Japan Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Type (Aqueous and Anhydrous), By End Use (Fertilizer, Chemicals, Refrigeration, Fibers & Plastics, Pharmaceutical, Pulp & Paper, and Others), and Japan Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Ammonia Market Insights Forecasts to 2035

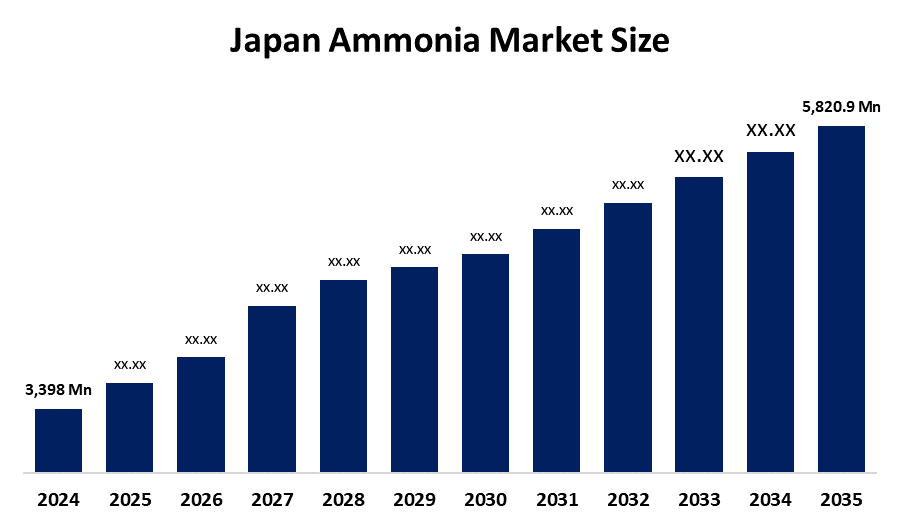

- The Japan Ammonia Market Size Was Estimated at USD 3,398 Million in 2024

- The Japan Ammonia Market Size is Expected to Grow at a CAGR of Around 5.02% from 2025 to 2035

- The Japan Ammonia Market Size is Expected to Reach USD 5,820.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Ammonia Market Size size is anticipated to reach USD 5,820.9 million by 2035, growing at a CAGR of 5.02% from 2025 to 2035. The Japan ammonia market is driven by strong demand in fertilizer production, ongoing industrial usage in chemical manufacturing and nitric acid production, and emerging applications in clean energy such as hydrogen carriers and carbon-free fuel initiatives. Government policies promoting decarbonization and green ammonia development, along with Japan’s focus on energy security and sustainable industrial practices, further support market growth.

Market Overview

The Japan Ammonia Market Size involves the production, import, distribution, and consumption of ammonia in major sectors such as fertilizers, chemicals, pharmaceuticals, refrigeration, and energy, including new uses for hydrogen carriers and clean fuel, thus sustaining the industrial activities, food security, and decarbonization goals of Japan.

The Japan Ammonia Market Size is highly influenced by the country's population of 124 million, its scarce domestic energy resources, and its large dependence on imports for food and fuel. Ammonia is vital for producing fertilizer, which is the base of Japan's food security, considering the country imports more than 60% of its food calories, but it is also heavily used in the chemical, pharmaceutical, and industrial manufacturing sectors. Besides that, Japan is facing serious environmental and energy problems, such as climate change, energy security, and high carbon emissions, which are resulting in increased demand for clean and low-carbon energy solutions. Ammonia is being seen more and more as a way to store hydrogen and as a fuel with no carbon emissions, particularly in power generation and shipping, thus emphasizing its strategic value.

Japan is one of the countries that strongly promotes ammonia through the Green Growth Strategy and the Carbon Neutrality by 2050 goal. The Ministry of Economy, Trade and Industry (METI) has earmarked over JPY 2 trillion (around USD 13-15 billion) from its Green Innovation Fund to support R&D and green and blue ammonia commercialization, hydrogen ammonia co-firing technologies, and international supply chains. Ammonia co-firing pilot projects in thermal power plants and global partnerships with Australia and the Middle East further enhance the adoption. These two initiatives, along with a clear policy direction and funding, led Japan decide to have ammonia as one of the main energy and industrial strategies, thus making the market very attractive from the two aspects of economics and sustainability marketing.

Report Coverage

This research report categorizes the market for the Japan Ammonia Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan ammonia market.

Japan Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,398 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.02% |

| 2035 Value Projection: | USD 5,820.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By End Use |

| Companies covered:: | Mitsui Chemicals, Inc., JCAM AGRI Co., Ltd., Katakura & Co-op Agri Co., Ltd., Ube Industries, Ltd., Mitsubishi Corporation, Idemitsu Kosan Co., Ltd., Sumitomo Corporation, JERA Co., Inc., Asahi Kasei Corporation, Resonac, Yara International, CF Industries Holdings Inc., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysi |

Get more details on this report -

Driving Factors

The Japan Ammonia Market Size is driven by strong demand from the fertilizer and chemical industries, growing use of ammonia as a hydrogen carrier and clean fuel, and Japan’s push for energy security and decarbonization. Government support under the carbon-neutral 2050 strategy, investments in green and blue ammonia projects, and adoption of ammonia co-firing in power generation further accelerate market growth.

Restraining Factors

The Japan Ammonia Market Size is restrained by high production and transportation costs, dependency on imported raw materials, infrastructure limitations for ammonia storage and handling, and technical challenges in scaling green ammonia and ammonia-based energy solutions. Strict environmental and safety regulations also add to operational complexities.

Market Segmentation

The Japan Ammonia Market share is classified into type and end use.

- The anhydrous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan Ammonia Market Size is segmented by type into aqueous and anhydrous. Among these, the anhydrous segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The anhydrous segment is growing because it offers higher ammonia concentration, greater efficiency in chemical and fertilizer production, and easier transport in industrial applications. Its use reduces storage volume requirements and energy consumption, making it the preferred choice across Japan’s industrial and energy sectors.

- The fertilizer segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Japan Ammonia Market Size is segmented by end use into fertilizer, chemicals, refrigeration, fibers and plastics, pharmaceuticals, pulp & paper, and others. Among these, the fertilizer segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The fertilizer segment is growing because ammonia is a key raw material for nitrogen-based fertilizers, essential for maintaining crop yields and supporting Japan’s food security. Rising agricultural demand and government initiatives promoting sustainable farming practices continue to drive ammonia consumption in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Ammonia Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui Chemicals, Inc.

- JCAM AGRI Co., Ltd.

- Katakura & Co-op Agri Co., Ltd.

- Ube Industries, Ltd.

- Mitsubishi Corporation

- Idemitsu Kosan Co., Ltd.

- Sumitomo Corporation

- JERA Co., Inc.

- Asahi Kasei Corporation

- Resonac

- Yara International

- CF Industries Holdings Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

• In November 2025, JFE Engineering Corporation launched Japan’s first large-scale ammonia co-firing dual-fuel engine for marine and power generation applications. The engine enables over 50% ammonia utilization alongside diesel, supporting national decarbonization and emissions-reduction goals.

Market Segment

This study forecasts revenue at the regional and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Ammonia Market Size based on the following segments:

Japan Ammonia Market, By Type

- Aqueous

- Anhydrous

Japan Ammonia Market, By End Use

- Fertilizer

- Chemicals

- Refrigeration

- Fibers & Plastics

- Pharmaceutical

- Pulp & Paper

- Others

Frequently Asked Questions (FAQ)

-

1. What is the Japan ammonia market size in 2024?The Japan ammonia market size was estimated at USD 3,398 million in 2024.

-

2. What is the projected market size of the Japan ammonia market by 2035?The Japan ammonia market size is expected to reach USD 5,820.9 million by 2035.

-

3. What is the CAGR of the Japan ammonia market?The Japan ammonia market size is expected to grow at a CAGR of around 5.02% from 2024 to 2035.

-

4. What are the key growth drivers of the Japan ammonia market?The Japan ammonia market is driven by strong demand in fertilizer production, ongoing industrial usage in chemical manufacturing and nitric acid production, and emerging applications in clean energy such as hydrogen carriers and carbon-free fuel initiatives. Government policies promoting decarbonization and green ammonia development

-

5. Which end-use segment dominated the market in 2024?The fertilizer segment dominated the market in 2024.

-

6. What segments are covered in the Japan ammonia market report?Key companies include Mitsui Chemicals, Inc., JCAM AGRI Co., Ltd., Katakura & Co-op Agri Co., Ltd., Ube Industries, Ltd., Mitsubishi Corporation, Idemitsu Kosan Co., Ltd., Sumitomo Corporation, JERA Co., Inc., Asahi Kasei Corporation, Resonac, Yara International, CF Industries Holdings Inc., and others.

-

7. Who are the key players in the Japan ammonia market?Key companies include Mitsui Chemicals, Inc., JCAM AGRI Co., Ltd., Katakura & Co-op Agri Co., Ltd., Ube Industries, Ltd., Mitsubishi Corporation, Idemitsu Kosan Co., Ltd., Sumitomo Corporation, JERA Co., Inc., Asahi Kasei Corporation, Resonac, Yara International, CF Industries Holdings Inc., and others

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?