Japan Automated Guided Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Tow Vehicle, Unit Load Carrier, Pallet Truck, Forklift Truck, Hybrid Vehicles, and Others), By Application (Transportation, Distribution, Storage, Assembly, Packaging, and Waste Handling), and Japan Automated Guided Vehicle Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Automated Guided Vehicle Market Size Insights Forecasts to 2035

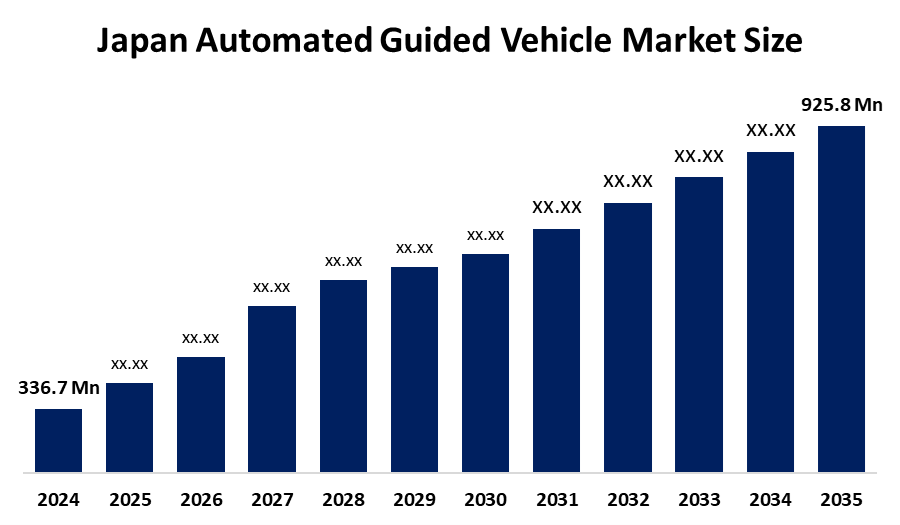

- The Japan Automated Guided Vehicle Market Size Was Estimated at USD 336.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.63% from 2025 to 2035

- The Japan Automated Guided Vehicle Market Size is Expected to Reach USD 925.8 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights, The Japan Automated Guided Vehicle Market Size is Anticipated to reach USD 925.8 Million by 2035, Growing at a CAGR of 9.63% from 2025 to 2035. The automated guided vehicle market in Japan is driven by rising labor shortages, rapid manufacturing automation, Industry 4.0 initiatives, smart factory adoption, technological advancements in robotics, and growing demand for efficiency in warehousing and logistics operations.

Market Overview

Japan Automated Guided Vehicle Market Size can be defined as encompassing the technologies concerned with the construction, manufacturing, and use of autonomous vehicles that rely on sensors, software, and navigation systems to move materials within the bounds of factories, warehouses, and logistics areas throughout Japan. The Japan automated guided vehicle market is on the rise as manufacturers and logistics companies are using automation to increase efficiency, decrease labor dependency, and make their operations more modern.

Japan's support for the AGV market comes in the form of subsidies, such as the SME Labor Saving Investment Subsidy, which covers up to ¥15 million per company for the adoption of automation. Catalog-based equipment lists combined with investment grants of up to ¥70 million serve as a powerful incentive for small and medium-sized enterprises (SMEs) to use AGVs, thus raising productivity, cutting down on labor costs, and facilitating smart factory projects.

AI, IoT, and vision-guided navigation are used by AGVs to improve material handling, route planning, and decision-making. The industries with the greatest potential are e-commerce logistics, smart warehousing, and the automotive, electronics, and healthcare industries. Recent innovations include Mitsubishi Logisnext's AGV forklift trial runs and Daifuku Co. Ltd.'s successful high-rise material handling system tests in Japan.

Report Coverage

This research report categorizes the market for the Japan Automated Guided Vehicle Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan automated guided vehicle market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan automated guided vehicle market.

Japan Automated Guided Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 336.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.63% |

| 2035 Value Projection: | 925.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Vehicle Type,By Application |

| Companies covered:: | Daifuku Co., Ltd., Toyota Industries Corporation, Mitsubishi Logisnext Co., Ltd., JFE Engineering Corporation, Fujitsu Automation Co., Ltd., Hitachi Industrial Equipment Systems Co., Ltd., Nidec Corporation, Murata Machinery, Ltd., Yaskawa Electric Corporation, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Automated Guided Vehicle Market Size in Japan is driven by labor shortages in the manufacturing and logistics sectors, and the complete incorporation of Industry 4.0 and smart factory solutions. The most prominent tech developments, such as AI-based navigation, IoT, and autonomous material handling, all contribute to higher operational productivity and accuracy. One of the factors that facilitates the deployment of AGVs is the government's backing in the form of initiatives and grants aimed at modernization. The demand from e-commerce, automotive, electronics, and healthcare is also another factor that contributes to the market growth, as companies are searching for cost-effective, scalable, and reliable automated material transport solutions.

Restraining Factors

The Automated Guided Vehicle Market Size in Japan is mostly constrained by high initial investment costs, complicated integration with the current systems, and maintenance needs. Besides, the unavailability of a skilled workforce for operator and technical support can also lead to delayed adoption in the case of small enterprises.

Market Segmentation

The Japan Automated Guided Vehicle market Size share is classified into vehicle type and application.

- The forklift truck segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Automated Guided Vehicle Market Size is segmented by vehicle type into tow vehicle, unit load carrier, pallet truck, forklift truck, hybrid vehicles, and others. Among these, the forklift truck segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its extensive use for heavy-load handling in manufacturing, warehousing, and logistics, excellent operational efficiency, industry adaptability, and robust interaction with automation and smart factory systems. For large-scale automated material handling applications, forklift AGVs are the best option due to their enhanced safety, decreased reliance on labor, and smooth material flow.

- The transportation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Automated Guided Vehicle Market Size is segmented by application into transportation, distribution, storage, assembly, packaging, and waste handling. Among these, the transportation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The strong need for effective, continuous material movement inside industrial facilities, warehouses, and logistics centers, which lowers labor dependency and operating costs, is what propels this supremacy. For sectors like automotive, electronics, and e-commerce, where precise and timely material movement is crucial, AGVs in transportation simplify workflow, improve safety, and boost production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Automated Guided Vehicle Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daifuku Co., Ltd.

- Toyota Industries Corporation

- Mitsubishi Logisnext Co., Ltd.

- JFE Engineering Corporation

- Fujitsu Automation Co., Ltd.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Nidec Corporation

- Murata Machinery, Ltd.

- Yaskawa Electric Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In March 2024, Mitsubishi Logisnext effectively demonstrated the utilization of automated guided forklifts (AGFs) in loading trucks, which are now being used in actual operations with the Japanese logistics partner Konoike Transport.

- In December 2023, Daifuku Co., Ltd. made the announcement of the commencement of operational testing for its latest high-speed, high-rise automated storage and retrieval system (AS/RS stacker cranes) in its newly established high-rise testing facility at the Shiga Works, which is the company’s core production base.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan automated guided vehicle market based on the below-mentioned segments:

Japan Automated Guided Vehicle Market, By Vehicle Type

- Tow Vehicle

- Unit Load Carrier

- Pallet Truck

- Forklift Truck

- Hybrid Vehicles

- Others

Japan Automated Guided Vehicle Market, By Application

- Transportation

- Distribution

- Storage

- Assembly

- Packaging

- Waste Handling

Frequently Asked Questions (FAQ)

-

What is the Japan automated guided vehicle market size?Japan automated guided vehicle market size is expected to grow from USD 336.7 million in 2024 to USD 925.8 million by 2035, growing at a CAGR of 9.63% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by labor shortages in the manufacturing and logistics sectors, and the complete incorporation of Industry 4.0 and smart factory solutions. The most prominent tech developments, such as AI-based navigation, IoT, and autonomous material handling, all contribute to higher operational productivity and accuracy. One of the factors that facilitates the deployment of AGVs is the government's backing in the form of initiatives and grants aimed at modernization. The demand from e-commerce, automotive, electronics, and healthcare is also another factor that contributes to the market growth, as companies are searching for cost-effective, scalable, and reliable automated material transport solutions.

-

What factors restrain the Japan automated guided vehicle market?Constraints include high initial investment costs, complicated integration with the current systems, and maintenance needs. Besides, the unavailability of a skilled workforce for operator and technical support can also lead to delayed adoption in the case of small enterprises.

-

How is the market segmented by vehicle type?The market is segmented into tow vehicle, unit load carrier, pallet truck, forklift truck, hybrid vehicles, and others.

-

Who are the key players in the Japan automated guided vehicle market?Key companies include Daifuku Co., Ltd., Toyota Industries Corporation, Mitsubishi Logisnext Co., Ltd., JFE Engineering Corporation, Fujitsu Automation Co., Ltd., Hitachi Industrial Equipment Systems Co., Ltd., Nidec Corporation, Murata Machinery, Ltd., Yaskawa Electric Corporation, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?