Japan Acetone Market Size, Share, and COVID-19 Impact Analysis, By Application (Solvents, Methyl Methacrylate, Bisphenol A, and Others), By Grade (Technical Grade and Specialty Grade), and Japan Acetone Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Acetone Market Insights Forecasts to 2035

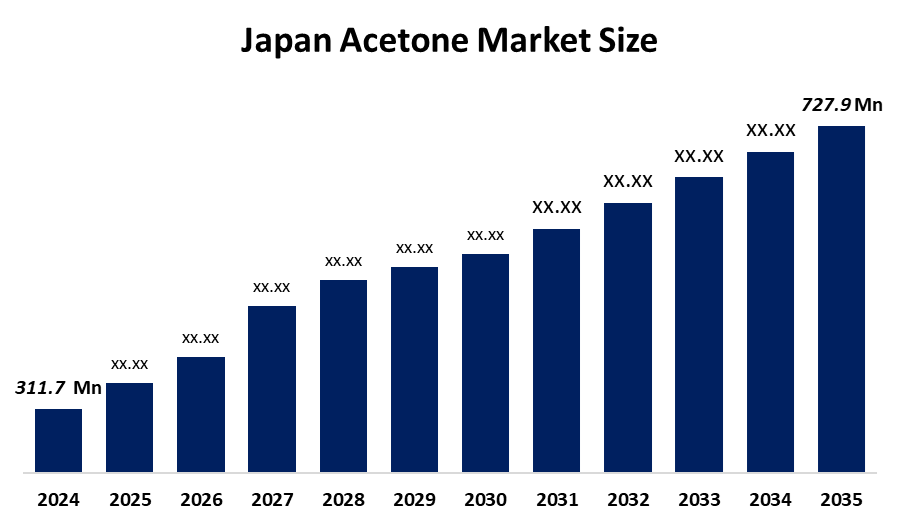

- The Japan Acetone Market Size Was Estimated at USD 311.7 Million in 2024

- The Japan Acetone Market Size is Expected to Grow at a CAGR of Around 8.02% from 2025 to 2035

- The Japan Acetone Market Size is Expected to Reach USD 727.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Acetone Market Size is Anticipated to reach USD 727.9 Million by 2035, Growing at a CAGR of 8.02% from 2025 to 2035. The Japan acetone market is driven by rising demand from the automotive, electronics, construction, and coatings industries, where acetone is used as a solvent, chemical intermediate, and cleaning agent, along with growth in adhesives, paints, plastics, and pharmaceuticals.

Market Overview

The Japan acetone market is basically the sector that deals with the production, distribution, and consumption of acetone in Japan. Acetone is a highly volatile, colorless liquid that is extensively used as a solvent, chemical intermediate, and cleaning agent in various industries such as paints and coatings, adhesives, electronics, pharmaceuticals, plastics, and synthetic rubber manufacturing. The market includes manufacturers, suppliers, distributors, and end users and is impacted by the demand from industries, trends in chemical production, and regulatory standards for chemical handling and safety in Japan.

The acetone market in Japan is a significant engine for the country's chemical and manufacturing sectors. This is because acetone is a major solvent and intermediate chemical in the production of paints, coatings, adhesives, pharmaceuticals, electronics, and plastics. In 2024, the demand for acetone in Japan amounted to approximately 134,000 tons, a figure that mirrors the sustained industrial demand in stable sectors such as chemicals and manufacturing. The heavy dependence of various industries on acetone underlines its role in industrial production, product quality, and the network of suppliers and customers that support the Japanese high-tech manufacturing industry.

The Japan government encourages the chemical industry to work on R&D and transformation on a larger scale, especially under green transformation and advanced manufacturing that encompasses capital investment and technology change incentives in chemical production. For FY 2024, Japan allocated about USD 220 million (¥32.7 billion) for green and manufacturing process transformation, which is a direct benefit to chemical companies making new, cleaner, and more efficient processes. Besides that, the government offers R&D tax credits and highly competitive research funding through the likes of the Japan Science and Technology Agency (JST) and competitive grants such as KAKENHI, which together promote research in the chemical innovation field, among others. The implementation of these measures is geared towards sustaining development and strategic positioning of the major chemical markets, such as acetone in Japan.

Report Coverage

This research report categorizes the market for the Japan acetone market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan acetone market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan acetone market.

Japan Acetone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 311.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 8.02% |

| 2035 Value Projection: | USD 727.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application |

| Companies covered:: | Mitsubishi Chemical Group, Sumitomo Chemical Co., Ltd., Tosoh Corporation, UBE Corporation, Asahi Kasei Corporation, Shin-Etsu Chemical Co., Ltd., •Mitsui Chemicals, Inc., INEOS Group Ltd., Shell Chemicals (Shell plc), SABIC (Saudi Basic Industries Corporation), CEPSA Chemicals, Arkema SA, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan acetone market is largely driven by the strong demand in the automotive, electronics, construction, and coatings industries. These industries mainly use acetone as a solvent, chemical intermediate, and cleaning agent. The rise in the production of paints, adhesives, plastics, synthetic rubber, and pharmaceuticals is also a factor that contributes to the demand. Besides, the market gets a boost from the rising attention to high-performance materials, bio-based chemicals, and advanced manufacturing processes.

Restraining Factors

The market for acetone in Japan is restrained due to the continuous fluctuation in the prices of raw materials, especially propylene, which has a direct effect on the cost of production. Usage is also limited in certain applications due to environmental and safety regulations concerning volatile organic compounds (VOCs) as well as the handling of chemicals. Thereby, besides these, the competition from substitute solvents and bio-based chemicals, coupled with market saturation in the mature industrial sectors, can hamper the growth.

Market Segmentation

The Japan acetone market share is classified into application and grade.

- The solvents segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan acetone market is segmented by application into solvents, methyl methacrylate, bisphenol A, and others. Among these, the solvents segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The solvents segment is growing because acetone is widely used as an efficient and fast-evaporating solvent in paints & coatings, adhesives, pharmaceuticals, and personal care products. Rising industrial activity, expansion of the construction and automotive sectors, and increasing demand from Japan’s manufacturing and export-oriented industries continue to drive strong consumption of acetone as a solvent.

- The technical grade segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Japan acetone market is segmented by grade into technical grade and specialty grade. Among these, the technical grade segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the forecast period. The technical grade segment is growing due to its cost-effectiveness and widespread use in large-volume industrial applications such as paints & coatings, adhesives, plastics, and cleaning formulations. Strong demand from Japan’s expanding manufacturing, construction, and automotive sectors drives higher consumption of technical-grade acetone compared to specialty grades.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the Japan acetone market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

Mitsubishi Chemical Group

• Sumitomo Chemical Co., Ltd.

• Tosoh Corporation

• UBE Corporation

• Asahi Kasei Corporation

• Shin-Etsu Chemical Co., Ltd.

• Mitsui Chemicals, Inc.

• INEOS Group Ltd.

• Shell Chemicals (Shell plc)

• SABIC (Saudi Basic Industries Corporation)

• CEPSA Chemicals

• Arkema SA

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan acetone market based on the below-mentioned segments:

Japan Acetone Market, By Application

- Solvents

- Methyl Methacrylate

- Bisphenol A

- Others

Japan Acetone Market, By Grade

- Technical Grade

- Specialty Grade

Frequently Asked Questions (FAQ)

-

1. What is the Japan acetone market size in 2024?The Japan acetone market size was estimated at USD 311.7 million in 2024

-

2. What is the projected market size of the Japan acetone market by 2035?The Japan acetone market size is expected to reach USD 727.9 million by 2035.

-

3. What is the CAGR of the Japan acetone market?The Japan acetone market size is expected to grow at a CAGR of around 8.02% from 2024 to 2035

-

4. What are the key growth drivers of the Japan acetone market?The Japan acetone market is driven by rising demand from the automotive, electronics, construction, and coatings industries, where acetone is used as a solvent, chemical intermediate, and cleaning agent, along with growth in adhesives, paints, plastics, and pharmaceuticals

-

5. Which application segment dominated the market in 2024?The solvents segment dominated the market in 2024

-

6. What segments are covered in the Japan acetone market report?The Japan acetone market is segmented on the basis of application and grade

-

7. Who are the key players in the Japan acetone market?Key companies include Mitsubishi Chemical Group, Sumitomo Chemical Co., Ltd., Tosoh Corporation, UBE Corporation, Asahi Kasei Corporation, Shin‑Etsu Chemical Co., Ltd., Mitsui Chemicals Inc., INEOS Group Ltd., Shell Chemicals (Shell plc), SABIC (Saudi Basic Industries Corporation), CEPSA Chemicals, Arkema SA, and others

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs

Need help to buy this report?