Japan Application Security Market Size, Share, By Component (Solution and Services), By End Use (BFSI, Retail, IT & Telecom, Healthcare, Manufacturing, Government & Defense, and Others), Japan Application Security Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Application Security Market Insights Forecasts to 2035

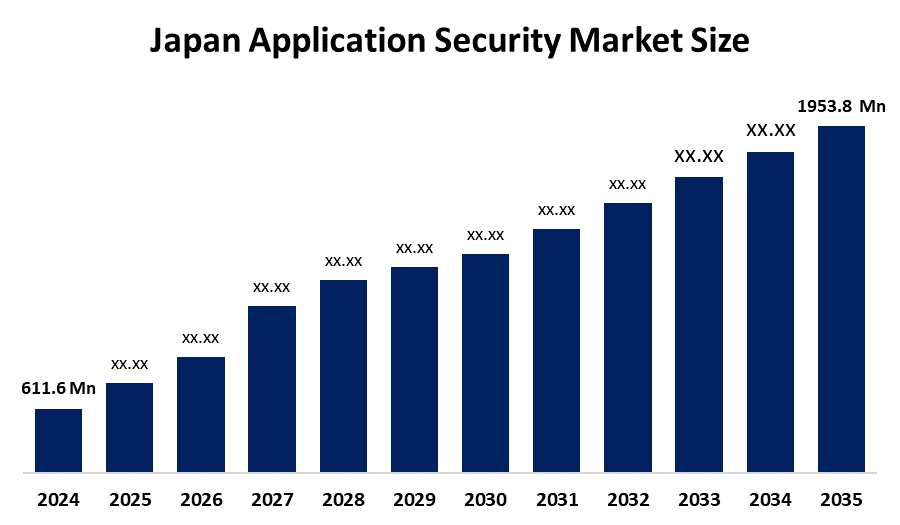

- Japan Application Security Market Size 2024: USD 611.6 Mn

- Japan Application Security Market Size 2035: USD 1953.8 Mn

- Japan Application Security Market CAGR 2024: 11.14%

- Japan Application Security Market Segments: Component and End Use.

Get more details on this report -

In Japan, application security refers to the measures, practices, and tools used to protect software applications from external threats throughout their entire lifecycle. This includes the identification, repair, and prevention of security vulnerabilities within web, mobile, and cloud-based applications. Key characteristics of the Japanese market include a high demand for premium reliability and a shift toward automated testing solutions like static application security testing (SAST) and dynamic application security testing (DAST). Current trends show a significant move toward DevSecOps, where security is integrated directly into the DevOps workflow to ensure rapid yet secure software delivery.

The Japanese government has been proactive in fortifying the nation's digital defenses through frameworks like the Cybersecurity Basic Act. Organizations such as the National Center of Incident Readiness and Strategy for Cybersecurity (NISC) have introduced stringent guidelines requiring critical infrastructure providers to perform regular application-layer risk assessments. In the private sector, collaborations between tech giants and security firms are flourishing, with many companies adopting the ISMAP (Information System Security Management and Assessment Program) to certify cloud-based application services for government and enterprise use.

Technological innovation in Japan is currently dominated by the adoption of artificial intelligence (AI) and machine learning (ML) for predictive threat modeling and automated vulnerability remediation. Advanced tools are now capable of analyzing vast datasets to detect anomalies in application behaviour in real-time. Additionally, the rise of serverless security and API Security tools is addressing the complexities of modern microservices architectures.

Japan Application Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 611.6 million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 11.14% |

| 2035 Value Projection: | USD 1953.8 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Component ,By End Use |

| Companies covered:: | Trend Micro, NEC Corporation, Fujitsu Limited, NRI Secure Technologies, Digital Arts Inc., FFRI Security, Inc., Internet Initiative Japan, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Application Security Market:

The market is primarily driven by Japan's surge in digital transformation (DX) initiatives across Japan, which has led to a proliferation of web and mobile applications. As businesses migrate to the cloud, the risk of data breaches increases, necessitating robust application-layer protection. Additionally, the rising adoption of IoT devices and the integration of 5G technology require secure application interfaces.

The Japan Application Security Market Size is restrained by the critical shortage of skilled cybersecurity professionals in Japan, making it difficult for firms to manage complex security tools. Furthermore, the high initial cost of implementing advanced application security platforms often deters small and medium-sized enterprises (SMEs) from adopting comprehensive security frameworks.

The market offers significant growth opportunities through the integration of AI-driven automated remediation and the expansion of security into IoT and 5G ecosystems. Furthermore, government-backed digitalization initiatives and the demand for managed security services provide substantial expansion potential for the Japanese application security market.

Market Segmentation

The Japan Application Security Market share is classified into components and end use.

By Component:

The Japan Application Security Market Size is divided by component into solutions and services. Among these, the solution segment accounted for the largest revenue market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the high adoption of web and mobile testing tools. However, the services segment is expected to grow at a significant CAGR as companies increasingly seek managed security and consulting services.

By End Use:

The Japan Application Security Market Size is divided by end use into BFSI, retail, IT & telecom, healthcare, manufacturing, government & defense, and others. Among these, the hospitals segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the high volume of sensitive financial transactions, while the IT & Telecom sector is projected to expand rapidly.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan application security market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Application Security Market:

- Trend Micro

- NEC Corporation

- Fujitsu Limited

- NRI SecureTechnologies

- Digital Arts Inc.

- FFRI Security, Inc.

- Internet Initiative Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Application Security Market Size based on the below-mentioned segments:

Japan Application Security Market, By Component

- Solution

- Services

Japan Application Security Market, By End Use

- BFSI

- Retail

- IT & Telecom

- Healthcare

- Manufacturing

- Government & Defense

- Others

Frequently Asked Questions (FAQ)

-

What is the Japan application security market?The Japan application security market encompasses solutions and services designed to protect web, mobile, cloud, and enterprise applications from cyber threats across the entire software development lifecycle, including vulnerability detection, testing, and remediation.

-

What is the current size and future growth outlook of the market?The market was valued at USD 611.6 million in 2024 and is expected to reach USD 1953.8 million by 2035, growing at a strong CAGR of 11.14% during the forecast period.

-

What are the key drivers fueling growth in the Japan application security market?Key drivers include rapid digital transformation initiatives, increased adoption of cloud and mobile applications, rising cyberattack frequency, IoT and 5G integration, and stricter government cybersecurity regulations.

-

Which component segment dominates the market in Japan?The solution segment dominates the market due to widespread adoption of application testing tools such as SAST, DAST, and API security solutions, while the services segment is gaining momentum through managed security offerings.

-

Which end-use industry holds the largest market share?The BFSI sector holds a significant market share due to high volumes of sensitive financial data and transactions requiring robust application-layer security, while IT & Telecom is expected to grow rapidly.

-

What are the major challenges faced by the Japan application security market?Major challenges include a shortage of skilled cybersecurity professionals, complexity in managing advanced security platforms, and high initial implementation costs that limit adoption among small and medium-sized enterprises

Need help to buy this report?