Japan Asthma Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Anti- inflammatory, Bronchodilators, and Combination Therapy), By Products (Inhalers and Nebulizers), and Japan Asthma Therapeutics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Asthma Therapeutics Market Insights Forecasts to 2035

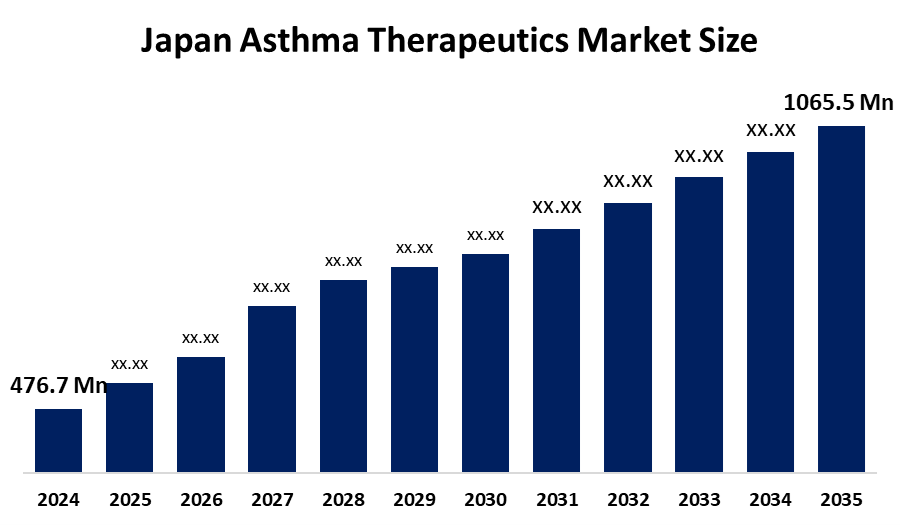

- The Japan Asthma Therapeutics Market Size Was Estimated at USD 476.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.59% from 2025 to 2035

- The Japan Asthma Therapeutics Market Size is Expected to Reach USD 1065.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Asthma Therapeutics Market size is anticipated to reach USD 1065.5 Million by 2035, Growing at a CAGR of 7.59% from 2025 to 2035. The asthma therapeutics market in Japan is driven by the need for medicines, including the most promising asthma treatment options, which have increased dramatically due to the rise in asthma prevalence. Furthermore, for uncontrolled asthma, novel treatments such as DNA vaccines, cytokine modulators, and anti-immunoglobulin E antibodies are currently being used.

Market Overview

The term asthma therapeutics describes the variety of drugs and therapeutic approaches used to treat and manage asthma, a long-term inflammatory condition of the airways that causes symptoms like wheezing, coughing, chest tightness, and shortness of breath. The symptoms of asthma include inflammation, blockage, and hyperresponsiveness of the airways; these symptoms are frequently brought on by allergens, pollutants, physical activity, or respiratory infections. Reducing airway inflammation, preventing exacerbations, and enhancing general lung function and quality of life are the main objectives of asthma treatments. The two primary categories of drugs used to treat asthma are controller (maintenance) and reliever (rescue). By lowering inflammation and preserving long-term control, controller medications such as biologics, long-acting beta-agonists (LABAs), leukotriene modifiers, and inhaled corticosteroids (ICS) are frequently used to avoid symptoms. Through the relaxation of airway muscles, reliever drugs, including anticholinergics and short-acting beta-agonists (SABAs) offer prompt relief from acute asthma attacks. For efficient management, combination inhalers with ICS and LABA are being used more and more. These biologics provide individualised therapy techniques by acting on particular immunological pathways. Improvements in AI-driven adherence tools, smart monitoring devices, and digital inhalers have also improved patient compliance and disease management.

Report Coverage

This research report categorizes the market for the Japan asthma therapeutics market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan asthma therapeutics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan asthma therapeutics market.

div class="table-responsive-outer">

Japan Asthma Therapeutics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 476.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.59% |

| 2035 Value Projection: | USD 1065.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Drug Class and By Products |

| Companies covered:: | Kyorin Pharmaceutical Co., Ltd, GlaxoSmithKline plc (GSK), Chugai Pharmaceutical, Daiichi Sankyo, Mitsubishi Tanabe Pharma, Mochida Pharmaceutical Holdings, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The asthma therapeutics market in Japan is driven by increasing awareness of respiratory health, rising air pollution, and rising asthma prevalence. The market is expanding due to developments in personalized medicine, inhalation technologies, and biologic medicines. The growing senior population and government programs to enhance asthma treatment also play a big role in the market's growth.

Restraining Factors

The asthma therapeutics market in Japan is mostly constrained by poor patient adherence to long-term medicine, the high expense of biologic therapies, and the lack of access to cutting-edge treatments in poorer nations. Furthermore, inhaler usage and corticosteroid side effects impede the best possible outcomes for managing asthma.

Market Segmentation

The Japan asthma therapeutics market share is classified into drug class and products.

- The anti-inflammatory segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Japan asthma therapeutics market is segmented by drug class into anti-inflammatory, bronchodilators, and combination therapy. Among these, the anti-inflammatory segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to its introduction of newly developed and reasonably priced anti-inflammatory biologics to treat individuals with severe asthma. Additionally, market R&D initiatives are being driven by partnerships among pharmaceutical companies, research institutes, and healthcare groups.

- The inhalers segment accounted for the largest revenue share and is expected to grow at a significant CAGR during the forecast period.

The Japan asthma therapeutics market is segmented by products into inhalers and nebulizers. Among these, the inhalers segment accounted for the largest revenue share and is expected to grow at a significant CAGR during the forecast period. This is due to reliability, adaptability, affordability, and mobility. Additionally, the rising incidence of COPD and asthma, as well as the increased demand for emergency treatment options to prevent unexpected events, have helped inhalers capture a sizable portion of the market.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan asthma therapeutics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kyorin Pharmaceutical Co., Ltd

- GlaxoSmithKline plc (GSK)

- Chugai Pharmaceutical

- Daiichi Sankyo

- Mitsubishi Tanabe Pharma

- Mochida Pharmaceutical Holdings

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan asthma therapeutics market based on the below-mentioned segments:

Japan Asthma Therapeutics Market, By Drug Class

- Anti- inflammatory

- Bronchodilators

- Combination Therapy

Japan Asthma Therapeutics Market, By Products

- Inhalers

- Nebulizers

Frequently Asked Questions (FAQ)

-

Q: What is the current size of the Japan asthma therapeutics market?A: The Japan asthma therapeutics market was valued at USD 476.7 million in 2024 and is projected to reach USD 1,065.5 million by 2035, growing at a CAGR of 7.59% from 2025 to 2035.

-

Q: Which drug class holds the largest market share in Japan?A: The anti-inflammatory segment held the largest market share in 2024, driven by the availability of new, cost-effective anti-inflammatory biologics for severe asthma patients

-

Q: Which product type dominates the market?A: Inhalers accounted for the largest revenue share due to their reliability, affordability, portability, and increasing demand for emergency asthma management

-

Q: What are the key driving factors for the marketA: Market growth is fueled by rising asthma prevalence, increasing air pollution, awareness of respiratory health, technological advancements in inhalers, biologic therapies, and personalised medicine, alongside government initiatives for asthma management.

-

Q: What challenges are restraining market growth?A: High costs of biologic therapies, limited access to advanced treatments, poor patient adherence to long-term medication, and side effects from corticosteroids and inhaler misuse constrain growth

-

Q: What are the main types of drugs used in asthma therapeutics?A: The market is segmented into anti-inflammatory drugs, bronchodilators, and combination therapy etc.

-

Q: Who are the key players in the Japan asthma therapeutics market?A: Major companies include Kyorin Pharmaceutical Co., Ltd., GlaxoSmithKline plc (GSK), Chugai Pharmaceutical, Daiichi Sankyo, Mitsubishi Tanabe Pharma, and Mochida Pharmaceutical Holdings.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?