Japan Aerosol Drug Delivery Devices Market Size, By Type (Inhaler, Pressurised Metered Dose Inhaler, Dry Powder Inhaler, Nebulizers, Jet, Mesh, Active, Passive, Ultrasonic), By Application (Copd, Asthma, Cystic Fibrosis), By Distribution Channel (Institutional Pharmacies, Retail Pharmacies, Online Pharmacies), Japan Aerosol Drug Delivery Devices Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareJapan Aerosol Drug Delivery Devices Market Insights Forecasts to 2035

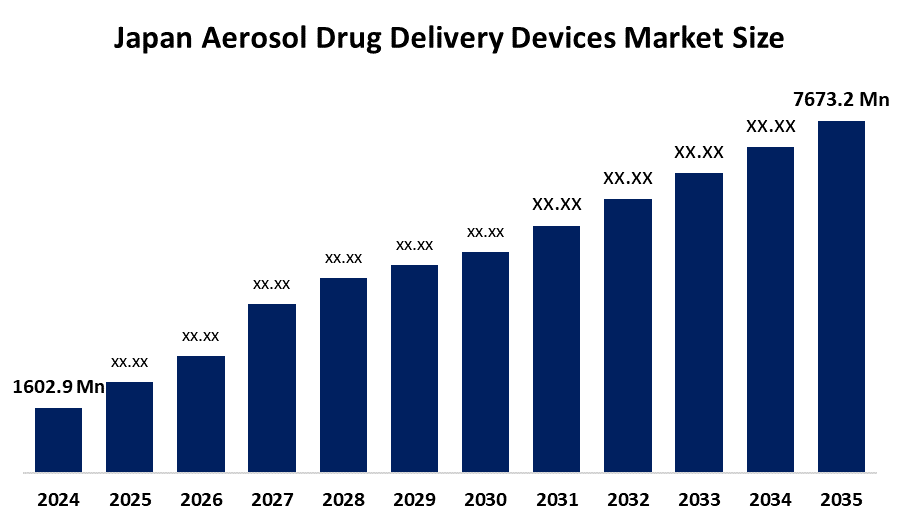

- Japan Aerosol Drug Delivery Devices Market Size 2024: USD 1602.9 Mn

- Japan Aerosol Drug Delivery Devices Market Size 2035: USD 7673.2 Mn

- Japan Aerosol Drug Delivery Devices Market CAGR 2024: 15.3%

- Japan Aerosol Drug Delivery Devices Market Segments: Type, Application, Distribution Channel

Get more details on this report -

The Japan aerosol drug delivery devices market size is a specially made to transform medicines into aerosol for inhalation and thus, allowing the treatment of respiratory and pulmonary diseases like asthma and COPD using inhalers and nebulizers to be more precise. Aerosol drug delivery devices are categorized as methods for administering drugs to the lungs for quick and efficient therapy. Such devices are considered the mainstay in the treatment of asthmatic, bronchial, and respiratory infections, as well as other diseases of the lung.The recent development is the adoption of smart, connected aerosol drug delivery devices with AI assisted dosing, adherence tracking, and cloud-based monitoring, enabling personalised treatment and improved clinical outcomes.The Digital Transformation Action Strategies for Software as a Medical Device (DASH for SaMD 2) program, initiated by the Ministry of Health, Labour and Welfare (MHLW) of Japan, aimed to overcome the hurdles in the development and marketing of medical software that includes digital health components, which are integrated with aerosol drug delivering devices. Japan introduced a dual-phase authorization process and targeted a 6-month priority review period for SaMD products as part of the regulatory reforms under the Pharmaceuticals and Medical Devices Act, thereby accelerating the pace of innovation. The Pharmaceuticals and Medical Devices Agency (PMDA), together with the MHLW, has created a consultation service and offered advice solely for SaMD, allowing manufacturers to manage the complicated approval processes effectively.The aerosol drug delivery devices market size in Japan is climbing up with a solid growth potential supported by the rise in respiratory diseases, the incorporation of smart connected devices, and the trend of self-administration at home. Additionally, the collaboration between AI and regulatory support is making the more future opportunities.

Japan Aerosol Drug Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1602.9 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 15.3% |

| 2023 Value Projection: | USD 7673.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Application, By Distribution |

| Companies covered:: | Terumo Corporation, Nipro Corporation, Japan Mitsubishi Tanabe Pharma, Otsuka Pharmaceutical Co., Ltd, Daiichi Sankyo Co., Ltd, Taisei Kako Co., Ltd, Olympus Corporation, Asahi Kasei Corporation, Fujifilm Holdings Corporation,and Others, key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Japan Aerosol Drug Delivery Devices Market:

The Japan aerosol drug delivery devices market size is driven by chronic respiratory illnesses, predominantly asthma and chronic obstructive pulmonary Disease (COPD), which are more frequently found, particularly among aged people. Additionally, the patients’ awareness of their disease has led to a preference for self-medication, thus creating a demand for inhalers, nebulizers, and aerosol delivery systems that are easy to use and the development of technology is also showing the way for smart and connected devices to come with AI-assisted dosing, adherence monitoring, and cloud connectivity which are in turn making treatment more effective and patients more compliant. Besides, there are very supportive government initiatives, the regulation process is becoming shorter and easier, and the promotion of digital health is triumphant, which together further unleash the innovation and adoption in the market. Thus, the market is poised for a promising period of growth in the future years.

The Japan aerosol drug delivery devices market size is restrained by the expensive prices related to the high-tech and smart devices that may restrict access for some patients. The complicated regulatory framework and the long approval process for new technology slow the entry of new products into the market. Furthermore, the unawareness or the lack of knowledge about digital and connected devices among some patient groups, together with the competition from alternative drug delivery systems, gives rise to the problems of acceptance and growth of the market.

Market Segmentation

The Japan Aerosol Drug Delivery Devices Market share is classified into types, applications, and distribution channel.

By Type:

The Japan aerosol drug delivery devices market size is divided by type into inhalers, pressurised metered dose inhaler, dry powder inhaler, nebulizers, jet, mesh, active, passive, ultrasonic, and others. Among these, the pressurized metered dose inhalers segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance due to convenience, exact dosing, quick action, and being well-known by doctors and patients have paved the way for them to be the front runners. Their leading position is also strengthened by the strong support of healthcare and the accessibility factor.

By Application:

The Japan aerosol drug delivery devices market size is divided by application into copd, asthma, cystic fibrosis, and others. Among these, the asthma segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Japan's asthma segment is dominated by its high incidence and the requirement for long-term inhalation therapy. Daily use and patients' acceptance of the method are the main factors of regular demand for aerosol devices.

By Distribution channel:

The Japan aerosol drug delivery devices market size is divided by distribution channel into institutional pharmacies, retail pharmacies, online pharmacies, and others. Among these, the retail pharmacies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In Japan, retail pharmacies are a great source of getting medicines because they provide easy access, quick availability, and personal assistance by a pharmacist. Customers like to purchase aerosol devices from these nearby stores due to their convenience and trustworthiness.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan aerosol drug delivery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Aerosol Drug Delivery Devices Market:

- Terumo Corporation

- Nipro Corporation

- Japan Mitsubishi Tanabe Pharma

- Otsuka Pharmaceutical Co., Ltd

- Daiichi Sankyo Co., Ltd

- Taisei Kako Co., Ltd

- Olympus Corporation

- Asahi Kasei Corporation

- Fujifilm Holdings Corporation

- Others

Recent Developments in Japan Aerosol Drug Delivery Devices Market:

In June 2025, Aerogen, the Ireland-based global leader in acute-care aerosol drug delivery, announced new expansion and investment plans for its operations in Japan, to support medical advancements in treating all respiratory conditions

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan aerosol drug delivery devices market based on the below mentioned segments:

Japan Aerosol Drug Delivery Devices Market, By Type

- Inhaler

- Pressurised metered dose inhaler

- Dry powder inhaler

- Nebulizers

- Jet

- Mesh

- Active

- Passive

- Ultrasonic

Japan Aerosol Drug Delivery Devices Market, By Application

- Copd

- Asthma

- Cystic fibrosis

Japan Aerosol Drug Delivery Devices Market, By Distribution Channel

- Institutional pharmacies

- Retail pharmacies

- Online pharmacies

Frequently Asked Questions (FAQ)

-

Q: What is the Japan aerosol drug delivery devices market size?Japan Aerosol Drug Delivery Devices Market is expected to grow from USD 1602.9 million in 2024 to USD 7673.2 million by 2035, growing at a CAGR of 15.3% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?Market growth is driven by the chronic respiratory illnesses, predominantly asthma and Chronic Obstructive Pulmonary Disease (COPD), which are more frequently found, particularly among aged people. Additionally, the patients’ awareness of their disease has led to a preference for self-medication, thus creating a demand for inhalers, nebulizers, and aerosol delivery systems that are easy to use.

-

Q: What factors restrain the Japan aerosol drug delivery devices market?Constraints include the expensive prices related to the high-tech and smart devices that may restrict access for some patients. The complicated regulatory framework and the long approval process for new technology slow the entry of new products into the market.

-

Q: How is the market segmented by phase type?The market is segmented into types, application, distribution channel.

-

Q:Who are the key players in the Japan aerosol drug delivery devices market?: Who are the target audiences for this market report?

-

Q: Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?