Italy Snack Bar Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cereal Bars, Protein Bars, Fruit and Nut Bars, and Other), By Ingredient Base (Nut-Based, Granola/Oat-based, Date-Based, Dairy/Protein-based, Other), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Other), and Italy Snack Bar Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesItaly Snack Bar Market Insights Forecasts to 2035

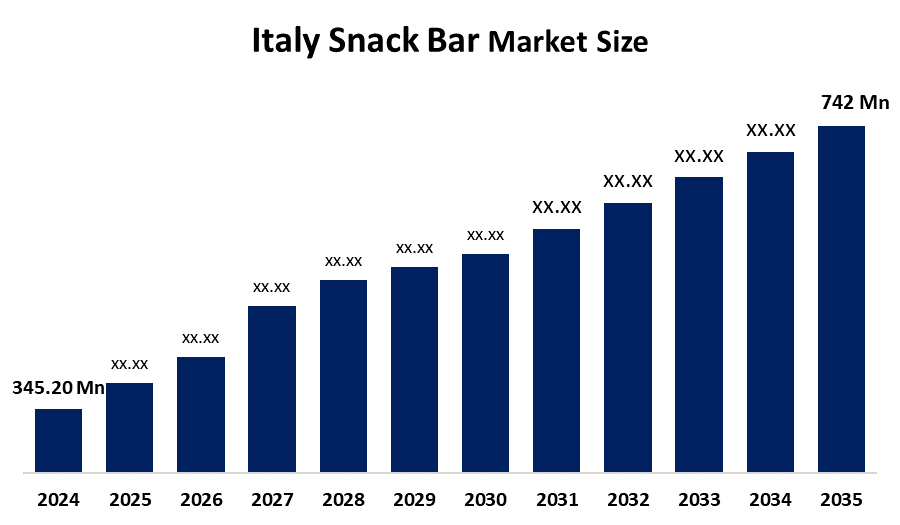

- The Italy Snack Bar Market Size Was Estimated at USD 345.20 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.2% from 2025 to 2035

- The Italy Snack Bar Market Size is Expected to Reach USD 742 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy Snack Bar Market Size Is Anticipated To Reach USD 742 Million By 2035, Growing At A CAGR Of 7.2% From 2025 to 2035. Italy’s snack bar market is driven by busy lifestyles, rising demand for convenient on-the-go food, growing health and wellness awareness, product innovation in flavors and nutrition, expanding retail distribution, urbanization, and an increasing consumer preference for quick and affordable snack options.

Market Overview

A snack bar is simply a small, easy, to, carry, ready, to, ready-to-eat food item that consists of grains, nuts, seeds, fruits, chocolate, or protein sources. Its main purpose is to serve as a quick, convenient snack for instant energy, nutrition, or fullness without having to be a full meal. It is, therefore, a great food option for people who lead a busy lifestyle on the go. Also, from various growth factors in the market, consumer demand for convenient, healthy snacks is one of the main driving forces behind product innovation, retail expansion, consumer health awareness, frequent consumption, and higher sales volume through a diversified range of flavours, functional benefits, and easy on, the, go access all over Italy.

The health and wellness trends are drastically reshaping the market, which is why there is a continually increasing demand for snack bars that are healthier and have greater nutritional qualities, such as high protein, low sugar, and organic ingredients. The increasing trend favours fitness and sports activities, which is another reason for it to be supported more. On top of that, constant innovation in the formulation and repositioning, especially in the premium segment, is necessary to enhance the market's overall value. Several manufacturers are channelling a lot of their resources towards new product development (NPD) that could serve specialized dietary needs, such as plant-based, vegan, and allergen, free bars, thus meeting the expectations of contemporary Italian consumers.

Italy's food culture is very much based on carbohydrate-rich products such as pasta and bread. This is particularly the case in the South of Italy and in the countryside, where traditional bakeries are predominant. Modern snack formats thus find it hard to break through the market here. Ferrero resolved this issue by releasing the Eat Natural bars that consist of commonly known fruit and nut ingredients. The rise of fruit and dried fruit bars by 34% since 2022 indicates that consumers are more and more willing to choose snack products that are not only convenient, traditional in taste and texture, but also portable.

Report Coverage

This research report categorizes the market for the Italy snack bar market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy snack bar market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy snack bar market.

Italy Snack Bar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 345.20 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 7.2% |

| 2035 Value Projection: | USD 742 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type |

| Companies covered:: | List of Key Companies Kellogg Company Ferrero Group Nestlé S.A. PepsiCo, Inc. General Mills Inc. Kind Snacks Cliff Bar & Company Associated British Foods plc Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Italy’s Snack Bar Market Size is driven by changing lifestyles, increasing urbanization, and growing demand for convenient on-the-go foods. Rising health awareness encourages consumption of protein, fruit, and functional bars made with natural ingredients. Product innovation, clean-label formulations, and familiar flavors aligned with traditional Italian tastes support acceptance. Expansion of supermarkets, convenience stores, and e-commerce improves accessibility, while marketing by major brands and private labels increases visibility and consumer trust.

Restraining Factors

Italy’s Snack Bar Market Size is restrained by a strong preference for traditional foods such as fresh bread and pastries, especially in rural areas. Price sensitivity, limited awareness of functional benefits, and scepticism toward processed snacks also slow adoption. Additionally, intense competition and regulatory requirements on labelling and health claims create challenges for manufacturers.

Market Segmentation

The Italy snack bar market share is classified into product type, ingredient base, and distribution channel.

- The cereal bars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Snack Bar Market Size is segmented by product type into cereal bars, protein bars, fruit and nut bars, and others. Among these, the cereal bars segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cereal bars dominate because they closely match traditional Italian eating habits that favour grains and carbohydrates. They are widely available, affordable, and easy to consume as a quick breakfast or snack. Many cereal bars use familiar ingredients like oats, wheat, honey, and fruits, making them feel less processed. Their versatility, mild flavours, and acceptance across all age groups further support their strong demand compared to protein or specialty bars.

- The granola/oat-based segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Snack Bar Market Size is segmented by ingredient base into nut-based, granola/oat-based, date-based, dairy/protein-based, and other. Among these, the granola/oat-based segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Granola and oat-based snack bars dominate in Italy because they feel familiar and natural to consumers who are used to eating grain-based foods like bread and cereals. These bars are affordable, widely available, and easy to eat at breakfast or between meals. They often contain simple ingredients such as oats, honey, and fruits, which are trusted by consumers. Their mild taste and suitability for all age groups make them more popular than nut- or protein-based bars.

- The supermarkets/hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy Snack Bar Market Size segmented by distribution channel into supermarkets/hypermarkets, convenience stores, specialty stores, online stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Supermarkets and hypermarkets dominate because they are easy to access and offer a wide variety of products at competitive prices. Consumers can buy different brands and flavours in one place, making shopping convenient. Large stores also display snack bars prominently and run promotions, which attract more buyers. Compared to small convenience stores, specialty shops, or online stores, supermarkets reach more people and encourage frequent purchases, making them the main distribution channel

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy snack bar market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- Kellogg Company

- Ferrero Group

- Nestlé S.A.

- PepsiCo, Inc.

- General Mills Inc.

- Kind Snacks

- Cliff Bar & Company

- Associated British Foods plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In March 2025, Ferrero launched Eat Natural fruit and nut bars in Italy, priced at EUR 3.59 to EUR 3.79 per 3-pack of 40-gram bars, targeting the Italian fruit and dried-fruit bar segment, valued at EUR 74 million in 2024 and growing at a 34% rate since 2022. This launch complements Ferrero's 2024 introduction of Fulfil protein bars and leverages the company's acquisition of Unrisen to strengthen bar production capacity.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy snack bar market based on the below-mentioned segments

Italy Snack Bar Market, By Product Type

- Cereal Bars

- Protein Bars

- Fruit and Nut Bars

- Other

Italy Snack Bar Market, By Ingredient Base

- Nut-Based

- Granola/Oat-based

- Date-Based

- Dairy/Protein-based

- Other

Italy Snack Bar Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Other

Frequently Asked Questions (FAQ)

-

What is a snack bar?A snack bar is a convenient, ready-to-eat food made from ingredients like fruits, nuts, oats, or protein, designed for quick energy, light meals, or healthy snacking anytime.

-

Which product type is most popular in Italy?Cereal bars are the leading product type because they suit Italian taste preferences, are easy to carry, affordable, and widely accepted for breakfast or in-between meals.

-

Which ingredient base is preferred?Granola or oat-based bars dominate due to their familiar taste, wholesome ingredients, nutritional benefits, and alignment with traditional Italian grain-focused diets

-

Where are snack bars mainly sold?Supermarkets and hypermarkets lead because they offer variety, promotions, convenience, and easy accessibility, attracting the majority of Italian consumers over smaller shops or online platforms.

Need help to buy this report?