projection: | USD 12.66 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | by Product , by Type |

| Companies covered:: | Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, QIAGEN N.V., Bio-Rad Laboratories, Siemens Healthineers, Fujirebio, Eiken Chemical, and Other Key Players |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the Japan Biomarkers Market:

The Japan Biomarkers Market Size drivers for growth in the Japan biomarker industry include an increase in the prevalence of chronic lifestyle-related diseases, increased life expectancy, and increased demand for early, accurate disease diagnosis. Additionally, the continued advancement of technology, in particular within genomics and proteomics, molecular diagnostics, the continued embrace of personalised medicine, the growing number of clinical trials, and the government support of innovative healthcare solutions are expected to support the continued growth of the Japan marker industry, including the discovery and use of new biomarkers across all sectors of healthcare and pharmaceuticals.

The Japan Biomarkers Market Size faces restraints such as high costs of biomarker development, validation, and advanced diagnostic equipment, limiting adoption in smaller clinics. Regulatory complexities, lack of standardised testing protocols, and lengthy approval processes slow market entry. Additionally, a shortage of skilled professionals in genomics and molecular diagnostics, along with limited awareness in certain healthcare segments, restricts broader implementation and growth.

The Japan Biomarkers Market Size offers opportunities the include developing non-invasive diagnostic options such as liquid biopsy, developing disease-specific biomarkers associated with neurodegenerative or chronic disease; expanding digital biomarker solutions; creating demand for efficacy safety biomarkers through personalized medicine and targeted therapies; partnering with organizations involved in data analytics and artificial intelligence to augment growth; increasing research and development investment; and capitalizing on unmet clinical needs to develop innovative products and services that utilize biomarkers.

Market Segmentation

The Japan Biomarkers Market share is classified into product, type, and end use.

By Product:

The Japan Biomarkers Market Size is divided by product into consumables, services, and software. Among these, the consumables segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The consumables segment dominates because reagents, kits, and laboratory supplies are used continuously in diagnostics, research, and clinical testing. Their recurring demand across hospitals, laboratories, and biotech facilities generates consistent revenue, making consumables the largest product segment in Japan.

By Type:

The Japan Biomarkers Market Size is divided by type into efficacy biomarkers, safety biomarkers and validation biomarkers. Among these, the efficacy biomarkers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The efficacy biomarkers segment dominates because they are essential for assessing treatment effectiveness, guiding personalised therapies, and supporting drug development. Their frequent use in clinical trials, therapeutic monitoring, and precision medicine drives higher demand compared to safety and validation biomarkers.

By End Use:

The Japan Biomarkers Market Size is divided by end use into pharmaceutical and biotechnology companies, diagnostic and research laboratories, hospitals and speciality clinics, and others. Among these, the pharmaceutical and biotechnology companies segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The pharmaceutical and biotechnology companies segment dominates because they heavily rely on biomarkers for drug discovery, development, and clinical trials. Biomarkers help evaluate drug efficacy, safety, and patient response, which is critical for personalised medicine. High R&D investment, growing focus on targeted therapies, and the need for efficient, data-driven drug development processes drive their leading market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Biomarkers Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Biomarkers Market:

-

Roche Diagnostics

-

Abbott Laboratories

-

Thermo Fisher Scientific

-

QIAGEN N.V.

-

Bio-Rad Laboratories

-

Siemens Healthineers

-

Fujirebio

-

Eiken Chemical

-

Others

Recent Developments in Japan Biomarkers Market:

- In February 2025, Roche Sequencing by Expansion (SbE). Roche launched this technology in Japan, significantly reducing whole-genome turnaround times to under six hours, enhancing rapid biomarker identification.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Biomarkers Market Size based on the below-mentioned segments:

Japan Biomarkers Market, By Product.

- Consumables

- Services

- Software

Japan Biomarkers Market, By Type

- Efficacy Biomarkers

- Safety Biomarkers

- Validation Biomarkers

Japan Biomarkers Market, by End Use.

- Pharmaceutical and Biotechnology Companies

- Diagnostic and Research Laboratories

- Hospitals and Speciality Clinics

- Others

Frequently Asked Questions (FAQ)

-

Q 1: What is the Japan biomarkers market size? Japan biomarkers market is expected to grow from USD 4.10 billion in 2024 to USD 12.66 billion by 2035, growing at a CAGR of 10.79 % during the forecast period 2025-2035.

-

Q 2: What are the key growth drivers of the Japan biomarkers market? Japan biomarkers market is driven by increasing chronic and age-related diseases, growing adoption of personalised medicine, advances in biotechnology and diagnostics, and strong government support for healthcare innovation

-

Q 3: What factors restrain the Japan biomarkers market? The Japan biomarkers market is restrained by high development and testing costs, regulatory complexities, lack of standardised protocols, limited skilled professionals, and slow adoption in smaller healthcare facilities .

-

Q 4: How is the Japan biomarkers market segmented by type? The Japan biomarkers market is segmented into efficacy biomarkers, safety biomarkers and validation biomarkers.

-

Q 5: Who are the key players in the Japan biomarkers market? Key companies include Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Qiagen N.V., Bio‑Rad Laboratories, Siemens Healthineers, Eiken Chemical, and others.

Need help to buy this report?