Japan Aseptic Packaging Market Size, Share, By Product (Cartons, Bottles & Cans, Bags & Pouches, Prefilled Syringes, Vials & Ampoules, and Others), By Application (Food, Beverages, Pharmaceuticals, and Others), Japan Aseptic Packaging Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsJapan Aseptic Packaging Market Insights Forecasts to 2035

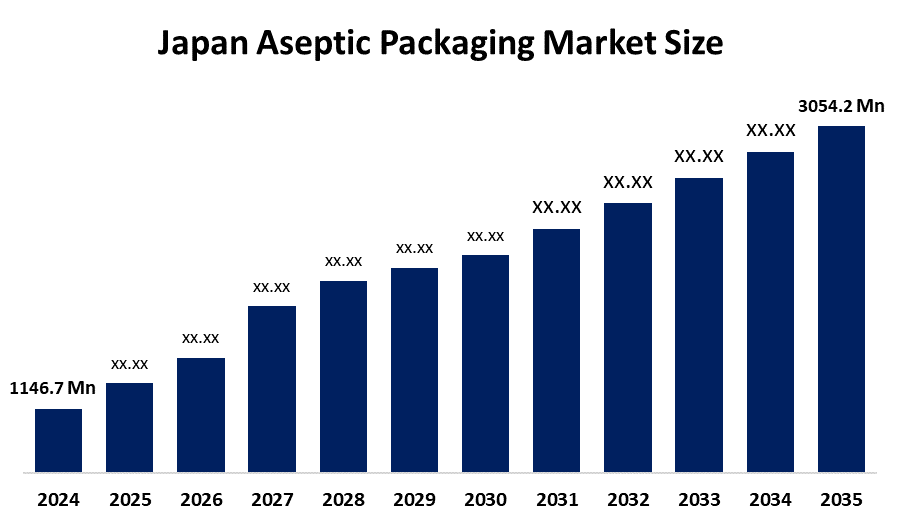

- Japan Aseptic Packaging Market Size 2024: USD 1146.7 Mn

- Japan Aseptic Packaging Market Size 2035: USD 3054.2 Mn

- Japan Aseptic Packaging Market CAGR 2024: 9.31%

- Japan Aseptic Packaging Market Segments: Product and Application.

Get more details on this report -

To create an aseptic package, a product would be heat-treated or sterilized separately from the container and then brought together in an ultra-clean environment for sealing. The finished product remains shelf-stable long-term without refrigeration or chemical preservatives. An example of this would be the growth of the Ready to Drink (RTD) and premium dairy markets in Japan, along with the emerging use of liquid nutritional supplements. Recent trends in Japan reflect a shift towards smart aseptic systems that include IoT sensors along with multilayered eco-friendly laminates to minimize the use of plastics while ensuring an absolute barrier from light and oxygen.

The Japanese government and several private sector organizations have implemented many projects to promote improved food safety and sustainability measures in the Japanese packaging industry. In particular, the Ministry of Agriculture, Forestry and Fisheries (MAFF) is responsible for leading the effort to implement a law around "Food Loss Reduction", which promotes the use of aseptic technology as a means to extend shelf life and reduce food waste throughout the country. In addition to working with the government, many of the largest companies in Japan, such as Nippon Paper Industries and Shikoku Kakoki, have combined their resources to create filling systems that comply with a higher level of sterilization known as the "6 log reduction" standard.

Japan's aseptic packaging industry is focused on new technology being developed around how accurately it can sterilize products and automate filling lines. Hydrogen peroxide vapor sterilizations have recently been developed for pet bottles, as well as electron beam (EB) technology, which has enabled chemical-free means of decontaminating packaging surfaces. Continuous level monitoring has been added to machines to ensure high-speed lines run with as little downtime as possible, and by using noncontact level sensors, the risk of cross-contamination is eliminated by measuring fill volume without coming into physical contact with the sterile product.

Market Dynamics of the Japan Aseptic Packaging Market:

The Japanese aseptic packaging market is driven by the changing lifestyles of consumers, which have created a significant demand for convenient, preservative-free beverage solutions. Evolving consumer preferences also place increased pressure on food and beverage manufacturers to utilize newer technology that is more efficient and cost-effective. In addition to offering these products, changes to food safety regulations and the national efforts being made to reduce food waste are creating additional complications for manufacturers. As a result of these pressures, many food and beverage manufacturers are transitioning from traditional chilled product distribution to ambient aseptic packaging formats.

The Japanese aseptic packaging market is restrained by small to medium-sized Japanese food and beverage manufacturers looking to invest in more advanced aseptic filling technologies is the high start-up costs associated with installing fully automated aseptic filling lines. In addition, the intricate steps involved in recycling multilayered aseptic cartons, particularly those containing aluminum foil and other types of plastic film materials, create additional challenges for manufacturers wishing to participate in Japan's circular economy.

The explosive growth of e-commerce and the continued rise of home delivery services will provide most opportunities for aseptic packaging due to the fact that aseptic products can be shipped without requiring refrigeration. Advances in bio-based barrier materials will provide additional growth opportunities for aseptic packaging companies, as hospitals have an increasing demand for sterile clinical nutrition.

Japan Aseptic Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1146.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 9.31% |

| 2035 Value Projection: | USD 3054.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Dai Nippon Printing Co., Ltd. (DNP), Toppan Inc., Toyo Seikan Group Holdings, Ltd., Nippon Paper Industries Co., Ltd., Shikoku Kakoki Co., Ltd., Rengo Co., Ltd., Fujimori Kogyo Co., Ltd., Sumitomo Bakelite Co., Ltd., Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan aseptic packaging market share is classified into product and application.

By Product:

The Japanese aseptic packaging market is divided by product into cartons, bottles & cans, bags & pouches, prefilled syringes, vials & ampoules, and others. Among these, the cartons dominated the market in 2024 and are anticipated to grow at a significant CAGR during the forecast period. Cartons are an extremely popular method of packaging that protects beverages, dairy, and liquid foods from outside contamination while maintaining the freshness of those products. In addition, Cartons are very lightweight, therefore easy to ship; they are also easy to recycle and dispose.

By Application:

The Japanese aseptic packaging market is divided by application into food, beverages, pharmaceuticals, and others. Among these, the beverages segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance can be attributed to strong consumer demand for packaged beverages, particularly juices, milk, and dairy products. These types of products need to be packaged effectively to maintain freshness as well as to be protected from contamination. is due to the growing consumption of nutritional and functional beverages, which has created a significant opportunity for companies that manufacture Aseptic Packaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan Aseptic Packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Aseptic Packaging Market:

- Dai Nippon Printing Co., Ltd. (DNP)

- Toppan Inc.

- Toyo Seikan Group Holdings, Ltd.

- Nippon Paper Industries Co., Ltd.

- Shikoku Kakoki Co., Ltd.

- Rengo Co., Ltd.

- Fujimori Kogyo Co., Ltd.

- Sumitomo Bakelite Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan aseptic packaging market based on the below-mentioned segments:

Japan Aseptic Packaging Market, By Product

- Cartons

- Bottles & Cans

- Bags & Pouches

- Prefilled Syringes

- Vials & Ampoules

- Others

Japan Aseptic Packaging Market, By Application

- Food

- Beverages

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

Q:What is the current size of the Japanese aseptic packaging market?A:The Japan aseptic packaging market was valued at USD 1,146.7 million in 2024, driven by strong demand for shelf-stable, preservative-free food, beverage, and pharmaceutical packaging solutions.

-

Q:What is the expected growth rate of the Japanese aseptic packaging market?A:The market is expected to grow at a CAGR of 9.31% during the forecast period 2025–2035, reaching an estimated value of USD 3,054.2 million by 2035.

-

Q:What are the key factors driving the Japan aseptic packaging market?A:Growth is driven by changing consumer lifestyles, rising demand for ready-to-drink beverages and dairy products, stricter food safety regulations, national initiatives to reduce food waste, and a shift from refrigerated to ambient packaging formats.

-

Q:Which product segment dominates the Japan aseptic packaging market?A:The cartons segment dominated the market in 2024 due to its lightweight nature, strong barrier protection, recyclability, and widespread use in beverages, dairy, and liquid food packaging.

-

Q:Which application segment holds the largest share in the Japan aseptic packaging market?A:The beverages segment accounted for the largest market share in 2024, supported by high consumption of packaged juices, milk, dairy products, and functional beverages requiring extended shelf life.

-

Q:Who are the key players operating in the Japan aseptic packaging market?A:Major companies include Dai Nippon Printing Co., Ltd. (DNP), Toppan Inc., Toyo Seikan Group Holdings, Ltd., Nippon Paper Industries Co., Ltd., Shikoku Kakoki Co., Ltd., Rengo Co., Ltd., Fujimori Kogyo Co., Ltd., Sumitomo Bakelite Co., Ltd., and other regional players.

Need help to buy this report?