Japan Adipic Acid Market Size, Share, By Application (Polyurethane, Nylon 6,6 Fiber, Nylon 6,6 Resin, Adipate Esters, and Others), By End-Use Industry (Automotive, Electrical & Electronics, Packaging & Consumer Goods, Building & Construction, and Textile), Japan Adipic Acid Market Insights, Industry Trends, Forecasts to 2035

Industry: Specialty & Fine ChemicalsJapan Adipic Acid Market Insights Forecasts to 2035

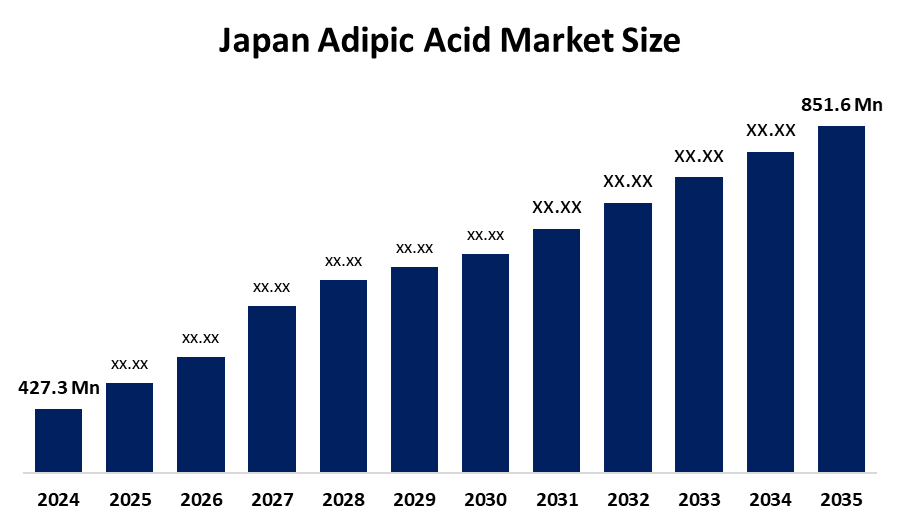

- Japan Adipic Acid Market Size 2024: USD 427.3 Mn

- Japan Adipic Acid Market Size 2035: USD 851.6 Mn

- Japan Adipic Acid Market CAGR 2024: 6.47%

- Japan Adipic Acid Market Segments: Application and End Use Industry

Get more details on this report -

The Japan adipic acid market covers the production and use of adipic acid, a key organic intermediate mainly used to create nylon 6,6 polymers and polyurethanes and adipate esters. It serves as an important fundamental element which supports Japan's specialty chemical industry to produce advanced materials that multiple industries require. Adipic acid serves as a common ingredient in nylon 6,6 resins and fibers which manufacturers use to produce automotive parts and electrical connectors and industrial textiles while polyurethane manufacturers use it for their flexible and rigid foam production. Adipate esters serve as plasticizers which manufacturers use in specialized coatings and consumer goods. The market experiences growth because automotive lightweighting and engineering plastics and high-durability textile applications maintain constant demand.

The technological advancements work toward achieving process optimization and energy efficiency and development of production methods which produce fewer emissions to comply with Japan's strict environmental regulations. The manufacturers work to enhance their operational sustainability through improvements in catalyst efficiency and waste reduction systems. The market will maintain its industrial significance through upcoming chances which will arise from bio-based adipic acid development and increased electric vehicle production and growing need for high-performance polymers within electronics and advanced manufacturing.

Market Dynamics of the Japan Adipic Acid Market:

The Japan adipic acid market is driven by constant demand from automotive and electrical and electronics and industrial manufacturing sectors that utilize nylon 6,6 resins and fibers and polyurethanes for their lightweight and durable and high-performance needs. The electric vehicle market continues to expand while engineering plastics gain more traction and Japan maintains its commitment to advanced materials manufacturing which results in continuous demand from all industrial sectors.

The market confronts obstacles because production expenses remain high while companies require large amounts of energy to produce their products and environmental regulations establish strict limits on their emission and waste disposal practices. Raw material price fluctuations and sustainability standard compliance expenses have a negative effect on profit margins for small manufacturers while their dependence on traditional petrochemical feedstocks prevents them from effectively managing their costs.

The market shows significant potential through the establishment of bio-based and low-emission adipic acid production technologies which support Japan's carbon neutrality goals. The market will experience new growth opportunities from three factors which include the rising use of lightweight materials in electric vehicles and the increasing need for high-performance polymers in electronics and the development of eco-friendly plasticizers and specialized chemicals.

Japan Adipic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 427.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.47% |

| 2035 Value Projection: | USD 851.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application |

| Companies covered:: | Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., Ascend Performance Materials, BASF SE, INVISTA, LANXESS AG, Solvay S.A., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Japan adipic acid market share is classified into application and end use industry.

By Application:

The Japan adipic acid market is divided by application into polyurethane, nylon 6,6 fiber, nylon 6,6 resin, adipate esters, and others. Among these, the polyurethane segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The polyurethane segment maintains its market leadership because multiple industries, including automotive and construction and consumer goods, drive demand for adipic acid, which is used to make both flexible and rigid foam products.

By End-Use Industry:

The Japan adipic acid market is divided by end-use industry into automotive, electrical & electronics, packaging & consumer goods, building & construction, and textile. Among these, the automotive segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The automotive industry shows strong growth for adipic acid because lightweight nylon 6,6 components become more common while vehicle production increases and demand rise for materials that provide high durability and performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan adipic acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Adipic Acid Market:

- Asahi Kasei Corporation

- Sumitomo Chemical Co., Ltd.

- Ascend Performance Materials

- BASF SE

- INVISTA

- LANXESS AG

- Solvay S.A.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan adipic acid market based on the below-mentioned segments:

Adipic Acid Market, By Application

- Polyurethane

- Nylon 6,6 Fiber

- Nylon 6,6 Resin

- Adipate Esters

- Others

Adipic Acid Market, By End-Use Industry

- Automotive

- Electrical & Electronics

- Packaging & Consumer Goods

- Building & Construction

- Textile

Frequently Asked Questions (FAQ)

-

What is the Japan adipic acid market size?Japan adipic acid market is expected to grow from USD 427.3 million in 2024 to USD 851.6 million by 2035, growing at a CAGR of 6.47% during the forecast period 2025-2035.

-

What are the key growth drivers of the Japan adipic acid market?Market growth is driven by rising demand for nylon 6,6 and polyurethanes from the automotive, electrical & electronics, and construction industries, increasing lightweight material adoption, and Japan’s focus on advanced and high-performance specialty chemical manufacturing

-

What factors restrain the Japan adipic acid market?Market restraints include high energy-intensive production costs, strict environmental regulations related to emissions and waste management, volatility in raw material prices, and rising compliance expenses associated with sustainability standards.

-

How is the Japan adipic acid market segmented?The market is segmented by application into polyurethane, nylon 6,6 fiber, nylon 6,6 resin, adipate esters, and others, and by end-use industry into automotive, electrical & electronics, packaging & consumer goods, building & construction, and textile.

-

Which end-use industry holds the largest market share?The automotive segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period, supported by increasing use of lightweight nylon 6,6 components and high-performance polymers.

-

Who are the key players in the Japan adipic acid market?Key companies include Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., Ascend Performance Materials, BASF SE, INVISTA, LANXESS AG, and Solvay S.A.

-

Who are the target audiences for this market report?The report targets chemical manufacturers, raw material suppliers, automotive and electronics companies, investors, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?