Japan Bike and scooter rental Market Size, Share, and COVID-19 Impact Analysis, By Vehicle (Bike and Scooter), By Service (Pay-as-you Go and Subscription Based), and Japan Bike and scooter rental Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Bike and scooter rental Market Insights Forecasts to 2035

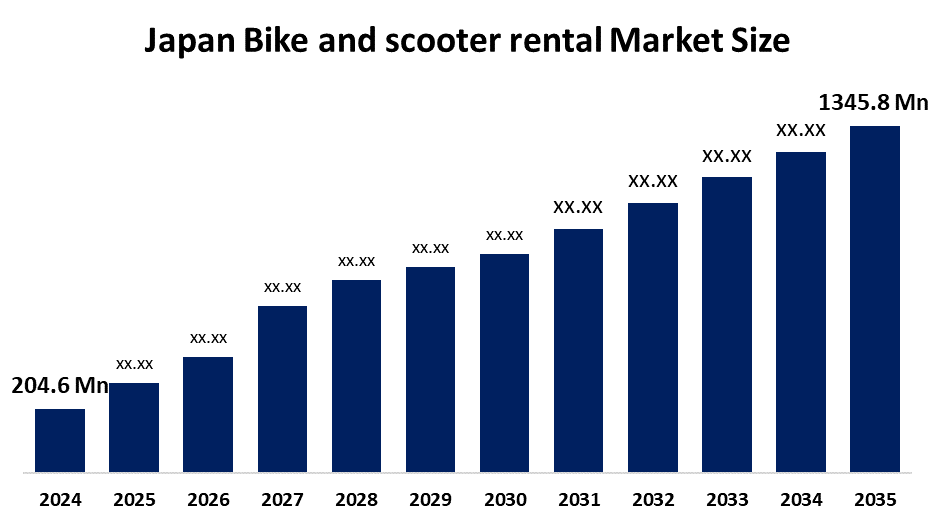

- The Japan Bike and Scooter Rental Market Size Was Estimated at USD 204.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 18.68% from 2025 to 2035

- The Japan Bike and Scooter Rental Market Size is Expected to Reach USD 1345.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Bike and Scooter Rental Market Size is anticipated to reach USD 1345.8 million by 2035, growing at a CAGR of 18.68% from 2025 to 2035. The bikes and scooters rental market in japan is driven by increasing awareness of the environmental risks posed by traditional automobiles, the need for sustainable and efficient transportation, and the affordability and practicality of micromobility options like renting a bike or a scooter, which let users avoid traffic jams.

Market Overview

Bike and scooter rental refers to a shared mobility service that allows individuals to rent a bicycle or electric/manual scooter for short-term use, usually through mobile applications, kiosks, or rented stations. The purpose of these services is to offer flexible, appropriate value, and an environmentally responsible mode of transport for final-meal connectivity, holiday, and commuting. Rent services for bikes and scooters are becoming more and more famous worldwide as a component of the shared mobility ecosystem. They serve both regular passengers and infinite passengers and are largely accessible in cities, tourist places, and college complexes. Unlike rent, with traditional ownership, customers require it without the spending and troubles of purchasing, maintaining, or storing the car. Technology integration is the main factor that makes modern bike and scooter rental systems possible. Through mobile apps using GPS and electronic payment methods, users can search, unlock, and pay for riding. Cities, bikes, and scooters also contribute significantly to tourism and hospitality by providing tourists with an easy method to locate rental businesses. In addition, both long-term users and daily travelers are being served by the emergence of seasonal and membership-based rental schemes. Rets complement buses, metro, and trains in multi-modal transportation networks, which are being improved through partnerships with local governments and transit officials.

Report Coverage

This research report categorizes the market for the Japan bike and scooter rental market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bike and scooter rental market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan bike and scooter rental market.

Japan Bike and Scooter Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 204.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 18.68% |

| 2035 Value Projection: | USD 1345.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Vehicle and By Service |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The bike and scooter rental market is driven by expanding use of app-based shared transportation, growing urban congestion, and rising demand for environmentally friendly mobility options. Demand is further increased by integration with public transportation networks, tourism, and last-mile connections. IoT-enabled fleet management, GPS tracking, and flexible rental models are examples of technological advancements that improve consumer comfort and stimulate market expansion.

Restraining Factors

The bike and scooter rental market is mostly restrained by high operating expenses, difficulties with fleet maintenance, and theft or vandalism problems. Adoption is also hampered by safety concerns, regulatory limitations in some places, and a lack of infrastructure specifically designed for bikes and scooters, which restricts the scalability of rental businesses.

Market Segmentation

The Japan bike and scooter rental market share is classified into vehicles and services.

- The bikes segment accounted for the largest revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan bike and scooter rental market is segmented by vehicles into bikes and scooters. Among these, the bikes segment accounted for the largest revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Technological developments that have improved the efficiency and accessibility of bike sharing are responsible for the large segmental share of bikes. The rental procedure has been simplified by the use of digital payment systems, smartphone applications, and GPS tracking, which makes it easy for customers to find, unlock, and pay for bikes.

- The pay-as-you-go segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan bike and scooter rental market is segmented by service into pay-as-you-go and subscription-based. Among these, the pay-as-you-go segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance due to its significant market share can be ascribed to a number of causes, including the fact that it provides consumers who might not need cars frequently but do occasionally need them with flexibility and cost. Tourists, infrequent commuters, and people who desire sporadic use without the commitment of ownership or set fees are among the many types of clients that find this approach appealing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan bike and scooter rental market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Docomo Bike Share, Inc.

- Open Street Inc.

- Mobike

- Giant Store Bike Rental

- Cyclocity

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan bike and scooter rental market based on the below-mentioned segments:

Japan Bike and Scooter Rental Market, By Vehicle

- Bikes

- Vehicles

Japan Bike and Scooter Rental Market, By Services

- Pay-as-you Go

- Subscription-Based

Frequently Asked Questions (FAQ)

-

Q: What is the size of the Japan bike and scooter rental market in 2024?A: The market size was estimated at USD 204.6 million in 2024.

-

Q: What will be the size of the Japan bike and scooter rental market by 2035?A: It is projected to reach USD 1345.8 million by 2035.

-

Q: What is the growth rate (CAGR) of the Japan bike and scooter rental market?A: The market is forecast to grow at a CAGR of 18.68% during 2025–2035.

-

Q: What are the major factors driving this market?A: Key drivers include urban congestion, demand for eco-friendly mobility, app-based accessibility, tourism, and integration with public transport systems.

-

Q: What challenges restrain the growth of this market?A: High operating expenses, fleet maintenance, theft, regulatory restrictions, safety concerns, and lack of infrastructure are the major restraints.

-

Q: Which vehicle type dominates the Japan bike and scooter rental market?A: The bike segment accounted for the largest revenue share in 2024 due to easier adoption and wide availability.

-

Q: Which service type leads the market?A: The pay-as-you-go segment dominated in 2024, appealing to tourists, occasional commuters, and users seeking flexibility

-

Q: What is the forecast period covered in this report?A: The report covers historical data from 2020–2023, base year 2024, and forecasts from 2025–2035.

-

Q: Who are the key target audiences for this market?A: Target audiences include market players, investors, end-users, government authorities, consulting firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?