Japan Automotive Simulation Software Market Size, Share, By Component (Solutions and Services), By Deployment Model (On-Premises and Cloud-Based), By End User (Automotive OEMs, Automotive Component Manufacturers, and Others), By Application (Vehicle Dynamics Simulation, Powertrain & Battery Simulation, ADAS & Autonomous Driving Simulation, Electromagnetic & Electronics Simulation, Crash, Safety & NVH Simulation, Testing & Validation, Supply Chain & Manufacturing Simulation, and Design & Development, Others), Japan Automotive Simulation Software Market Insights, Industry Trends, Forecasts to 2035.

Industry: Electronics, ICT & MediaJapan Automotive Simulation Software Market Insights Forecasts to 2035

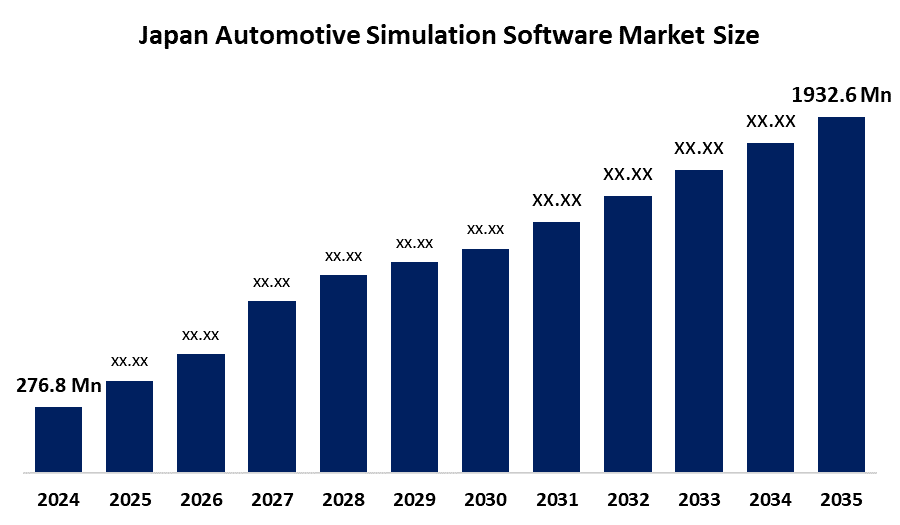

- Japan Automotive Simulation Software Market Size 2024: USD 276.8 Mn

- Japan Automotive Simulation Software Market Size 2035: USD 1932.6 Mn

- Japan Automotive Simulation Software Market CAGR 2024: 19.32%

- Japan Automotive Simulation Software Market Segments: Component, Deployment Model, End User, and Application

Get more details on this report -

Japan Automotive Simulation Software refers to computer-based applications used to simulate the designing, analysis, and testing of car models and their processes in a digital world before their actual production takes place. This software is commonly used in Japan’s automotive industry to reduce time and cost in the developmental process. Some of the main applications of the software are vehicle dynamics simulation, electric vehicle powertrain simulation, battery simulation, simulation of Advanced Driver-Assistance System (ADAS) & Autonomous Driving, Crash, Safety, & NVH simulation, simulation & testing of electromagnetic & electronic systems, digital manufacturing & supply chain, among others. Market forces driven by the software are the quick adoption of electrification, software-defined vehicles, the need for improved safety, among others.

The focus of technological developments is on cloud-based HPC, digital twins, AI-driven multi-physics simulation, and enhancements to CAD, CAE, and PLM. The future will cover simulation software related to battery simulation, virtual homologation, optimization using AI, smart manufacturing, and full-vehicle digital twins, establishing simulation software as an essential technology in Japan’s future car developments.

Market Dynamics of the Japan Automotive Simulation Software Market:

The Japan Automotive Simulation Software Market Size is propelled by the increasing adoption of electric vehicles, autonomous vehicles, and software-defined vehicles. The automotive original equipment manufacturing companies are increasingly adopting simulation software to cut down the costs associated with physical prototyping, develop vehicles within stipulated timescales, and ensure adherence to safety, emission, and performance standards.

The Japan Automotive Simulation Software Market Size is restrained by high initial software licensing expenses, the challenge of integrating legacy engineering systems, and the absence of competent simulation engineers. Small to mid-size suppliers are challenged by adoption because of cost constraints and relying on external engineering service providers for simulation.

The Japan automotive simulation software market offers excellent future prospects based on the implementation of cloud-based simulation solutions, AI-powered digital twins, and virtual homologation solutions. Rising interest in autonomous mobility solutions, battery technology, and smart manufacturing will trigger greater dependency on scalable simulation solutions. Joint efforts by software companies, carmakers, and institutes will open up long-term growth prospects.

Japan Automotive Simulation Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 276.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 19.32% |

| 2035 Value Projection: | USD 1932.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Component |

| Companies covered:: | Any’s Japan K.K. Assaults Systems K.K. Siemens K.K. Autodesk Japan K.K. PTC Japan Math Works Japan ds PACE GmbH Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan automotive simulation software market share is classified into component, deployment model, end user, and application.

By Component:

The Japan Automotive Simulation Software Market Size is divided by component into solutions and services. Among these, the solutions segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Dominance is catalysed by the extensive use of advanced simulation tools for the purposes of prototyping, system integration, regulatory approval, development in electrification, and ADAS programs, which provide quick design cycles, lower testing expenses, improved simulation precision, and market-leading product development for Japanese automakers.

By Deployment Model:

The Japan Automotive Simulation Software Market Size is divided by deployment model into on-premises and cloud-based. Among these, the cloud-based segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Growth drivers include the need for scalable compute resources, collaboration, processing, reduced infrastructure, licensing, engineering, and cloud security, enabling Japanese auto manufacturers to deal with complex simulations effectively and increase innovation speed across the country.

By End User:

The Japan Automotive Simulation Software Market Size is divided by end user into automotive OEMs, automotive component manufacturers, and others. Among these, the automotive OEMs segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The market is growing due to the investments of OEMs in the areas of electrification, software-defined vehicles, ADAS, regulation, virtual homologation, and safety, as the manufacturers emphasize simulation engineering to enhance performance and keep pace with global competition in the Japan automotive market.

By Application:

The Japan Automotive Simulation Software Market Size is divided by application into vehicle dynamics simulation, powertrain and battery simulation, ADAS and autonomous driving simulation, electromagnetic and electronics simulation, crash, safety and NVH simulation, testing and validation, supply chain and manufacturing simulation, design and development, and others. Among these, ADAS and autonomous driving simulation dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The factors driving dominance include increasing ADAS adoption rates, autonomous driving development and research activities, the complexity of sensor fusion development, scenario testing demands, the necessity for virtual validation, tightening safety regulations for compliance, and less reliance on on-road testing in Japanese markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan automotive simulation software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Automotive Simulation Software Market:

- Any’s Japan K.K.

- Assaults Systems K.K.

- Siemens K.K.

- Autodesk Japan K.K.

- PTC Japan

- Math Works Japan

- ds PACE GmbH

- Others

Recent Developments in Japan Automotive Simulation Software Market:

In July 2024, Altair Engineering Inc. launched Altair Hyper Works 2024, highlighting the significant enhancement in their unified simulation environment that boasts more efficient AI, assisted tasks, and enhanced solver performance and capabilities in automotive structural, electromagnetic, and multi/physics simulations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan automotive simulation software market based on the below-mentioned segments:

Japan Automotive Simulation Software Market, By Component

- Solutions

- Services

Japan Automotive Simulation Software Market, By Deployment Model

- On-Premises

- Cloud-Based

Japan Automotive Simulation Software Market, By End User

- Automotive OEMs

- Automotive Component Manufacturers (Tier-1 / Tier-2)

- Others

Japan Automotive Simulation Software Market, By Application

- Vehicle Dynamics Simulation

- Powertrain & Battery Simulation

- ADAS & Autonomous Driving Simulation

- Electromagnetic & Electronics Simulation

- Crash, Safety & NVH Simulation

- Testing & Validation

- Supply Chain & Manufacturing Simulation

- Design & Development

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan automotive simulation software market size?The Japan automotive simulation software market is expected to grow from USD 276.8 million in 2024 to USD 1,932.6 million by 2035, registering a CAGR of 19.32% during the forecast period 2025–2035.

-

What are the key growth drivers of the Japan automotive simulation software market?Market growth is driven by rising adoption of electric and autonomous vehicles, increasing use of software-defined vehicle architectures, growing reliance on virtual prototyping to reduce physical testing costs, stricter safety and emission regulations, and accelerated adoption of digital engineering workflows by Japanese automotive OEMs and suppliers

-

What factors restrain the Japan automotive simulation software market?Key restraints include high initial software licensing and implementation costs, complexity in integrating simulation platforms with legacy engineering systems, shortage of skilled simulation engineers, and budget limitations faced by small and mid-sized automotive component manufacturers.

-

How is the Japan automotive simulation software market segmented?The market is segmented by component (solutions and services), deployment model (on-premises and cloud-based), end user (automotive OEMs, automotive component manufacturers, and others), and application

-

Which application segment dominates the Japan automotive simulation software market?ADAS and autonomous driving simulation dominates the market due to increasing development of advanced driver-assistance systems, growing complexity of sensor fusion and scenario testing, rising safety compliance requirements, and reduced dependence on real-world road testing.

-

Who are the key players in the Japan automotive simulation software market?Key companies operating in the market include Ansys Japan K.K., Dassault Systems K.K., Siemens K.K., Autodesk Japan K.K., PTC Japan, MathWorks Japan, dSPACE GmbH, and others.

-

Who are the target audiences for this market report?The report targets automotive OEMs, automotive component manufacturers, software vendors, investors, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?