Italy Smart Home Market Size, Share, and COVID-19 Impact Analysis, By Product (Comfort & Lighting, Control & Connectivity and Other), By Installation Type (New-Build Integrated, Retrofit / Add-On), By Connectivity Technology (Wi-Fi, Zigbee / Z-Wave, Bluetooth Low Energy and Other), By End-User Housing Type (Apartments and Condominiums, Detached Houses and Villas and Other), and Italy Smart Home Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyItaly Smart Home Market Insights Forecasts to 2035

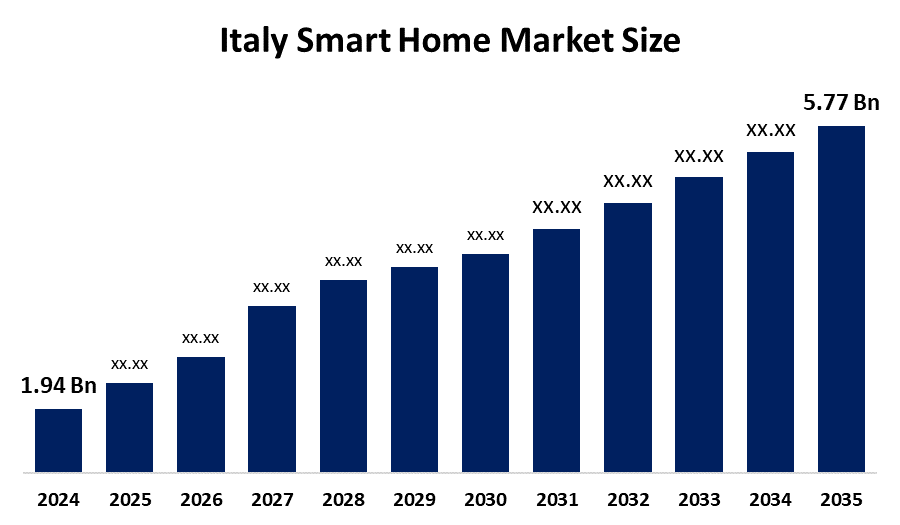

- The Italy Smart Home Market Size Was Estimated at USD 1.94 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.42% from 2025 to 2035

- The Italy Smart Home Market Size is Expected to Reach USD 5.77 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy smart home market size is anticipated to reach USD 5.77 billion by 2035, growing at a CAGR of 10.42% from 2025 to 2035. The Italy smart home market is driven by rising internet penetration, growing adoption of IoT devices, increasing demand for energy-efficient solutions, enhanced home security needs, smartphone integration, government support for smart infrastructure, and improving consumer awareness of connected home technologies.

Market Overview

The term Italian smart home market basically means the market of applications of smart devices and systems in homes. These homes are controllable automatically or through smartphones. The technologies help to control the lighting, security, heating, and appliances, thus making homes more comfortable, safer, energy-efficient, and easier to control for Italian consumers. Besides that, the growth of the market is supported by various factors like increasing smartphone usage, the demand for home security, the awareness of energy saving, more internet connectivity, the increasing affordability of smart devices, government incentives for energy efficiency, and the adoption of IoT-based home automation solutions.

Italy smart home market is on the rise through the implementation of several key trends. Greater incorporation of Internet of Things (IoT) technology is one of those trends which allows for seamless device, to, device communication (smart lighting, thermostats, security systems). The use of voice-controlled virtual assistants and apps on smartphones is becoming more popular, thus making it possible for users to control the home environment remotely. Also, energy management solutions are becoming very popular as consumers are committed to cutting down on the use of energy and saving on the cost of utilities, and at the same time, they are supported by government incentives. Meanwhile, the adoption of smart security solutions, such as video doorbells, surveillance cameras, and smart locks, is on the rise due to mounting concerns about home safety. Moreover, the market for compatible platforms and easy, to, use systems that improve overall home comfort is expanding.

The government's aid to the smart home market in Italy is through tax incentives as well as energy efficiency programs that promote the uptake of connected technologies. Programs such as the Superbonus 110% offer homeowners who go for energy-saving and smart systems a considerable tax deduction, which helps to lower the cost of installation. Also, the additional deductions of up to 65% for energy-efficient improvements set the price of smart home tech at a level that is accessible. Besides one another, these measures will serve the energy and efficiency goals of the EU and, at the same time, will encourage the use of environmentally friendly means of living, thus resulting in more IoT-based devices being used in Italian homes.

Report Coverage

This research report categorizes the market for the Italy smart home market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy smart home market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy smart home market.

Italy Smart Home Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.94 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 10.42% |

| 2035 Value Projection: | USD 5.77 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product ,By Installation Type, By Connectivity Technology, By End-User Housing Type |

| Companies covered:: | Signify (Philips Hue), Samsung Electronics, Schneider Electric SE, ABB Ltd, Honeywell Home / Resideo, Google (Nest), Amazon (Ring / Alexa), Xiaomi,and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy smart home market is driven by increasing consumer demand for convenience, safety, and energy efficiency. Rising adoption of smartphones and high-speed internet is enabling easy control of connected devices. Growing awareness of energy-saving solutions, supported by government incentives and EU climate targets, is accelerating adoption. Additionally, increasing concerns about home security, advancements in IoT technology, affordability of smart devices, and integration of voice assistants are collectively fueling the growth of smart home solutions across Italian households.

Restraining Factors

The Italy smart home market faces restraints due to high initial installation costs and concerns over data privacy and cybersecurity. Limited consumer awareness in rural areas and lack of standardization among devices can hinder adoption. Additionally, technical complexity and compatibility issues between different smart home platforms may discourage some households from investing in these solutions.

Market Segmentation

The Italy smart home market share is classified into product, installation type, connectivity technology, and end-user housing type.

- The control & connectivity segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy smart home market is segmented by product into comfort & lighting, control & connectivity, and other. Among these, the control & connectivity segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The control & connectivity segment dominates the market because it helps connect and manage all smart devices from one place. Products like smart hubs, sensors, and voice assistants make it easy for users to control lighting, security, and appliances using smartphones. As more Italians use internet-connected devices and prefer simple, remote control of their homes, demand for control and connectivity solutions continues to grow steadily.

- The retrofit/add-on segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy smart home market is segmented by installation type into new-build integrated and retrofit/add-on. Among these, the retrofit/add-on segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The retrofit/add-on segment dominates the market because most Italian houses are already built, and upgrading them is more practical than new construction. Homeowners prefer smart devices that can be easily installed without major renovations, such as smart lighting, thermostats, and security systems. These solutions are more affordable, flexible, and quick to install, making them suitable for older buildings and apartments. Additionally, users can upgrade step by step based on their needs and budget.

- The wi-fi segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy smart home market is segmented by connectivity technology into wi-fi, zigbee / z-wave, bluetooth low energy and other. Among these, the wi-fi segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Wi-Fi segment dominates the market because it is widely available in most households and supports easy, fast connectivity for multiple smart devices. Wi-Fi-enabled products like cameras, lights, thermostats, and voice assistants can be easily controlled via smartphones or apps without additional hubs. Its high-speed connection and reliability make it convenient for remote monitoring and automation. The ease of installation and compatibility with existing home networks also encourage consumers to choose Wi-Fi-based smart home solutions over other technologies.

- The apartments and condominiums segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy smart home market is segmented by end-user housing type into apartments and condominiums, detached houses, villas, and others. Among these, the apartments and condominiums segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The apartments and condominiums segment dominates the market because most Italians live in urban residential buildings. Smart home solutions, such as lighting, thermostats, and security systems, are particularly useful in apartments, offering convenience, energy efficiency, and safety in smaller living spaces. Additionally, these homes often have limited space, making compact and easy-to-install smart devices more practical. The urban lifestyle and higher awareness of technology among city residents further drive the adoption of smart home solutions in apartments and condominiums.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy smart home market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Signify (Philips Hue)

- Samsung Electronics

- Schneider Electric SE

- ABB Ltd

- Honeywell Home / Resideo

- Google (Nest)

- Amazon (Ring / Alexa)

- Xiaomi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent News:

In May 2024, Vitesy introduced the first natural and sustainable air purifier, Natede Smart. It is designed to complement any modern interior, and features the most advanced sensors for temperature, humidity, pollutants, fine particulates (PM2.5), and carbon monoxide (CO). It is also known to eliminate toxic agents safely.

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy smart home market based on the below-mentioned segments:

Italy Smart Home Market, By Product

- Comfort & Lighting

- Control & Connectivity

- Other

Italy Smart Home Market, By Installation Type

- New-Build Integrated

- Retrofit / Add-On

Italy Smart Home Market, By Connectivity Technology

- Wi-Fi

- Zigbee / Z-Wave

- Bluetooth Low Energy

- Other

Italy Smart Home Market, By End-User Housing Type

- Apartments and Condominiums

- Detached Houses and Villas

- Other

Frequently Asked Questions (FAQ)

-

1. What is the Italy smart home market?The Italy smart home market includes connected devices and systems that automate home functions like lighting, security, heating, and appliances for convenience, safety, and energy efficiency.

-

2. What are the key drivers of the Italy smart home market?Rising adoption of IoT devices, demand for energy efficiency, home security, smartphone integration, and government incentives drive market growth.

-

3. Which products dominate the Italy smart home market?The control & connectivity segment, including smart hubs, sensors, and voice assistants, dominates.

-

4. Which connectivity technology is most popular?Wi-Fi is the most widely used connectivity technology for smart home devices.

-

5. Which installation type is most common?Retrofit/add-on solutions dominate due to the large number of existing homes.

-

6. Which housing type dominates adoption?Apartments and condominiums lead, as most Italians live in urban residential buildings.

-

7. What role does the government play in this market?Government incentives like Superbonus 110% and energy-efficiency programs encourage adoption of smart and energy-saving devices.

-

8. What are the main trends in the Italy smart home market?Rising IoT integration, voice-controlled assistants, energy management solutions, and advanced security systems are key trends.

-

9. What are the main challenges in this market?High installation costs, cybersecurity concerns, lack of standardization, and technical complexity restrain growth.

Need help to buy this report?