Japan Agribusiness Market Size, Share, By Product (Grains and Cereals, Dairy, Oilseed, Livestock, and Others), By Application (Agrichemicals, Seed Business, Breeding, and Machinery and Equipment), Japan Agribusiness Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureJapan Agribusiness Market Insights Forecasts To 2035

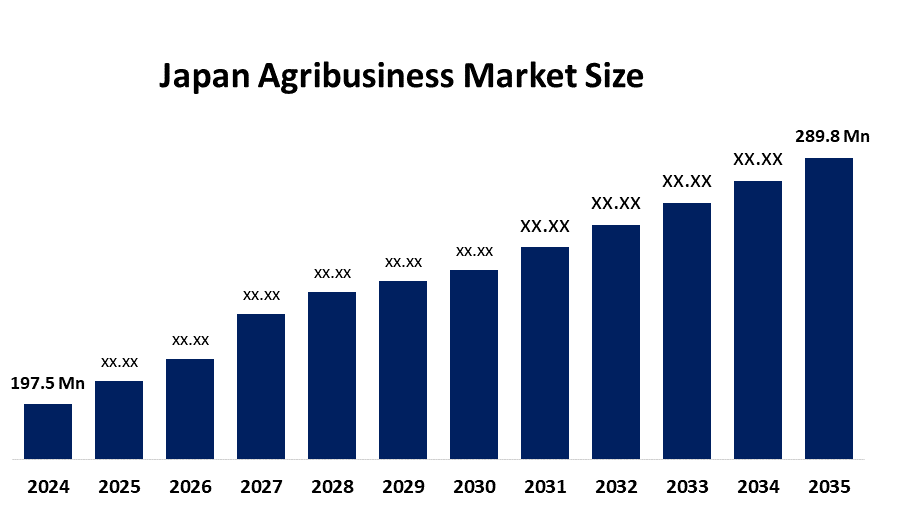

- Japan Agribusiness Market Size 2024: USD 197.5 Mn

- Japan Agribusiness Market Size 2035: USD 289.8 Mn

- Japan Agribusiness Market Size CAGR 2024: 3.55%

- Japan Agribusiness Market Size Segments: Product And Application

Get more details on this report -

The Agribusiness Market Size in japan involves the whole spectrum of agricultural activities, from production to processing, distribution, and services necessary for farms and food supply chains. It covers everything from seeds, fertilizers, chemicals, and farm machinery to food processing and transportation. The use of the products and services in the market is wide, as they serve crops, animals, fish, and food products, and the factors behind this market are modern farming practices, mechanization, precision agriculture, sustainability, and, not least, the domestic demand for premium, safe, and traceable food in Japan.

Japan's Agribusiness Market Size is bolstered by the government's large-scale participation through the ministry of agriculture, forestry, and fisheries(MAFF), which allocates more than 2 trillion for agriculture every year. The government provides support through various schemes, such as paying for 40% of smart farming equipment, half the cost of crop insurance premiums, and the Green Food System Strategy, which brings about sustainability, the use of machines, and improvements in production in all farming and food supply chains.

Japan’s Agribusiness Sectoris considerably progressed by the use of robotic harvesters powered By AI, autonomous tractors made by Kubota and Yanmar, IoT-based precise farming, and drone-supported monitoring of crops. These innovations not only increase efficiency and productivity but also lower labor dependence, thus opening up the future of smart agriculture, automation, and agritech exports.

Japan Agribusiness Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 197.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 3.55% |

| 2023 Value Projection: | USD 289.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Product |

| Companies covered:: | Kubota Corporation, Yanmar Co., Ltd., Iseki & Co., Ltd., Mitsubishi Mahindra Agricultural Machinery, Kumiai Chemical Industry, Nihon Nohyaku, Kaneko Seeds, Hokko Chemical Industry, Sakata Seed Corp. Mitsui Chemicals, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Agribusiness Market:

The Japan Agribusiness Market Size Is driven by major demographic issues, specifically the quick aging of the farming population and the declining number of workers, which require speeding up the adoption of technology. This will lead to a strong need for smart farming solutions such as AI, IoT, and robotics to make the work more efficient and productive. The government support that is strong and the initiatives that are aimed at guaranteeing national food security and promoting sustainable, modern agriculture also contribute to the market growth. Besides, the changing consumer preferences for high-quality, safe, and sustainably produced food items are the main drivers of the market.

The Japan Agribusiness Market Size Is restrained by the fast-aging labor force and the resulting labor shortages, because of the migration of young people to cities. Together with a divided industry structure and the small area of cultivable land owing to the mountainous nature of Japan, large and efficient farming becomes very hard.

The opportunities for the future in the japan agribusiness market size are focused on smart farming and automation, whose expansion is being driven by the urgent need to reduce severe labor shortages that are severe. Additionally, there are huge opportunities in the area of introducing sustainable agricultural practices and technologies (including vertical farms, eco-friendly machinery, etc.), besides taking advantage of the increasing global demand for premium-quality Japanese food products for export.

Market Segmentation

The Japan agribusiness market share is classified into product and application.

By Product:

The Japan Agribusiness Market Size is divided by product into grains and cereals, dairy, oilseed, livestock, and others. among these, the grains and cereals segment dominated the share in 2024 and is anticipated to grow at a remarkable cagr during the forecast period. Due to substantial domestic consumption, government assistance for staple crops, well-established supply chains, and steady demand for processed and packaged foods, the grains and cereals category will dominate the Japanese agribusiness industry. Japan has the highest revenue share and steady growth due to its reliance on grains for processed food production, livestock feed, and food security.

By Application:

The Japan Agribusiness Market Size is divided by application into agrichemicals, seed business, breeding, and machinery and equipment. Among these, the agrichemicals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to the strong need for crop protection and production enhancement, the agrichemicals segment leads the Japanese agribusiness market. Agrichemicals are necessary for effective, contemporary farming methods since farmers depend on fertilizers, insecticides, and herbicides to increase output on limited arable land, fight pests and illnesses, and guarantee consistent, high-quality products.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved withinThe Japan Agribusiness Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Agribusiness Market:

- Kubota Corporation

- Yanmar Co., Ltd.

- Iseki & Co., Ltd.

- Mitsubishi Mahindra Agricultural Machinery

- Kumiai Chemical Industry

- Nihon Nohyaku

- Kaneko Seeds

- Hokko Chemical Industry

- Sakata Seed Corp. Mitsui Chemicals

- Others

Recent Developments in Japan Agribusiness Market:

- In June 2025, at Expo 2025, Kubota showed off next-generation autonomous tractors and robotic harvesters, continuing its journey to complete automated farming solutions.

- In February 2025, AGRIST increased the use of AI-powered robot harvesters for cucumbers and peppers, which made the operation more efficient and less dependent on human labor.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan agribusiness market based on the below-mentioned segments:

Japan Agribusiness Market, By Product

- Grains and Cereals

- Dairy

- Oilseed

- Livestock

- Others

Japan Agribusiness Market, By Application

- Agrichemicals

- Seed Business

- Breeding

- Machinery and Equipment

Frequently Asked Questions (FAQ)

-

What is the Japan agribusiness market size?Japan agribusiness market is expected to grow from USD 197.5 million in 2024 to USD 289.8 million by 2035, growing at a CAGR of 3.55% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the major demographic issues, specifically the quick aging of the farming population and the declining number of workers, which require speeding up the adoption of technology. This will lead to a strong need for smart farming solutions such as AI, IoT, and robotics to make the work more efficient and productive.

-

What factors restrain the Japan agribusiness market?Constraints include the fast-aging labor force and the resulting labor shortages, because of the migration of young people to cities.

-

How is the market segmented by application?The market is segmented into agrichemicals, seed business, breeding, and machinery and equipment.

-

Who are the key players in the Japan agribusiness market?Key companies include Kubota Corporation, Yanmar Co., Ltd., Iseki & Co., Ltd., Mitsubishi Mahindra Agricultural Machinery, Kumiai Chemical Industry, Nihon Nohyaku, Kaneko Seeds, Hokko Chemical Industry, Sakata Seed Corp. Mitsui Chemicals, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?